Tether Dominates Stablecoins

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 92;

It was only last March that Silicon Valley Bank (SIVB) collapsed. It had mismanaged its bond portfolio and quickly suffered a run on its deposits, making it unviable. Circle was a leading issuer of stablecoins, and being regulated, were one of the “good guys” in the crypto space. Unluckily for them, they held $3.3 billion of deposits with SIVB. The bailout meant they faced no losses, but it knocked confidence, nevertheless.

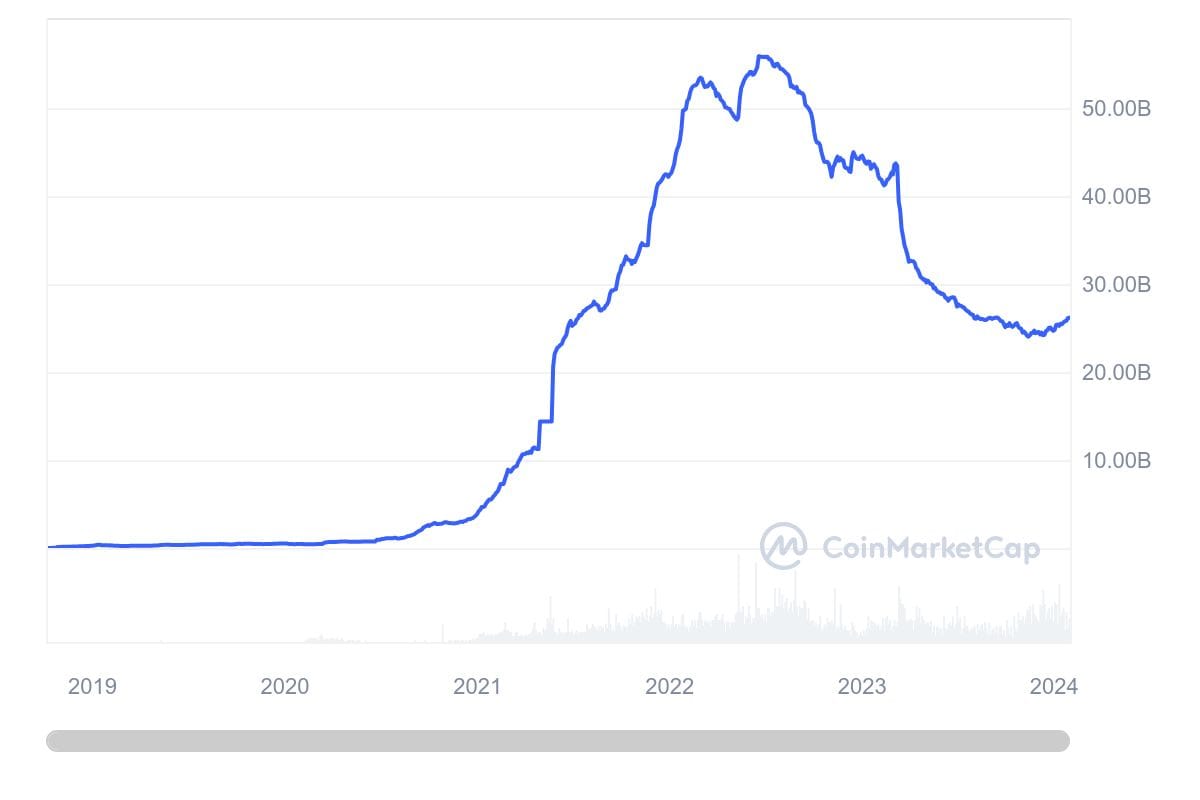

USDC Supply

I have always cheered for USDC because I felt they were trying to do the right thing. They were solving problems that needed to be solved. It is a relief their issuance is rising again, and this may well tie in with the new US ETFs. Presumably, Wall Street would much rather deal with the likes of USDC than offshore unknowns.

Given the banking system had tried hard to block crypto fiat transactions, the stablecoin was the workaround. Better still, it was much faster in settling trades and gave rise to decentralised finance (DeFi). The attempts to hurt the crypto space ended up making it stronger.

Then there’s Binance’s stablecoin (BUSD), once full of promise but now dead in the water. According to Coindesk,

“BUSD came under regulatory scrutiny in February after the New York Department of Financial Services (NYDFS) ordered Paxos to stop issuing it. Shortly after, Binance was sued by the Commodity Futures Trading Commission (CFTC) for allegedly offering unregistered crypto derivative products in the U.S. and violating federal law.”

