Monthly Rebalancing Report;

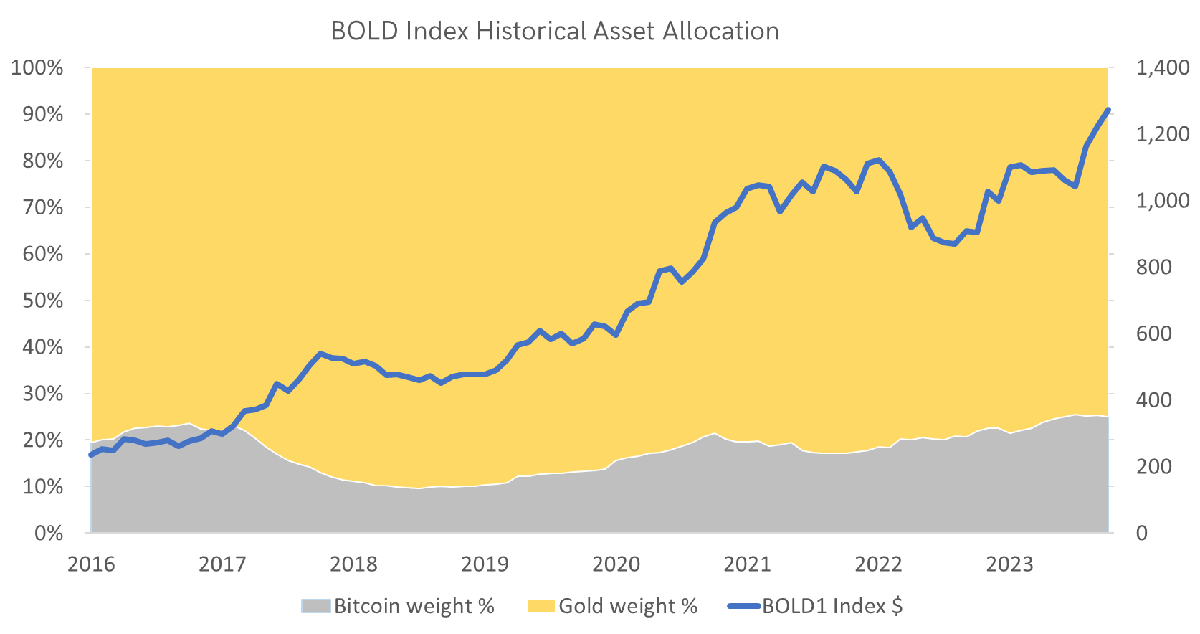

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while gold prefers risk-off.

BOLD rose by 4.9% in December, taking the return for the year to 40.9% in USD terms. Over the month, Bitcoin rose by 12.6% (2023 +157%), gold rose by 1.3% (2023 +13.1%), while equities rose by 4.8% (2023 +23.8%). Dollar weakness continued with a decline of 2.1%.

Bitcoin had a standout year, closing at $42,507, up from $16,539 last January. Much of the gains were flattered by the depressing price a year ago. What is important is how the price is now back above the average price of this halving cycle, which began in May 2020, as shown by the red dashed line. The next cycle will take place in April, and we have previously seen strength in the preceding months.

