Equity vs Bonds – Another All-Time High

Disclaimer: Your capital is at risk. This is not investment advice.

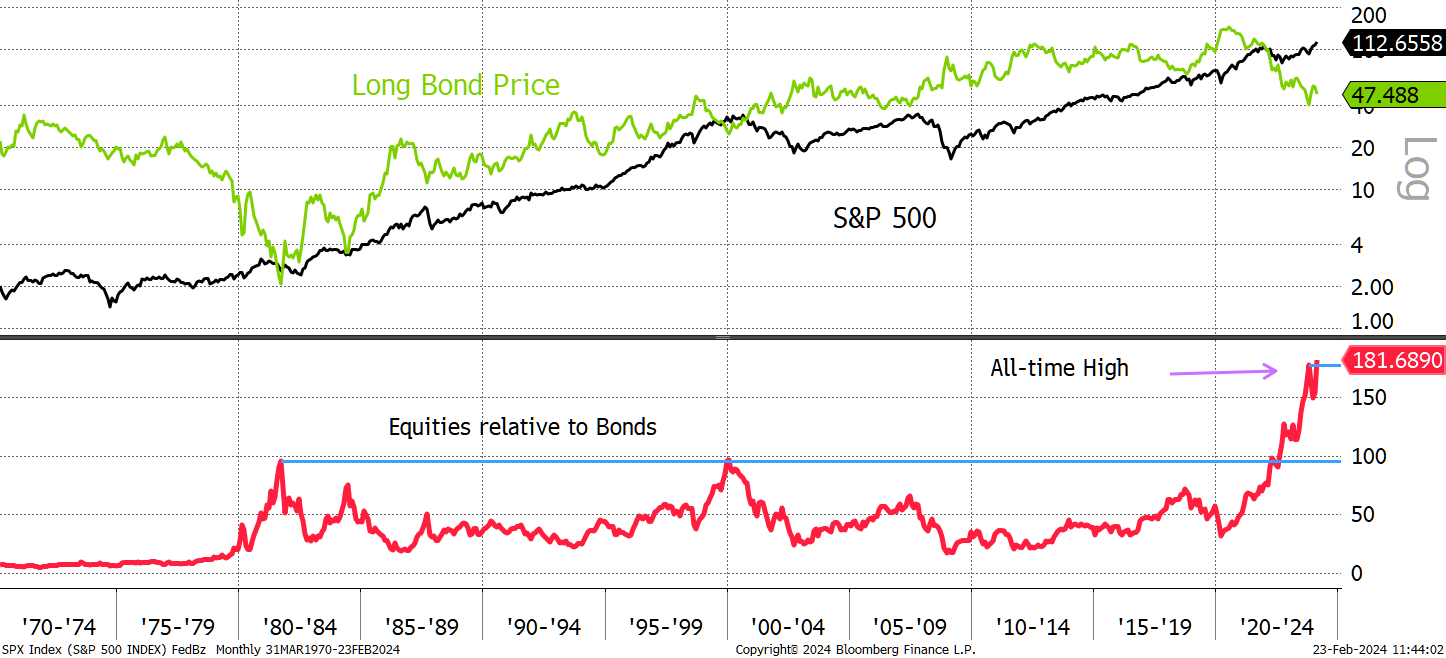

In a week where bonds fell, and equities rose, the link between them has made another all-time high, driven by technology stocks, following Nvidia’s (NVDA) strong results. This stands out because this equity versus bond link didn’t break out for 40 years but has recently become a regular event.

S&P 500 Makes a New High as Bonds Decline

In 1982 and 2000, the last major peaks in this relationship, big things were happening. In 1982, bonds were at their lowest ebb as yields brushed 16%. Both equities and bonds were cheap at the time, but with inflation near 10%, bonds were even cheaper with a 6% real yield; something rarely seen.

In 2000, it was the other way around as technology stocks surged beyond recognition, while bonds paid a more modest 6% yield. But with inflation close to 2%, a 4% real yield was historically attractive, especially when there was a budget surplus and low outstanding debt.

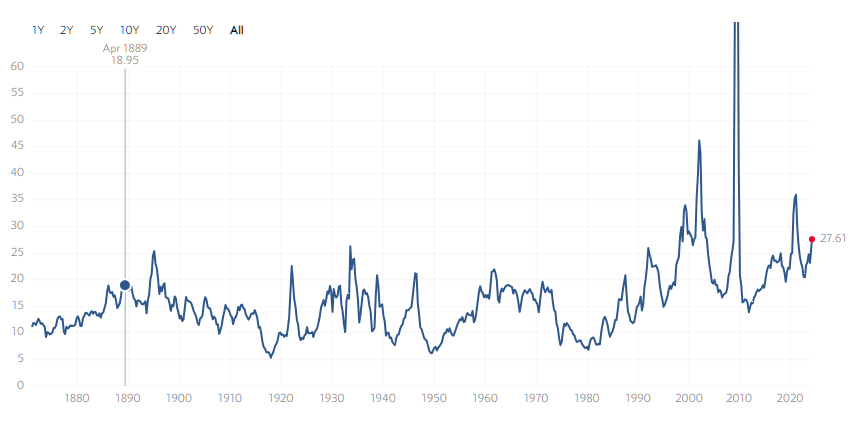

This time around we have a 4.3% yield with 3.1% inflation (or 3.9% core). Stocks are mixed because, generally speaking, mid and small caps offer good value in most countries, while US large caps stand out as generationally pricey as shown by the PE ratio.

