ByteTree BOLD Index

Disclaimer: Your capital is at risk. This is not investment advice.

Monthly Rebalancing Report;

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

BOLD rose by 3.9% in October, taking the return for the year to 34.3% in USD terms. Over the month, Bitcoin rose by 9.0%, Gold rose by 2.7%, while equities rose by 9.7%. It has been a notable time for liquid alternative assets as the US dollar fell by 3%.

Bitcoin is once again shooting the lights out as we approach the next halving in April next year. We also patiently await the likely approval of Bitcoin ETFs in the USA. Gold has also been strong and trades just below its all-time high.

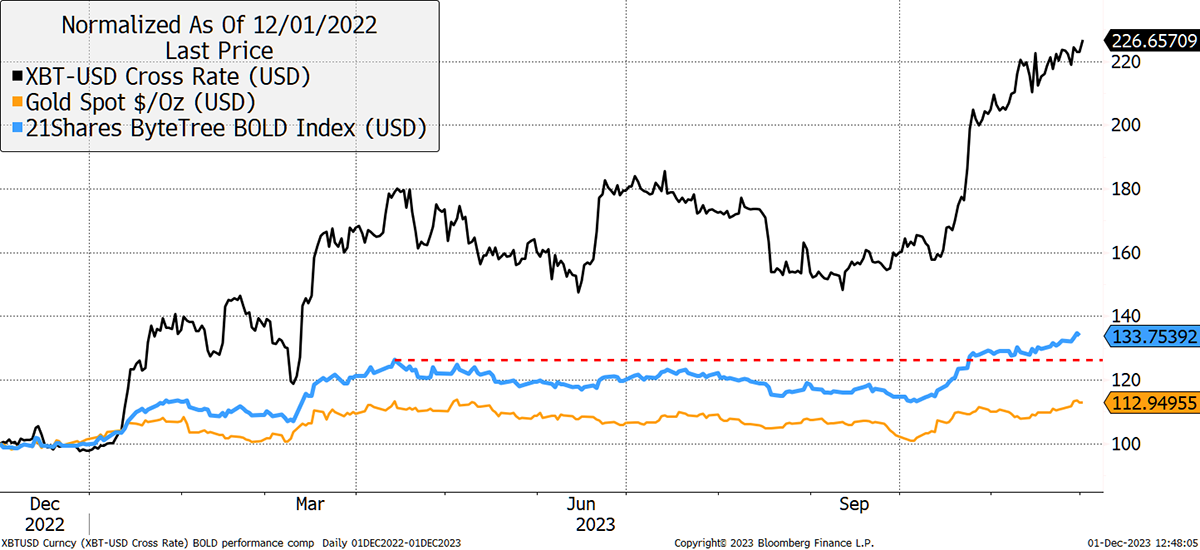

Bitcoin, Gold, and BOLD over One Year