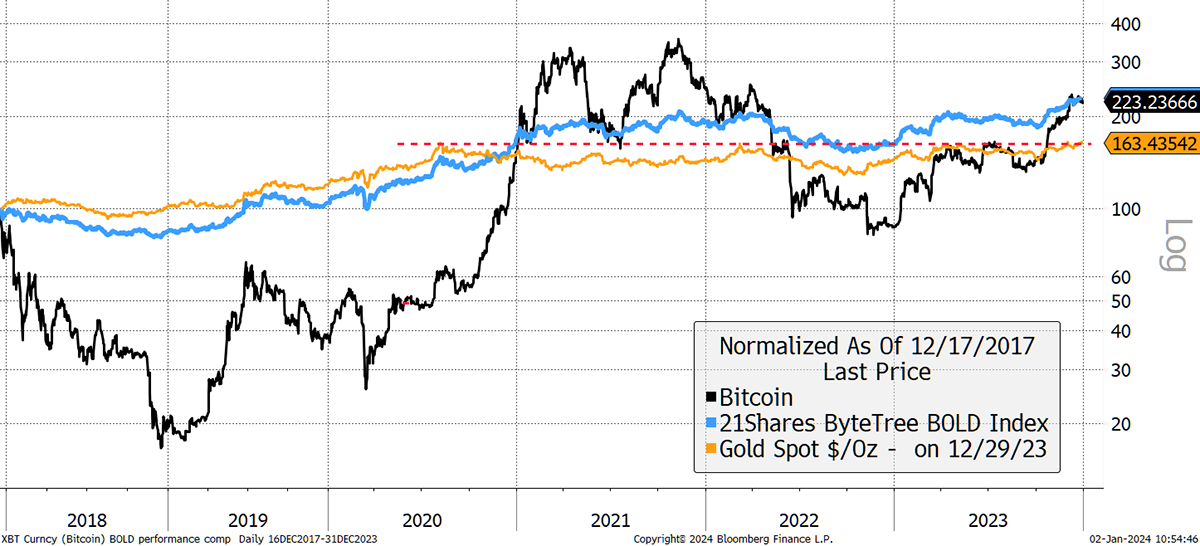

Bitcoin, Gold, BOLD, since December 2017

Gold has remained a stable and dependable store of value, which is its most important role. Since the 2017 bitcoin price high, gold is up 63% while bitcoin is up 123%. Remarkably, BOLD was up 128%, while remaining much more stable during two bitcoin bear markets.

Had an investor held $20 of bitcoin and $80 of gold in December 2017, they would today have $175. Yet with BOLD, they had $228. The additional return came from rebalancing transactions, which are an important driver of value creation.

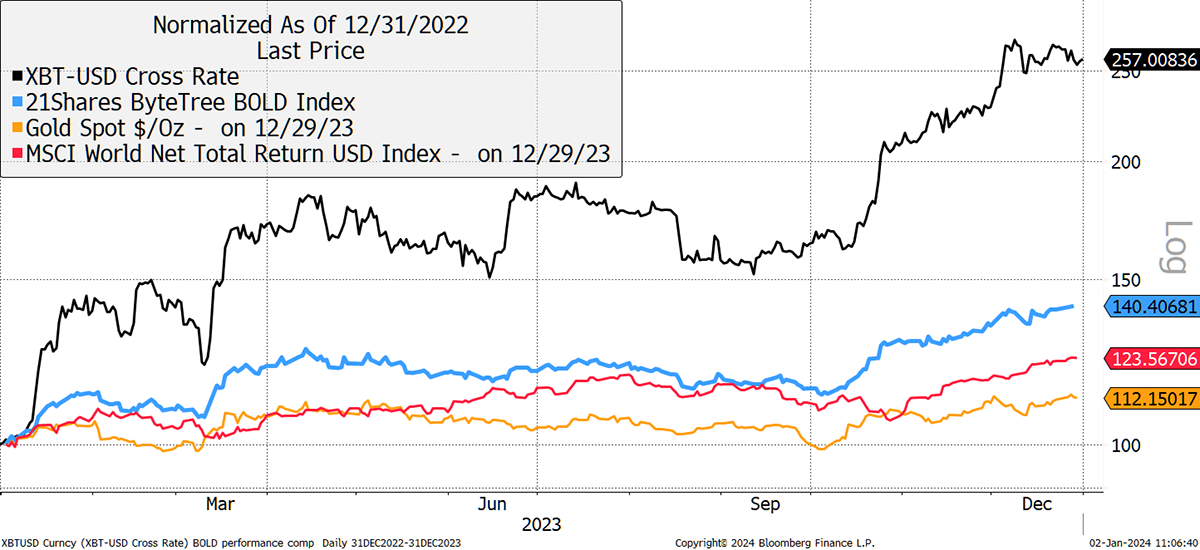

Over the past year, a strong year for bitcoin, BOLD once again comfortably beat global equities. Gold returned 12%, which wasn’t bad considering the headwinds caused by rising interest rates.