The S&P 5000 Price to Earnings Ratio

This makes this a perplexing time for market watchers. Our equities are surging while bonds are falling and may continue to fall. The last time we saw this was in the 1970s when the equity versus bond chart surged. But crucially, back then, the stock market was cheap post-1974. It was a great time for value investors who managed to deliver real returns during a period of high inflation.

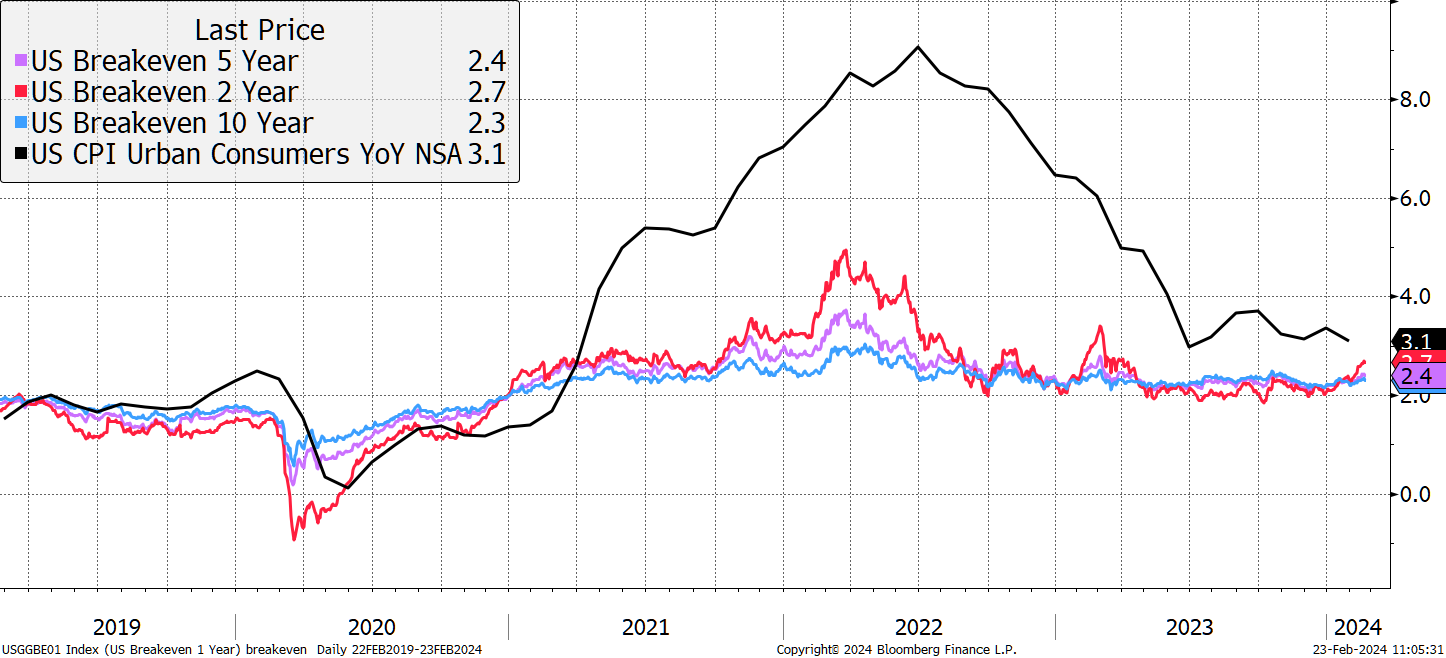

It makes sense that bonds aren’t yet ready to perform, but you have to wonder if the equity bond divergence is telling us that inflation is a more sustained problem than the popular narrative would have you believe. I say that because these things always make sense in the end.

A Week @ByteTree

Once a month, and since 2012, I have written Atlas Pulse on gold. It is normally my favourite piece, so much so, that I do it for free. The chart I would highlight helps us to understand the continued softness in the bond market.

Inflation Expectations Rise

Gold is sensitive to both bonds and inflation. With yields rising, that’s bad for gold, but if inflation expectations are rising, that offsets the weakness in bonds. Gold is four times more sensitive to inflation than interest rates, but this point hasn’t been witnessed since the 1970s, so few really understand or believe it.

ByteTree Venture recommended a UK midcap insurance company, which is dirt cheap, while the Multi-Asset Investor also focused on the bond decline. But in the main, it was an issue packed with client feedback which I invited last week. There were some excellent questions on Asia, Ruffer, Capital Gearing, Personal Assets, the yen, the yuan, Argonaut, Alliance Trust, and dividends.

Finally, in crypto, I highlighted the rapidly improving market breadth charts, which you can see here. So many tokens are showing strength and our team looked at Helium, ThorChain and VeChain. It’s a crazy new world.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()