Decoding Solana: The Rise and Resilience

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: SOL;

Solana is a layer-1 smart contracts blockchain platform recognised for its cost-effectiveness and high throughput. Following a challenging phase after the fallout of FTX and its association with the platform, Solana bounced back strongly in 2023 with institutional partnerships and increased on-chain activity. This Token Takeaway will analyse the fundamentals of Solana and the value proposition of its native token, SOL.

Overview

Originating in 2017, Solana introduced its beta mainnet in March 2020, stemming from a collaboration among former colleagues from the semiconductor giant Qualcomm. Solana's core mission was to tackle the frustratingly slow transaction speeds and high costs inherent in earlier blockchains such as Bitcoin and Ethereum. Prioritising an exceptional user experience, Solana stands out by providing one of the fastest and most cost-effective layer-1 blockchain platforms in the industry. These attributes have positioned Solana as a preferred platform among users, inspiring developers to create dApps, NFTs, and various other innovations on its infrastructure.

History

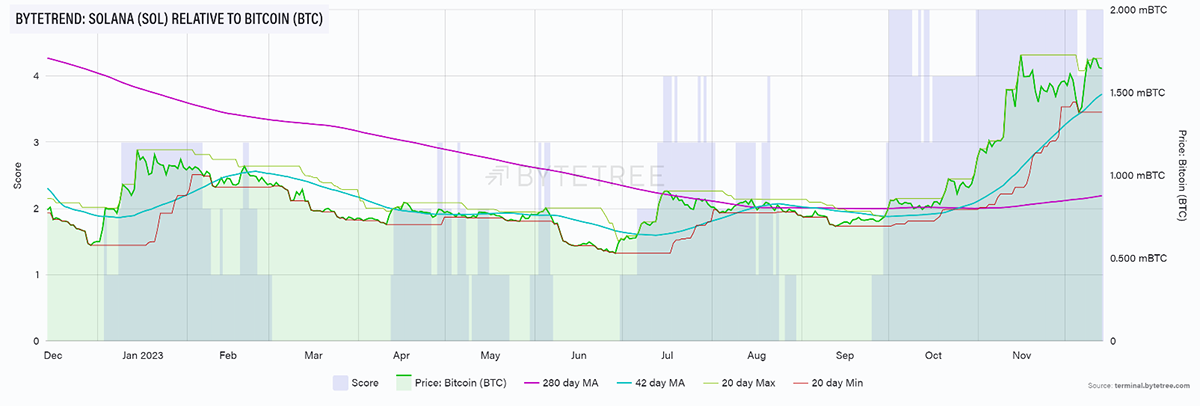

During the 2021 bull market, Solana became one of the most popular layer-1 protocols and was recognised as the prominent 'ETH-Killer'. With various macro factors at play, the price of SOL surged over 1000% from July 2021 to November 2021, an astonishing rise that seemed almost too good to be true. However, the subsequent pullback proved devastating as SOL entered a prolonged bearish trend along with the entire market, erasing nearly all its previous gains by June 2022.

Adding to the downturn, FTX collapsed in November, triggering widespread fear, uncertainty, and doubt (FUD) across the market. Solana, which was deeply connected with FTX and its controversial founder, SBF, suffered the hardest blow. SOL faced intense selling pressure, leading to an additional 80% loss in value by the end of December 2022, plummeting to $8 per token from its peak of $260.

The crucial point to note is that SOL's fluctuations were primarily a result of external influences, while the underlying blockchain remained fundamentally sound, leading to SOL becoming undervalued following the FTX collapse. As expected, Solana has made a remarkable recovery and is presently valued at $70, marking a staggering 750%+ increase in less than a year. Solana is essentially mirroring its 2021 performance and striving to reclaim the same level of prominence it held within its sector during that period.

How Does Solana Work?

At its core, Solana’s high throughput is achieved by its unique consensus mechanism called Proof of History (PoH). PoH orders transactions by utilising cryptographic timestamps, enabling a secure and efficient consensus. It arranges events in a linear, verifiable sequence, ensuring accuracy without using intense computational resources. Nodes prove the passage of time by solving complex puzzles, which creates a historical record. This method establishes an order for transactions, reducing the need for energy-intensive calculations, enhancing scalability, and securing the network against manipulation, allowing for faster and more reliable consensus.

PoH's unique methodology enhances the efficiency, scalability, and security of blockchain networks. It significantly reduces the computational workload required for reaching consensus, thereby improving scalability. By accurately ordering events through timestamps, PoH ensures a reliable and tamper-proof historical record, enhancing security against potential manipulation or fraud.