BOLD in 2023

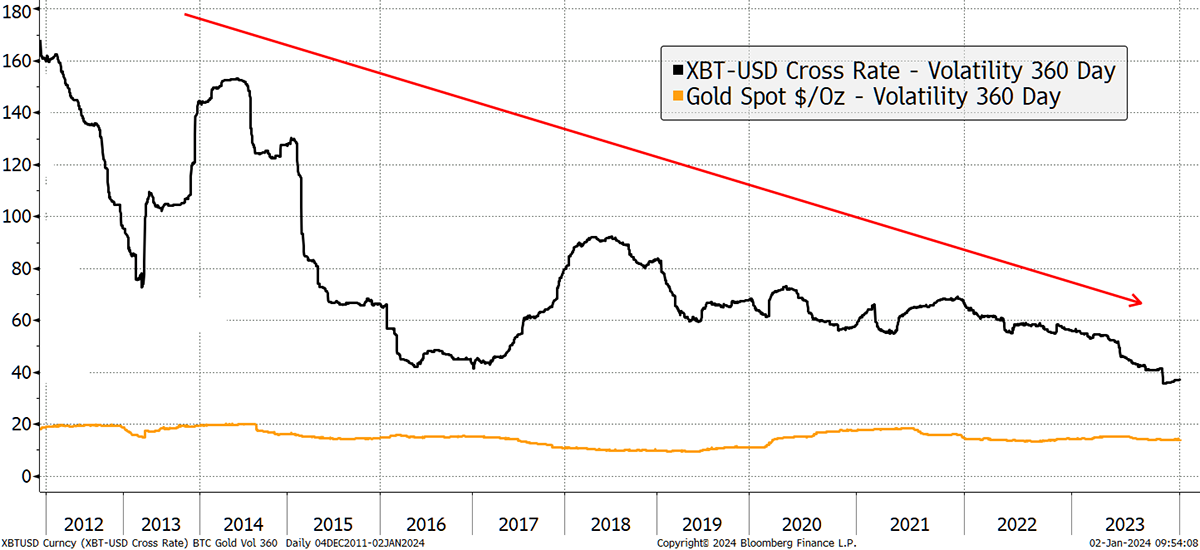

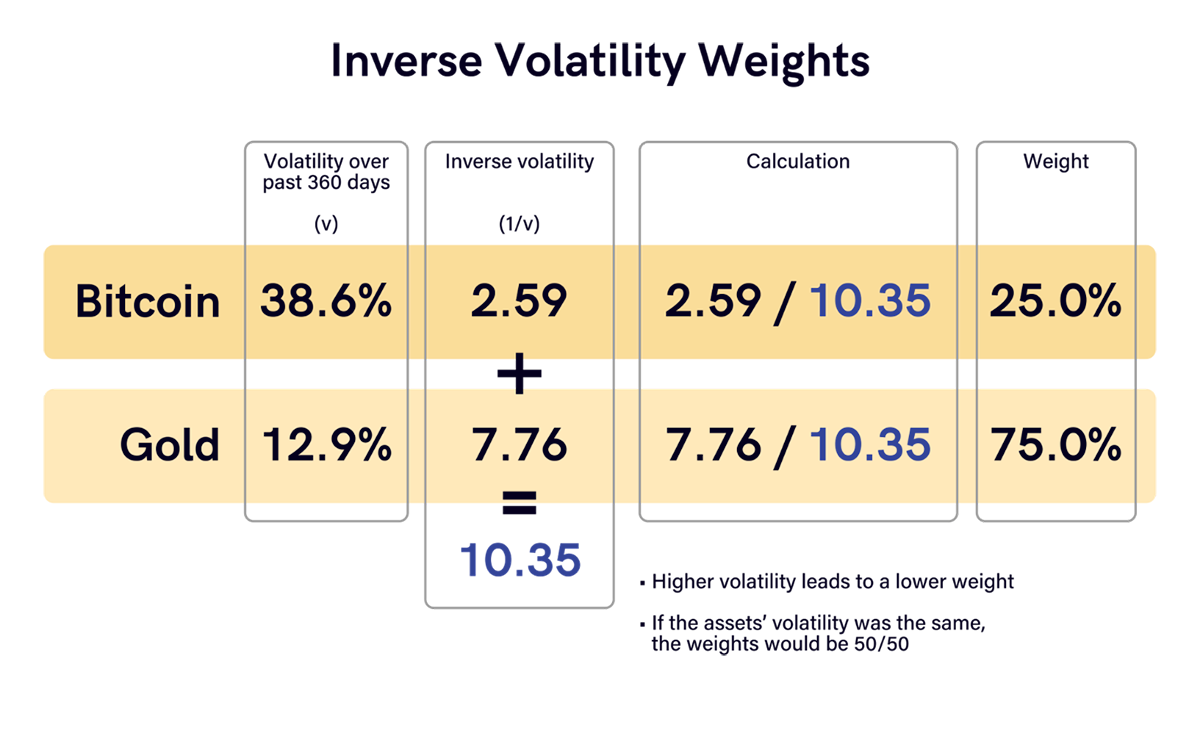

BOLD allocates to bitcoin and gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the month rebalancing. Bitcoin’s volatility has fallen significantly over the years and is now no more volatile than a typical blue-chip stock.

Bitcoin and Gold Past 360-day Volatility at Record Low

The lower volatility has resulted in a bitcoin weight of 25.0% against 25.3% a month ago. The remaining 75.0% is allocated to gold using this formula. Due to price gains in December, the bitcoin weight increased to 27.3% at the month's end. This was reduced back to 25%, meaning some bitcoin was sold for gold. In