ETFs and Musical Chairs

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 93;

So far, and with net inflows of $620m, it’s been more of a game of musical chairs than anything else. To put things into perspective, ByteTree data shows how January has seen ETF inflows of 13,929 BTC, which compares to 49,136 BTC in Q4 last year.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Investment Flows | $621 million net inflows to Bitcoin ETFs |

| Technicals | Pullback |

| On-chain | Positive |

| Macro | Steady |

Investment Flows

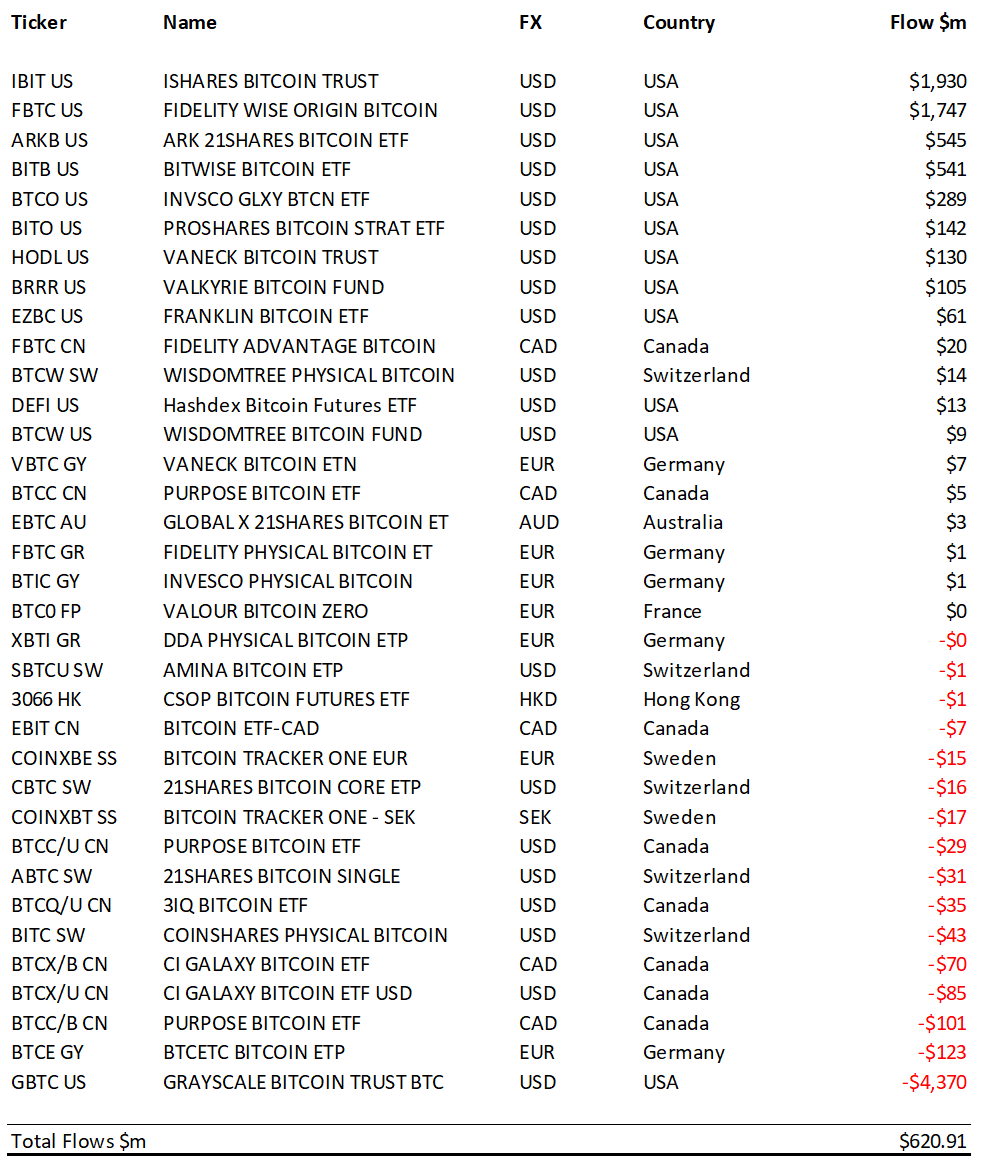

The nine new US spot Bitcoin ETFs are two weeks old. They have seen an almighty $5.56 billion of inflows. Unfortunately, there was leakage on the other side, with $4.93 billion of outflows, leaving net inflows of approximately $621 million.

