Mega Flows

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 94;

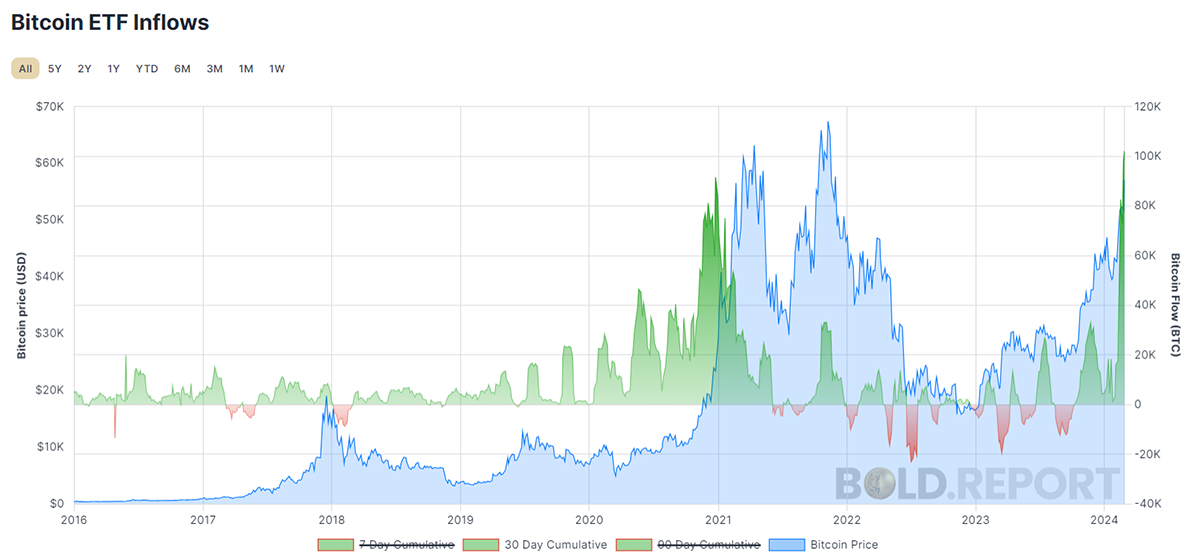

Over the past 30 days, ByteTree’s new BOLD.REPORT website shows the strongest new inflows on record. I have always said ETF flows were important, and it turns out they are. Massively so.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Technicals | Boom |

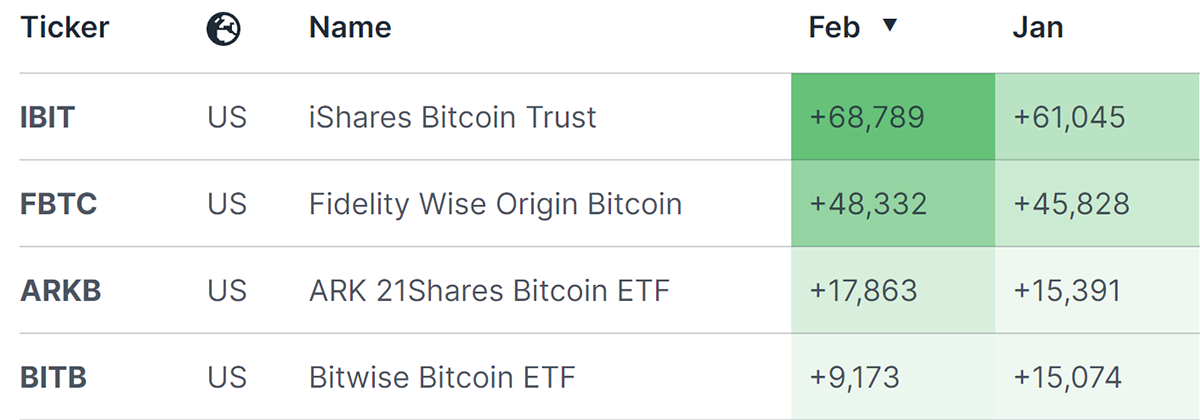

| Investment Flows | ETFs Scoop up 106,225 BTC in 2024 |

| On-chain | Stable, but Fees Ease |

| Regulation | ECB Slams the US Bitcoin ETFs |

Technicals

It’s boom time for bitcoin. As I write, the price is flirting with $60,000, not seen for nearly 2.5 years. It feels like a decade as you never quite adapt to crypto winters. It means the all-time high is within reach, and bitcoin may break out to a new all-time high before halving. That would be a first.