contrast, during the 2022 bitcoin bear market, gold was sold for bitcoin, which meant bitcoin was topped up on price weakness.

The current Bitcoin weight has been steadily rising since 2018, as the volatility has fallen. As it continues to mature as an asset, I expect the weight to reach perhaps 30% over time.

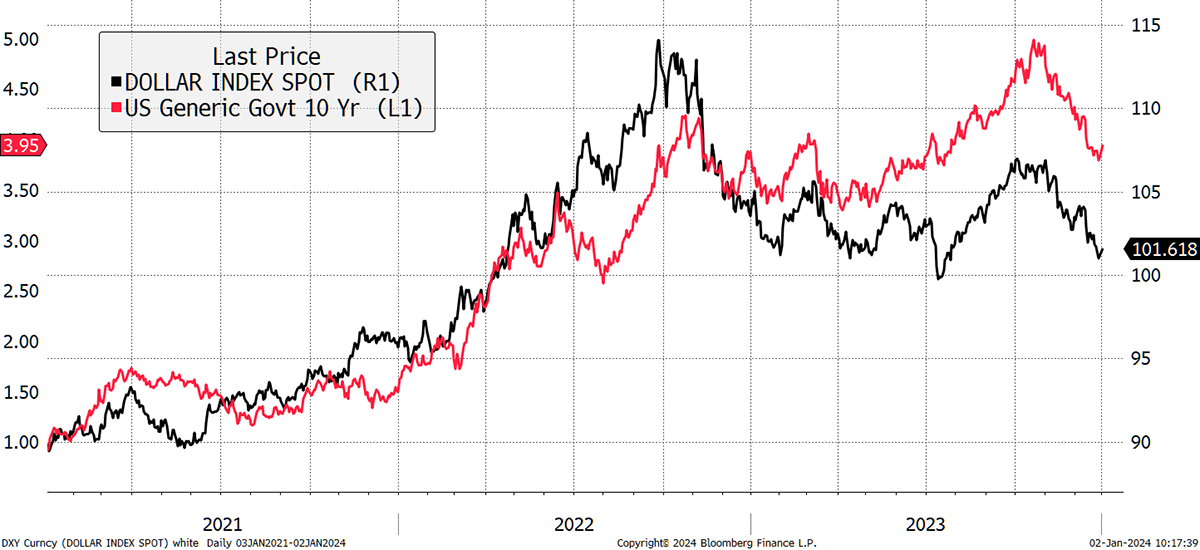

In recent years, since the interest rate hiking cycle began, the strength of the US dollar has been closely tied to the bond yield, as shown below. It stands to reason that if the Fed cuts rates, as they are widely expected to do, the dollar will remain soft. A weak dollar is generally considered to be bullish for both bitcoin and gold.

