ByteFolio Issue 91;

The US Bitcoin ETFs have traded for seven days. I will cover this in more detail in ATOMIC (on bitcoin) later this week, but early figures suggest it is somewhat disappointing. I see net inflows into bitcoins ETFs of $572 million, which is a terrific number, but expectations were in the multiple billions. It is certainly true that the new ETFs took in $3.84 billion, while Grayscale (GBTC) shedded $2.74 billion and Proshares Bitcoin Futures (BITO) $91 million.

What they are not telling you is that $485 million has left the European and Canadian ETFs, presumably reinvested into the US ETFs, bringing down the net total inflows. But regardless, having bitcoin ETFs in the USA is long-term bullish. Blackrock and Fidelity unquestionably send a positive message. In my opinion, having low-cost US ETFs is more bullish on a ten-year view than on a ten-day view. Bitcoin is a now formally part of the financial system, as I mentioned last week, ETH will soon join it.

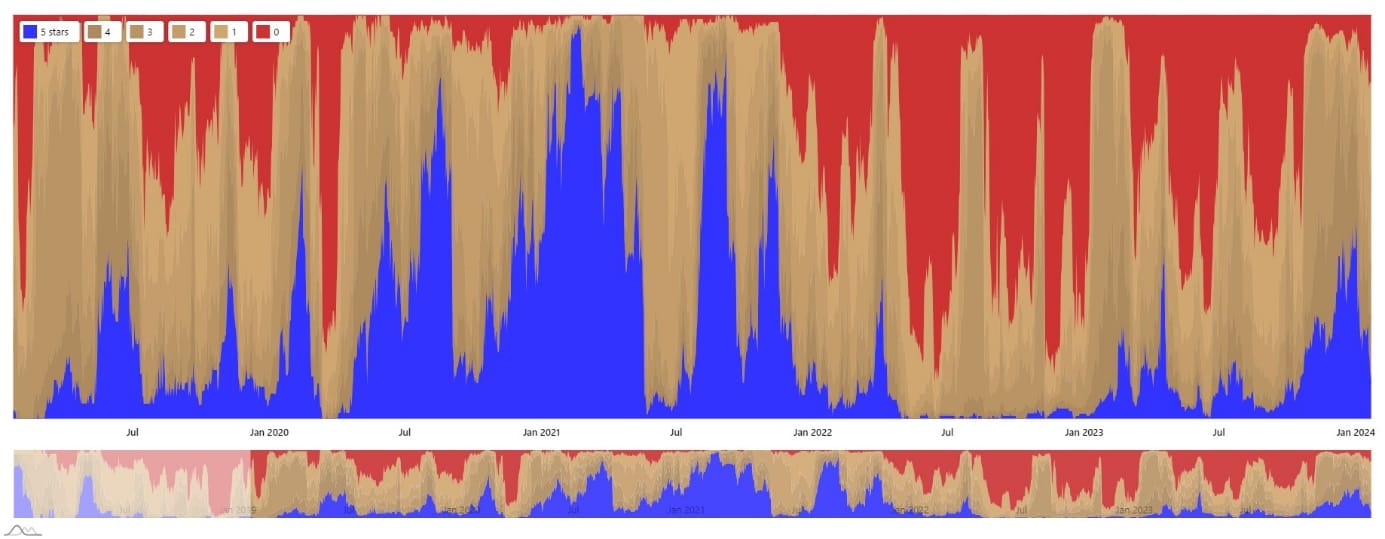

But as many have pointed out, it is better to travel than arrive, and the number of uptrends in the top 100 tokens is falling. It was all looking so good, but this is a modest setback.

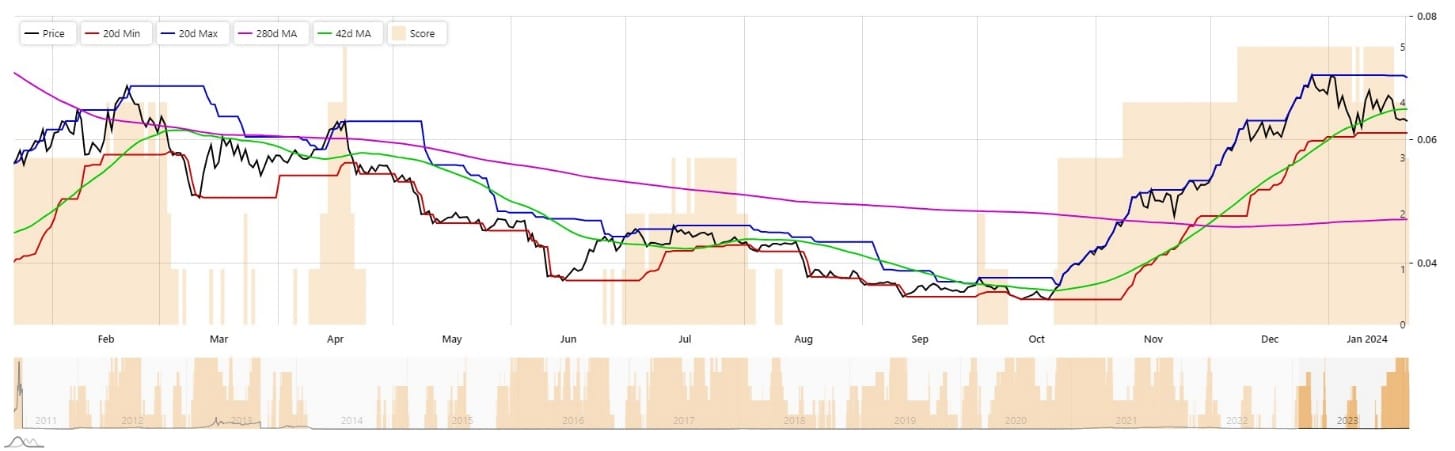

That can also be seen on the ByteTree Crypto Average (BCA), our equally weighted index, which has dropped from a 5 to a 3-star trend. It’s not a crisis, but alt season has hit a speed bump.