Bitcoin Testing the All-Time High

Longer term, the six-year regression, which has appreciated with an IRR of 41%, still looks good. Bitcoin is past the halfway mark (red dashed line). These days, heavily oversold (lower green dashed line) looks like $18k, while heavily overbought (upper green dashed line) would be $140k. It could happen.

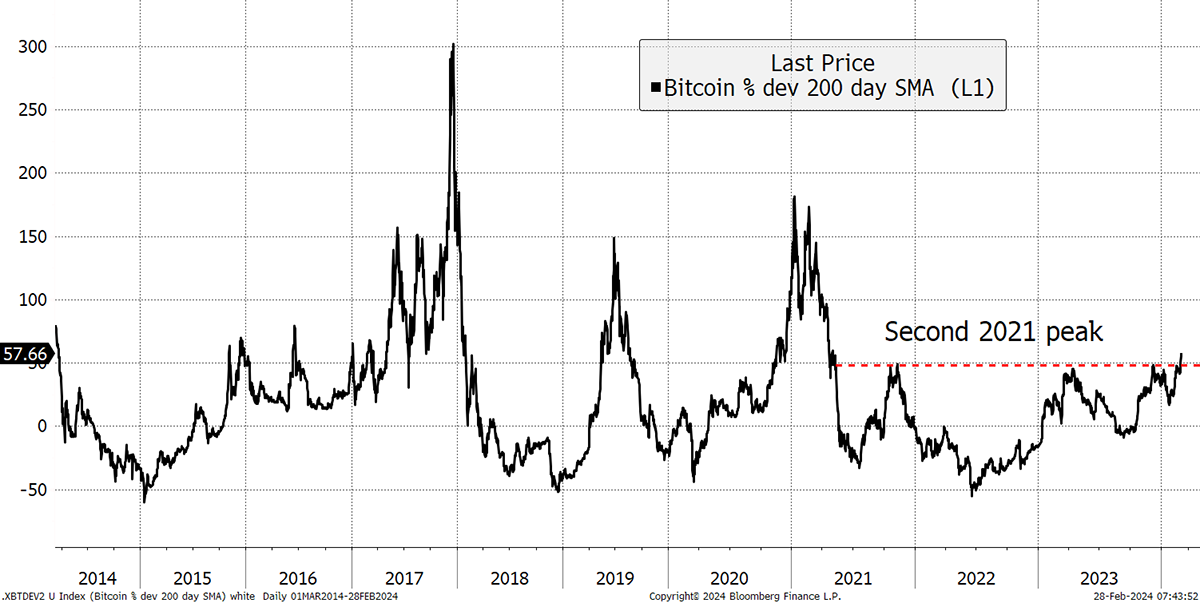

A rally from $16k to $60k in a little over a year is impressive, and it’s worth noting how extended the price is from the trend. Bear in mind that being extended isn’t necessarily a bad thing, but as we all know, you can have too much of a good thing. The current reading shows the price is 57% above the 200-day moving average, which we saw on the last all-time high and again earlier this year. But a high number normally means a major top or a period of consolidation. Of course, we prefer the latter, and with halving coming in April, it seems more likely.

Is Bitcoin Overbought?

What we can be sure of is that the rally is well underway, and a wise option when the market is a little heated is to embrace BOLD (ByteTree’s Bitcoin and Gold Index) instead. What we can be sure of, whenever this Bitcoin rally ends, is that gold will carry on, albeit at a slower pace.