The Dollar and Rates

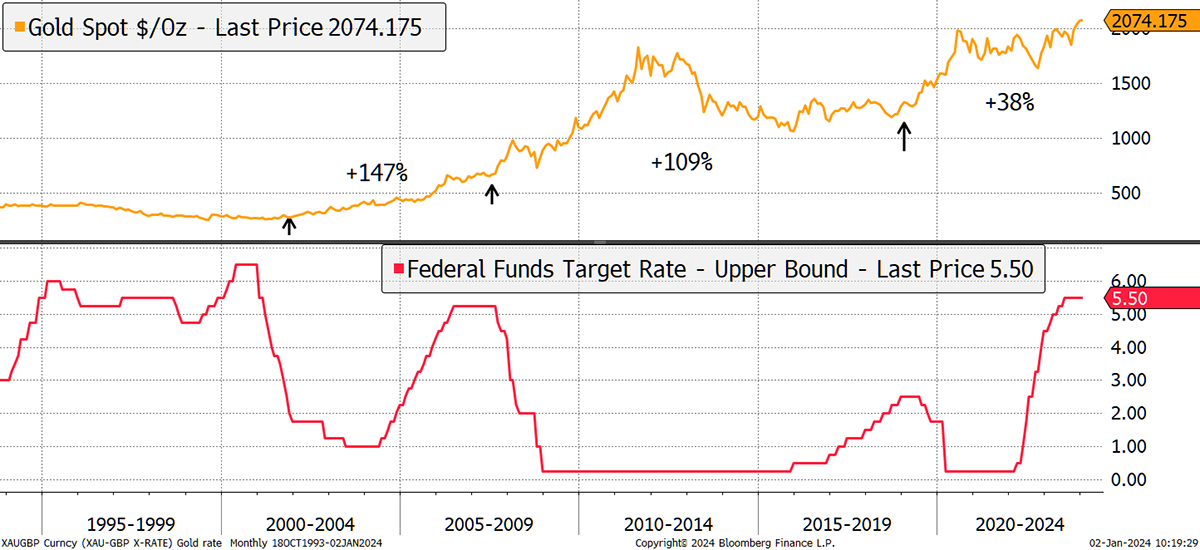

But a weak dollar with falling rates is very bullish for gold. I show the last three rate cycles, which, in each case, led to a new gold bull market. It isn’t certain that the Fed will cut, but if it does, then gold should perform well. Moreover, the chart pattern is long-term bullish, which implies a lasting bull market is underway at a time when institutional investors are underweight. Gold has plenty of reasons to perform in 2024.