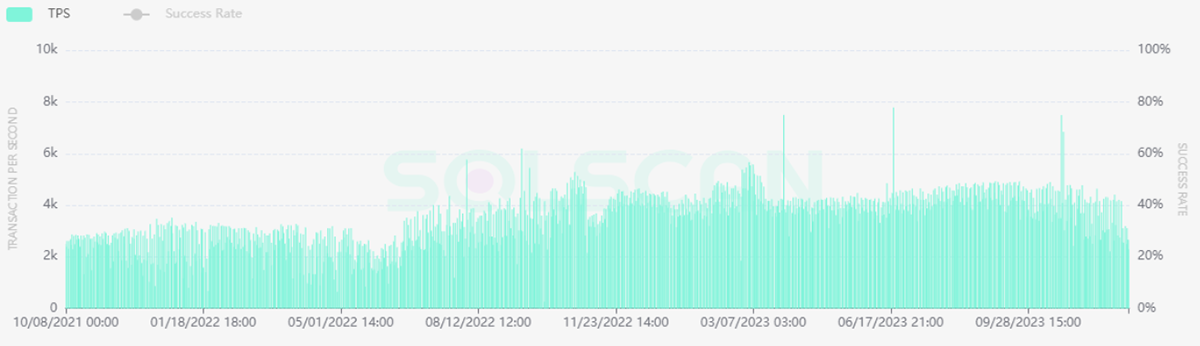

According to Solana Docs, the platform is theoretically able to achieve a maximum of 710k transactions per second (TPS). The current TPS is 4518, which is a lot higher than many layer-1s.

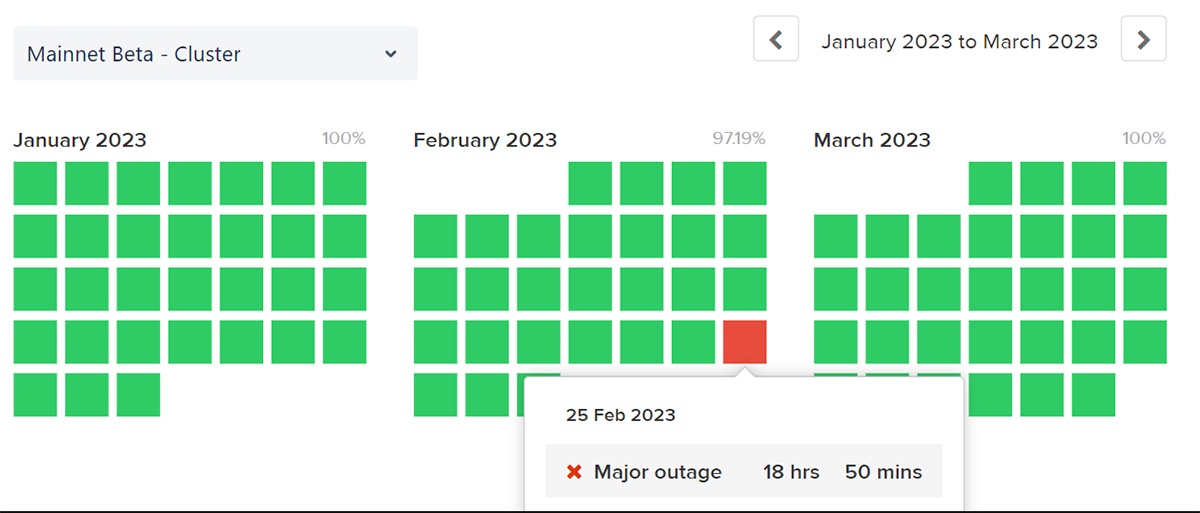

Solana has faced periodic crashes, experiencing several outages throughout its existence. A notable incident occurred on February 27, 2023, causing a significant outage lasting nearly 19 hours. These interruptions in Solana's service are troubling as they disrupt the ecosystem and affect user confidence. Despite this, starting from March 2023, Solana has managed to maintain uninterrupted service, achieving 100% uptime each month. While this is a positive streak, Solana's reputation regarding security remains a concern due to its history of outages.