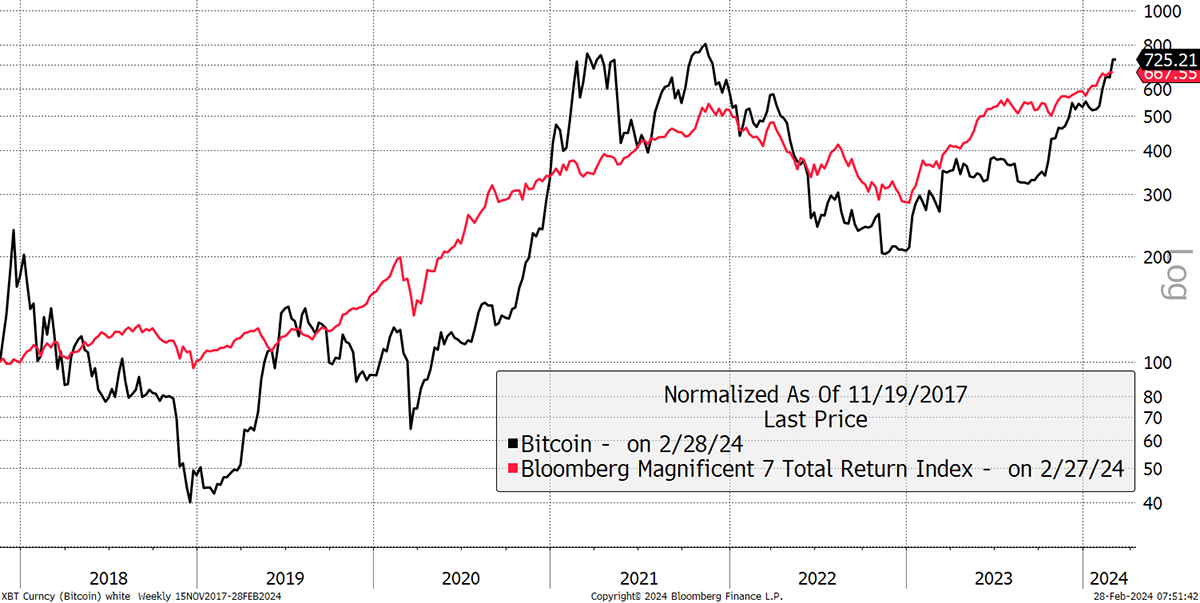

Bitcoin is basically an off-grid version of the Magnificent 7 leading technology stocks. Little wonder the establishment feels they don’t need to hold bitcoin because they already have their own version. It’s an observation which reminds us Bitcoin is only testing the high from November 2021, and its performance is in line with high-beta growth markets in general.

Mag 7 and Bitcoin

Investment Flows

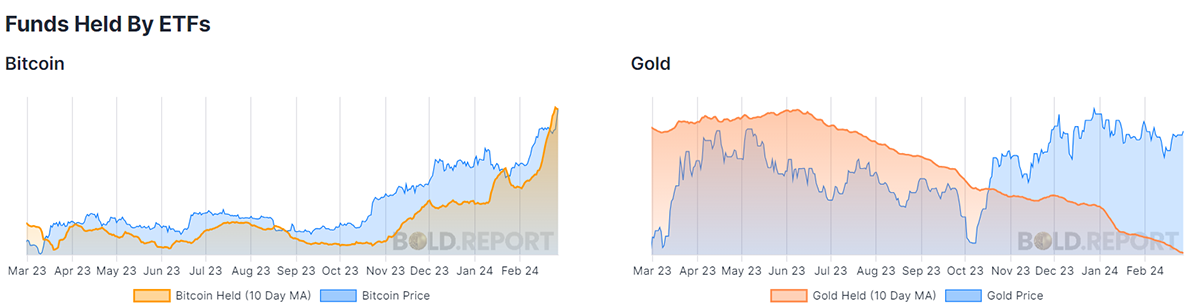

As you probably know, the US approved nine new Bitcoin spot ETFs on the New York stock exchange in early January. It has led to 106,225 BTC being added to the global Bitcoin ETF pool, which now holds close to a million BTC worth $57 billion.

Over the past 30 days, ByteTree’s new BOLD.REPORT website shows the strongest new inflows on record. I have always said ETF flows were important, and it turns out they are. Massively so.

The purchases have been even greater than that but offset by sales elsewhere. The big winners are:

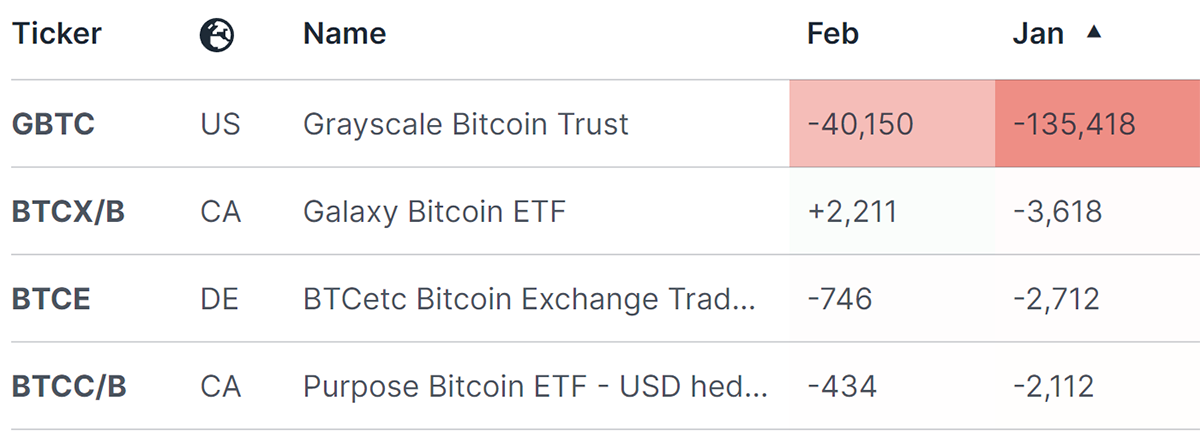

And the big four losers:

