Bitcoin Halving: The Great Anti-Climax

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 95;

The fourth Bitcoin block halving is expected to take place on Saturday, 20th April, at 16:51 GMT. This is an estimation, as block times are not exact, but it will not vary by much. What we know for sure is that it will take place on the 840,000th block. In this issue, I will review what it all means.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Technicals | Volatility Spike |

| Investment Flows | The BOLD.Report |

| On-chain | Stable |

| MicroStrategy | Saylor Cashes in on the 156% Premium |

| Halving | Who Pays for Bitcoin? |

Technicals

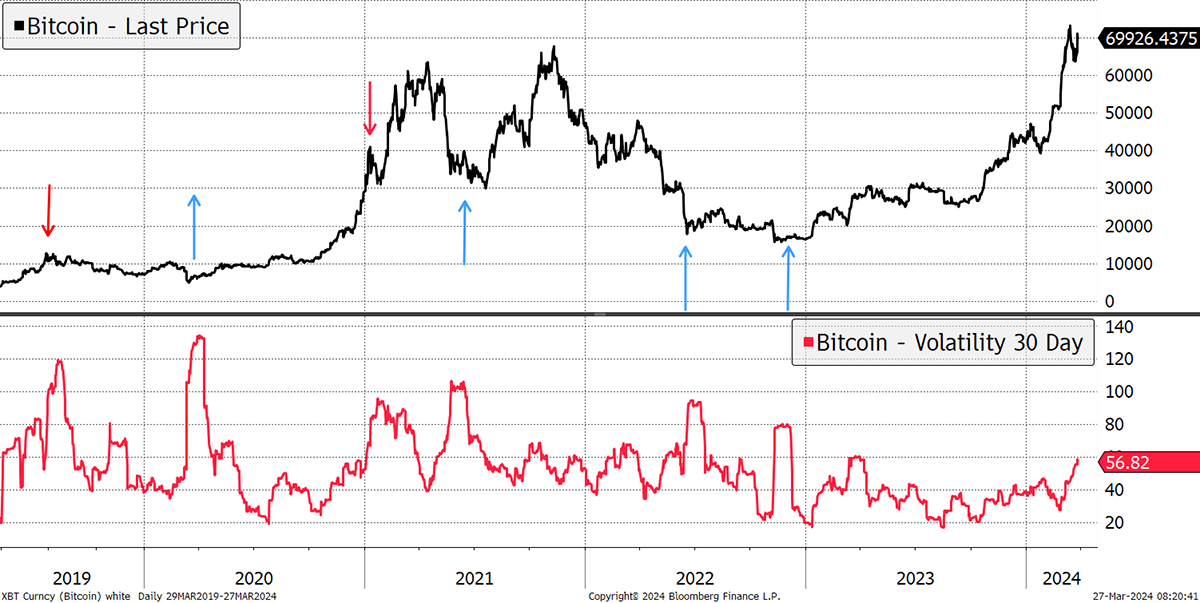

Bitcoin volatility remained low last year, while the price more than doubled. Trends thrive on low volatility; the trouble comes when it spikes because that can mark the reversal. In the chart below, I show Bitcoin over five years with 30-day volatility spikes. There were two upward volatility spikes in 2019 and early 2021, which marked short-term peaks, and four downward spikes, which led to rallies. Volatility has been rising, and while it is still 57%, if it rises much further, this will start to look like a blow-off top.

Bitcoin Volatility Spikes

That doesn’t have to be a problem because it could just be a consolidation or a pause. It would be unusual to see Bitcoin come under pressure at this stage of the cycle. That said, everything has been brought forward this time.

Bitcoin halving takes place roughly every four years, or more specifically, every 210,000 blocks. I show the dates of the last three halvings in red. It’s fair to say they were bullish events as the Bitcoin supply kept on falling.

Bitcoin and Halving

My observation on the halving cycle has been that the price has rallied to a notable high. A savage bear market followed, and then the cycle-end saw the price above the cycle average. The difference this time is that Bitcoin has made an all-time high ahead of the upcoming halving event. No doubt the normal cycle would have been repeated, but the January approval of the ETFs brought forward the animal spirits. That said, we should be clear that this recent all-time high is limp by historic standards. What happened to the usual surge once the new high is reached?

The consensus view is that halvings are bullish because they squeeze supply. If demand can remain constant, or better still increase, the price can only rise. That’s true. But many Bitcoiners believe “in the math”, with the implication that demand is irrelevant and halving alone will see the Bitcoin price go to the moon. I have never believed that to be true.