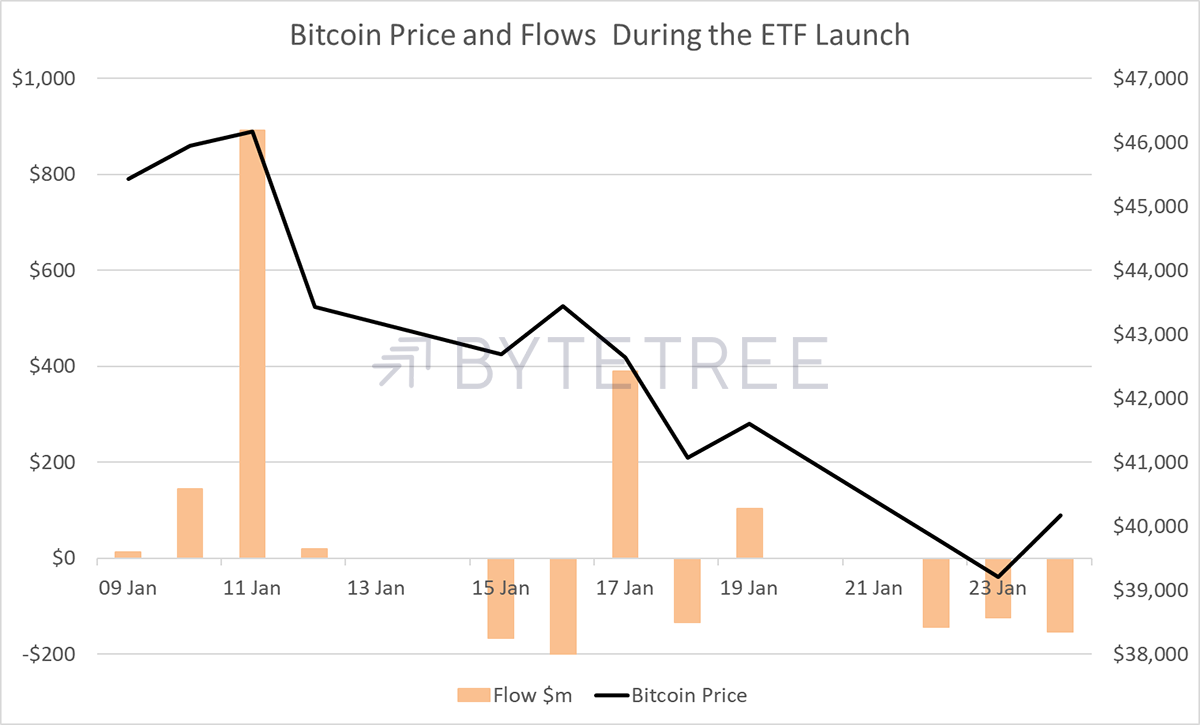

Most of the new money went into iShares and Fidelity, with our partner, ARK 21 Shares, coming in a respectable third place. These funds are all charging low (0.12%) or even zero fees as a promotion. As for the outflows, it is unsurprising to see Grayscale (GBTC) see $4.37 billion of outflows, given it has been charging 2.5% since 2013 and still charging 1.5% today. As a result, I would expect those $500 million daily outflows to continue. The futures ETF (BITO) also lost $123m of assets. I have plotted the net flows each day with the price of bitcoin overlaid.

What the market hasn’t talked much about is the impact on European and Canadian ETFs, which have seen their assets switched to the new lower-fee US ETFs. In aggregate, this amounts to outflows of $450m, with $123 million from Europe’s largest ETF, BTCE, which charges 2%. Canada’s Galaxy and Purpose products also saw outflows of $256m.

So far, and with net inflows of $620m, it’s been more of a game of musical chairs than anything else. To put things into perspective, ByteTree data shows how January has seen ETF inflows of 13,929 BTC, which compares to 49,136 BTC in Q4 last year. The average price of bitcoin was $36k in Q4 and $43k in January, so dollars had more purchasing power late last year.

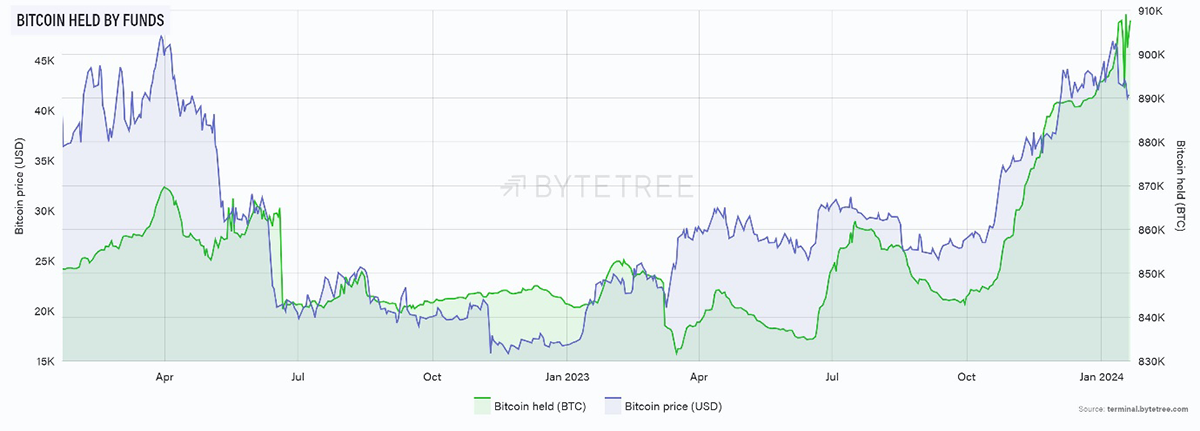

Most importantly, it is crystal clear how important fund flows have been for bitcoin. The price has closely resembled the buoyancy of the funds, shown here in BTC held.