Gold Likes Rate Cuts

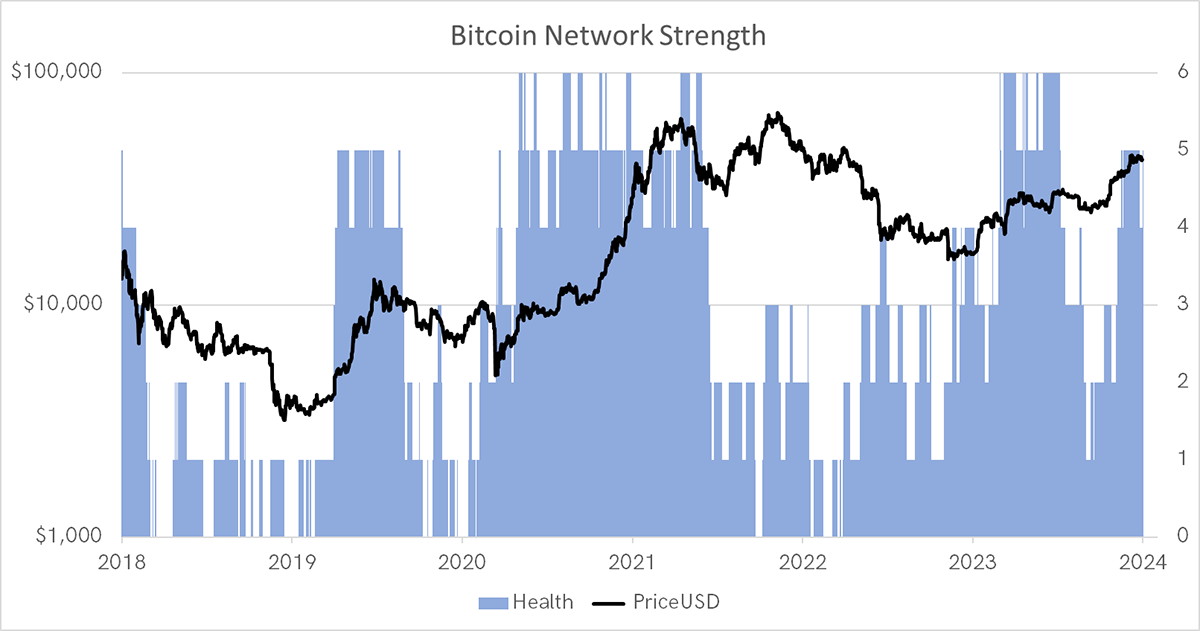

Bitcoin is also in good health, as shown by ByteTree’s network demand model, which measures blockchain activity.

Bitcoin Network Is Growing

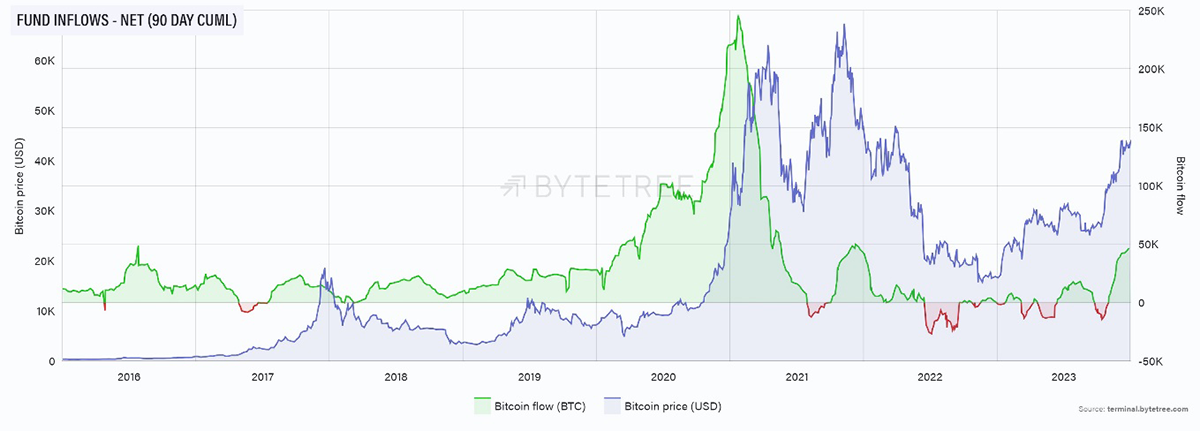

Not only is bitcoin network traffic strong, but it is widely expected that US spot ETFs will be approved. That is expected to bring about additional demand. Historically, inflows into bitcoin funds and ETFs have tended to be a positive price driver. More funds that are readily available to institutional money, driven by BlackRock’s marketing efforts, could be very positive indeed.

Bitcoin Fund Flows Are Strong

It is important to consider that while both bitcoin and gold like a weak dollar, bitcoin prefers rising rates, reflecting a strong economy. In contrast, gold prefers rates to be falling. Bitcoin also likes buoyant financial markets, whereas gold can perform well in a recession. These differences, with a degree of negative correlation, are why the combination is so powerful.