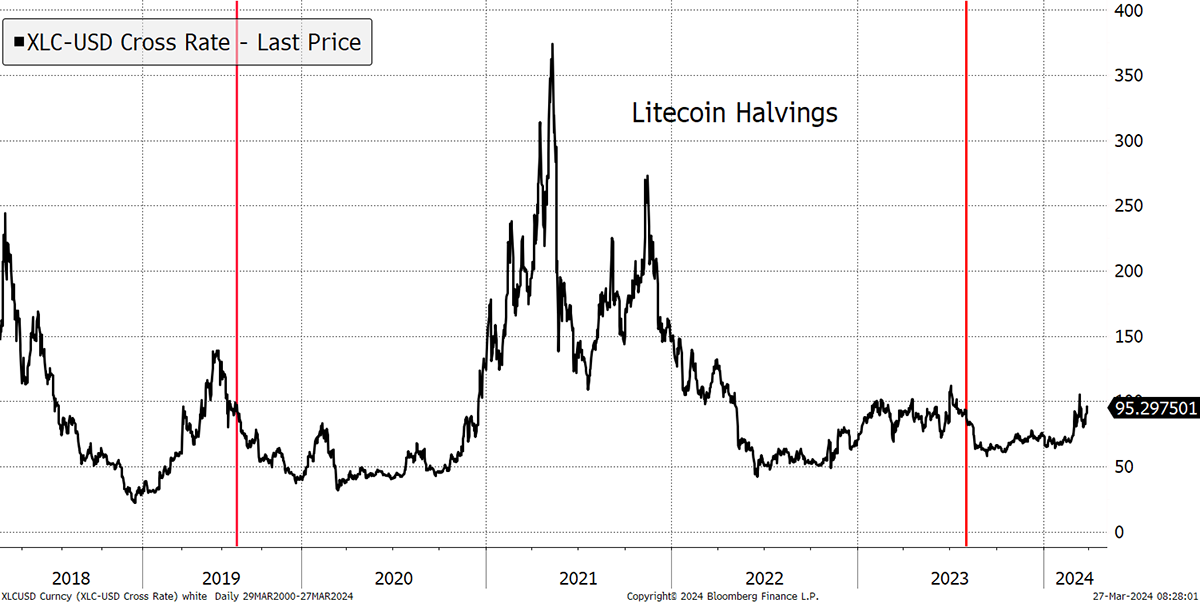

Litecoin is one of the many copycats of Bitcoin. The rate of new supply is slightly below Bitcoin, but that hasn’t helped it, nor have halving events. The last two halvings in 2019 and 2023 led to precisely nothing. It demonstrates that if a crypto token has low demand, supply is already too high, and even if you stopped new supply altogether, it still wouldn’t create value.

Litecoin Halvings Created No Value

The important point is that Litecoin is not Bitcoin, nor will it ever be, despite having very similar supply-side dynamics. There can only be one, and all of the clones are essentially worthless. Bitcoin has the network effect, and should that wane, the price will fall, just as it has done in the late stages of each cycle.

That is why I believe that Bitcoin is a demand story. If supply was unlimited, the case for “digital gold” could never be made. This is why the ETFs are so important, not just this year but for over a decade. Funds and ETFs are the most efficient way to bring in the big money. They are an intrinsic part of the network.

