With the Bitcoin ETFs Approved, the Focus Shifts to Gold

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

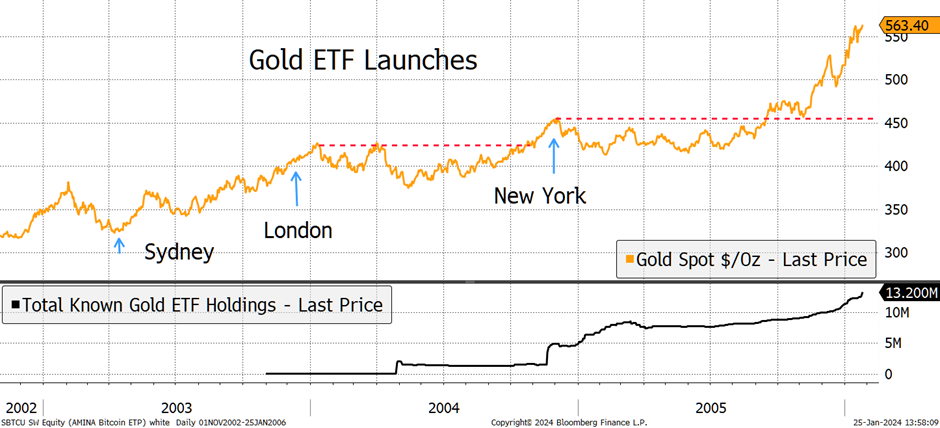

In January, BOLD fell by 0.8%, Bitcoin fell by 0.1%, Gold fell by 1.1%, while equities rose by 1.2% in USD terms. January saw the launch of the nine US spot bitcoin ETFs with great fanfare. Just as with the launch of the gold ETFs back in 2003/4, the anticipation exceeded the event. Gold ETFs proved to be bullish over the long term, as they attracted over $133 billion of capital, but in the immediate aftermath of the launch, there was profit taking. That said, investors didn’t have to wait long to make money as gold would rise fourfold in the coming years.

Gold ETFs Changed the World

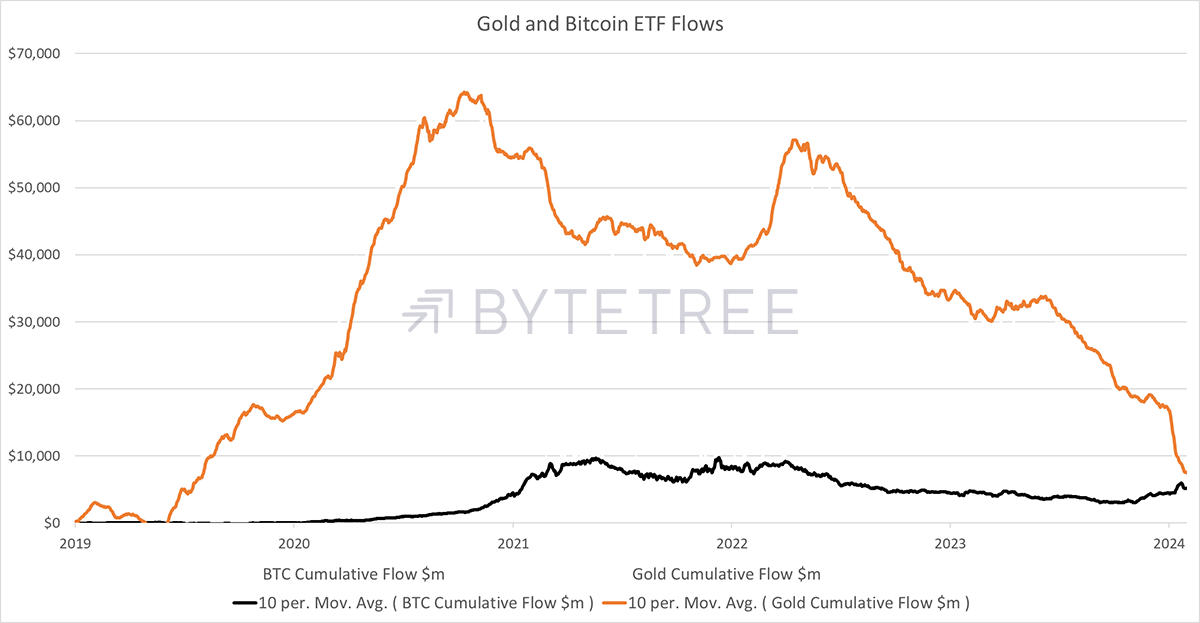

While the gold ETFs proved to be transformational for the asset, the flows peaked in October 2020 and have seen $56 billion leave since. All in all, the gold ETFs have seen a modest $8.4 billion of inflows since January 2019, in contrast to the bitcoin ETFs that have seen $5.6 billion. On this measure, bitcoin has nearly caught up with gold.