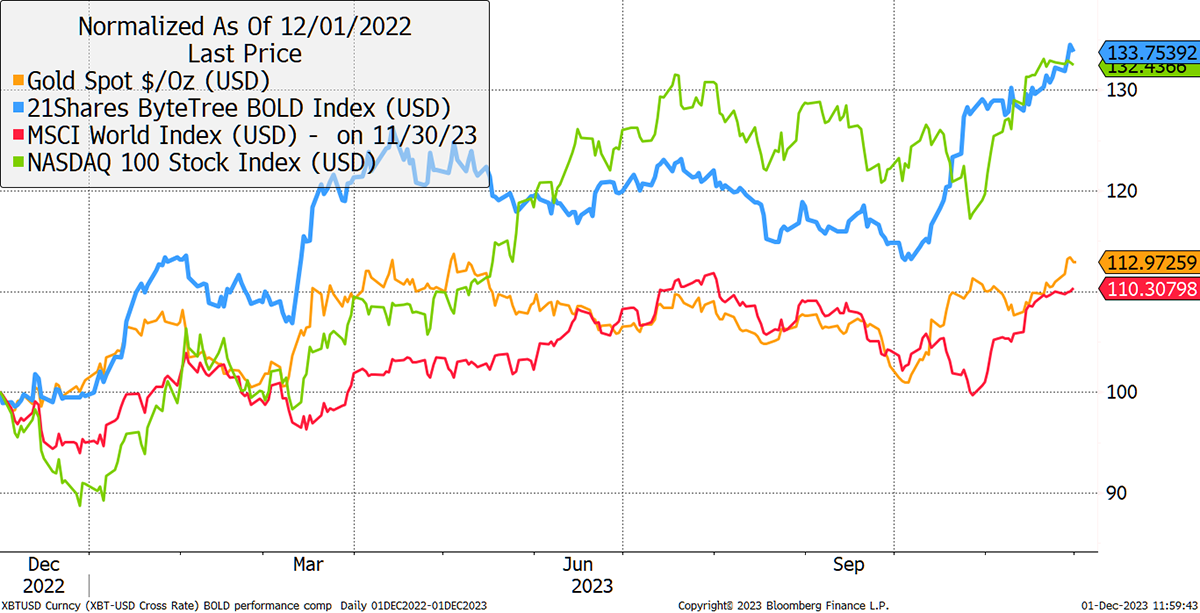

With Bitcoin so strong, it is better to remove it from the charts because it distorts them; such are the huge gains. Gold has delivered similar returns to global equities, while BOLD has narrowly beaten the Nasdaq. With technology so strong this year, that is an achievement. One noticeable difference has been volatility, where BOLD has 15% and the Nasdaq 24% over the past year.

BOLD over One Year

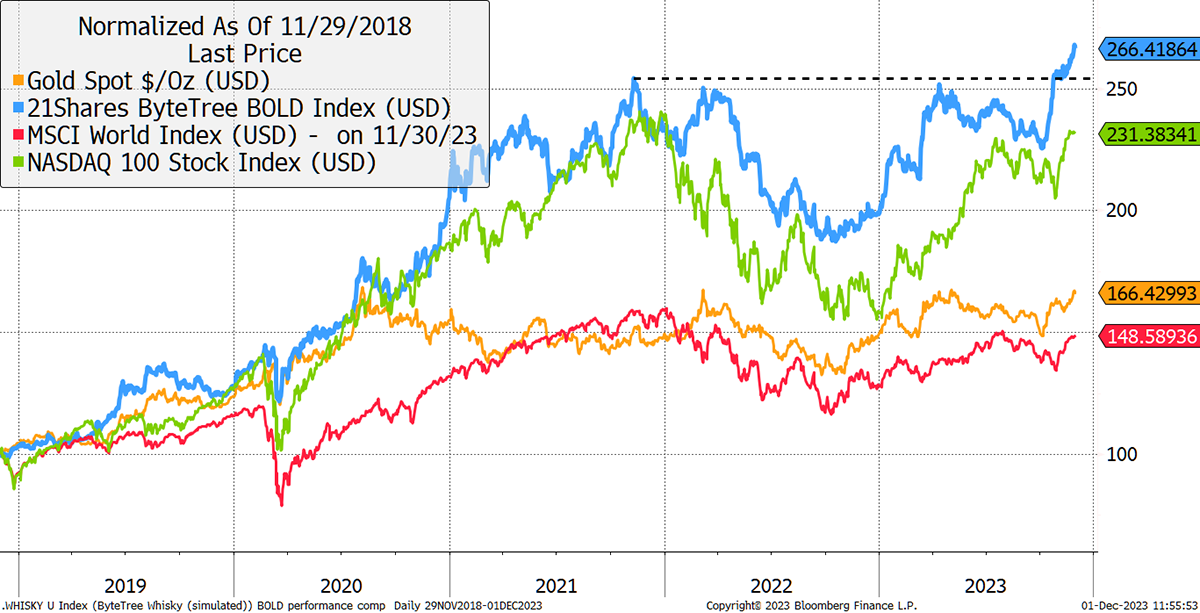

Over five years, BOLD’s all-time high stands out. BOLD fell less than the Nasdaq in the 2022 bear market and recovered sooner and stronger. It is noticeable how BOLD’s drawdowns have repeatedly been less than the stockmarket. BOLD is a defensive trade.

