The Multi-Asset Investor Track Record to End 2023

Disclaimer: Your capital is at risk. This is not investment advice.

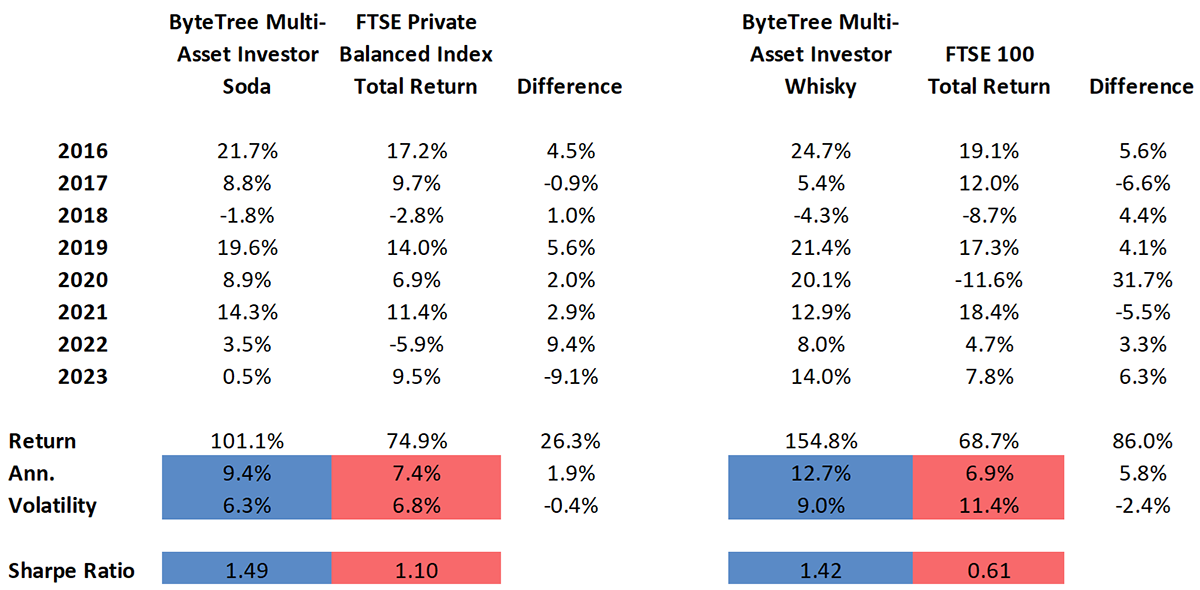

We are pleased to inform our clients of the updated track record for The Multi-Asset Investor Portfolios at the end of 2023. Both portfolios managed a positive return, with Soda giving back much of the relative performance gained in 2022. Fortunately, Whisky continued to perform well, making another leap forward. I have also briefly covered Venture below.