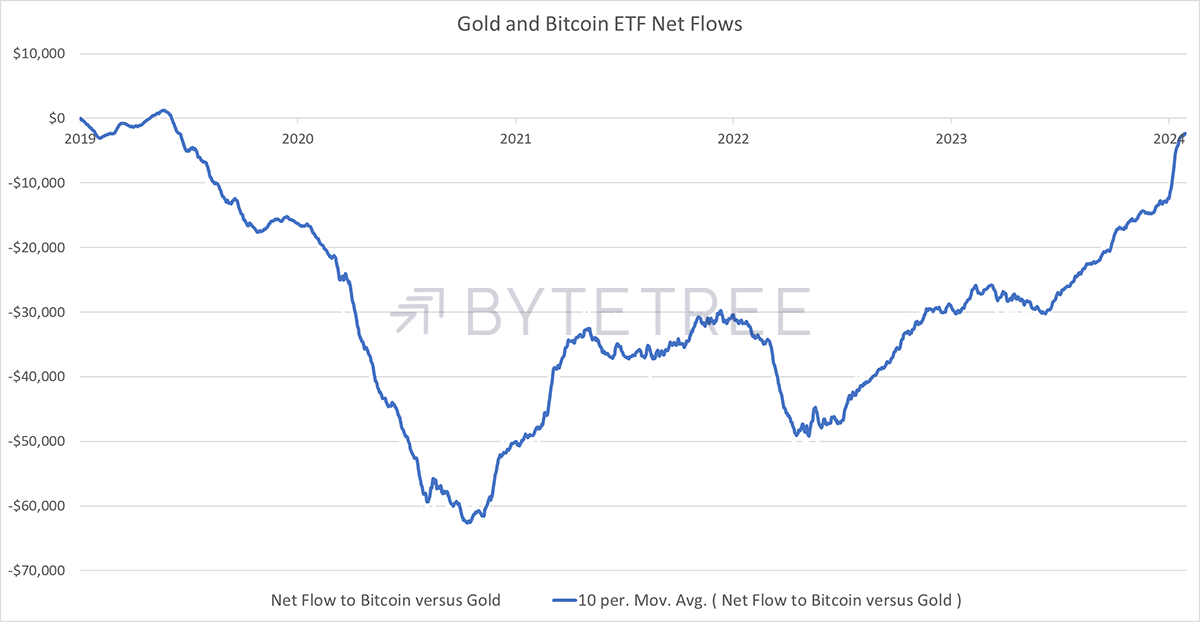

Looking at the net flows, which is gold flows less bitcoin flows, gold has been severely lagging since late 2020, with a modest fight back in 2022.