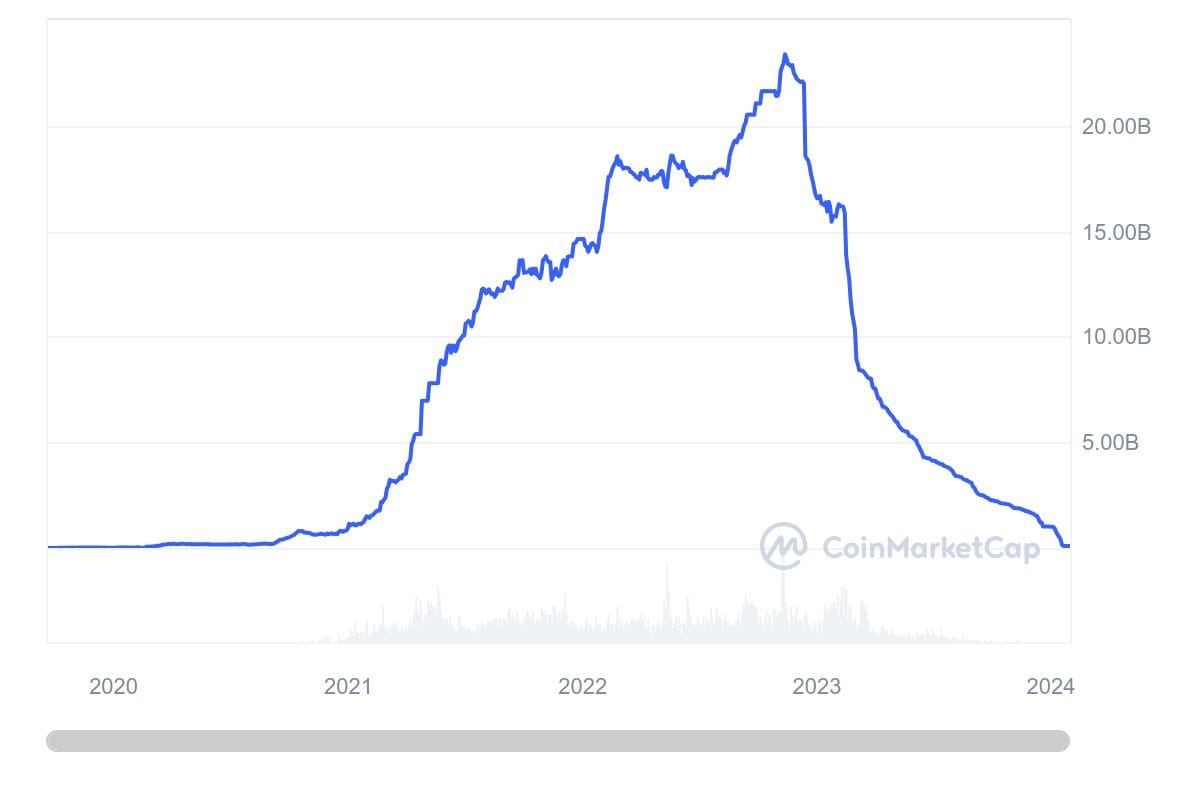

This forced the Binance exchange to stop supporting BUSD, and it has collapsed from $22 billion and is now close to zero.

BUSD Supply

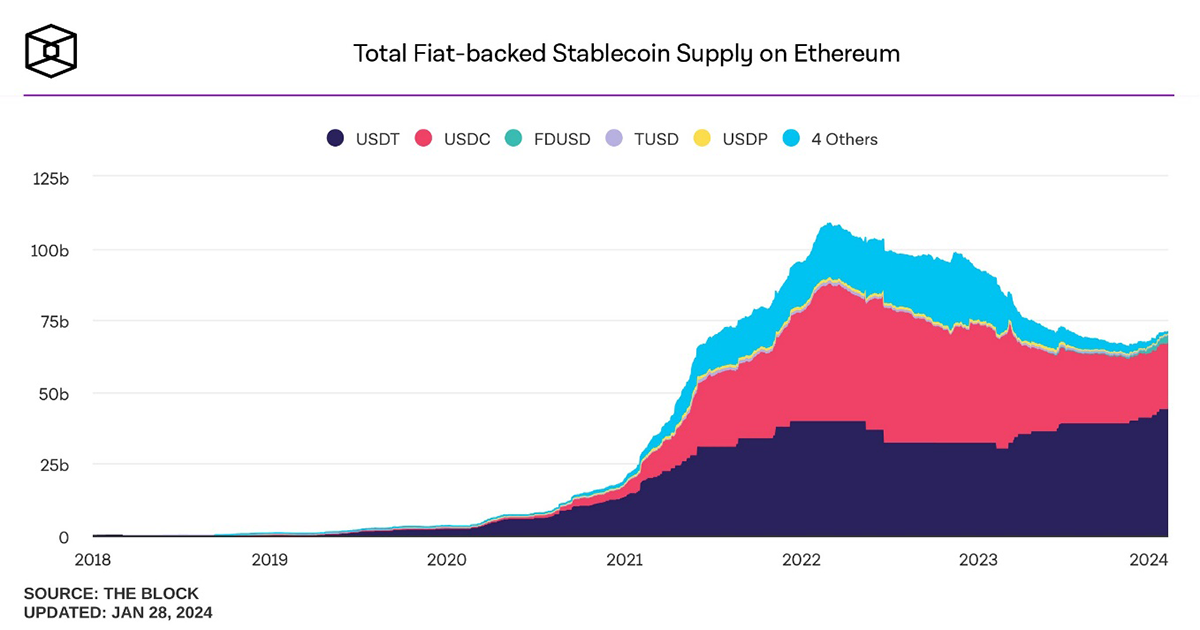

The presumably unintended consequence of bashing the good guys is that it has paved the way for the baddies to thrive. Tether (USDT) has grown to $96 billion, and given they don’t pay income, with interest rates at 5.5%, it’s a nice little earner. Higher rates also mean any hole in the balance sheet that existed in the past doesn’t need to exist in the future, provided they do the right thing. USDT has become the dominant player in stablecoins.

The risk is that Tether is so large that it is now a single point of failure in crypto. The risk isn’t their balance sheet because they’ve outgrown past issues, but it could come from regulators. That said, I suspect the ETF paves the way for new stablecoin issuers from Wall Street, which could grow quickly alongside the ETFs.

These are worth $34 billion, and I see no reason they don’t climb past $200 billion over the next few years.