The biggest loser is GBTC, which has seen 175,568 BTC sold since its conversion to an ETF. Most of the money was recycled into the new lower-fee US ETFs in the winner category. Other casualties came from Europe and Canada, where fees were also higher. BTCE, Europe’s largest Bitcoin ETF, has seen outflows, along with the Canadian leaders. It seems the party is moving to the New York stock exchange.

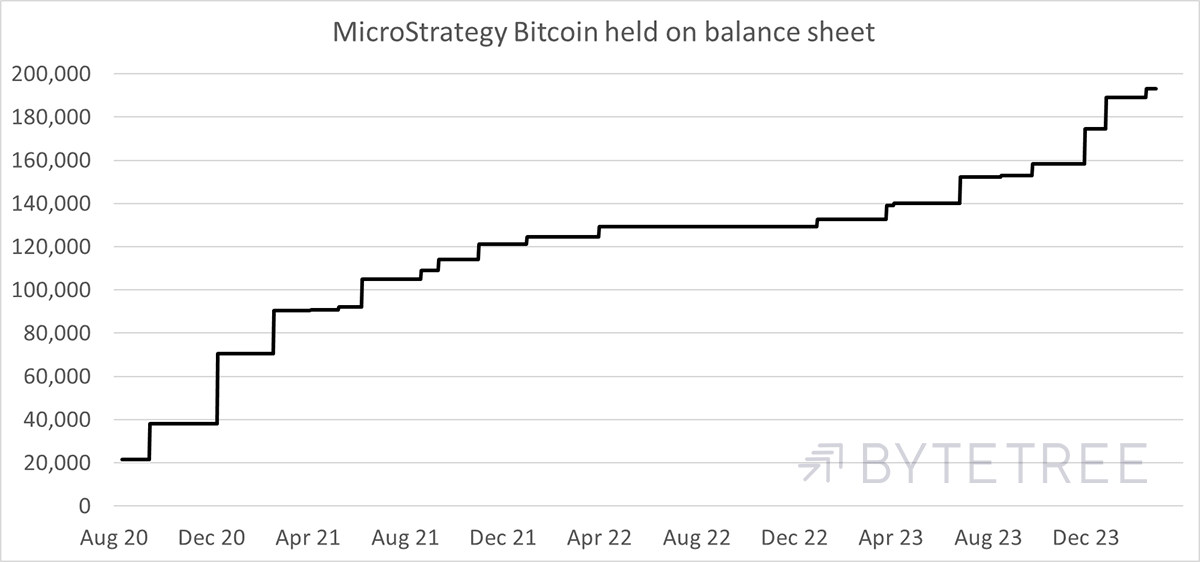

Not only has big money moved into the Bitcoin ETFs, but to top it off, Michael Saylor’s MicroStrategy (MSTR) has just acquired another 3,000 BTC. That takes their total balance to 193,000 BTC held on their balance sheet.