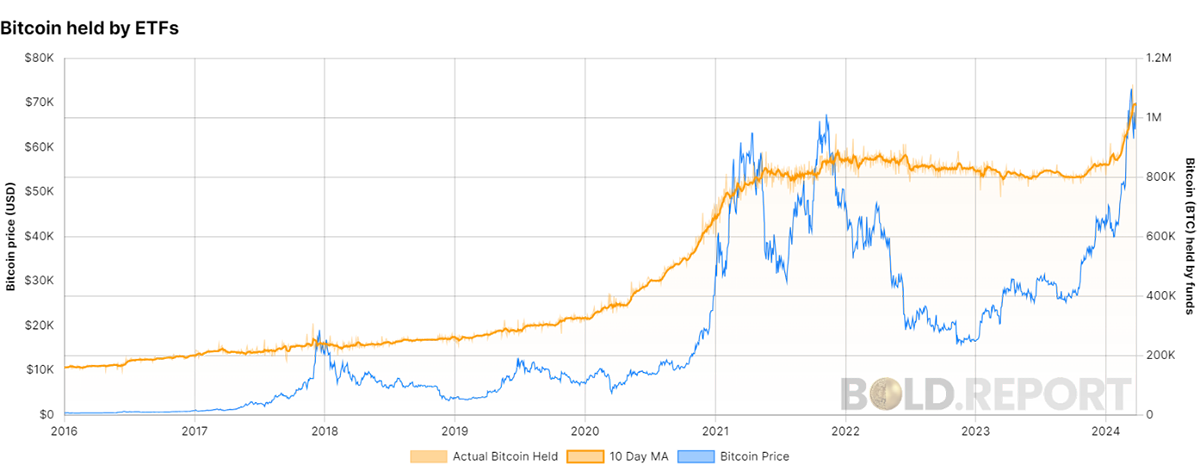

Investment Flows

Our data set on Bitcoin (and gold) fund flows has been upgraded on BOLD.report. The number of Bitcoins held by funds was flat between the 2021 high and recently. Then, in Q4 2023, the Canadian and European ETFs saw huge inflows in anticipation of the US ETFs launch, which carried on into Q1 this year. The ETFs have acquired more than a million Bitcoins, which has had a positive impact on price.

Bitcoin Held by ETFs

The ETF flows are shown below, and the recent surge is record-breaking stuff. What’s more, this is shown in Bitcoin, which costs far more today than during the 2020-surge. We have never seen so much money enter the Bitcoin Network in such a short space of time, which is why the price is at an all-time high.

Bitcoin ETF Inflows

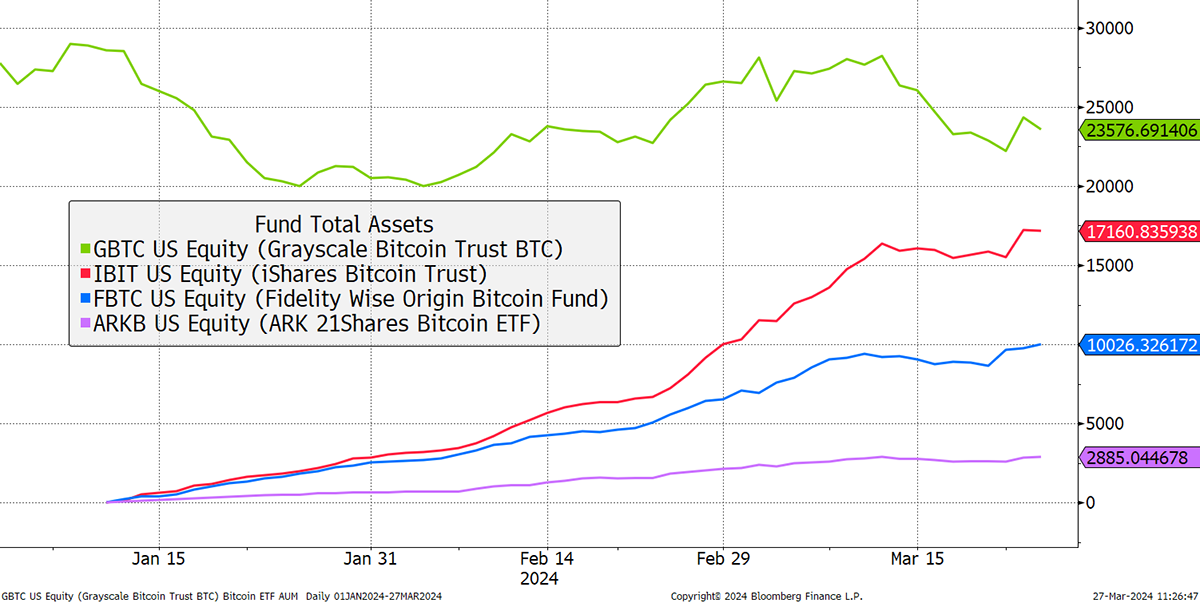

Flows seem to have peaked for the time being, which isn’t surprising given how strong they have been, and I would doubt the halving bulls haven’t already invested ahead of time. To clarify, the iShares Bitcoin Trust (IBIT) is still growing, but Grayscale (GBTC) is shrinking. These ETFs were launched on 10th January when Bitcoin was $46,159. GBTC assets are the same while the price has surged. IBIT has gone from $0 to $17.1 billion in 10 weeks. Fidelity Bitcoin (FBTC) and ARK 21Shares (ARKB) haven’t done badly either.