BOLD Makes over Five Years

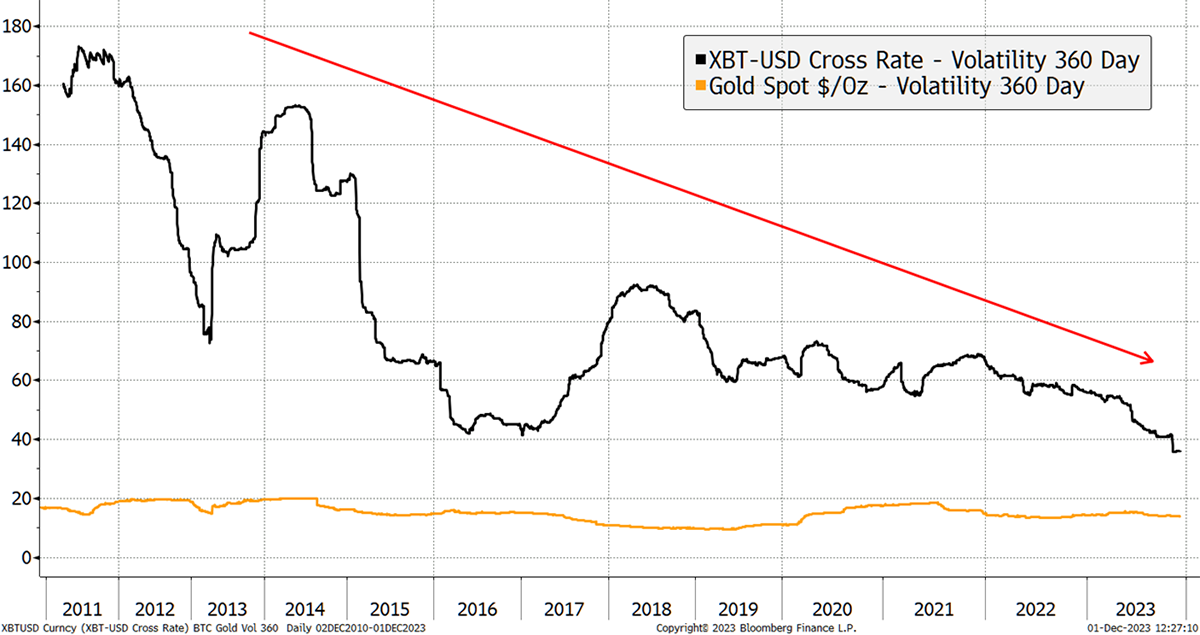

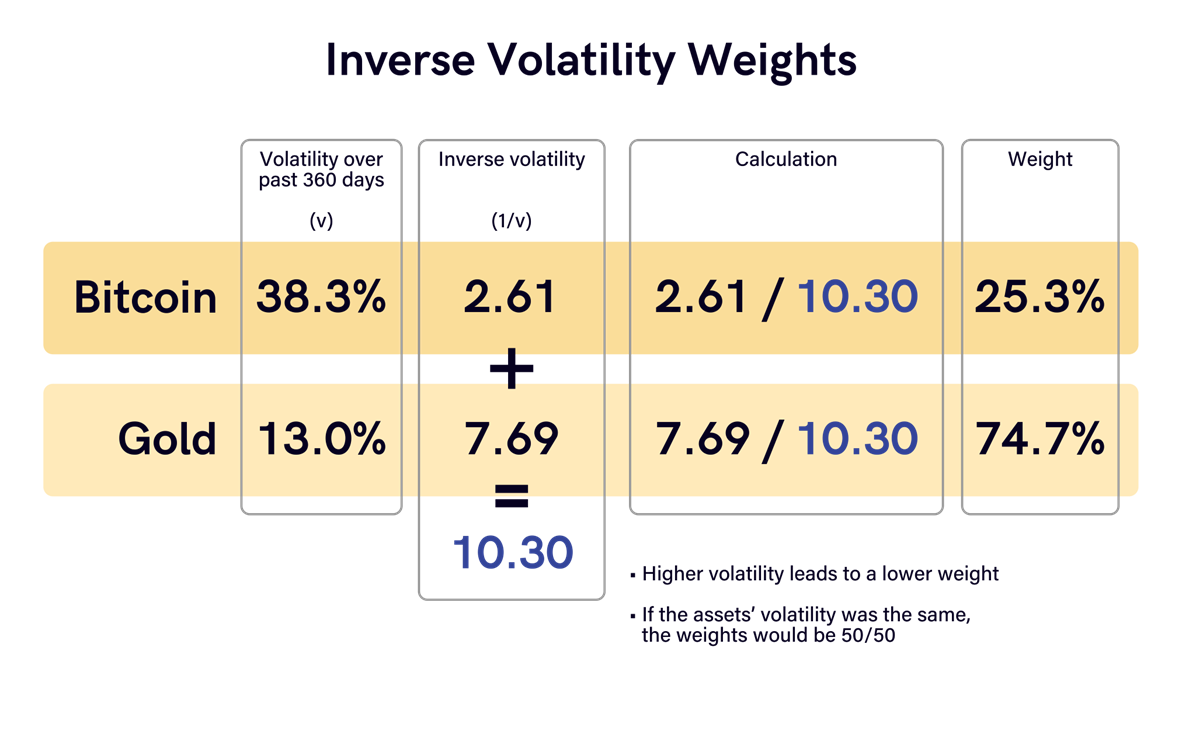

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility. That is a measure of daily price movement, both up and down. The less volatile asset, which has always been Gold, gets a higher weight in the index at the end-of-the-month rebalancing. Notice how Bitcoin’s volatility has fallen markedly. It is maturing as an asset class as institutional investors engage in the space.

