A Vibrant Market for Oil

Oil has always played an important role in my investment process. Going back to economic basics, energy is the basis of civilisation. It does hard work for us and is turned into capital stock such as homes, factories, roads, and the railways. Provided that society can consume more energy productively, it will grow, and living standards will improve. In trying to design a system that doesn’t require more energy to be consumed, society can only fall backwards. To deny that is to misunderstand economics 1.01.

Within energy, oil rules the transport sector because it is dense. That means it contains more energy, with less mass and volume than other alternatives. Not only does transport enable goods to be shipped around the world, it allows us to drive to work, visit faraway places, and helps farmers to reduce their workforce by 99% thanks to machinery. Oil’s role in society has many more years ahead.

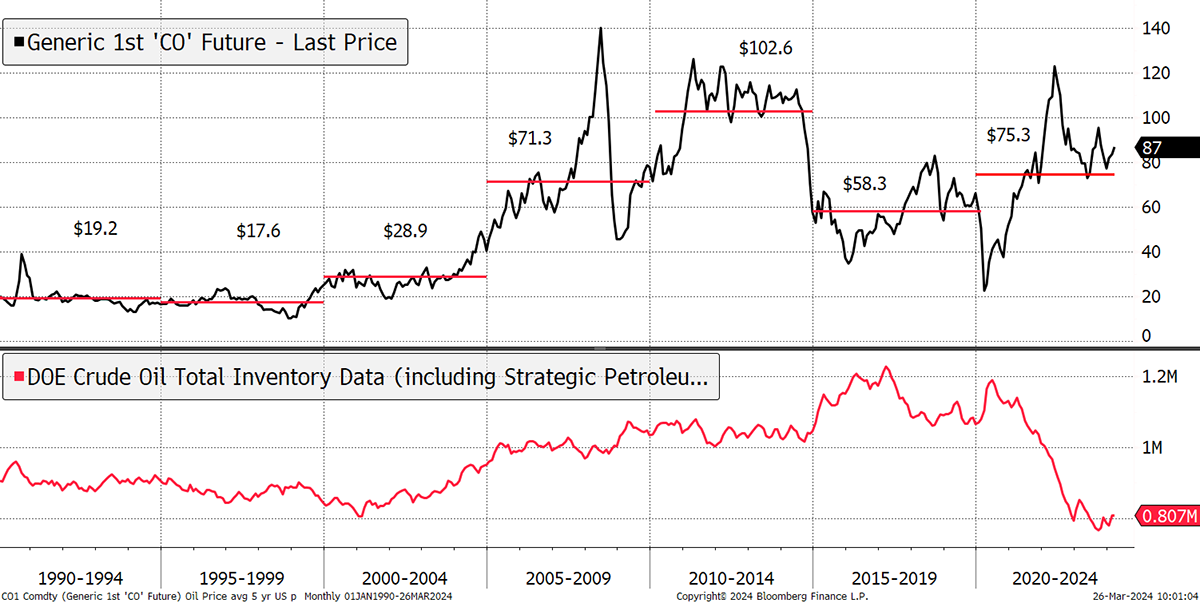

The price of Brent crude has been unusually volatile in recent years. Being the preferred energy source for transport, it collapsed during the pandemic while we stayed at home. It soon recovered as lockdowns ended, only to surge when the war began. Useful politicians (there are some) know that cheap energy is the basis of civilisation, and so to thwart an oil shock, the US strategic reserve (red line) was drained to offset the tightness in supply. Here we are in 2024, and the correction is behind us. Oil is back in an uptrend, and at some point, that strategic reserve may be refilled.