The Bitcoin Price Is Influenced by Fund Flows

I am not suggesting the fund flows set the price in its entirety, but now that the funds hold 908k BTC out of a total of 19.6 million, it is by far the largest measurable investor group. Besides, we know from 20 years of observation how important gold ETF flows were to the gold price, and the same rules apply to bitcoin today.

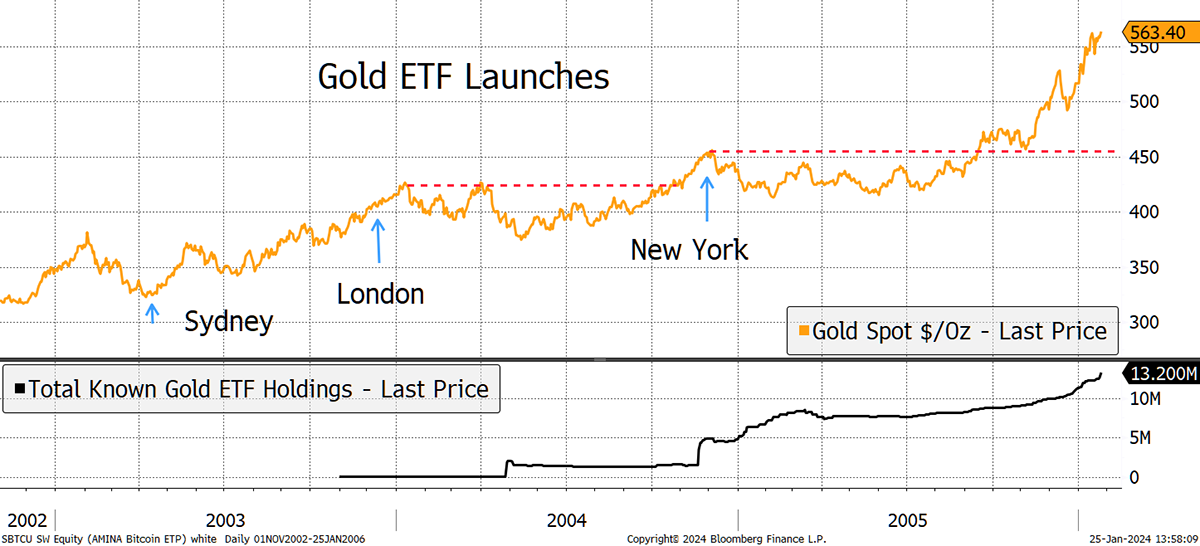

Let’s briefly go back to 2003, when the first gold ETF was launched in Sydney. I remember the news coverage at the time, and it was a relatively quiet affair. Then, later that year, a gold ETF was launched in London, at which time the price was 25% higher. That wasn’t quiet at all, and everyone was talking about gold. Then, a year later, GLD was launched in New York with great fanfare. H/T Dominic Frisby for the inspiration.

