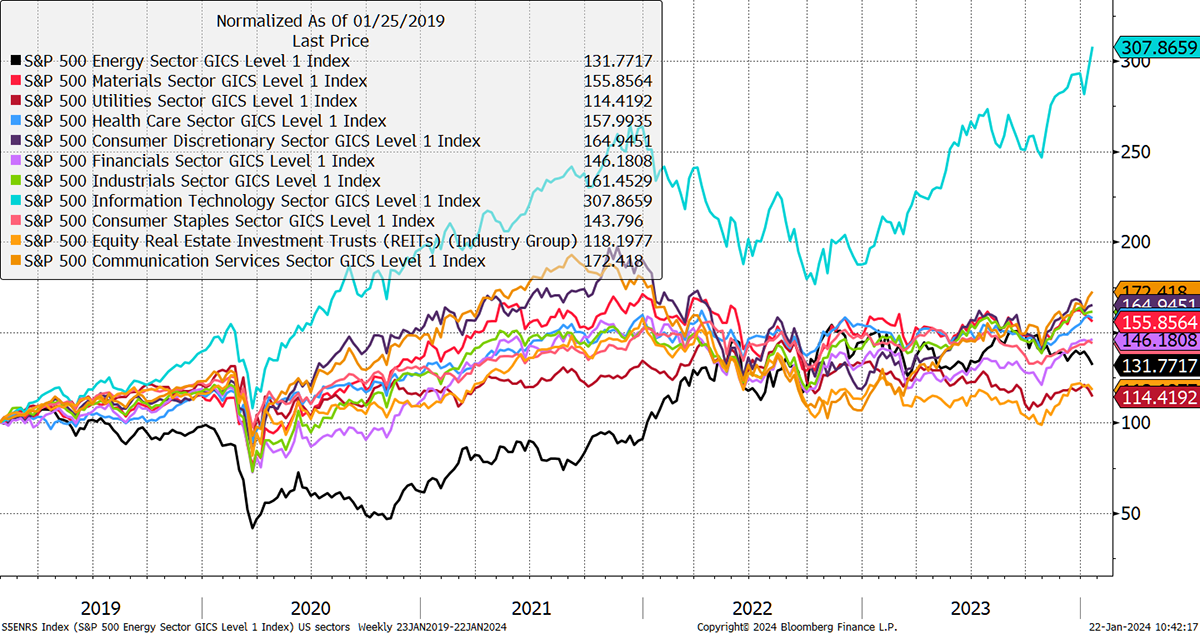

In a quick turn of events, the S&P 500 just made an all-time high, driven by the large tech stocks, which have sprung back to life. Looking back five years, there’s the technology sector, and then there’s the rest of the market, which resembles the rest of the world.

Tech and the Rest

It’s all about artificial intelligence, which I will demonstrate. I went to Microsoft’s Bing browser and asked it to “act as a financial journalist and write a piece explaining why NVIDIA is so valuable.” Bing came straight back to me.

Certainly! Nvidia is a technology company that has been around since 1993. It was founded by three computer chip engineers who predicted that as computers developed, they would need to get better at processing complex visuals (1). The company has since grown to become one of the most valuable companies in history, with a market capitalization of $939.3 billion (1).

Nvidia's success can be attributed to its graphics processing units (GPUs), which are used to run graphics-heavy video games. However, the company's GPUs have also been adopted by artificial intelligence researchers to run powerful new algorithms that are causing breakthroughs in the field (1). Nvidia has been steadily growing its AI-focused business over the past several years, but the explosion of interest and investment in the space over the past six months has turbocharged its sales (1).

Nvidia's GPUs are well-suited to crunching the massive amounts of data that are necessary to train cutting-edge artificial intelligence programs like Google's PaLM 2 or OpenAI's GPT4 (1). The company's revenue and margins have skyrocketed, with revenue up 101% on the back of 171% data-center growth last quarter (2). Nvidia's current valuation represents a discount compared to a fellow high-flier (3).

In conclusion, Nvidia's GPUs have become a critical component of the artificial intelligence revolution, and the company's success is a testament to the importance of innovation and foresight in the technology industry.

Source: Conversation with Bing, 22/01/2024.