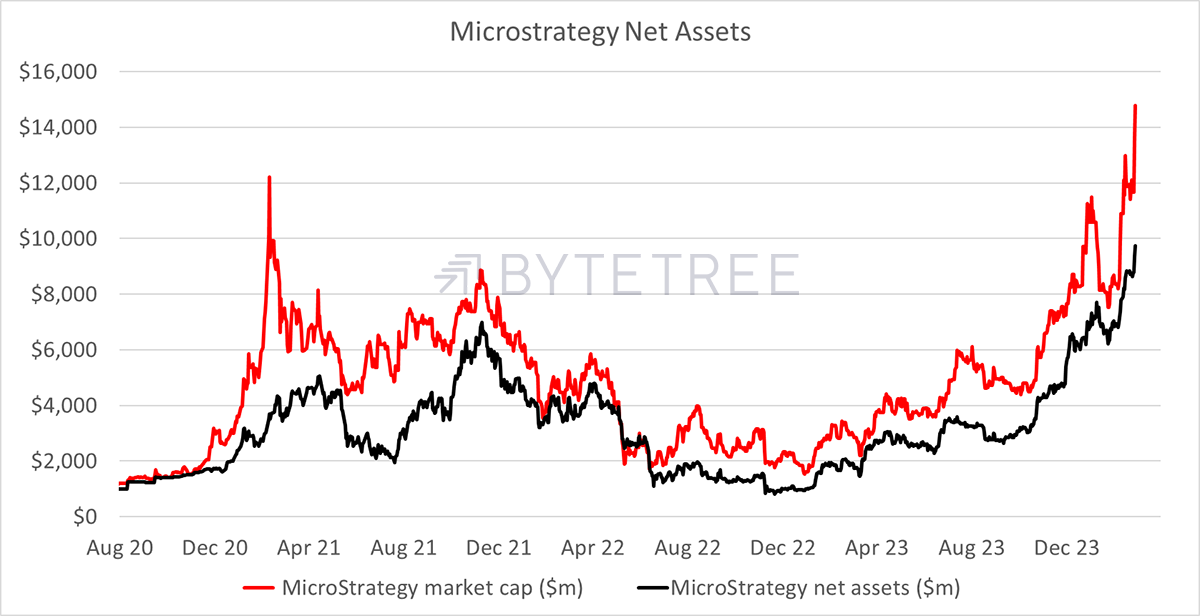

The company’s net assets ($1 billion for the legacy software company and $2.2 billion debt) are now $9.8 billion with a market cap of $14.8 billion.

That works out at a 52% premium to net asset value. Therefore, it is much more prudent to buy the ETFs, or else you will be paying $152 for $100 of bitcoin. Why would anyone do that?

UK-based Bitcoin investors do, among others. MSTR stock is one of the few ways to trade Bitcoin using your broking account, as Bitcoin ETFs remain banned in the UK. It’s the most bizarre situation for what used to be the world’s most important financial centre.

I would just point out that Michael Saylor, CEO, has been personally selling some of his MSTR stock awarded to him via share options. Admittedly, it’s little bits at a time, but it goes counter to the narrative. Then you realise this was on a single day, amounting to $3,828,351.87.

Moreover, he became a bitcoiner in the summer of 2020 and hasn’t traded until recently. Then, every trading day this year at a rate of 5,000 shares each day.

Inside Transactions at MicroStrategy - Michael Saylor Only

By my reckoning, that amounts to $117,881,350. I wonder what he invests in. US Treasuries? A fourth superyacht? He should consider BOLD.