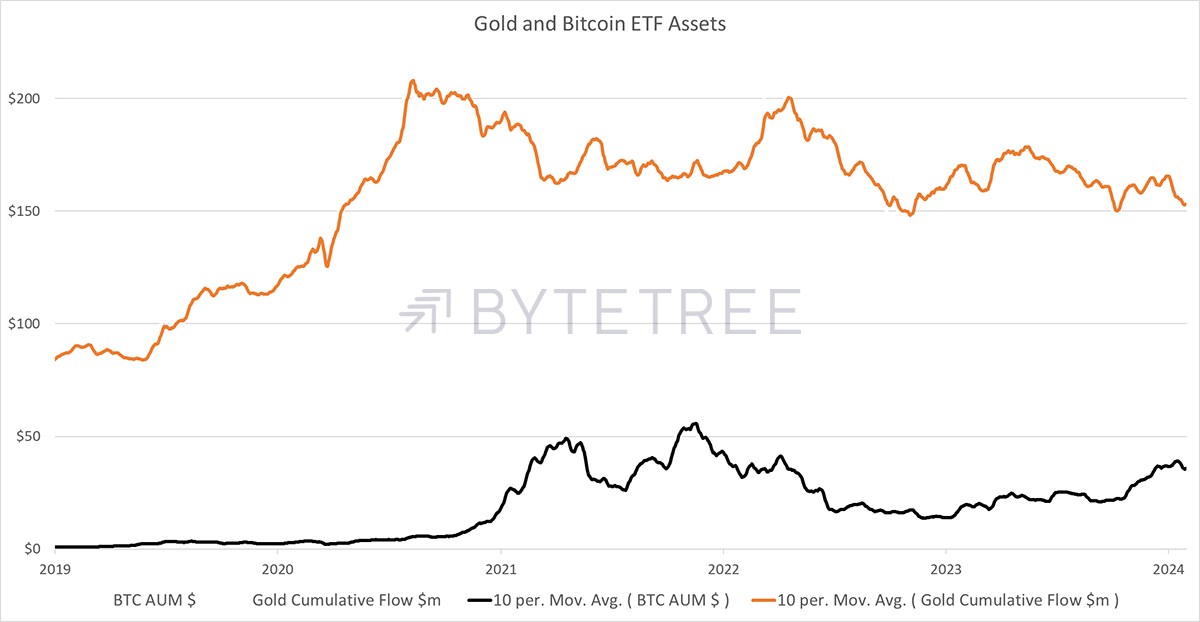

While the direction of travel has favoured the bitcoin ETFs, it is important to remember that with $154 billion under management, the gold ETFs are still four times larger than bitcoin ETFs that hold $39 billion.

The expectation is that this gap will close, and that is plausible, but bitcoiners should acknowledge that it will take a very long time. The entire US bitcoin ETF event has seen $2.9 billion of inflows since the end of September 2023 in anticipation of the ETF approvals. The bulls believe the bitcoin price appreciation will do the heavy lifting, but they mustn’t forget that the miners need to be paid.

In less than 100 days, the next bitcoin halving will see this cost fall by half, less fees, which are around a third of miner revenue. That will prove positive for the bitcoin price, but much less so than in past cycles because we have to face the reality of large numbers. Inflows into bitcoin ETFs need to be large and consistent to sustain materially higher bitcoin prices. In that sense, bitcoin may start to resemble gold sooner than many think, but that’s not to say it couldn’t manage a 20% to 40% CAGR for the rest of this decade. If the asset allocators get behind it, it almost certainly will.