Oil Price with Five-year Averages and the Strategic Reserve

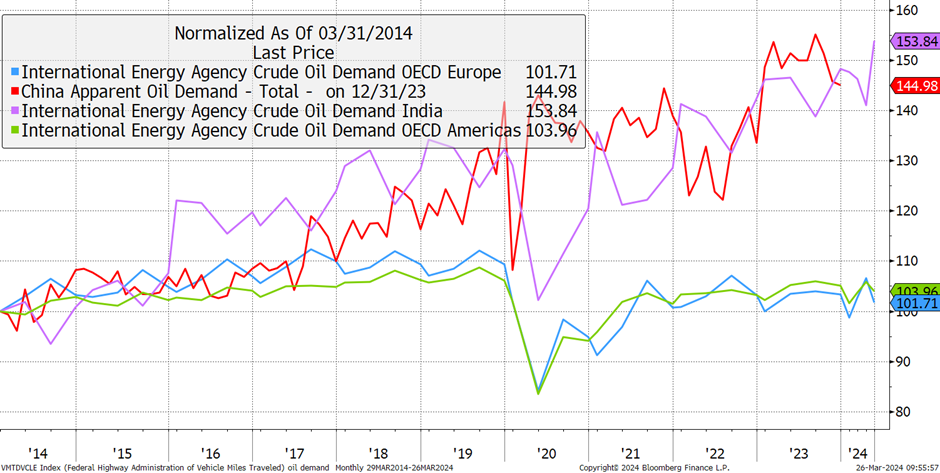

If the price is rising in the absence of a new supply shock, that normally means an increase in demand. That is structural, and don’t bother looking to the West; it’s all happening in the East. Europe and North America are not growing consumption, but China and India most certainly are. Notice how Europe and the US are not seeing consumption fall either. Noble attempts to electrify have made some progress but at enormous cost to society.

Oil Demand Grows in the East

Oil is already a significant position in the portfolios. Soda holds the Energy ETF (ENGW), and Temple Bar’s (TMPL) biggest positions are Shell (SHEL) and Total (TTE France). We own Latin America (highly correlated with oil), and Capital Gearing (CGT) and Ruffer (RICA) both have some exposure.

In Whisky, we hold Harbour Energy (HBR), Tenaris (TEN Italy), Schlumberger (SLB USA) and Repsol (REP Spain). We also own a double dose of Brazil.