On-chain

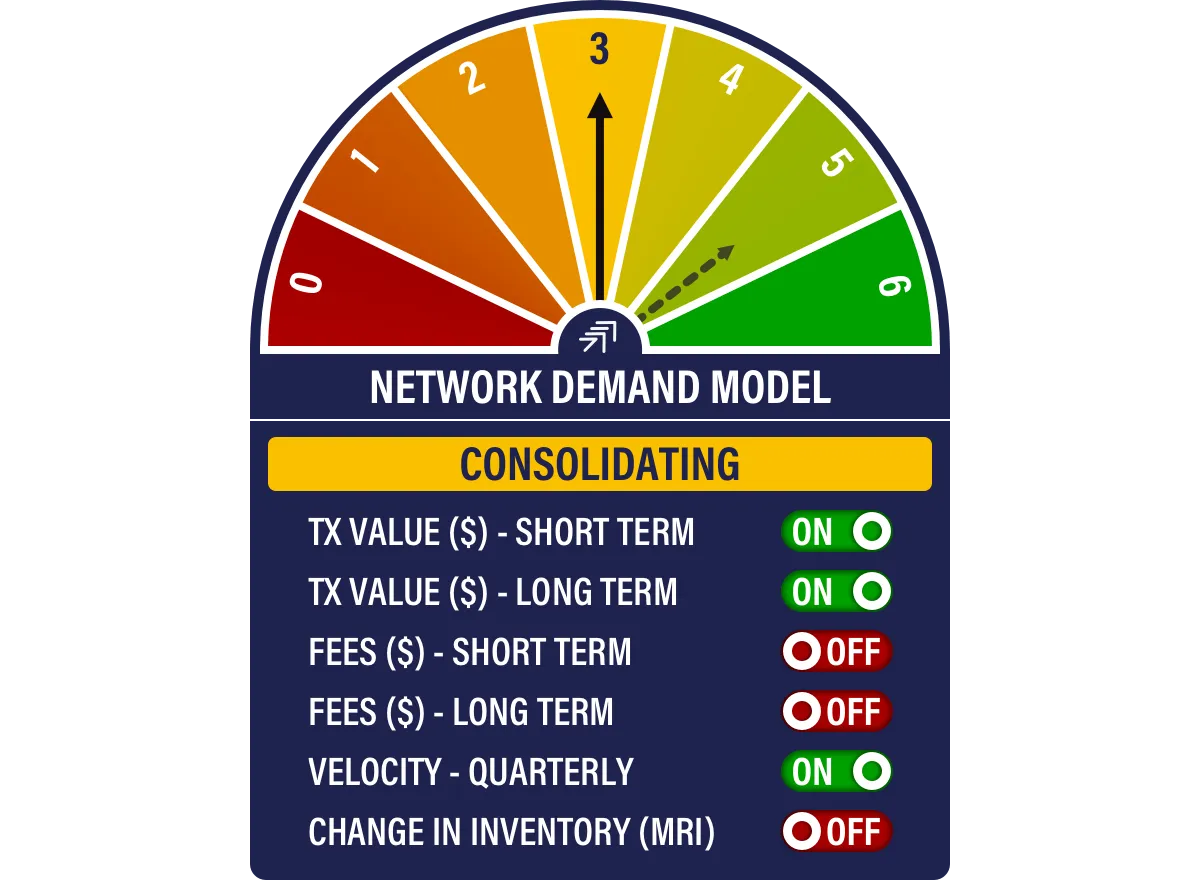

The Bitcoin Network Demand Model scores 3/6, which might seem light, but we can blame fees.

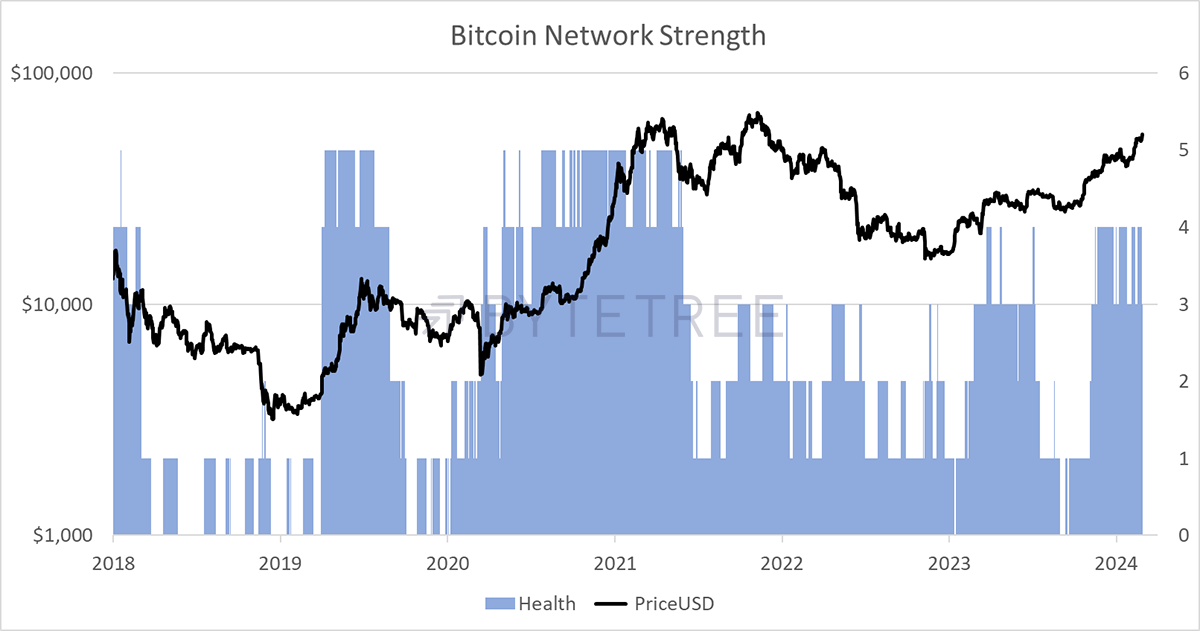

Firstly, don’t panic; the network is still in rude health.