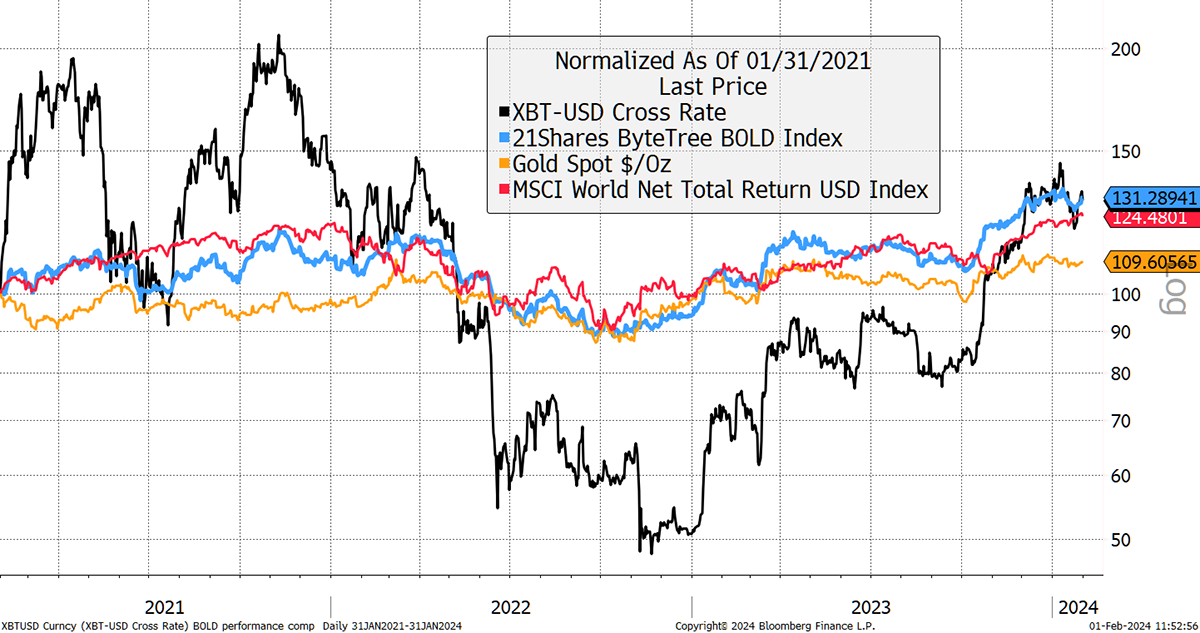

But considering what has worried the mainstream asset allocators is bitcoin’s cyclicality, often mistakenly referred to as its volatility. The last three years have been a tough period for bitcoin, and they have not been that fruitful for gold either. BOLD has beaten bitcoin by a narrow margin but done so with the volatility and drawdowns more in keeping with gold.

Three Years of Bitcoin, Gold, BOLD, and Equities (since 31 January 2021)

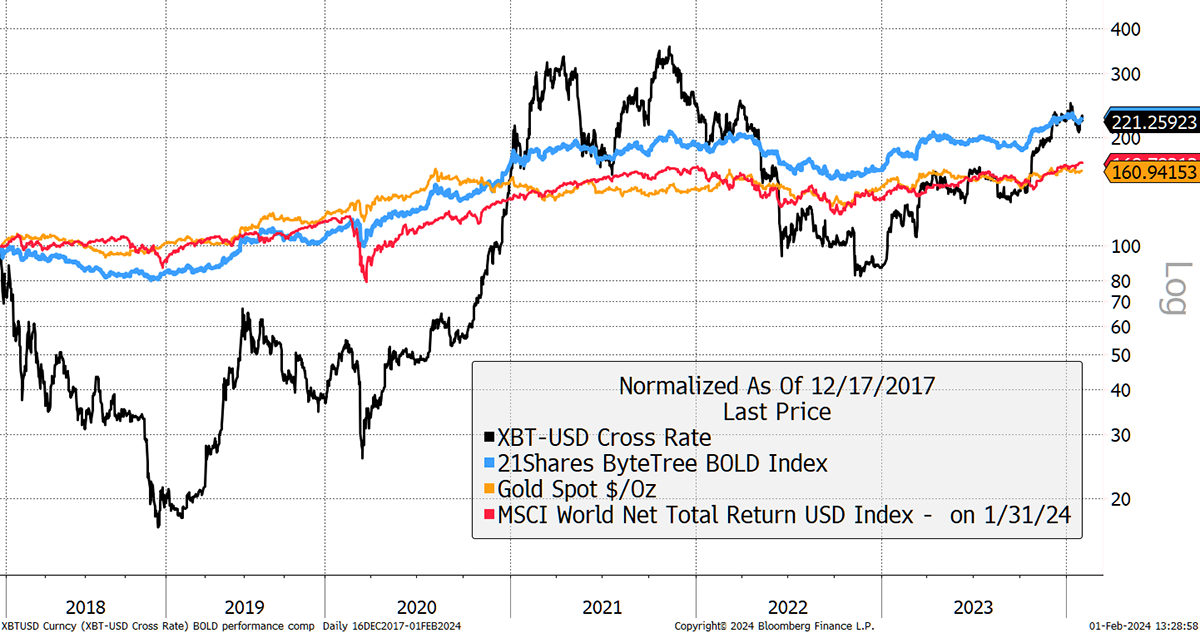

Over the six-year period since bitcoin’s high in 2017, BOLD has once again matched the returns of bitcoin, with the volatility near that of gold and without bitcoins’ cyclicality. A much calmer journey that was smoothed by gold’s counter-cyclical nature.

Six Years of Bitcoin, Gold, BOLD, and Equities (since 16 December 2017)