iShares Soon to Take Over from Grayscale

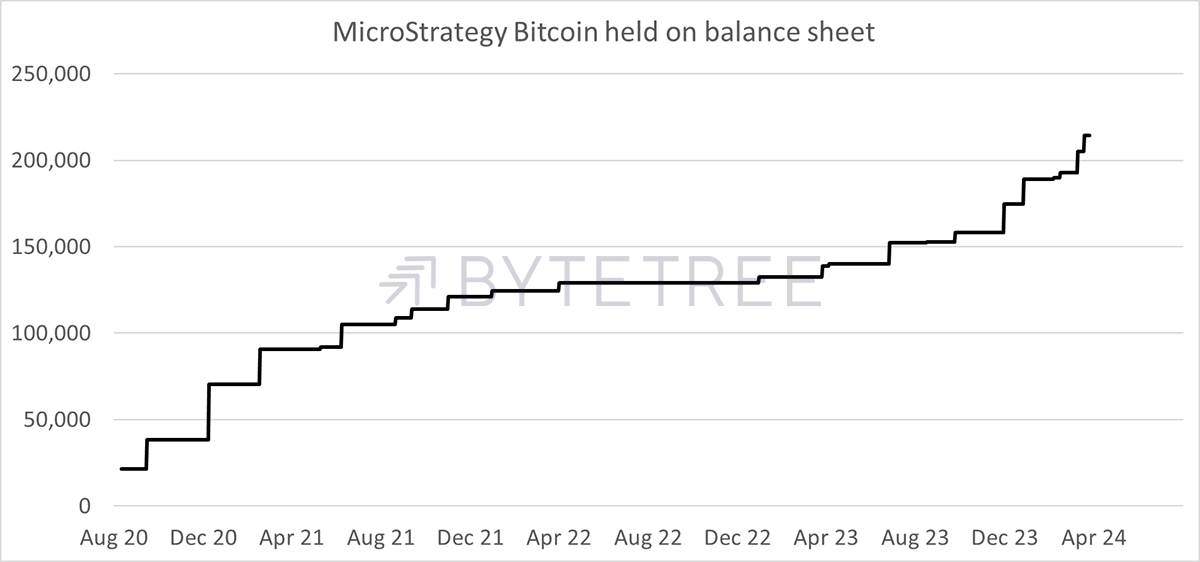

But whatever Grayscale sells seems to end up in MicroStrategy (MSTR), the company controlled by Michael Saylor. Following the issuance of convertible debt, MSTR now holds 214,246 Bitcoin, which is 1.1% of the world’s total Bitcoin supply.

MicroStrategy: Bitcoin Held on Balance Sheet

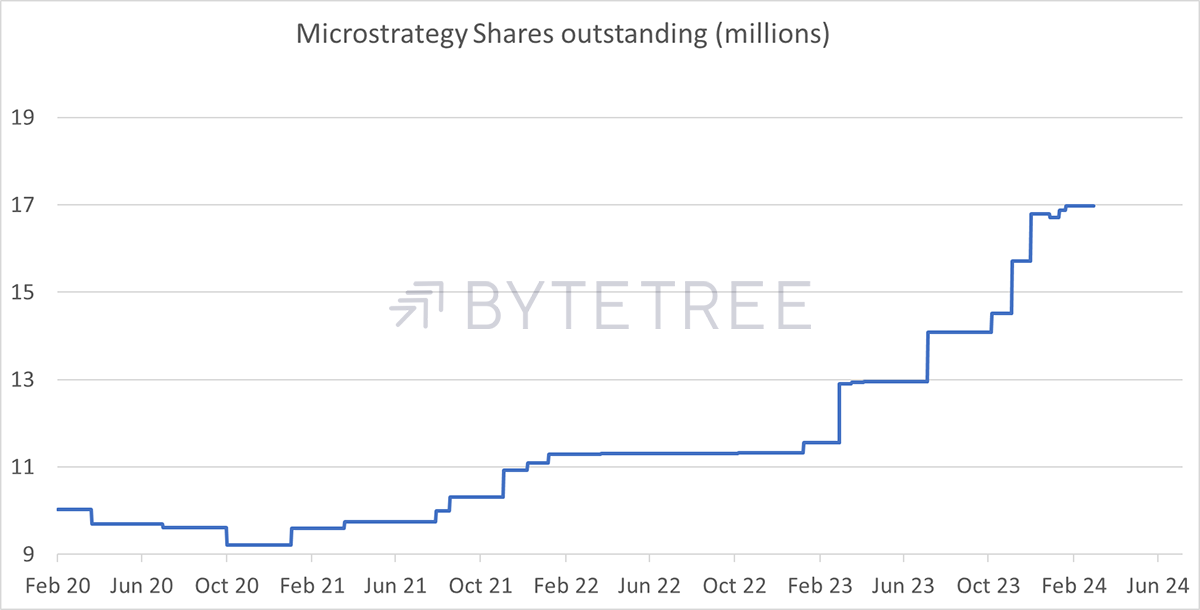

MSTR has been issuing equity to accumulate Bitcoin.