Gold ETFs Changed the World

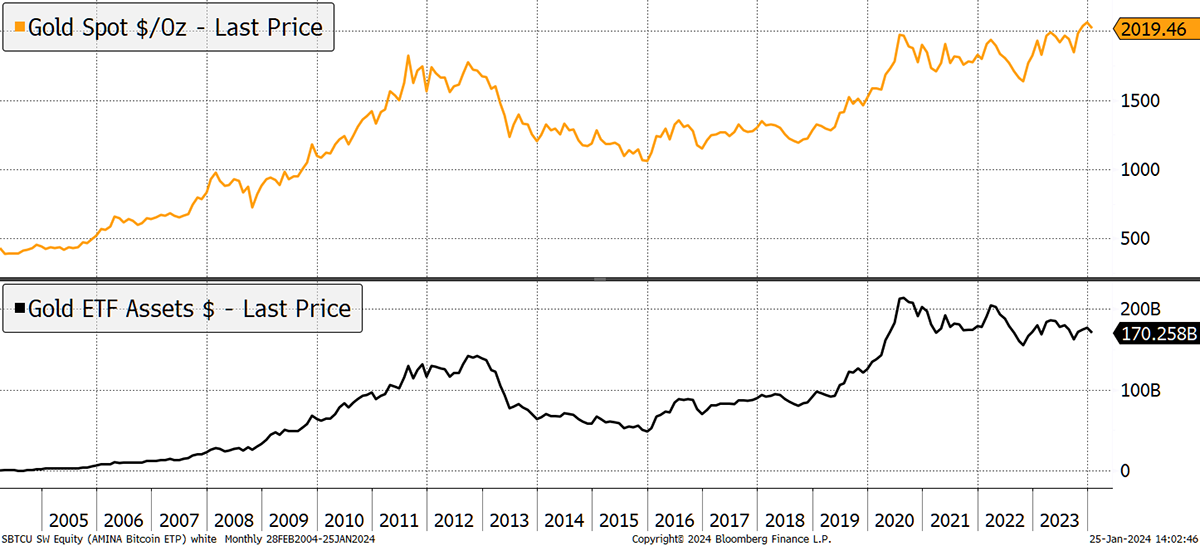

The key point is the market quickly learned how ETFs would boost demand for gold. And you know how they say it’s better to travel than arrive? Well, by London’s launch, the price surged into the launch, only to stall for a year thereafter. Then it did it again for New York, by which time gold had appreciated by 35%. From bitcoin’s perspective, the next part is the fun part. Gold ETF assets grew to a peak of $220 billion by 2020. Where are the bitcoin ETFs today? A mere $34 billion and the wealth management industry haven’t yet started their inevitable collective 2% allocation.

Gold ETFs Grew to $200 Billion

Bitcoin ETFs haven’t even started!

While the recent net inflows relating to the US ETF launches have been slightly underwhelming, it’s important to remember that people consciously invested or reinvested $5.56 billion into bitcoin ETFs, which is huge. The outflows were due to investors seeking cheaper products, or indeed, it is rumoured that the FTX unwind dropped a billion dollars of BTC. Whatever the answer, there was heavy demand in the run-up to the launch, and the leading US ETFs will end up being massive.

I suspect GBTC continues to bleed, but this long-awaited ETF development is huge progress for the bitcoin ecosystem. Most of the world’s investors can now invest through their conventional brokerage account safely, cheaply and simply. By most, I mean people living outside of the United Kingdom where these products have been banned by the Financial Conduct Authority (FCA) since October 2020 (implemented January 2021).

They remain silent on the issue and have never given a satisfactory reason for doing so. UK policy is now at odds with global policy, and it is a truly tragic situation. At least it helps us better understand the reasons behind the slow death of the UK stockmarket.

Consider the various crypto scandals. None of them were in ETFs, and many of them would have been avoided had ETFs been more widely available and sooner. Forcing law-abiding consumers into dark corners of the internet to buy bitcoin is a regulatory failure. When they banned bitcoin ETFs, they had been happily trading across UK retail investment platforms since 2015.

The ban was decided when the price was $10k. It seems likely that an adviser expected bitcoin to go to zero, and the regulator would be a hero when that came about. Unfortunately for them, it never did, and it never will. But you can imagine the conversation that bitcoin was a suspected Ponzi scheme. It had no intrinsic value, along with all things virtual that live on the internet. Some people just don’t get the network effect and the lasting value they create. The FCA needs to reverse the bitcoin ban for all investors, and not a moment too soon. It’s up to all of us to lobby for change.

Technicals

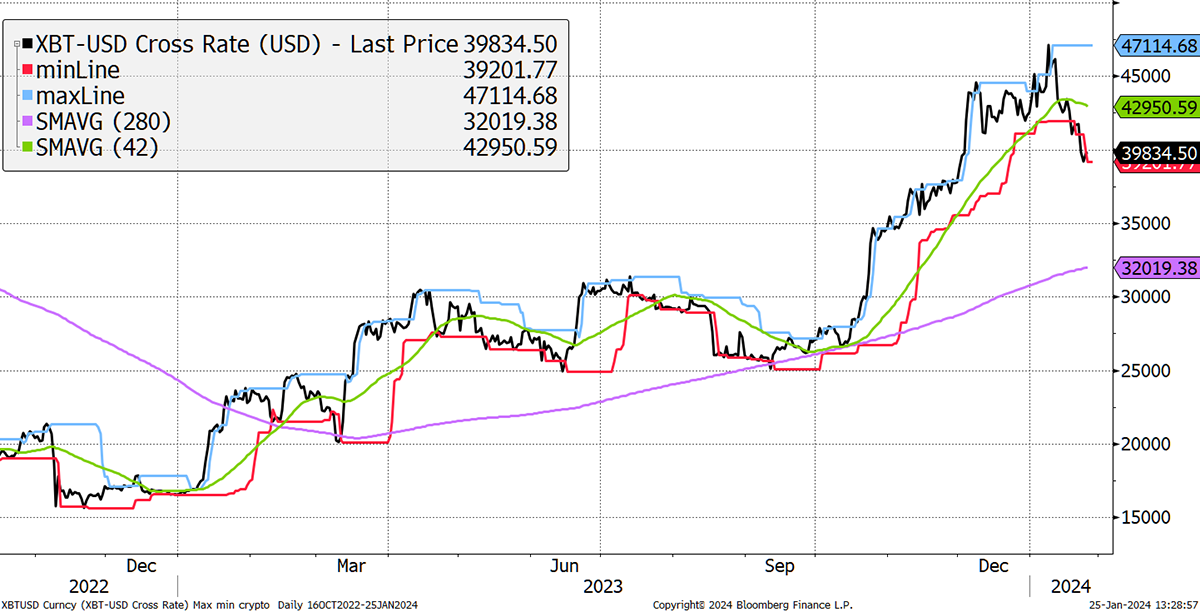

Today, the bitcoin price is $40k and will likely be headed higher over the coming years despite the recent setback. This happened when the gold ETFs were launched and is happening again. Let’s not forget that the price has risen significantly since the miserable end of 2022. All in all, we are in a good place.