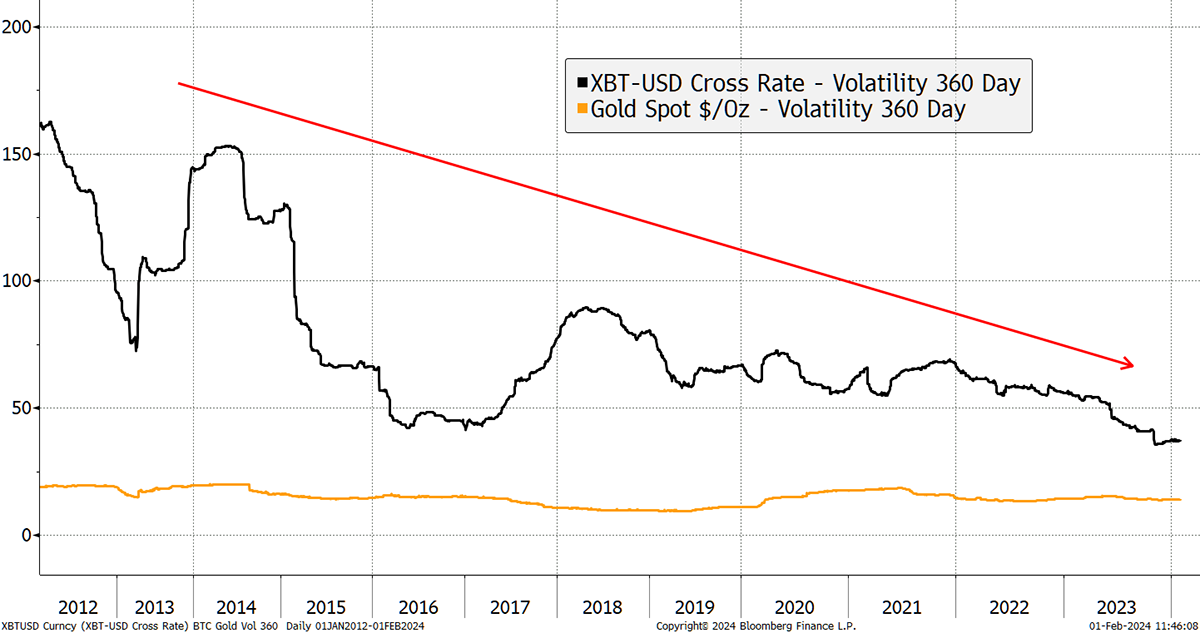

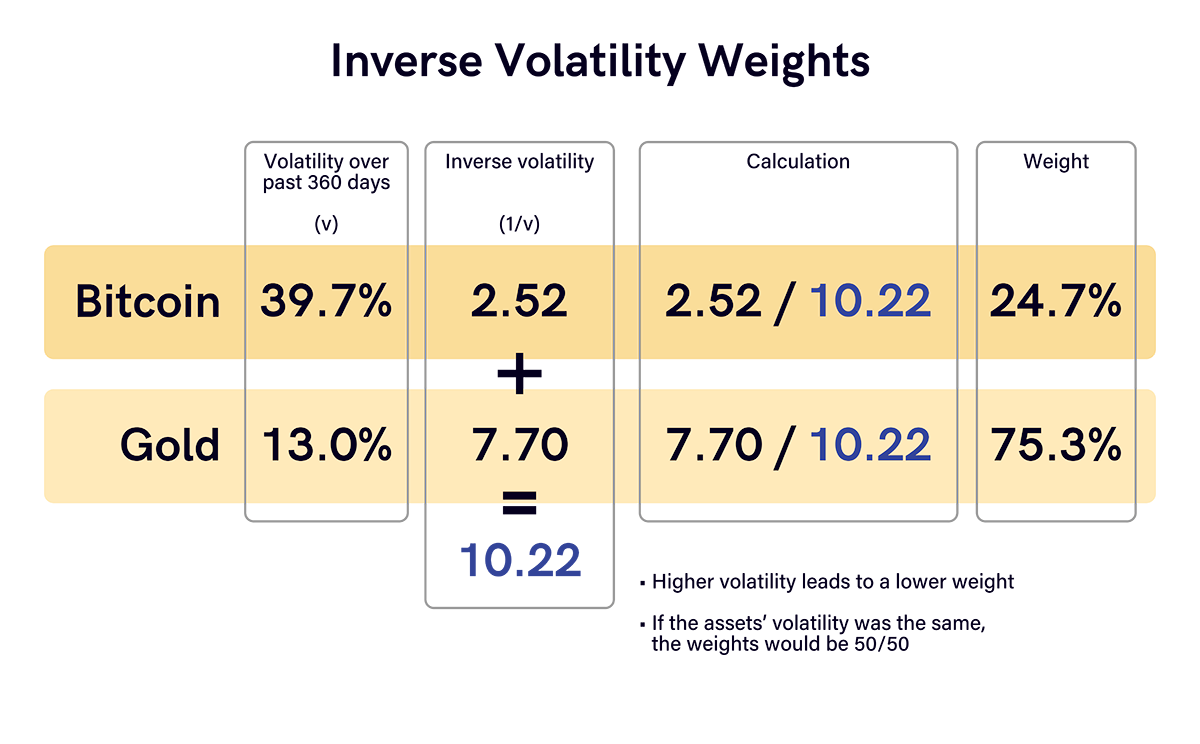

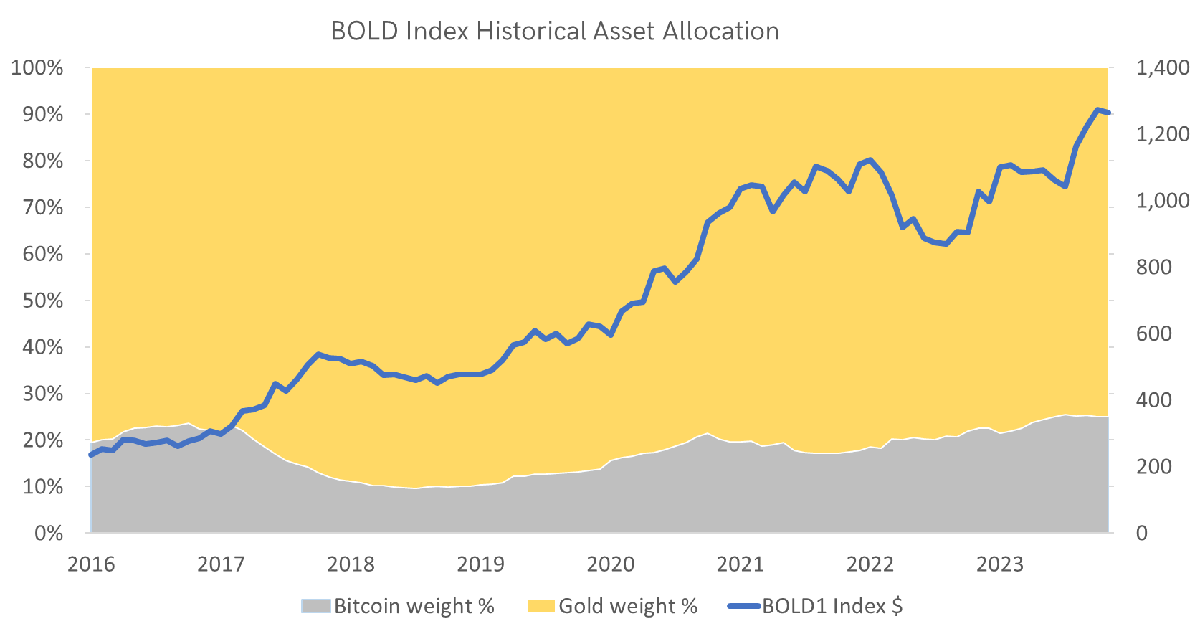

BOLD allocates to bitcoin and gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the month rebalancing. Bitcoin’s volatility has fallen significantly over the years and is now no more volatile than a typical blue-chip stock. In this regard, bitcoin is widely misunderstood.

Bitcoin and Gold Past 360-day Volatility at Record Low

The volatility for bitcoin and gold over the past 360 days was observed to be 39.7% for bitcoin and 13.0% for gold. This has resulted in weights of 24.7% bitcoin and 75.3% gold using this formula. Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset. It is therefore “risk-weighted”.

As the volatility has fallen, the bitcoin weight has been steadily rising since 2018.