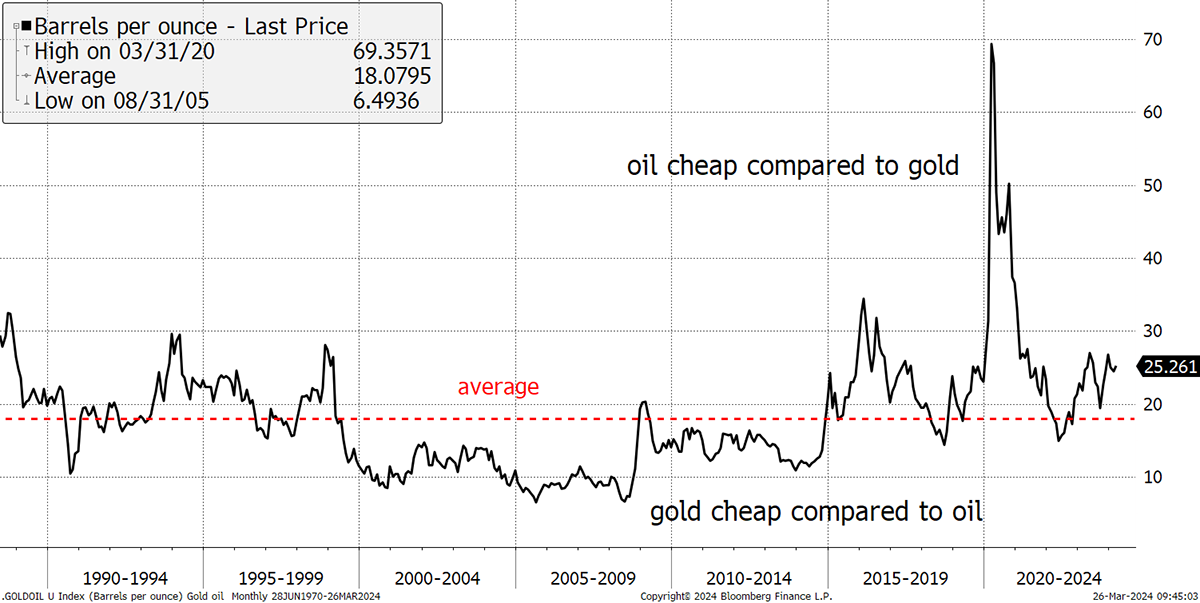

I am not going to add further exposure to energy because we are already there. It wasn’t a difficult decision to do that, even if it was slightly early. The relationship between gold and oil is a useful tool. If gold is strong and oil is trading cheaply by comparison, the portfolio gods are on your side. The gold-to-oil ratio is at 25, while the historical average has been 18. In simple terms, oil could be 40% higher than it is today, at $120, and wouldn’t be out of whack with the normal state of affairs.

Oil Trades Cheaply to Gold

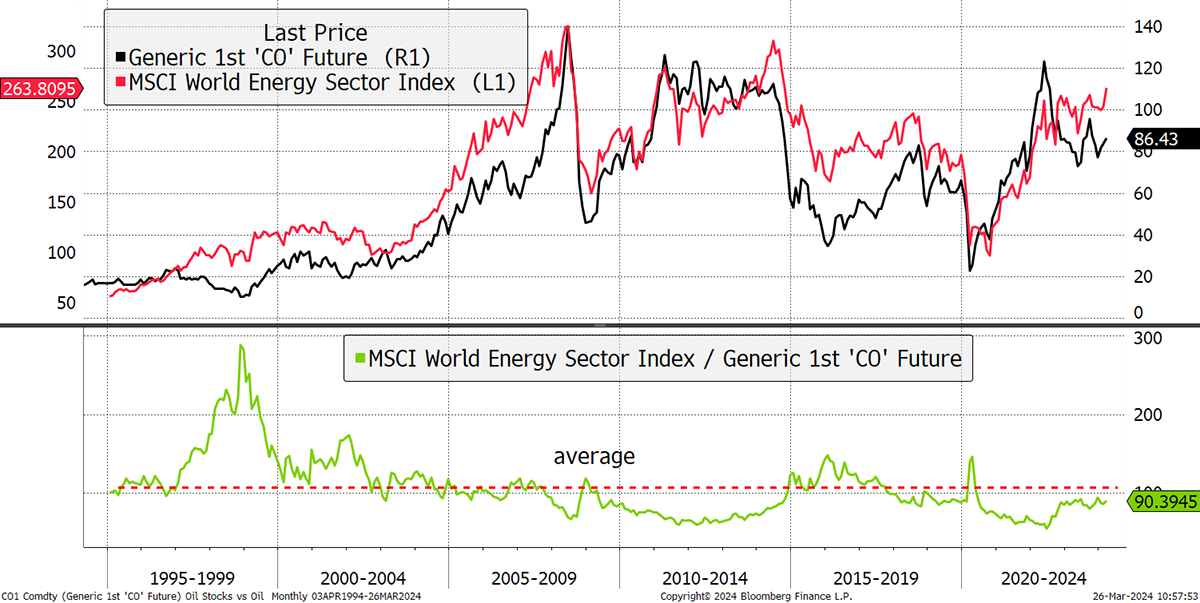

That’s not a prediction, just an observation. Gold looks bullish, oil looks bullish, and oil is cheap gold. Now, comparing oil stocks with oil, they appear to be in front, but the green line suggests otherwise. That is the historical average between oil and oil stocks, and there’s a little upside on this basis. I won’t get too excited about that because the green line is structurally lower post-2008, but take comfort that we are not overpaying for energy stocks.

Energy Stocks Fair Value vs Oil

In summary, we are substantially invested in the energy sector and should benefit from a firmer oil price. I hope this translates into strength in Latin America, especially Brazil. If it doesn’t, we will have to revisit that at a later date.

Investment Trusts

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd