“Better Off in BOLD”

Disclaimer: Your capital is at risk. This is not investment advice.

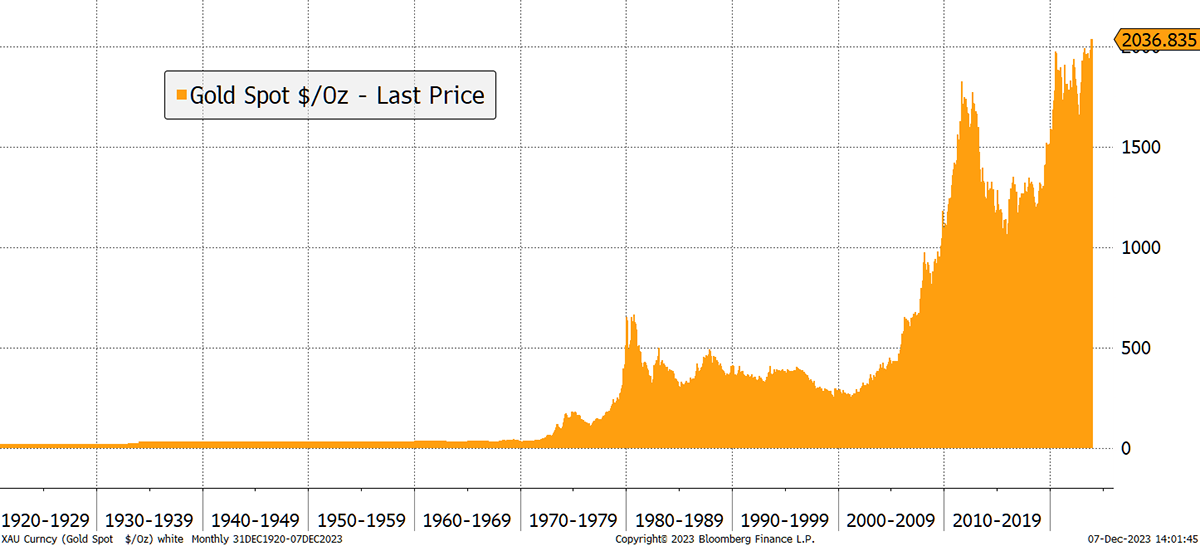

It has been an eventful year for our favourite two alternative assets. Gold is up 11%, while bitcoin has managed an impressive 158%. Yet bitcoin is still down substantially since the old high in 2021. In contrast, gold just made a new all-time high; something it has been doing repeatedly for 5,000 years. In our webinar next week, we will look at the outlook for both assets in 2024.

We admire alternative assets, yet many regulators, investors and commentators share a dislike for them, and bitcoin sits at the top of the list. Those who embrace the idea of backing alternatives, which sit outside of the financial system, seem to fight over whether bitcoin or gold is better. ByteTree makes the case that there is no need to choose between them, as they work better together, which is demonstrated by our BOLD index.

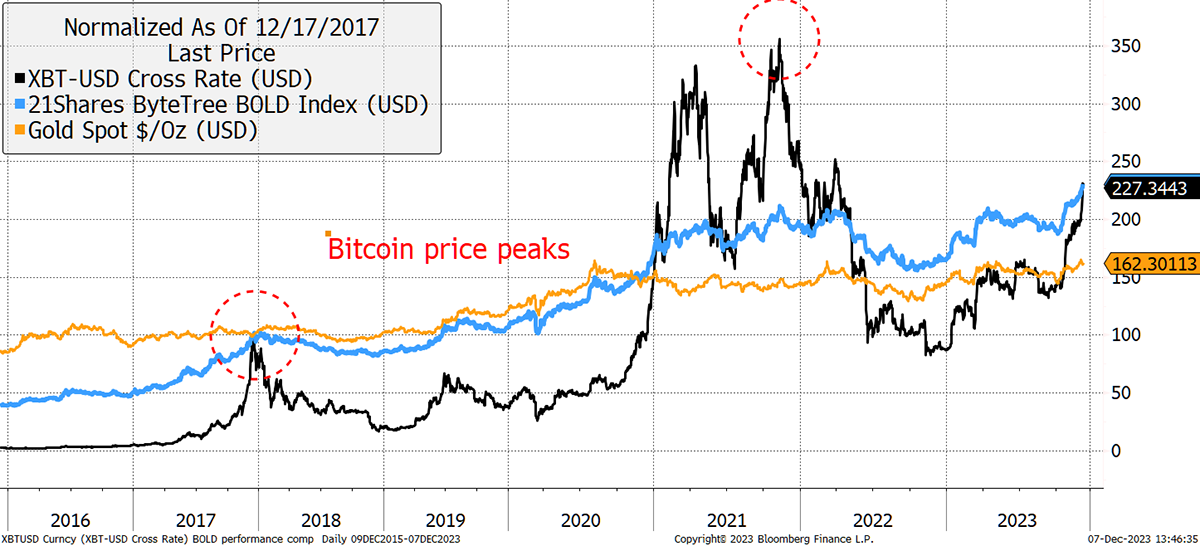

BOLD Matches Bitcoin Since 2017

The major bitcoin price peaks in 2017 and 2021 were followed by corrections of 83% and 76% respectively. This compares with 19.5% and 26% corrections for the BOLD Index. Even gold, known as a reliable safe haven with low price volatility, fell by 21% in 2022 and 45% between 2011 and 2015. Risk matters because losses are hard to recover from, and it is better to avoid them.

BOLD is calm because it was built that way. At ByteTree, we understand the fundamental differences between bitcoin and gold. They are driven by different factors and are therefore unlikely to have major corrections at the same time. Bitcoin is currently hyped, while gold is half asleep. That will reverse, as it always does, the next time financial markets come under pressure.

You might assume you’d have given up return for diluting your bitcoin with gold, but since the 2017 peak, you haven’t. What’s more, BOLD has delivered twice the return from gold over the six-year period. The more recent peak in 2021 saw another period of excess return from BOLD, but this time, it matched gold while significantly outperforming bitcoin. BOLD and gold may only be up 11% since November 2021, but that’s about the same as inflation and way ahead of Bitcoin.

In the webinar, I’ll be covering bitcoin’s halving in April, the ETF demand, on-chain data, price trends and corrections, investor positioning and more. For gold, it will be a focus on rates, inflation and the dollar, along with geopolitics.

A Century of Gold

Bitcoin and Gold in 2024

A Week at ByteTree

I covered the latest phase of the momentum crash in The Multi-Asset Investor. The economy is unquestionably slowing, with cold winds from China. But the momentum crash can be a good thing for investors; you just need to be on the right side of the market.

In ByteFolio, we also covered the breakout in crypto, which seems to be going from strength to strength. The portfolio is doing nicely, but keeping up with bitcoin in recent weeks is a challenge in itself.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()