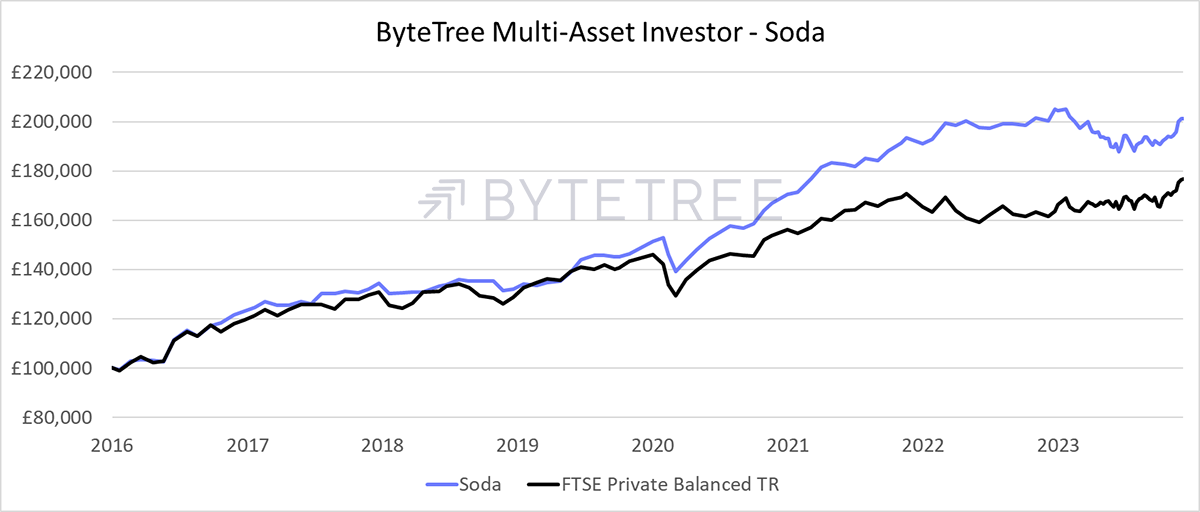

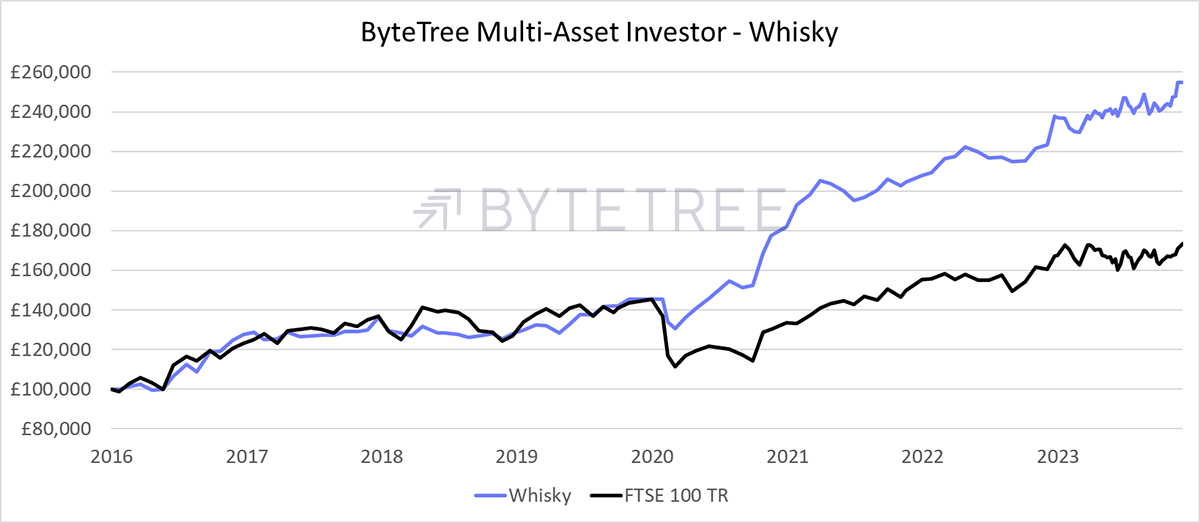

While 2023 was challenging for Soda on a relative basis, it is worth noting how over the four-year period, marked by the pandemic, 1 Jan 2020 to 31 Dec 2023, Soda rose 29.5% (index 23.4%), while Whisky rose 66.9% (index 20.7%).

Both portfolios take a very different path from market portfolios, which track or hug a market index. The Multi-Asset Investor focuses on risk management and embraces undervalued assets with opportunity and diversification. In contrast, a typical index includes everything within its realm despite the fact it might be over-valued or low quality. Over the years, most of the excess returns from the Whisky and Soda portfolios have come about during adverse market conditions while keeping up, or even doing slightly better, during the good times.

The Soda Portfolio gave back some performance last year as it had exposure to two of the leading UK defensive funds, which came under pressure. It also held the yen for portfolio protection, which was not required as the stockmarket rose against expectations. Above all, Soda lacked equity exposure and not enough in high-risk equity such as technology stocks. We are living through the gradual unwinding of a generational asset bubble in bonds, real estate, and much of the stockmarket. The Soda Portfolio is much more focused on tangible assets, bought at low prices, which can generate real returns.