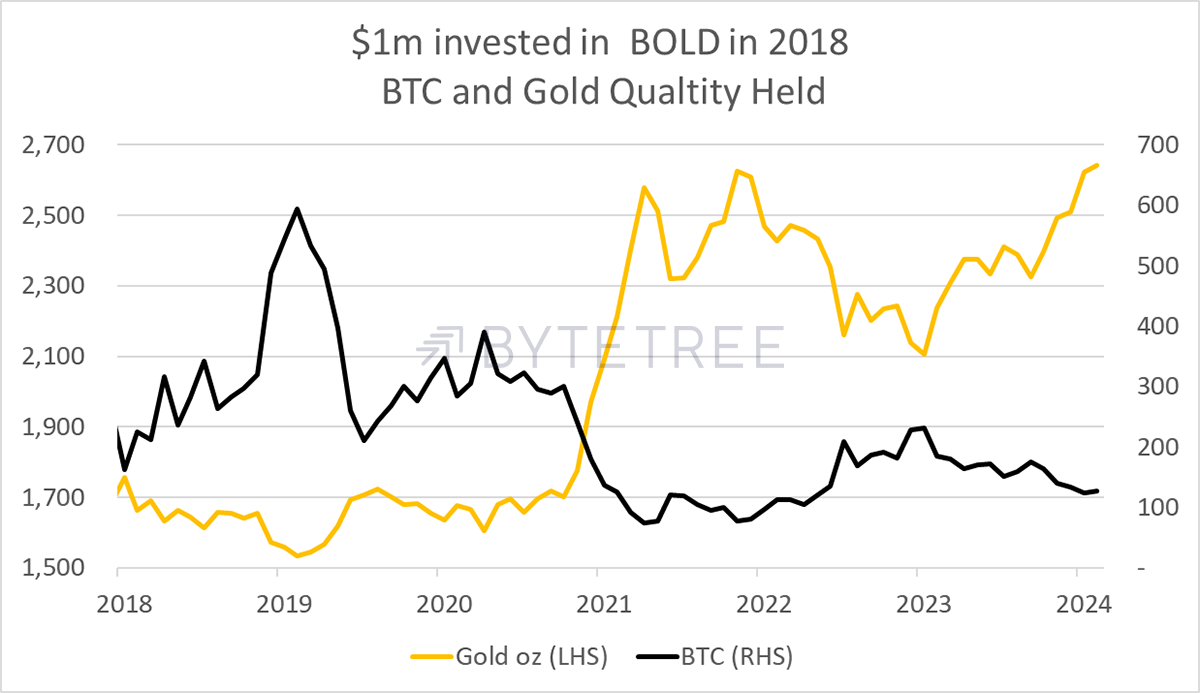

The important thing about the risk weights and rebalancing is how the BOLD strategy accumulates the weaker asset. In late 2022, that was bitcoin, having fallen by 76% in the bear market. That meant an investor who backed BOLD with $1 million in January 2018 increased their 78 BTC to 231 BTC in 2022 at the expense of gold. However, over the past year, they have done the opposite and have been reducing bitcoin while boosting gold from 2,104 ounces to 2,641 ounces.

Should gold beat bitcoin over the coming months, which is seemingly likely due to the weak state of the economy and the likelihood of lower interest rates, BOLD will once again have the upper hand. The regular rebalancing transactions are a vital part of the BOLD strategy. Without them, investors holding bitcoin and gold passively would be materially worse off.

