Asset Managers

Trade in Whisky;

I joined the asset management business in April 1998, a time when asset management stocks were riding high. The stockmarket was booming, and tracker or index funds were already well established but considered dull. For the asset managers, the money was made in active management, where the fees were higher. No one complained in the 1990s because returns were high. It was in the 2000 to 2002 bear market when fees started to come under pressure.

Index funds date back to 1974, courtesy of the late Jack Bogle, who founded Vanguard. He suggested you didn’t bother picking stocks, just own the market. You could never beat the market that way, but at least you’d keep up, especially if the fees were low. Index funds were a simple and effective strategy, but accessing them was clunky until the exchange-traded fund (ETF) came to be. That would enable the whole index to be traded over the stockmarket as if it were a single share.

In 1993, Standard and Poors listed their Depositary Receipt, the S&P 500 Trust (SPY), nicknamed the “spider”. By 1995, it passed $1 billion, then $10 billion in 1999 and $100 billion in 2012. Today, it has grown to $495 billion and charges a mere 0.09% per year. It is remarkable how the S&P 500 has performed so well and at such a low cost to investors.

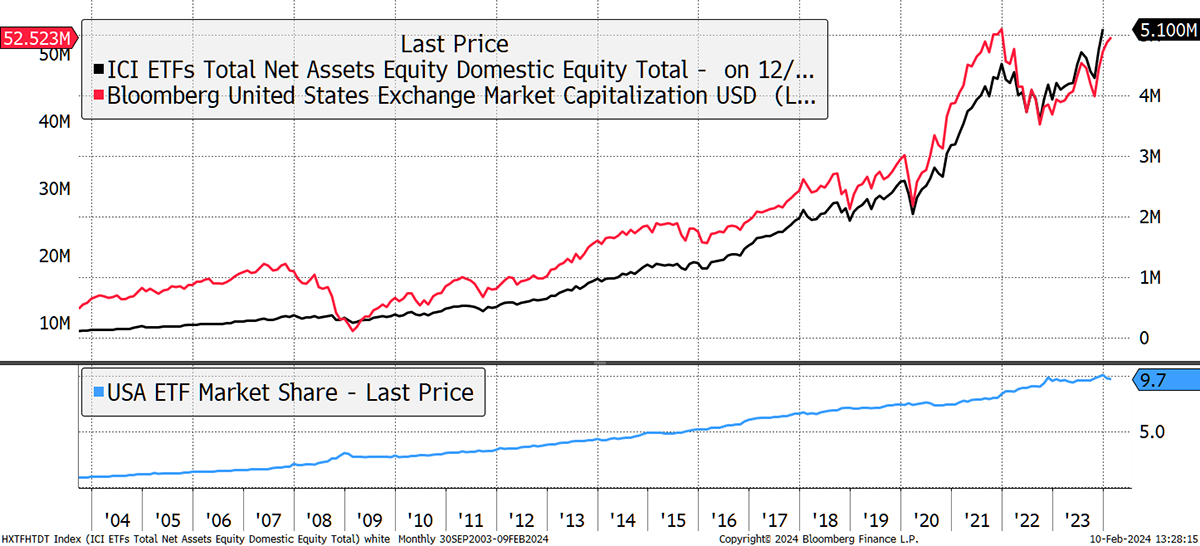

Today, the US ETF industry manages $5.1 trillion in US equities, which amounts to 9.7% of the stockmarket. These are huge numbers, and the boom in index funds/trackers/ETFs/passive (so many names) has transformed the asset management industry. The costs of transactions, custody, asset management and administration have fallen sharply.

The Growth of ETFs

Good riddance to the high-fee active managers, but there are problems with excessive passive management. There comes a point where too much passive money crowds out the active money, which carries out the vital role of valuing securities. Competent active managers pursue value in either the short or the long term. More importantly, competent managers will shun overvalued securities. In contrast, the index funds buy anything and everything without question, which is fine so long as they aren’t in a dominant position, which today they are.

But against that, the regulatory pressures for low fees have overwhelmed rational and efficient markets. Don’t get me wrong, I am a great fan of index funds and ETFs, but I equally believe active management has its place. There needs to be a balance.

In the late 1990s, index funds were already winning the argument, but the active managers wouldn’t let go. They kept their fees as high as they could, for as long as they could, but effectively tracked the index and talked a great story.