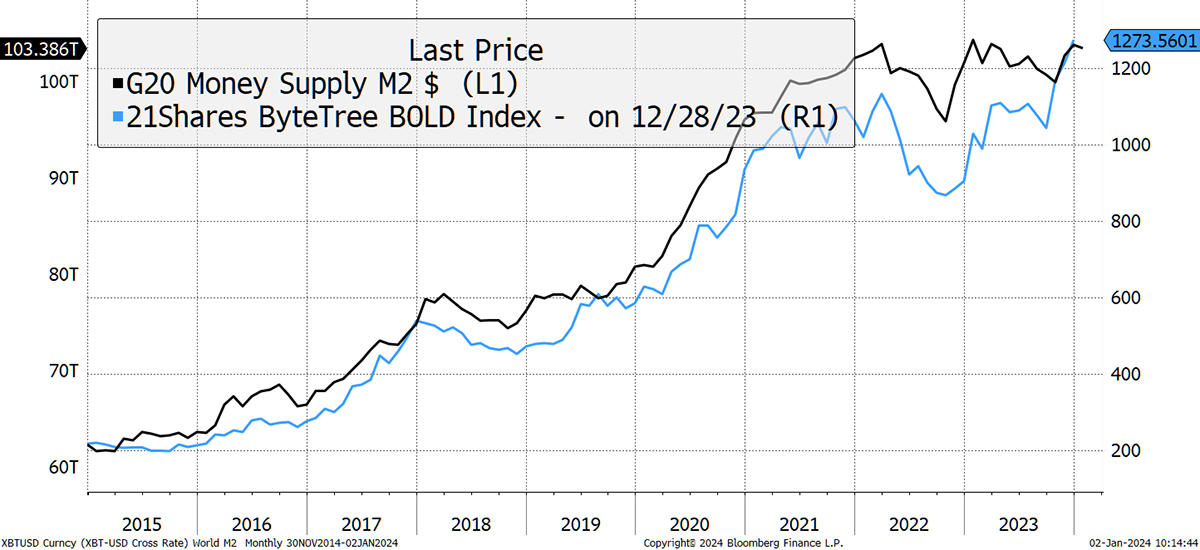

Both assets respond well to a growing money supply, but if the tide is coming in, then bitcoin tends to be the beneficiary, whereas if it is going out, the money tends to flow to gold instead.

BOLD Leads the Money Supply

The correlation with the global money supply is notable. The money supply has grown on average at 7% per annum. BOLD has appreciated more than three times faster.

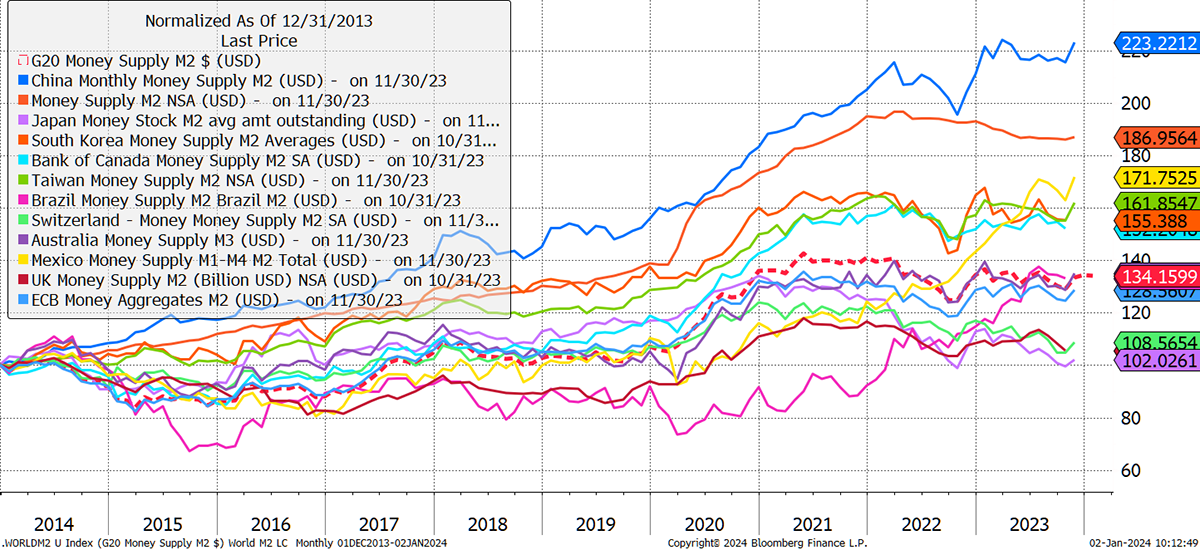

While the developed world has been shrinking its money supply, the worst appears to be behind it. The money supply is expanding in China (blue), and that has boosted BOLD. It appears to be turning up.

Printing in China

Summary

BOLD is an efficient way to capture returns from an ever-increasing money supply. And if the economy cools in 2024, expect the printing to accelerate. BOLD is the optimal way to invest in liquid alternative assets.

Contact

For information on investing in BOLD, contact bold@bytetree.com

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Vinter Index Provider

21Shares BOLD ETP

Bitcoin and Gold Research

Follow @ByteTree on X.com (formerly Twitter)