MicroStrategy Shares

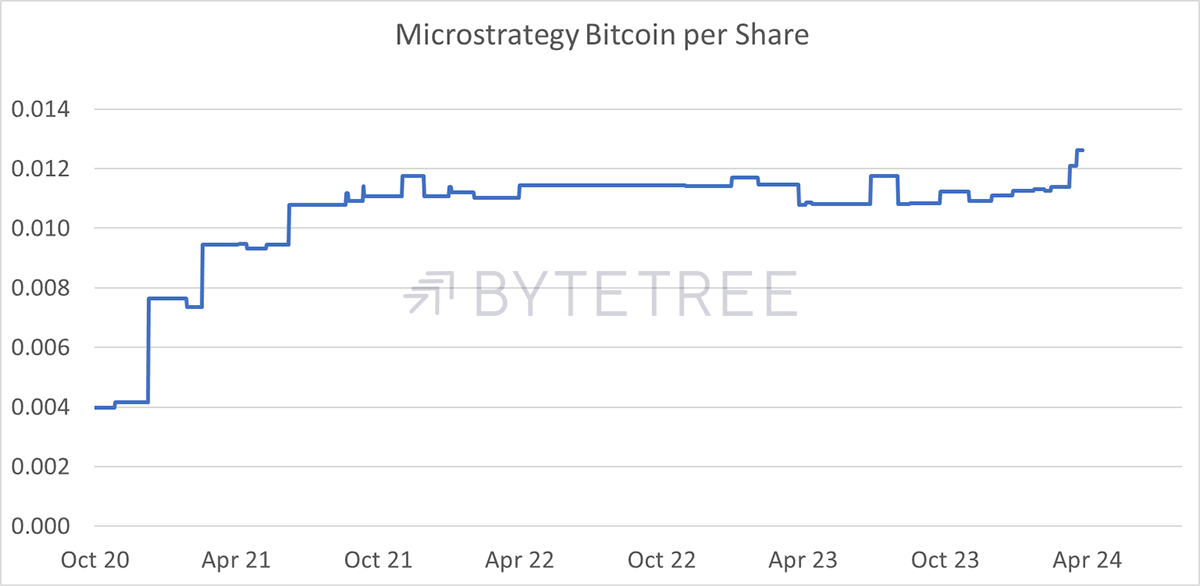

The early purchases were funded with cash, and then, debt, which increased Bitcoin per share. The use of equity explains why MSTR’s Bitcoin per share didn’t rise. The company recently increased their debt from $2.2 billion to $3.6 billion through the issue of two new convertible bonds. Since these are debt instruments, the Bitcoin per share has been rising again.

MicroStrategy: Bitcoin per Share

That’s a good thing, but it does increase risk, as leverage ratios would come under pressure if Bitcoin fell significantly. Moreover, MSTR has the potential to fall because the shares trade 156% above the business’s fair value. That means if you wanted to invest $100 into Bitcoin, it would cost $256 to do so via MSTR.