The Solana Ecosystem and Partnerships

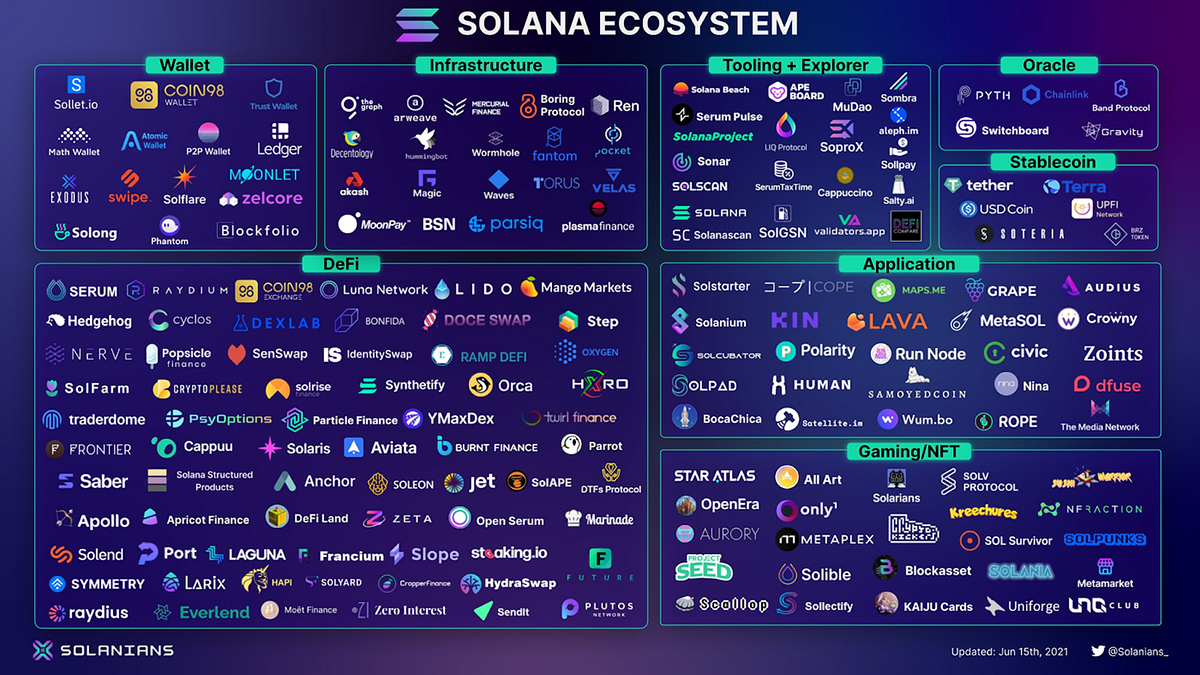

Solana has one of the largest ecosystems with applications in sectors including DeFi, Gaming, NFTs, Payments and Wallets. According to their website, they have 623 projects on their platform.

Among the 623 projects, 331 are digital collectables (NFT projects) or gaming applications. Given that running both NFT projects and gaming apps demands substantial on-chain operations, Solana's swift and cost-effective infrastructure perfectly aligns with these requirements. Michael Wagner, co-founder of STAR ATLAS (a popular game of Solana), said:

“We just needed a scalable tech because we anticipate having millions to potentially billions of users interacting with the metaverse at some point. High transaction throughput, low transaction costs, the sub-second finality which translates to low latency for our players on speed changes, all important.”

Moreover, a total of over 110 million NFTs were minted on Solana. Although the NFT craze has completely died down, Solana seems to have benefitted from it while it lasted.