Bitcoin and Gold past 360-day Volatility at Record Low

The lower volatility has resulted in a higher Bitcoin weight of 25.3% vs 25.1% a month ago. The remaining 74.7% is allocated to Gold using this simple formula.

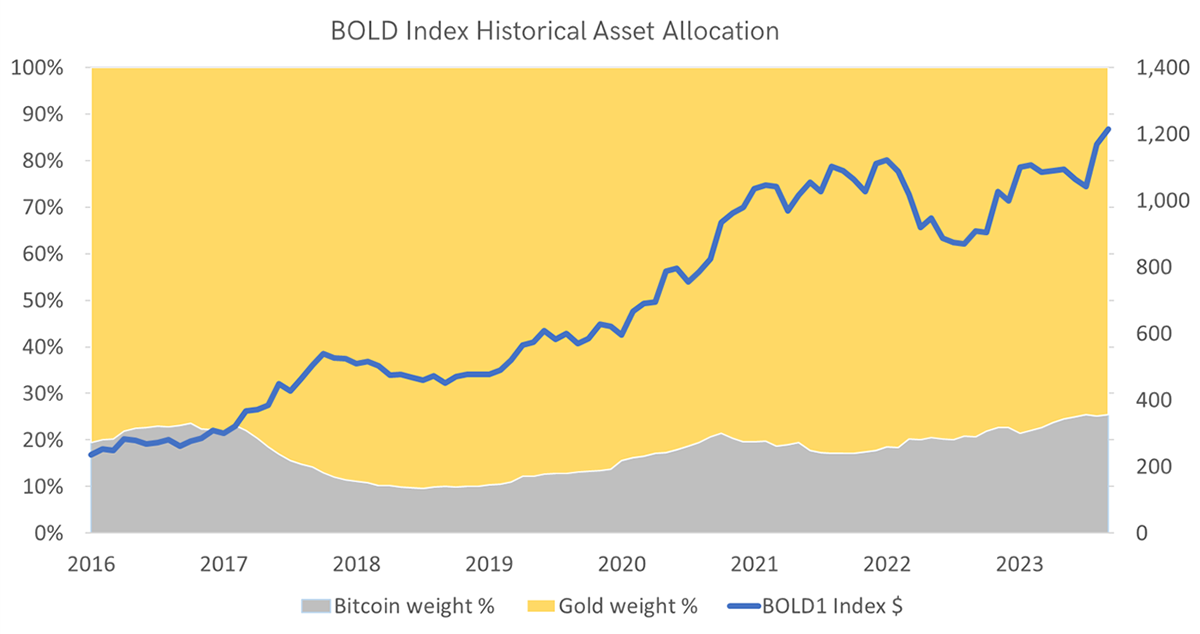

The current Bitcoin weight is high by historical standards and has been rising as volatility has been falling. This is likely to continue as institutional investors embrace Bitcoin. The more weight behind the system, the more market depth there is, and that results in greater stability.