BitUSD - Bitcoin in Dollars - ByteTrend Score 2/5

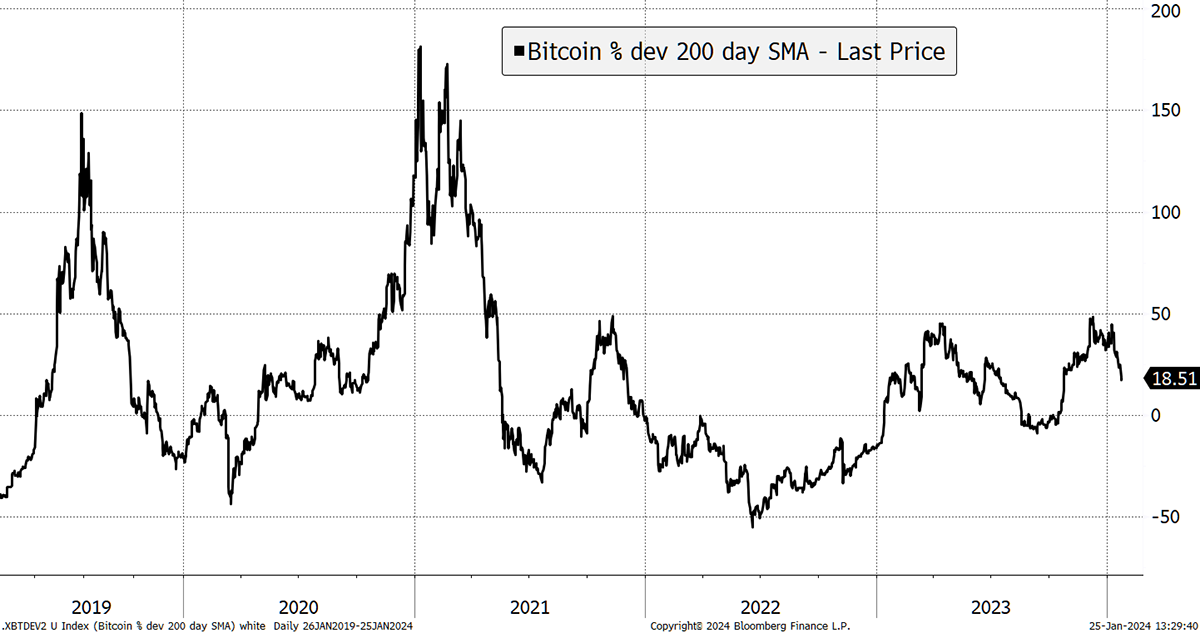

What matters here is the 200-day moving average is upward-sloping, and the trend appears to be quite strong. What’s more, we have the next bitcoin halving estimated to take place on 22 April, just 88 days from now. That’ll pull back the crowds, and I’ll cover halving next month. More immediately, bitcoin was ahead of itself two weeks ago but is now in a better place.

Is Bitcoin Overbought?

In the longer term, the six-year regression, which has appreciated with an IRR of 41%, is looking good. In addition, price volatility is lower than in years past. Hugging the red line would be no bad thing.

Bitcoin Growing Up

All things considered, it is looking rather upbeat.

