The Bitcoin Surge

Disclaimer: Your capital is at risk. This is not investment advice.

Bitcoin is up 23% this year, which can be added to the +57% move in Q4 2023. It’s all about the huge flows of cash into the new Bitcoin ETFs in the USA. The leading funds from iShares, Fidelity and ARK 21Shares (ByteTree’s partner) have amassed nearly $12 billion of assets since the 11th January launch date. It has been remarkable. Not only has the US regulator approved these products, but they have been sponsored by some of the leading names in finance.

ByteTree has been tracking Bitcoin ETFs since 2020. In aggregate, these funds added 48,914 BTC in Q4 last year in anticipation of the US product launches in January. And this year, they have added a further 74,701 BTC. The aggregate Bitcoin ETFs now manage $49 billion, which compares to $153 billion in Gold ETFs and $15 billion in silver ETFs. Do not be surprised that these impressive numbers from Bitcoin ETFs have coincided with a tech-led equity bull market.

In recent years, Bitcoin cycles have broadly followed the stockmarket, while Gold has followed bonds. Just as bonds and equities have traditionally been combined in portfolios to reduce risk, you can do the same with Bitcoin and Gold. The advantage is that you get the best of both worlds because Gold prefers risk-off, while Bitcoin prefers risk-on. Investors seeking protection against monetary inflation should turn to Bitcoin and Gold, which we call BOLD.

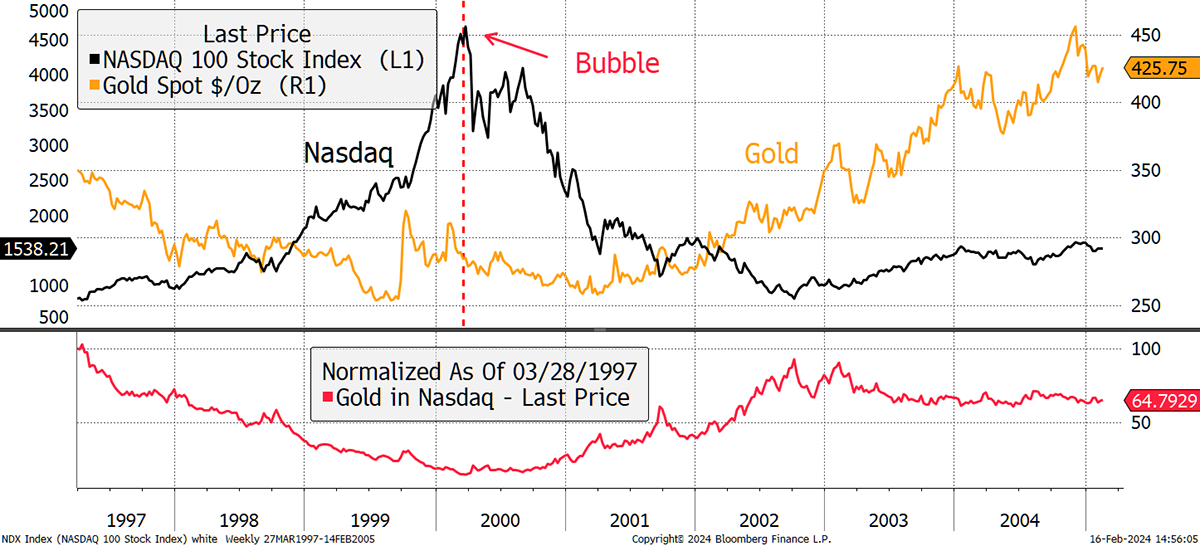

We should also remember to keep a level head. Bitcoin is on a tear, while Gold remains calm. I’m sure we’ve seen this movie before.

Nasdaq Versus Gold in 2000

There are benefits of holding BOLD over Bitcoin and Gold in isolation:

- BOLD maintains an equal level of risk in each asset, currently 75% Gold and 25% Bitcoin. That means for every $100 invested, the risk of making or losing $10 is about the same in each asset.

- Monthly rebalancing transactions sell the stronger asset and add to the weaker asset. Over time, this buy low, sell high approach has led to excess returns of 5% to 7% per year over and above buy and hold.

- Holding Bitcoin and Gold can be stressful. BOLD leads to a calmer outcome, with volatility only marginally higher than Gold.

ByteTree will soon be launching a new website called The BOLD Report, which will explain everything you need to know about these great assets. For a taster of what’s yet to come, here is our new 60-second explainer.

A Week At ByteTree

In The Multi-Asset Investor, I wrote about asset managers, an industry I joined in 1998. There was more talk about ETFs and how they now account for 10% of the entire US stockmarket. The industry has been under pressure because fees have declined as investors switched from active funds to passive ETFs. I looked at the sector in detail and chose another beauty for the Whisky Portfolio. Please read the note and have a look at the asset manager comparison table.

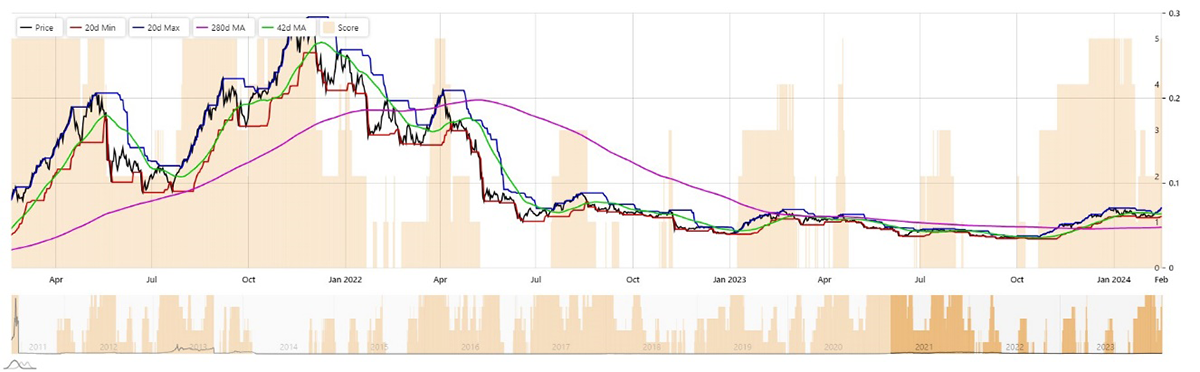

In ByteFolio, ByteTree’s analysts identify the leading projects in crypto. It’s all going rather well, and the altcoin bull market is only getting going. The ByteTree Crypto Average (BCA) is waking up again. Last time, back in 2020, it went completely nuts. If you missed our video from last week explaining why, then have a look, but I warn you, it’s 30 minutes, not 60 seconds.

Crypto Trends in BCA

I hope you enjoyed the BOLD explainer. If you did, please forward it to your friends and colleagues who may appreciate it.

Have a great weekend,

Charlie Morris

Founder, ByteTree