BOLD not only manages risk with the inverse volatility weighting methodology, but the rebalancing of transactions notably adds value over time. Each month, the rebalancing process sells the stronger asset and reinvests the proceeds into the weaker asset. This buy low, sell high approach accumulates the weaker asset over time.

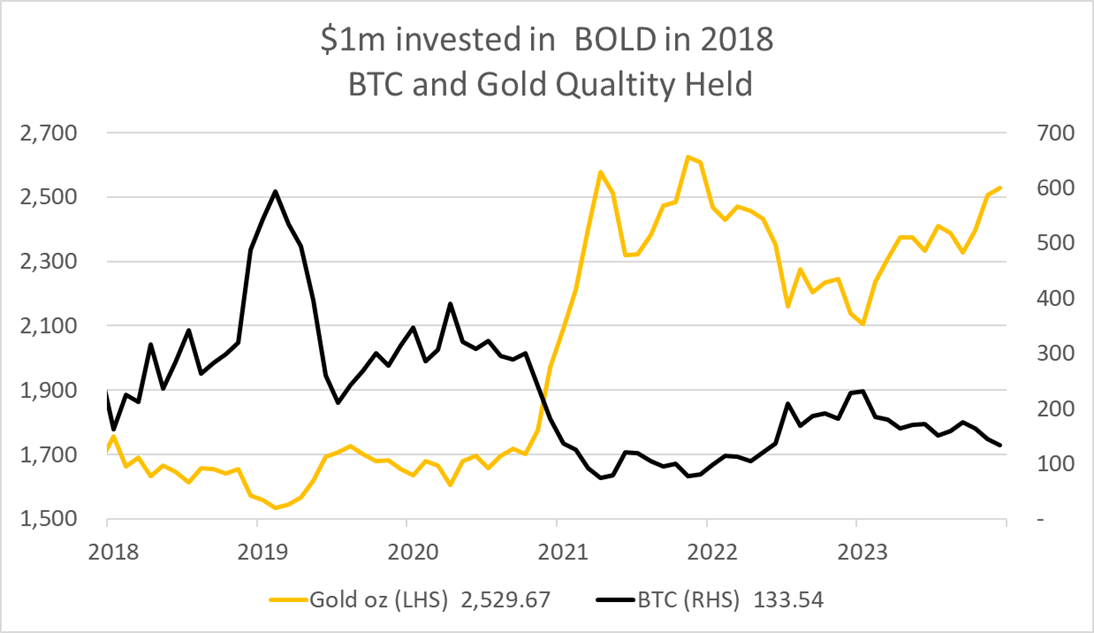

An investor who put $1,000,000 into BOLD in 2018 would have started with 162 bitcoins and 1,756 ounces of gold. By November 2023, that investor now has 134 bitcoins and 2,430 ounces of gold. BOLD has been a gold accumulation strategy over the period, reducing its Bitcoin by 18% but increasing its gold holding by 38%.

In the 2022 bear market, it was the other way around as BOLD swapped Gold for Bitcoin. At the Bitcoin peak in November 2021, our BOLD investor held 77 Bitcoins and 2,625 ounces of Gold. By the Bitcoin low at the end of 2022, or 15 rebalancing transactions later, they held 231 Bitcoins and 2,104 ounces of Gold. The gold quantity had reduced by 20%, but the Bitcoins held grew threefold. That meant BOLD held ample Bitcoin at the start of the bull market this year.

Had the investor not rebalanced, they would have held 93% in Gold and 7% in Bitcoin at the beginning of 2023 and returned 20% instead of BOLD’s 34%. This demonstrates the power of rebalancing, but make no mistake, if you are certain which asset will win in the future, then that asset will beat BOLD. The trouble with that is we might think we know which asset will be the strongest, but we don’t.