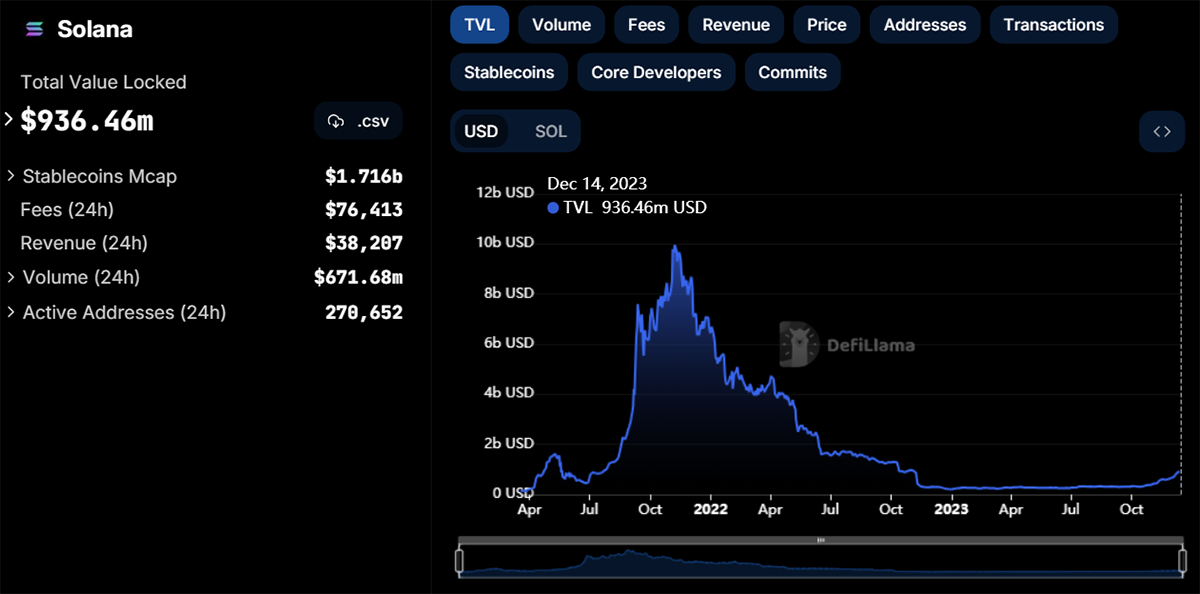

The Solana ecosystem has a TVL of $936.4m. Although the TVL is down significantly from its all-time high of $9.9bn, it’s up by 345% this year, of which Marinade Finance accounts for 83% of TVL dominance. Moreover, there are over $1.7bn worth of stablecoins operating on Solana, with 53% USDT dominance.

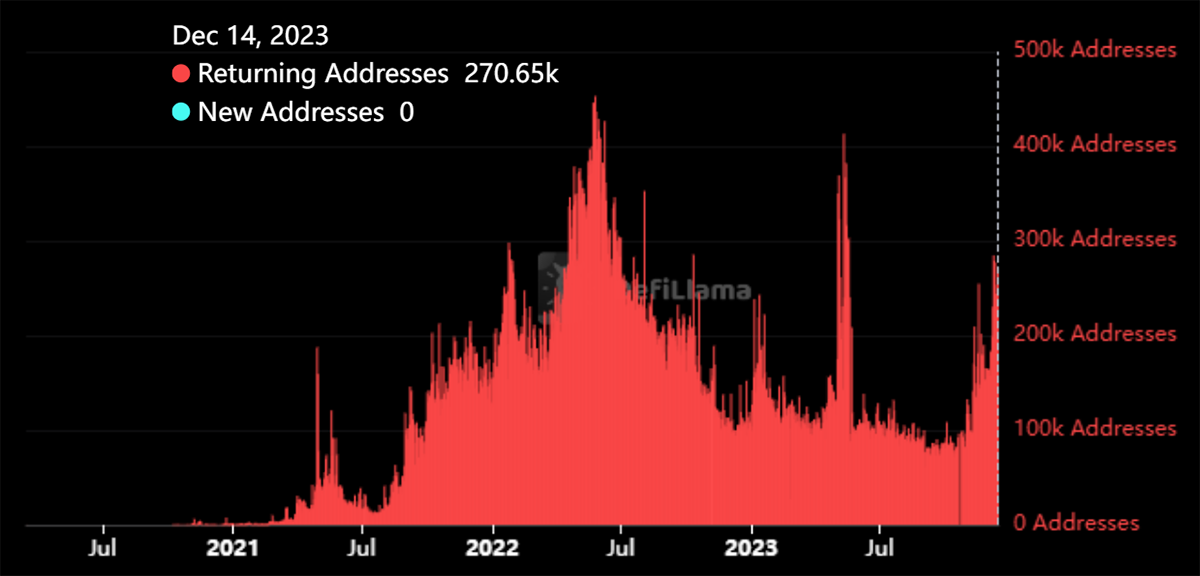

As illustrated in the above chart, the active addresses on Solana have started to rise from the end of October 2023. This is likely due to the heightened activity on Star Atlas, a Sci-Fi-themed game on Solana.

Other big external blockchain projects have also started to show interest. With the success of the HIP70 proposal, the Helium Network, a top blockchain-powered project that connects IoT devices globally, was successfully migrated to the Solana blockchain on 18 April 2023. This community-backed decision aims to benefit from Solana's cost-effectiveness, scalability features and high-performance capabilities. Similarly, Render, the largest decentralised, blockchain-powered, and GPU-based cloud computing platform, also migrated to Solana for similar reasons. Furthermore, Rune Christensen, co-founder of MakerDAO, proposed migrating the MakerDAO platform from Ethereum to Solana. This widespread interest in Solana underscores its resilience and the value it brings as an efficient layer-1 platform.

With Solana’s average transaction fee of $0.00025, it's a cost-effective choice for serving as a payment solution. Shopify, a major player in the US e-commerce market with a 10% share, teamed up with Solana Pay to introduce a crypto payment option. Solana Pay, the decentralised peer-to-peer payments platform built by Solana Labs on the Solana blockchain, is now available for millions of businesses within the Shopify ecosystem to allow their customers to pay using crypto. This collaboration marks a substantial stride forward, potentially signalling the start of widespread adoption.