NVDA is actually valued at $1,476 billion, which is a lot more than the $939 billion stated. You will have noticed the piece cites three sources, the first being an article on Yahoo Finance published last May, when the market cap was indeed $939 billion. Bing summarized these three stories about NVDA, and you have to admit, it’s quite a good little piece, but, for some reason, it used out-of-date data despite being a master of the internet.

The main point is that NVDA’s GPUs have become a critical component of the artificial intelligence revolution.

I phoned a friend who manages a tech fund for his thoughts. He agrees that big tech valuations are impossible to justify, even on rosy scenarios, but he said it’s the only game in town. The world is headed for recession, and the best bit about AI is that it’s virtual and, in investors’ eyes, an escape from the harsh realities of the real world.

He also made a very good point that you shouldn’t think of Apple making phones, Microsoft with spreadsheets and Google on search. Along with Meta, Amazon and Tesla, these companies are all conglomerates desperate to outdo one another. They are all involved in everything related to the internet.

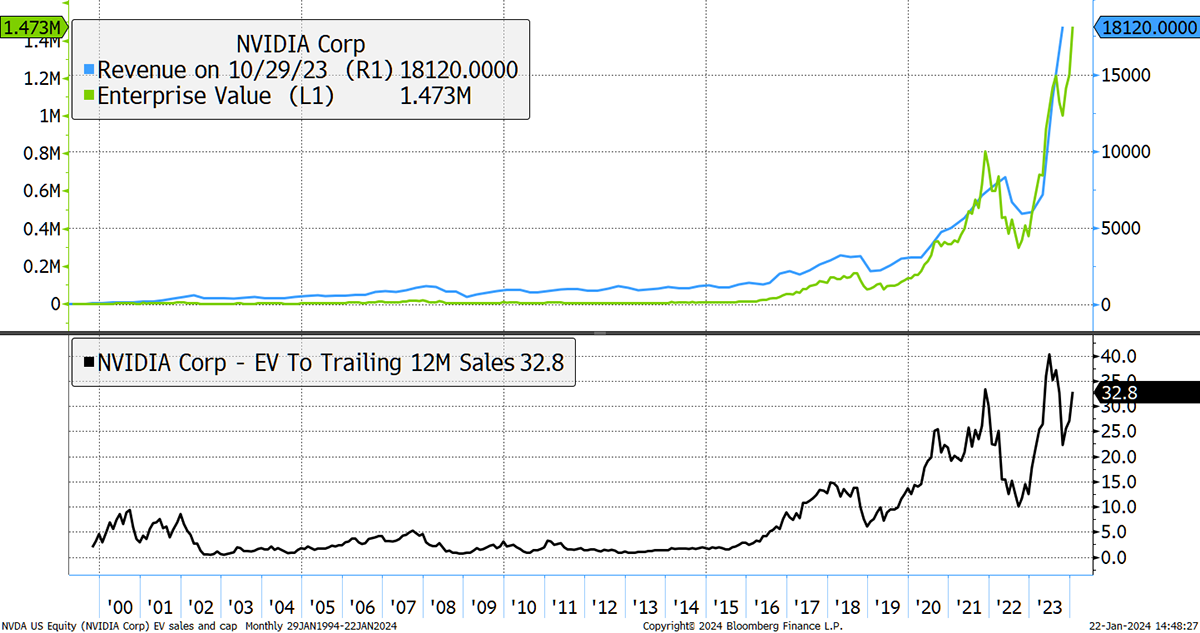

NVDA trades on 33x sales, which is huge. You often see that sort of valuation in promising and excitable small caps, and fair enough. FeverTree, who make mixers, managed to reach 20x sales without any tech. But when it comes to trillion-dollar companies, it is very rare to see that kind of excitement.

I show the enterprise value (EV), market cap plus net debt, alongside the company’s revenues. The EV to sales ratio is shown beneath, which is 33x.

NVIDIA Trades on 33 Times Sales

Let’s be clear: 33x profit is a high valuation, which means 33x sales is monstrous. The rationale is that their net income margins, which were 12% a decade ago, are today 22% and heading for 55% in 2025. In that year, they are expected to generate $47 billion of free cash flow. To justify a $1.5 trillion valuation, they will need to.

NVDA makes these incredibly powerful chips that are the bottleneck in AI. Without their chips, forget it, which means they have a monopoly. So far as I understand it, the big tech firms are fighting over one another to secure supply at sky-high prices.

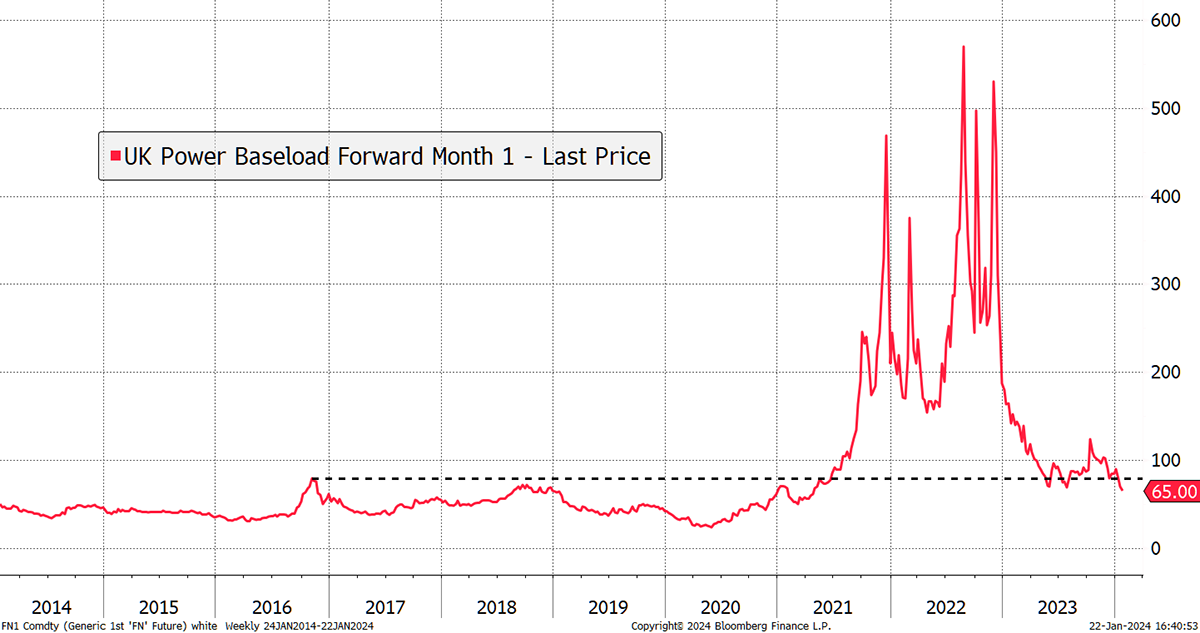

Remember the surging energy prices during the pandemic? They have collapsed by 88%, and no one is talking about it. It had nothing to do with the government policy or intervention, just market forces, which have returned to normal. Still, cheaper energy is a good reason for the economy to be doing better than expected.

UK Energy Prices Back to Normal

NVDA’s technological lead is estimated to be three years, but it’s certainly not forever because it never is. If there’s one thing super-normal profits are sure to do, it is to attract competition.