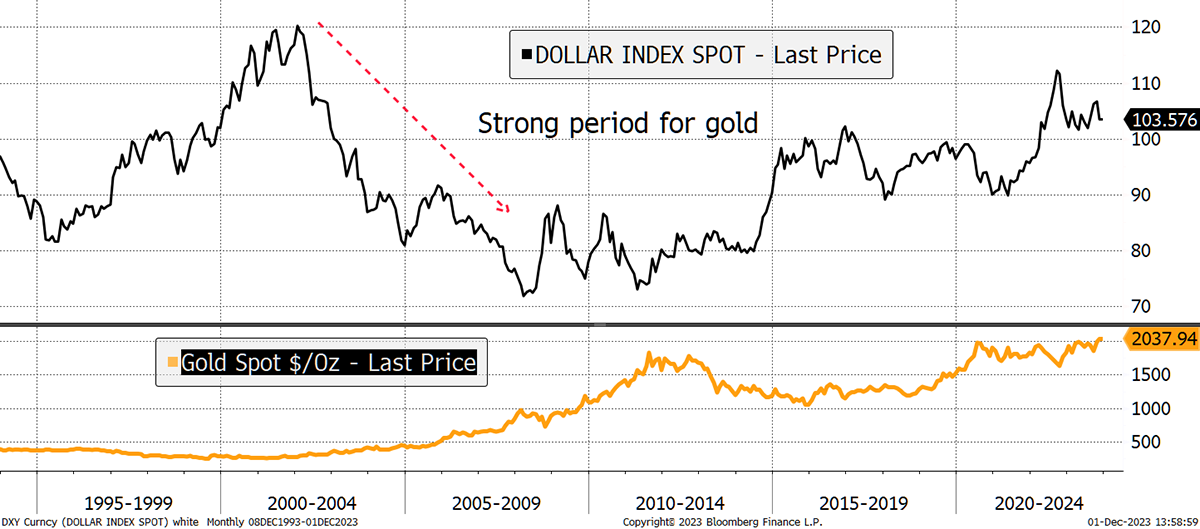

One important development is the weakening dollar, which should provide support for both assets. Gold’s best performance in recent years came in the 2000 to 2011 period, which coincided with a weak dollar. Gold peaked in 2011 as the dollar started to recover. The dollar rally last year led to downward pressure on asset prices, and they have been much stronger since it reversed. If the dollar continues to slide, it will be a powerful driver, and BOLD should perform well.