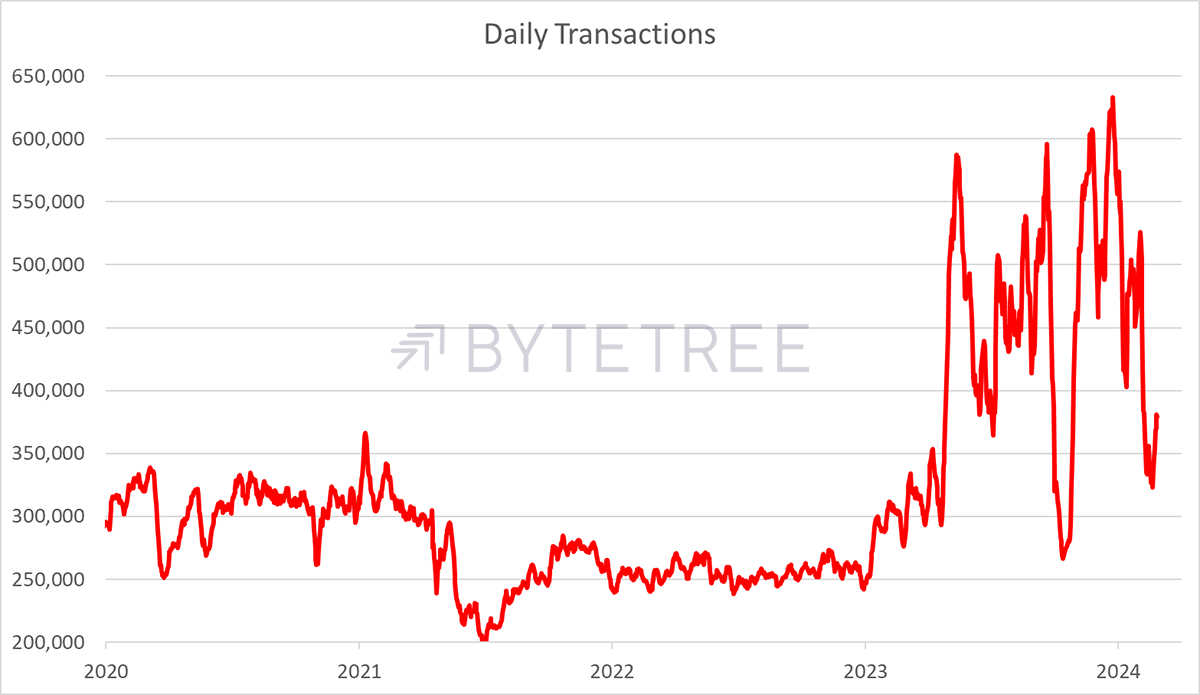

But fees have eased back.

It is nothing to fear because transactions have fallen due to the reduction in ordinal transactions.

Yet the network is booming because the big money has arrived. We have huge inflows, but they don’t require many transactions. The good news is that the bitcoin price is still in line with network activity.