MicroStrategy Premium

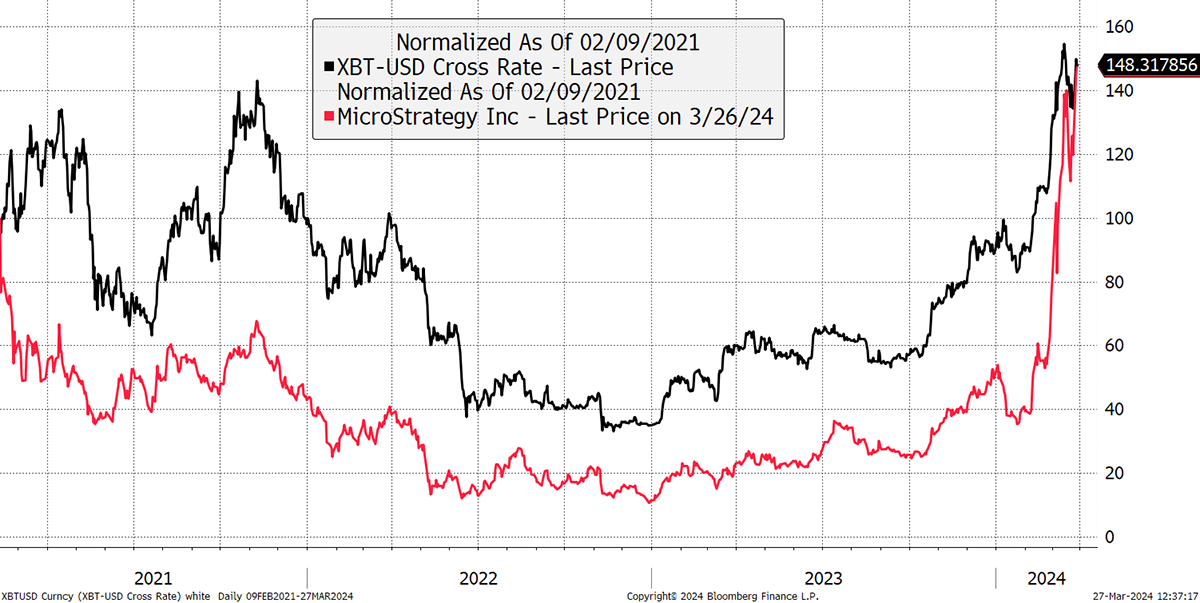

This is a very dangerous situation for investors. At some point, when the meme thing wanes, MSTR will plummet, just like Gamestop (GME). And if Bitcoin moves higher, which I hope it does, MSTR shares may not follow, as we saw three years ago. To illustrate this, the record premium occurred on 9th February 2021. Since then, an investment in MSTR, as opposed to Bitcoin, has been devastating until recently.

Bitcoin vs MicroStrategy

I do not see how it will be different this time. There is no reason to hold an asset trading at a 156% premium. Investors will lose. It amazes me how this meme craze carries on while Saylor has personally sold $263,116,450 of MSTR shares this year.

On-chain

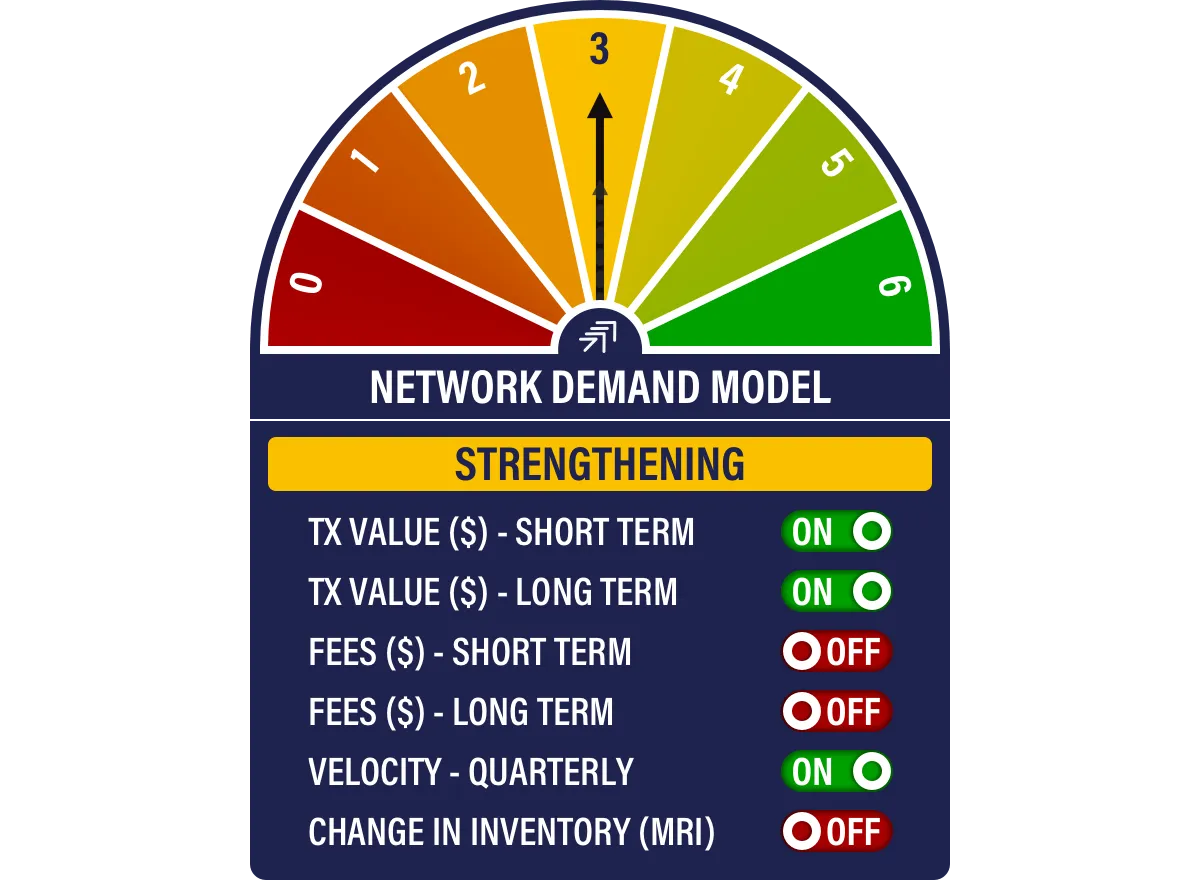

Once again, the Bitcoin Network Demand Model scores 3/6, which is primarily due to low fees. The important point is that spend, which is linked to price, remains strong.