Soda has returned 2% more than the FTSE Private Balanced Index and has done so with lower volatility. That lower volatility led to significant excess returns in 2022, only to give some back in 2023. All in all, it has been a far more profitable journey to shun speculations and embrace sound investment principles within a cautious, balanced portfolio.

The Whisky Portfolio had another good year compared to the UK stockmarket. While this has been the fairest comparison over the years, in 2023, Whisky started to embrace international shares. Today, a third of Whisky is invested in non-UK stocks, and so in future years, it will make sense to make a broader comparison blending the FTSE 100 with an international index.

Most years have seen Whisky beat the market, but 2020 was the standout. At that time, many companies exposed to the real economy performed poorly as the economy entered lockdown. Whisky avoided these stocks as lockdowns were introduced, only to embrace them later on. It led to an exceptional performance that year.

2023 was another good year, with several successes. The portfolio caught three of the top ten stocks in the FTSE 100, including Centrica, Melrose and JD Sports, and two from the FTSE 250 mid-caps, including RHI Magnesita and Marks and Spencer. There were also successes in the Poland Equity ETF and WH Smiths. Detractors included Drax and palladium.

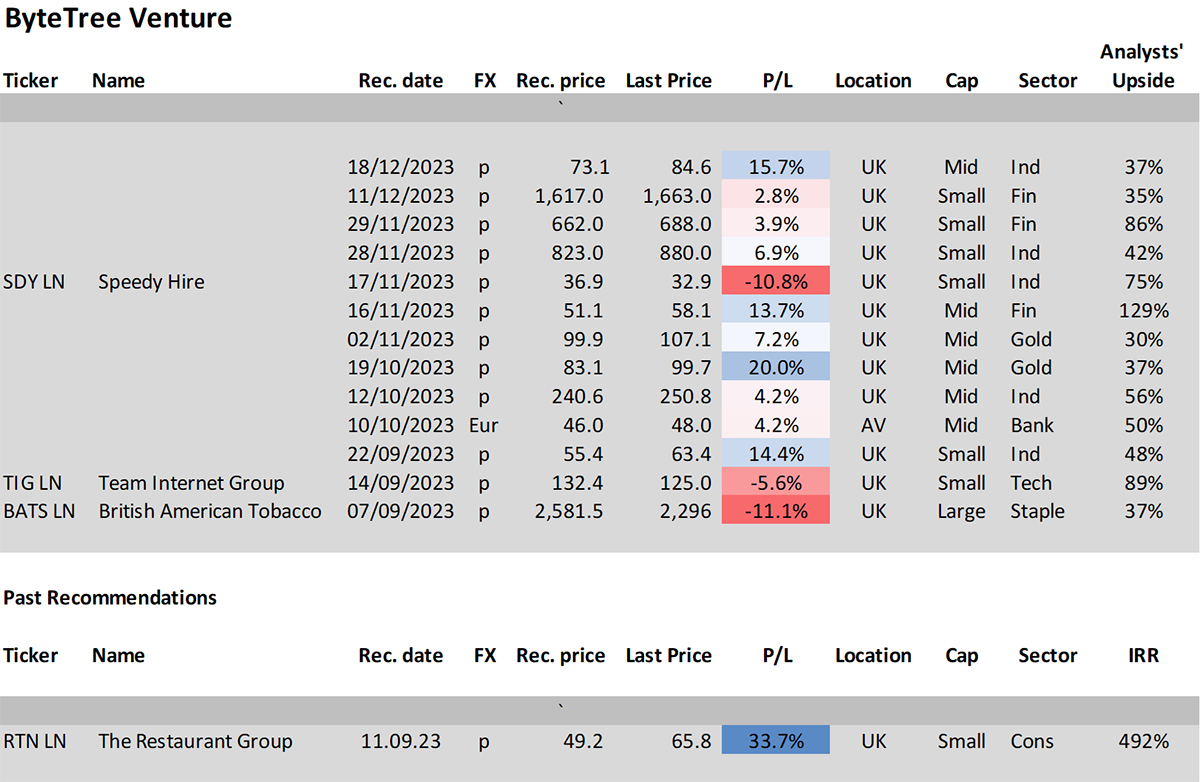

Venture

The Venture Portfolio was born in September 2023 and has 14 stocks, with just one sold following a takeover bid. That was the Restaurant Group, owner of Wagamama. Venture was created because I kept coming across these ridiculously undervalued situations which were not liquid enough for the Whisky Portfolio.

Most stocks are based in the UK, but that is mainly because it is where the best value currently resides. One is Austrian. I have shown the names of three current holdings that are currently underwater to give a flavour of what resides beneath. The profitable holdings remain hidden to protect our intellectual property.

Have a great weekend,

Charlie Morris

Founder, ByteTree

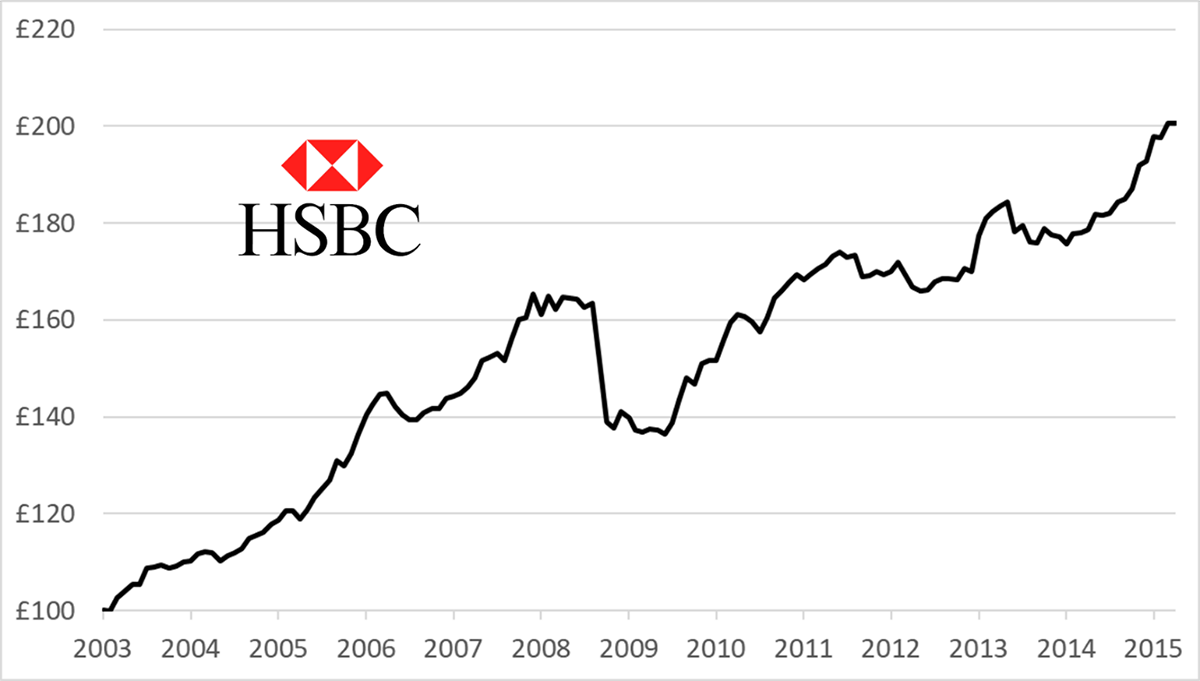

Prior to managing the Whisky and Soda portfolios, Charlie Morris spent 17 years at HSBC Global Asset Management. He launched the Absolute Return Service in 2003, with the track record shown.

HSBC Absolute Return Service

Comments ()