Bitcoin Below Fair Value

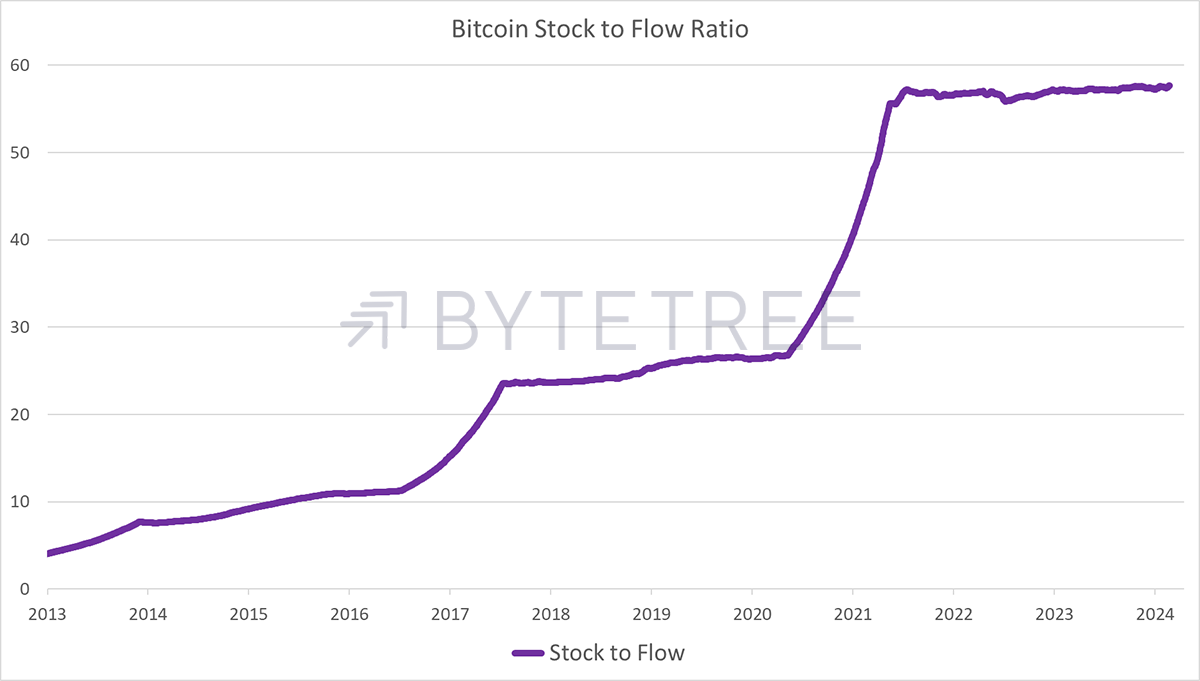

But let’s not forget that halving is coming. It happens on the 840,000th block, and I forecast that it will come on 20 or 21 April. As we get closer, we will be able to refine that. It means that the annual growth in supply falls from 1.8% (in line with gold) to 0.9%. But that’s boring, and in Bitcoinland, we prefer the Stock to Flow Ratio because it goes up rather than down. The next stop will be over 100, and the bulls point out it’s higher than gold. More on that next month.

Regulation - The ECB Slams Bitcoin ETFs

The ECB Blog published a piece on their blog ETF approval for Bitcoin – the naked emperor’s new clothes. It was written by a couple of ECB technocrats, Ulrich Bindseil and Jürgen Schaaf, who specialise in payments. They are presumably bright people, in the hard-working and diligent sense, but when it comes to Bitcoin, they just don’t get it. Or, being the hard-working and diligent types, they don’t want to get it. Their opening line says it all.

“Bitcoin has failed on the promise to be a global decentralised digital currency and is still hardly used for legitimate transfers. The latest approval of an ETF doesn’t change the fact that Bitcoin is not suitable as means of payment or as an investment.”

Satoshi’s Bitcoin White Paper never promised anything, especially about Bitcoin; it was more of a proposal. It used the word “currency” once, and that was while referring to (folding) cash. It isn’t a currency, by my reckoning; a view shared by bulls and bears alike. It is a digital asset that behaves more like a commodity than an equity. You only have to watch old sci-fi movies to realise such a concept is inevitable.

The ECB claims Bitcoin failed in transfers despite it transacting around $50 billion each week on-chain and even more off-chain. Naturally, the ECB use the term “legitimate” because they believe they are morally superior beings. And, of course, no one ever did bad things with euros. More importantly, it’s their controlling instinct that is so damaging to the European (inc. UK) economy.

It is strange for a major financial institution to call a trillion-dollar global monetary network a failure. But then you realise we are talking about the ECB, and you’d be even more amazed by what they consider to be a success. Bitcoin hasn’t failed despite their ongoing attempts to stifle it. It’s because the system has become suspicious of innovation.

Europe (inc.UK) is falling behind the USA (economically, not culturally) at a rapid pace and has become the slowest growing continent on earth, even if you include Antarctica. There are many reasons, most of them green, but it’s the instinct to ban new ideas rather than embrace them that is so worrisome. As a European, it saddens me that none of the Mag 7 Stocks could have been made in Europe (inc. UK). In the 20th century, that statement wasn’t true, but today it is.

The ECB’s second point was that the latest Bitcoin ETF approval in the USA doesn’t change things. This shows how they really don’t get it. Bitcoin is a network, and the ETFs just added a significant new source of demand.

The US bitcoin ETFs have scooped up nearly 100k bitcoin this year, drawing billions of dollars into the ecosystem. Even more important than the money perhaps, is the legitimacy of this freedom-loving, alternative digital asset. Gary Gensler, the SEC boss who was cool on the bitcoin ETF approvals, shows that legitimacy doesn’t come from regulators. In this case, it came from BlackRock, Fidelity, capital markets, and the US financial system as a whole. Gensler might prefer a job at the ECB.

Bitcoin is now a part of the financial landscape, and we Europeans (inc. UK) still ban it. It is very simple; we are on the wrong side of financial history. To those who don’t get Bitcoin, it’s simply digital gold. That short description is good enough, but best of all, it is simple. The ECB owns plenty of gold, so they should have a good chance of grasping the digital upstart and stop confusing it for a payment system.

Organisations, especially those in the public sector, that remain wary of Bitcoin and crypto are in denial of Schumpeter’s (another great Austrian) creative destruction, where the new technologies crowd out the new. It is true that price discovery is imperfect and that there are too many scams. I bet we’ll find fewer in the US going forward because the legitimate path is always more fruitful.

The ECB and their friends see financial freedom and decentralisation in a poor light. It would be much more impressive to see Bindseil and Schaaf consider how Europe (inc. UK) could challenge the US and leapfrog them with a radical and brave regulatory framework embracing this new world.

Summary

As I keep on saying, spare a thought for gold. All of this money surging into Bitcoin, some of it has been funded by gold. Best not to forget that these things are always cyclical.

Too busy to worry about it? There’s always BOLD.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.