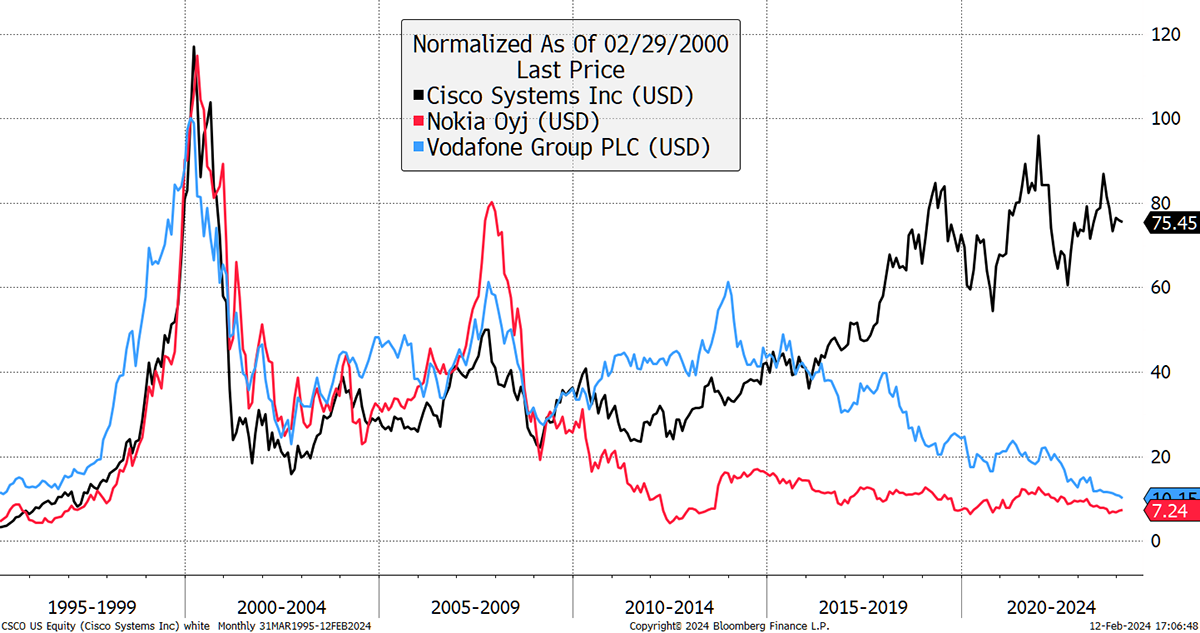

Just as index funds buy the biggest stocks at any price, so did the active managers. In 1999, we witnessed stocks such as Cisco (CSCO), Nokia (NOKIA) and our own Vodafone (VOD), which briefly made up 15% of the FTSE 100 before falling 80% by 2002. These kinds of distortions will always correct in the end, but it can take time.

The Big Stocks in 2000

The shift of funds moving from active to passive management has seen the active fund management industry become a shadow of its former self. The remaining major active managers are collectively valued at the same amount as BlackRock alone. Naturally, there are many private companies and a booming industry in hedge funds, but the buzz isn’t what it used to be. Asset managers used to trade on high valuations. In contrast, today, they have been left to value investors.

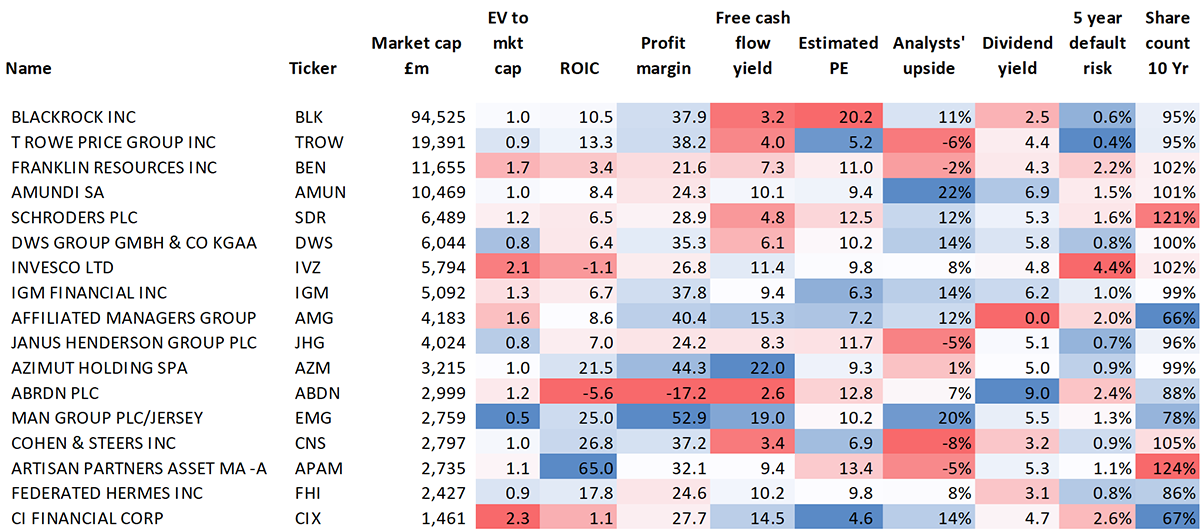

Today’s profits in the asset management industry come from low prices and vast scale or high margins and added value. BlackRock (BLK), with its gleaming iShares brand, Fidelity and Vanguard dominate the first group, but the latter two are private companies. For the higher margin asset managers, the focus is on genuine active management, private equity, hedge funds and other specialist areas. Here is what’s left of a once valuable industry, BlackRock excluded.

Asset Manager Key Financial Ratios

Browse at the table and see what stands out. In my opinion, business quality is highlighted by profit margin and return on capital. The longer-term capital discipline is reflected via the share count. 100% implies no change in the number of issued shares. Above 100% means new shares were issued, and below 100% means there were buybacks. The PE and the free cash flow yield are indicative of valuation. Default risk looks at the balance sheet, although it’s not just net debt but business risk in general. EV to market cap is useful because it measures risk to the investors, as opposed to the company, and indicates value for money. Putting these together, there’s a standout winner.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 Crypto Composite Ltd