On-chain

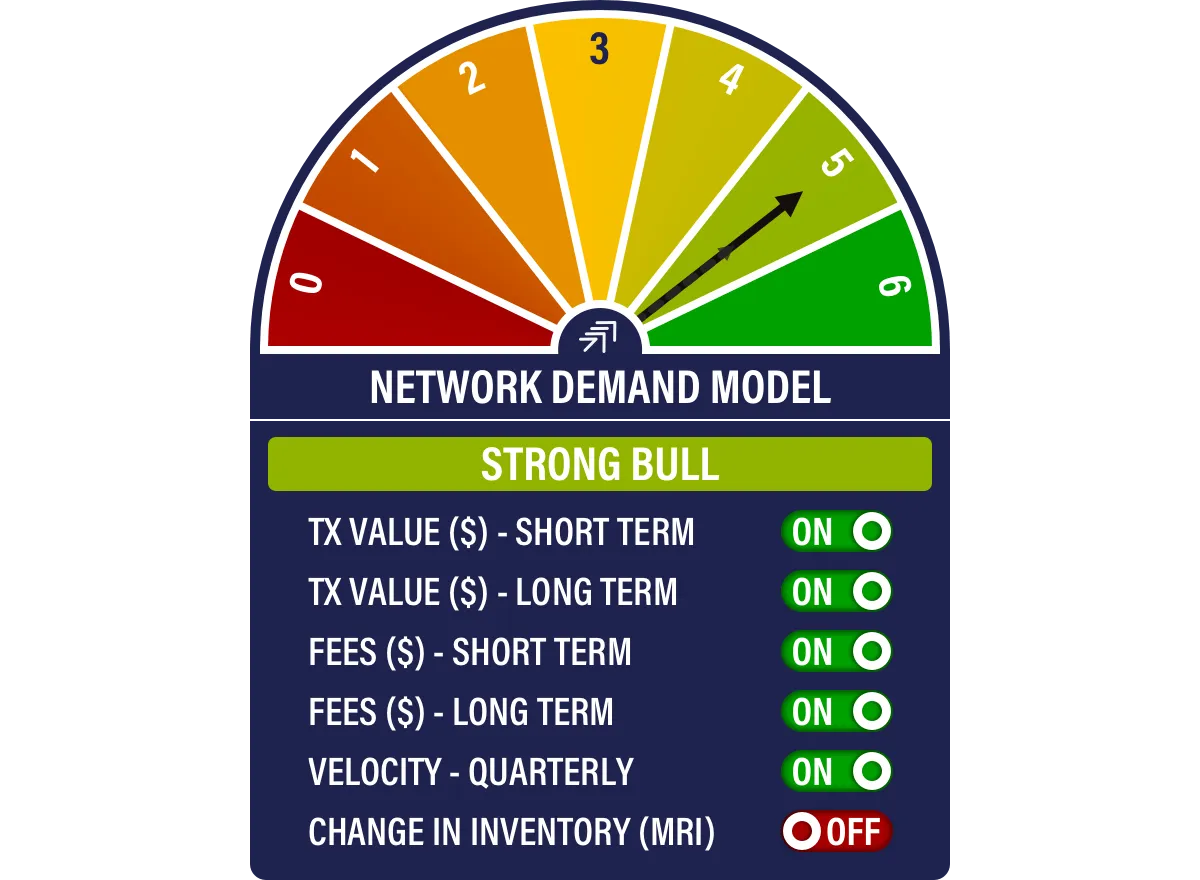

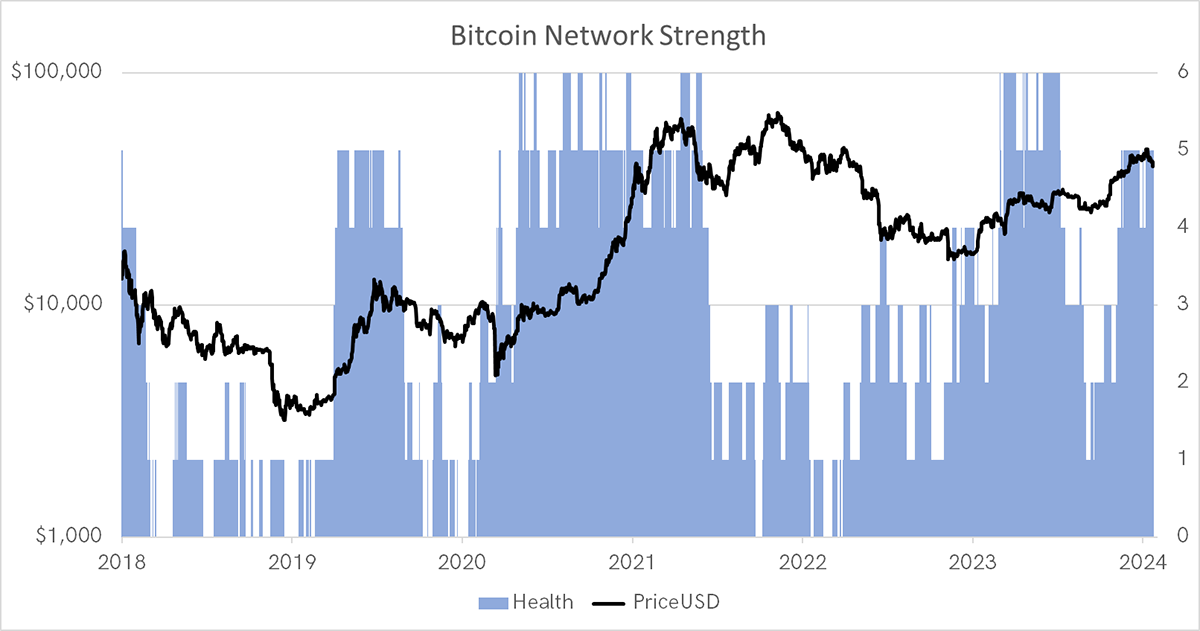

The blockchain is strong, with 5 out of 6 of our indicators positive, as seen on the network strength chart.

The one negative to consider is that the network (red) is slowing, but we should recognise how much activity is connected to the ETFs. All those musical chairs as bitcoins shift from one owner to another.