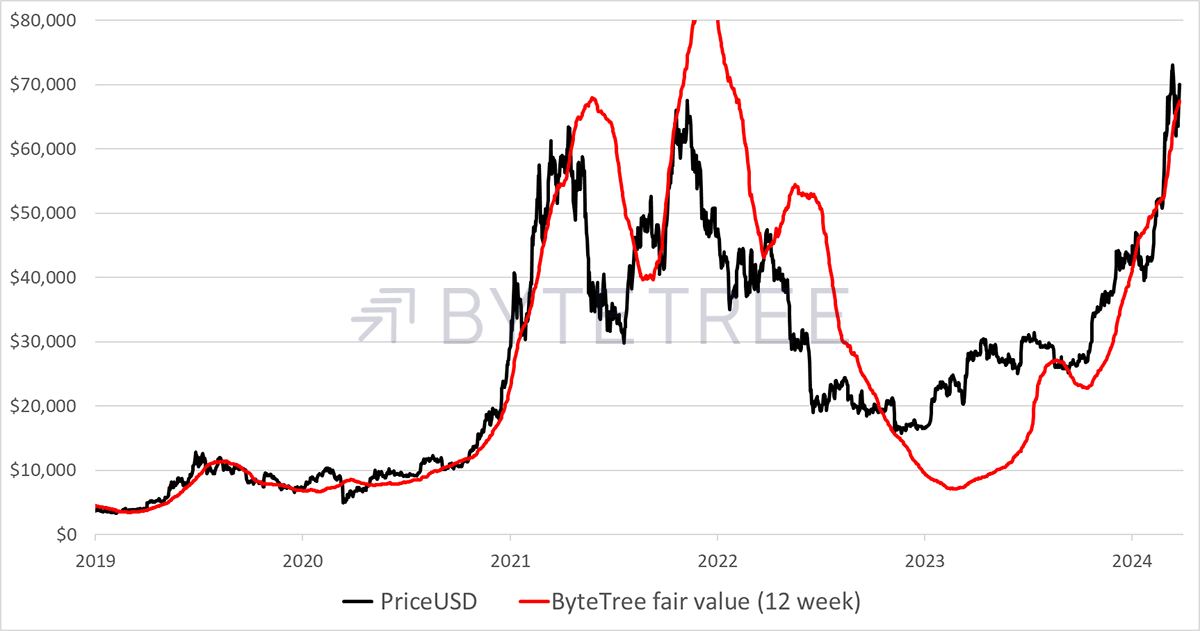

I will show just one chart this time, and that is the price against the network, which remains in line. This is reassuring as it shows Bitcoin trades at fair value.