A Weak Dollar Boosts Gold

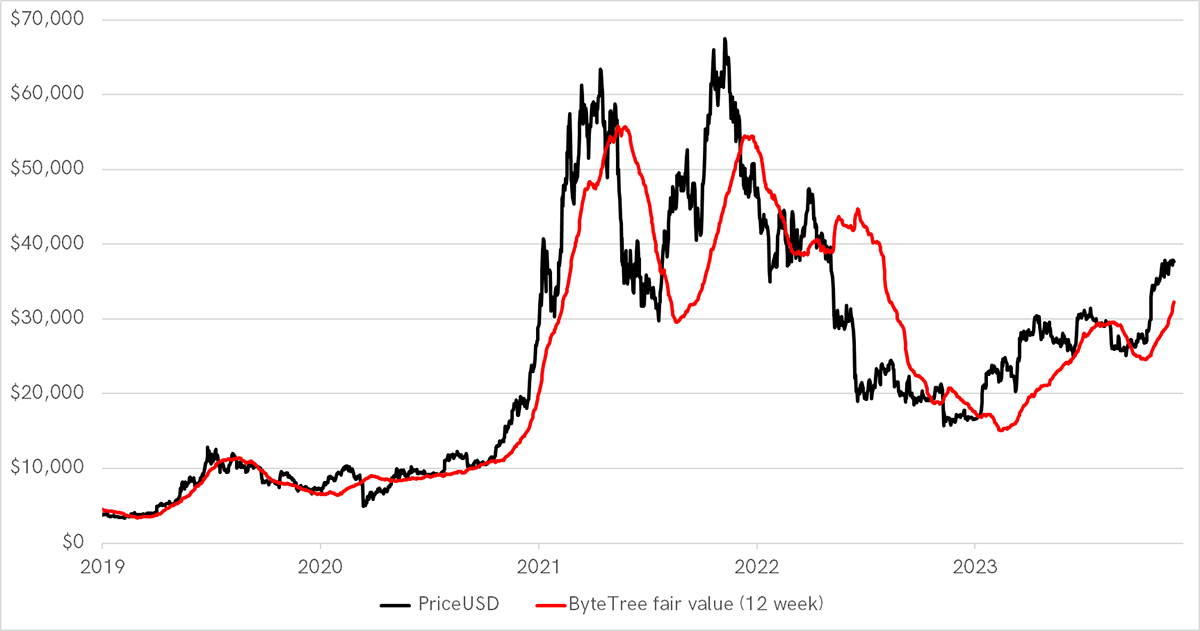

Bitcoin will probably grow regardless of the dollar as the network is expanding again. This means more users, more transactions, more applications, and more wealth being stored and transferred across the blockchain. Bitcoin is back in growth mode, and the future looks bright.

Bitcoin Network Is Growing

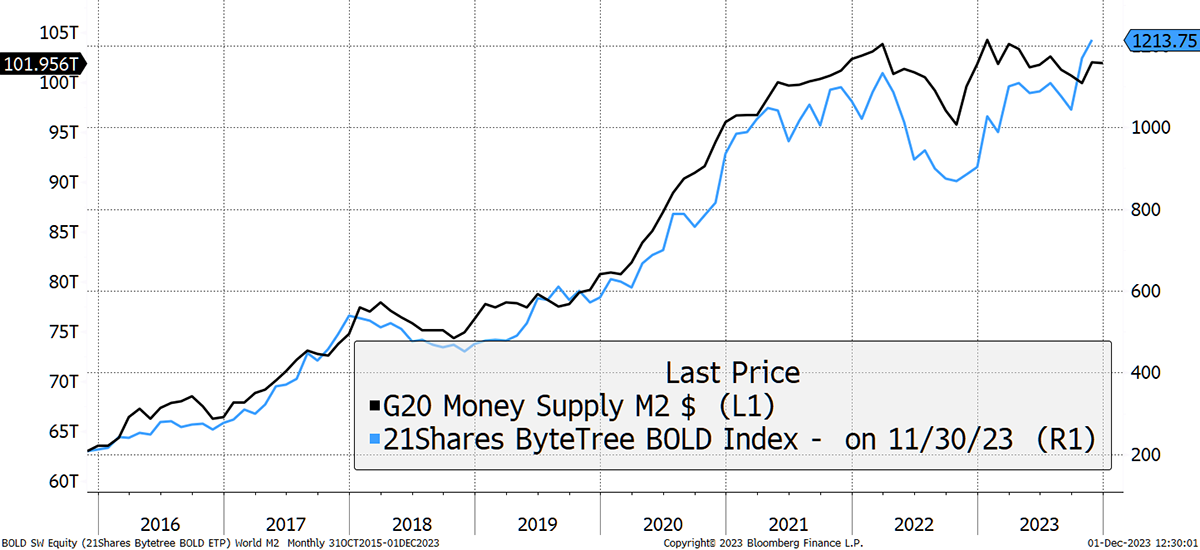

The outlook for both Bitcoin and Gold is encouraging. Investors are underweight, and both assets have good momentum behind them. We are living in an uncertain world, and after two years of a shrinking money supply, as the central bankers hike interest rates, it seems likely this will reverse. At least that is the message from BOLD, which appears to be forecasting the money supply growth to resume.

BOLD Leads the Money Supply

Bitcoin and Gold Research

At ByteTree, we write about Gold each month in Atlas Pulse and Bitcoin in ATOMIC. For a deeper dive into each asset, have a look at our latest updates:

Summary

BOLD is well placed for the macro environment. It also allows investors to hold Bitcoin with improved risk management. I continue to be impressed by just how well it behaves and performs.

Contact

For information on investing in BOLD, contact bold@bytetree.com

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Vinter Index Provider

21Shares BOLD ETP

Bitcoin and Gold Research

Follow @ByteTree on X.com (formerly Twitter)