Bitcoin and Gold in 2024

Disclaimer: Your capital is at risk. This is not investment advice.

We have patiently been waiting for Bitcoin and Gold to make new all-time highs, and time is finally here. Gold’s all-time high was a quiet affair, while Bitcoin got all the media attention; perhaps that says a lot about the nature of each asset. 2024 will certainly be an interesting year.

Webinar

Join us for a captivating webinar featuring the world's top three Bitcoin and Gold fund managers as they explore the converging landscapes of these two assets.

The webinar will commence with a welcome and introduction, during which each panellist will share insights into their respective roles in Bitcoin and Gold. A 30-minute discussion will then explore topics such as the convergence of Bitcoin and Gold, government and regulatory perspectives, central bank involvement, competition between the assets, and risk vs return profiles in strategic asset allocation. Finally, the webinar will conclude with an engaging 25-minute Q&A session, allowing attendees to pose their questions directly to the experts.

A Week at ByteTree

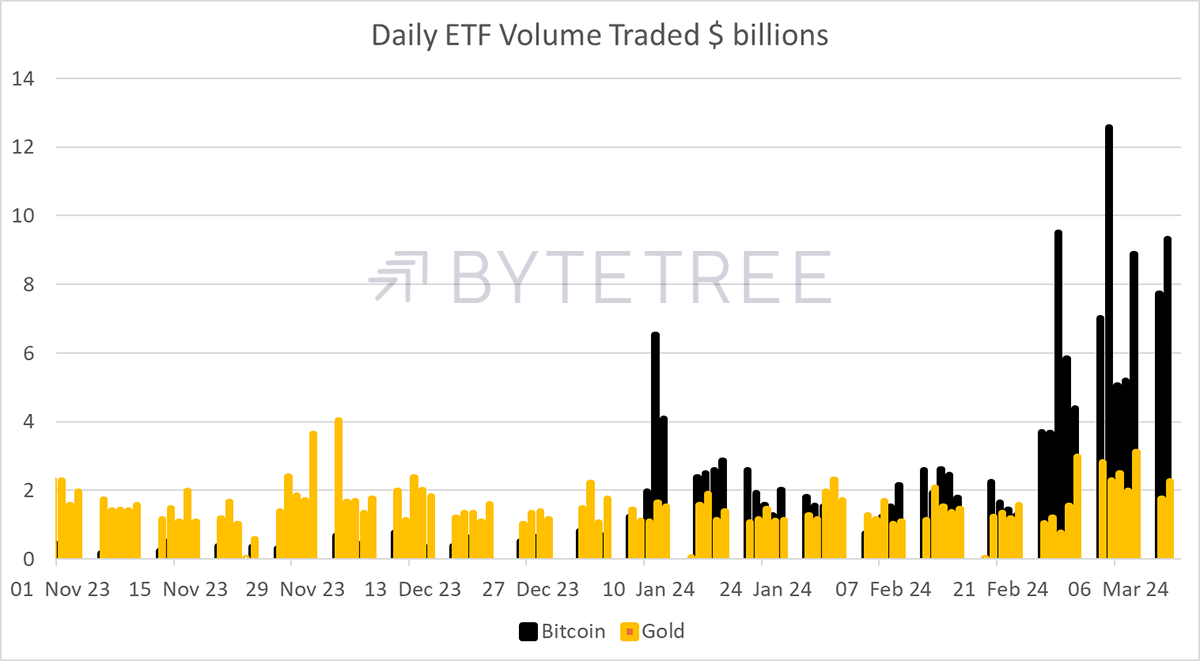

My latest Atlas Pulse update published data on the Bitcoin and Gold ETFs, which showed how the new US funds have more liquidity than the Gold ETFs

It is remarkable that Gold ETFs typically see $2bn in daily trading volume when Bitcoin ETFs can be 4x that. But bear in mind that gold is a $15 trillion market, which is 10x larger than Bitcoin. Bitcoin ETFs make up 5% of their supply, whereas for Gold, it’s just 1%. In addition, the total daily Gold volume, which includes physical, OTC and futures, is estimated to be $150 billion per day. I reiterate that Gold and Bitcoin are not in competition any more than equities are with bonds. There was also an excellent piece by Rob Marstrand on Milei’s ten-point plan to turn around Argentina. Definitely worth a read.

In Venture, I selected another deeply undervalued +£50 billion asset manager with an enterprise value close to zero.

In The Multi-Asset Investor, I review Brazil. It turns out that Petrobras held back dividends to fund the energy transition by presidential order. The company say they are committed to oil production and will be one of the last companies standing in the sector. The market panic is overdone, especially when you consider what the UK government did to North Sea producers. That was pure economic vandalism.

In Crypto, we covered THORChain (RUNE) and Solana (SOL). RUNE is one of our holdings and is up 75% this week. Why can’t the stock market do that?

Don’t forget to sign up for the webinar. Larry, Mark and I are the original Bitcoin and Gold fund managers, each with a different take. At least they are managing funds, I only dreamt up an index.

Have a great weekend,

Charlie Morris

Founder, ByteTree