Bitcoin at Fair Value

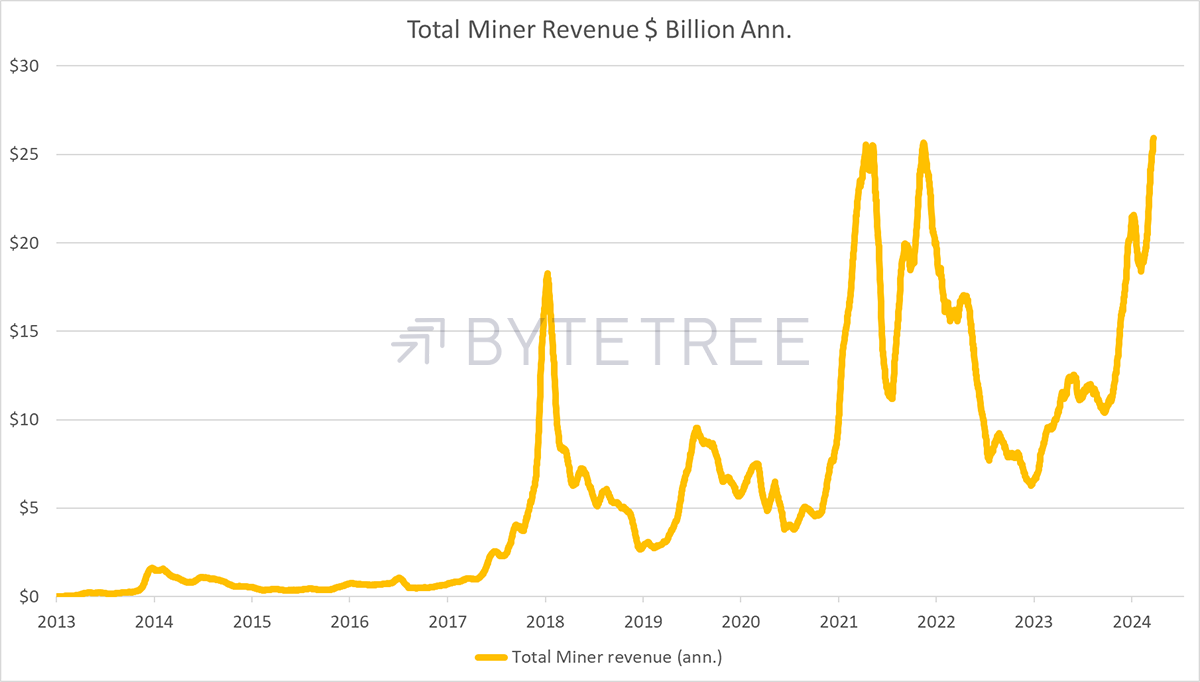

More pertinent is the upcoming halving. In a few weeks, the block reward will halve from 6.25 BTC per block to 3.125 BTC. That will nearly halve the miners’ revenue, which is currently at a run rate of $26 billion per year.

Bitcoin Miner Revenue

Since Bitcoin’s inception in 2009, miners have earned $62,321,959,555, which is a lot of money. The basic idea is that each cycle sees the miners receiving fewer Bitcoins, and the popular view is the price rises to compensate.

But, there is another angle, and that is transaction fees, which the miners receive in addition to the block reward. These were very low in the early days and are currently around $6 per transaction. In the past, they have risen above $50 at times of network congestion. The key is that for the miners to be rewarded in the long term, they must keep on rising.

Percentage of Fees in Bitcoin Miner Revenue

Halving – Who Pays for Bitcoin?

Funding the miners keeps the network running, as they do it because they get paid. As we move into the 5th cycle (epoch), the block reward is falling, and sooner or later, this will need to topped up with higher fees. The fees have very much reduced since the last cycle due to the implementation of SegWit, a system upgrade to increase the network capacity.

Bitcoin Epochs

As we move through the cycles, the new supply shrinks rapidly. In the next cycle, the miners will be paid 656,250 Bitcoin, with a further 8%, or more, in transaction fees. Then, in the next cycle, this will be 328,125 Bitcoin, with even higher transaction fees and so on. The fees will have to keep on rising because we can't count on an ever-higher Bitcoin price, whether we like it or not.

Future Bitcoin Epochs

There are realistic limits. Gold’s market cap is $15 trillion, while Bitcoin’s is $1.5 trillion. Perhaps Bitcoin will catch up with gold. While I’m bullish on both, I deem that scenario to be optimistic, but we’ll go with it. If the price doubled each cycle, then the catch-up would happen by 2036, but what then? Would Bitcoin become worth multiples of gold? I very much doubt that.

The alternative mechanism is higher transaction fees. This strikes me as a much more plausible solution for feeding the miners. However, it is significant and will presumably require more technological improvements to scale the Bitcoin Network over time. When the miners only receive a few Bitcoins, they’ll need much higher fees to compensate. That’s fine, provided small transactions can be managed by layer-2 solutions while the larger transactions take place directly on-chain.

One question I have always had is that if the gold mines stopped producing gold, that’s probably bullish for gold, but more importantly, there is no impact on the functioning of the gold market. If the Bitcoin miners stopped working, the network would stop. The Bitcoin miners not only find new Bitcoin, but they also run the network.

At current prices, gold miners produce around $300 billion of gold each year, which is consumed by central banks, industry, investment, and jewellery. Bitcoin only consumes $26 billion. While these numbers are large, there is plenty of room for Bitcoin to grow from here. Besides, Bitcoin will never stop, nor will Litecoin. It’s simply a matter of demand.

Summary

Halving is always exciting in the run up. The anti-climax is halving itself. All you see is a couple of numbers changing on a screen. But behind that, the Bitcoin Network tightens, as supply wanes. Assuming demand grows, the price can only ever go up.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.