Bitcoin Below Fair Value

Macro

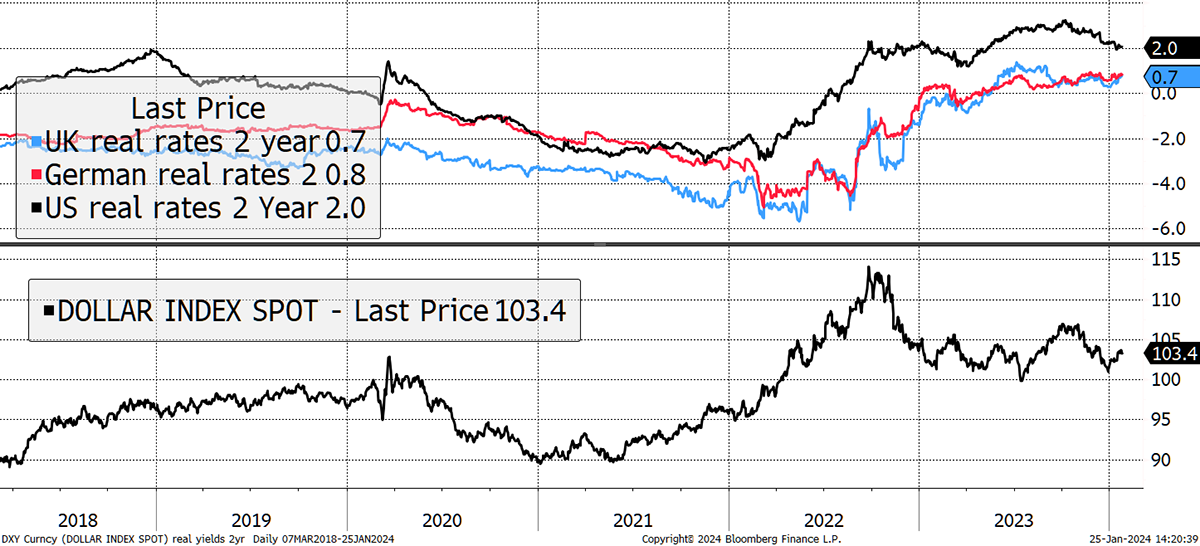

The one risk that never leaves us is the potential for a stronger US dollar. Short-term real interest rates have been cooling, which ought to ease the dollar. That’s obviously good for bitcoin. Spot the real rate spikes in late 2018, March 2020, and 2022 in the chart below. All of these led to rough times for bitcoin. Bitcoin prefers easy money… but don’t we all.

Real Rates and the Dollar

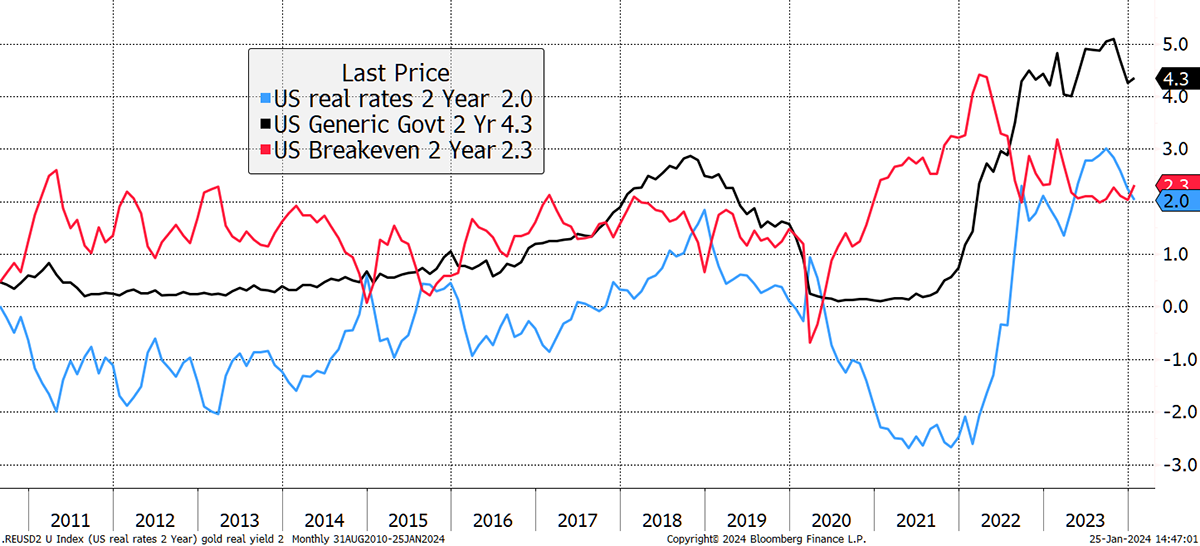

Looking at what makes up real rates, I show it alongside the 2-year yield and 2-year expected inflation. We mustn’t forget that inflation expectations are 2.3% and stubbornly refusing to fall below 2%. In the meantime, and while Wall Street seems to think inflation is already below 2%, the last print was 3.4%. Higher inflation is good for bitcoin and gold. Where they differ is that bitcoin prefers a hot economy with yields flat or rising, 2022 excepted. In contrast, gold likes rates to be falling. Gold can thrive on misery.

Inflation Expectations Remain Elevated

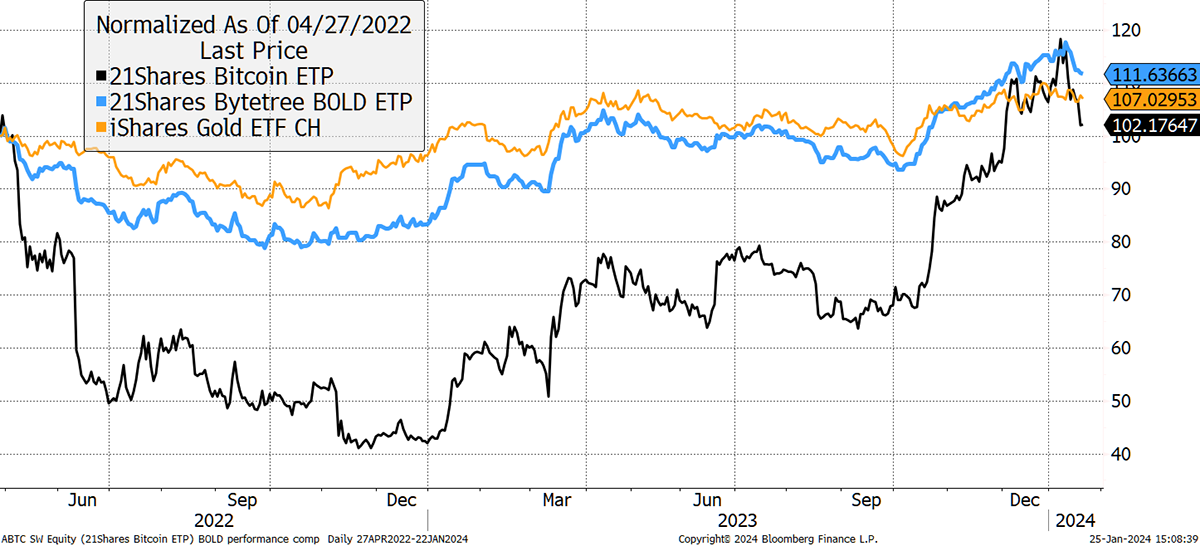

You’ll know my views that gold and bitcoin sit together. I show the 21Shares ByteTree BOLD ETF, the world’s first to combine bitcoin with gold, since launch on 27 April 2022. That was a rough start, but since then, BOLD is ahead of both bitcoin and gold. It is remarkable.

Better off in BOLD Since the ETF Launch

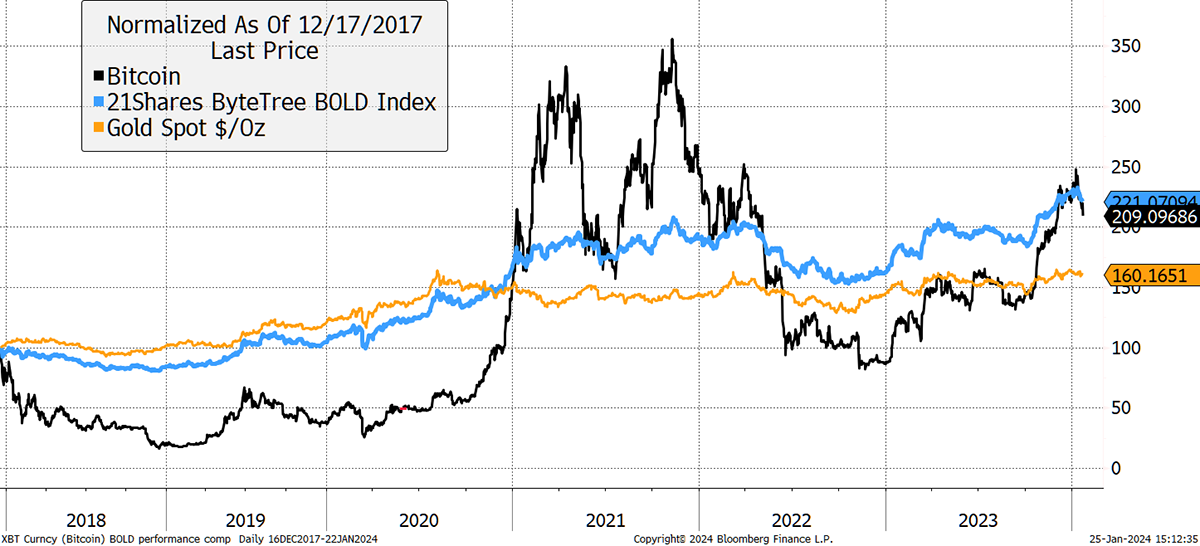

That even holds true over six years since bitcoin’s 2017 peak at $19k. Imagine that, and without the headache. BOLD enhances gold while calming bitcoin.

Better off in BOLD since 2017

Summary

Memories of 2003/4 and what happened to the gold market is the model to follow. Yet bitcoin could be bigger because the world is digital, and more importantly, the global financial services industry has barely started with its 2% allocation. And as you all know, they’d be better off in BOLD.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.