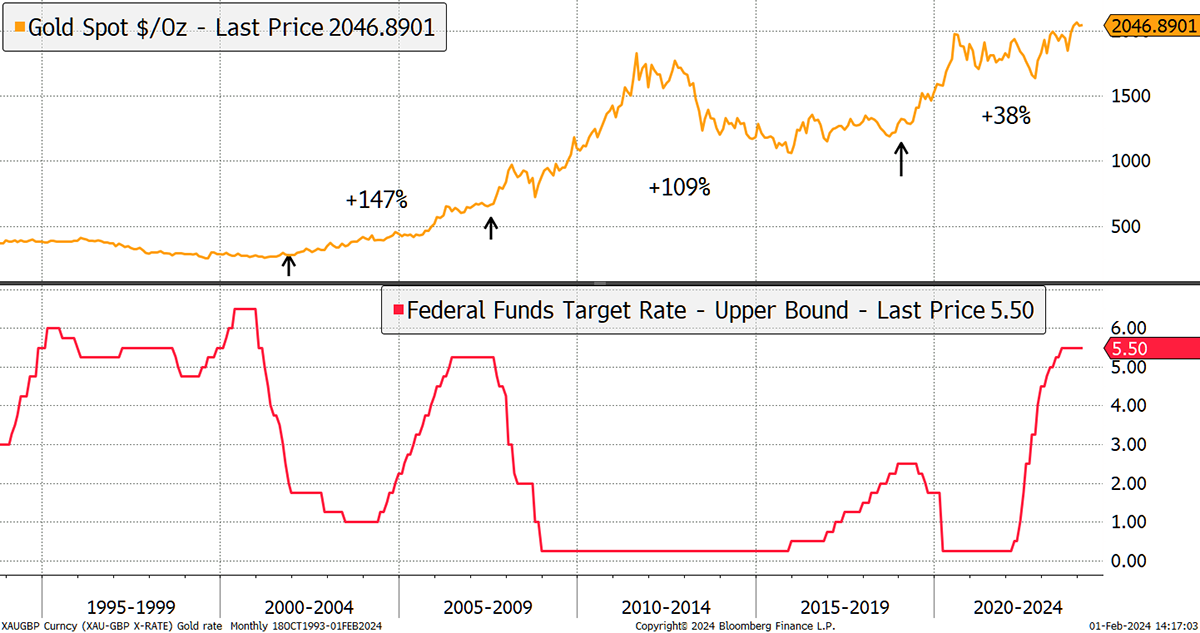

Gold Responds Well to Lower Rates

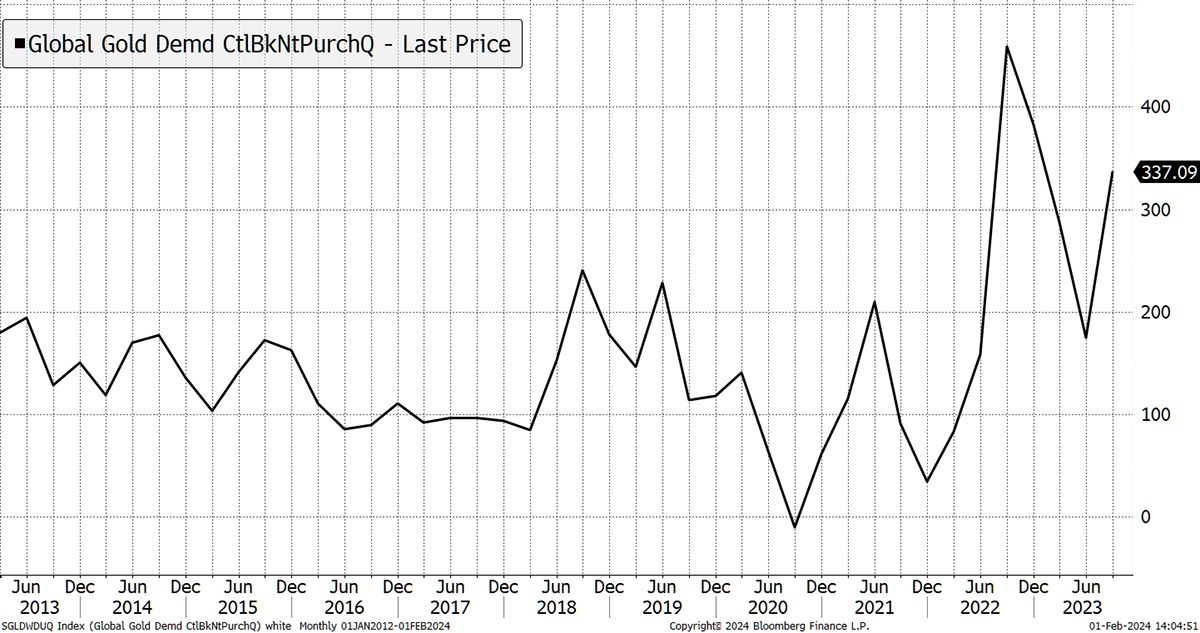

Moreover, while bitcoin is expected to see higher price appreciation, we must forget that there is real money behind the $14 trillion gold market. The official sector, which includes central banks, sovereign wealth funds and governments, bought 337 tonnes of gold last quarter, and those purchases are likely to accelerate. That equates to $24 billion of inflows in a three-month period, or four times what the bitcoin ETFs have ever seen since their inception in 2013.

Official Sector Gold Demand

As always, with the likes of bitcoin and gold, there are periods of hope and periods of despair. Currently, bitcoin has come through a hype phase, whereas gold’s sentiment is weak. Yet, consider that gold is on the verge of an all-time high, having easily absorbed $56 billion of investor selling pressure over the past three years. If it can shake that off, just imagine what it will do when that money comes flooding back… which it always does.

Summary

BOLD is the prudent course for investors who want to protect themselves from monetary inflation but don’t want or feel the need to choose between bitcoin and gold. They serve different purposes but with the same long-term objective.

The BOLD strategy balances exposure between these highly liquid alternative assets and boosts returns by (historically) 5% to 7% per annum from rebalancing transactions while providing investors with a much calmer journey.

Contact

For information on investing in BOLD, contact bold@bytetree.com

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Vinter Index Provider

21Shares BOLD ETP

Bitcoin and Gold Research

Follow @ByteTree on X.com (formerly Twitter)