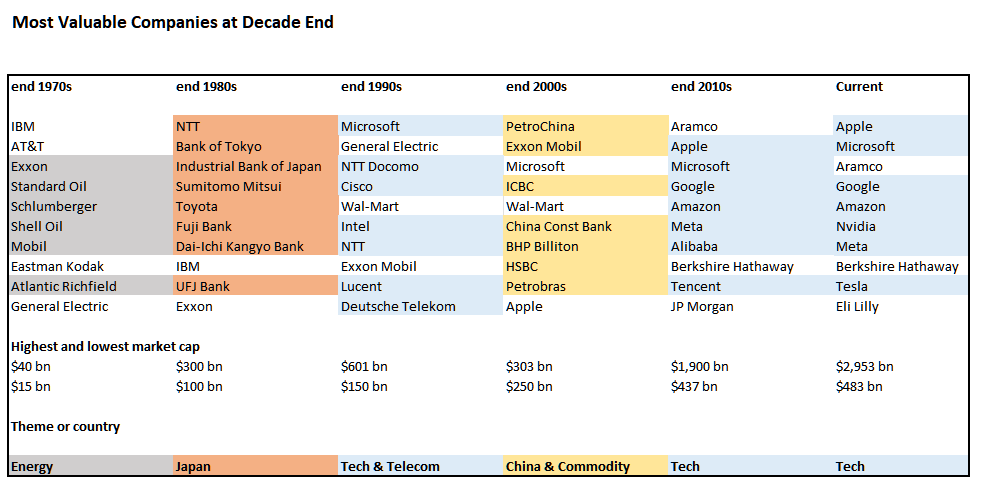

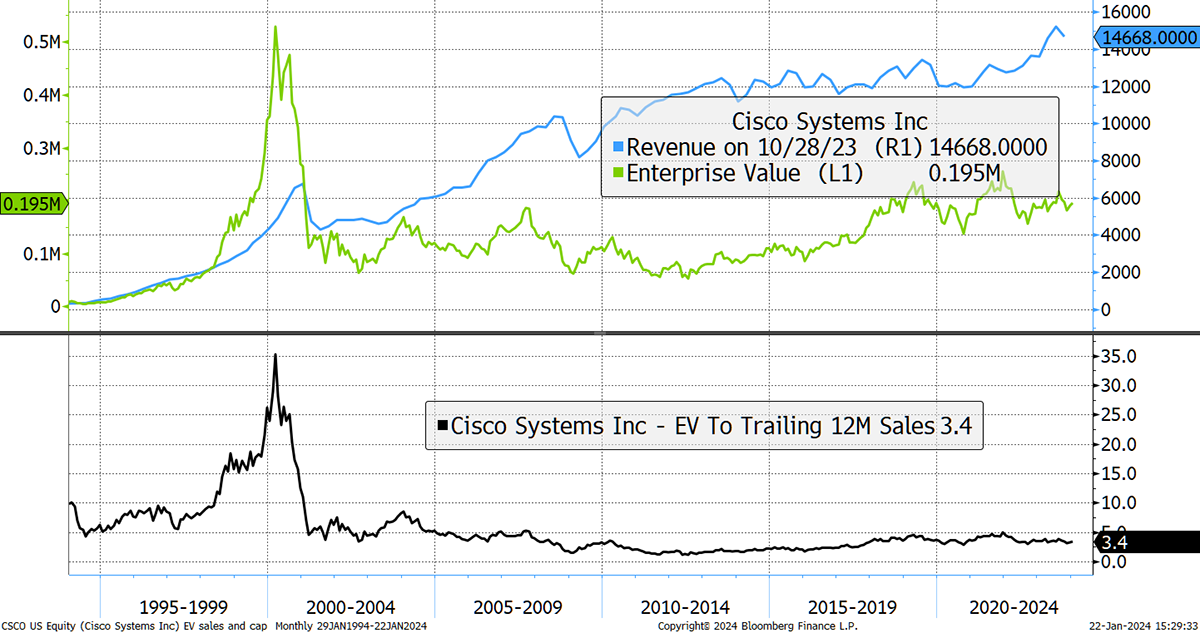

They say history doesn’t repeat itself, but it rhymes. Going back to 2000, Cisco (CSCO) was the gateway to the internet. Just as you need NVDA for AI today, back then, you needed CSCO’s routers to command the internet. In late 1999, CSCO was the world’s fourth most valuable company. Today NVDA is the fifth, while CSCO shares are still 33% below their peak.

It is remarkable how much this list shifts. Tech dominated the list in the late 1990s but was barely noticeable ten years later. But it’s back and bigger and bolder than ever before. The current list resembles the end of the 2010s, just with Chinese tech out and NVDA and Eli Lilly in.

Cisco Managed 35x Sales, Then 3x

I know it’s tough when the stock market makes an all-time high and we aren’t feeling it, but what’s currently happening in big tech is utter madness. I saw this on X.com:

As of January 19th, NVIDIA and Microsoft had accounted for about 75% of the S&P 500's gain this year, while the 20 largest stocks in the index accounted for 110% of the index's upside move. The remaining ~480 stocks were acting as a drag.

We’ve been here before two decades ago and know how it ends. We just need to be patient. When it does, all that money will shift from growth to value, just as it did last time in 2000. And the time before in 1972.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd