Bitcoin Reaches a New All-Time High

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 98;

A new day, a new all-time high. After a quick profit booking on 5 March, Bitcoin is currently inches away from hitting $72k per coin.

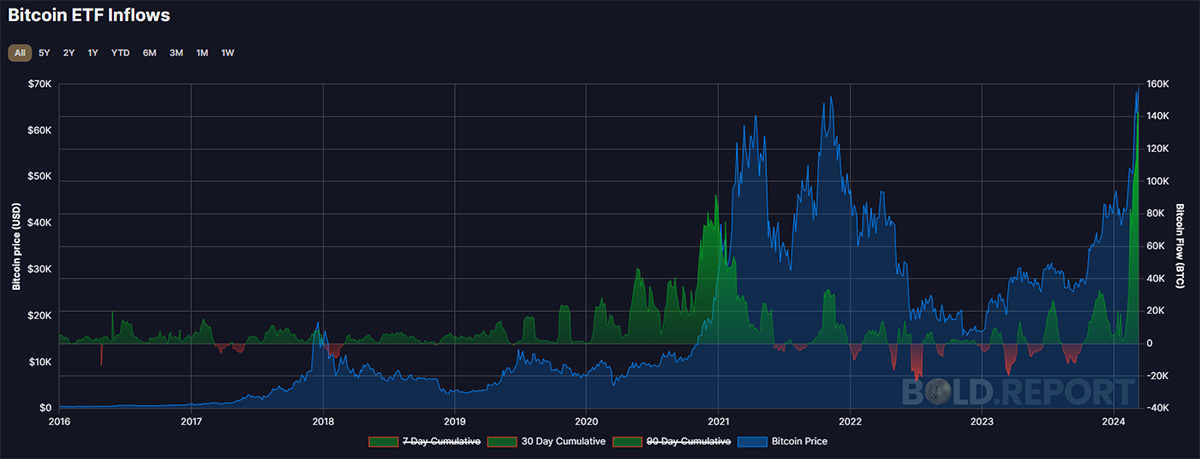

The momentum behind the BTC price is largely fuelled by demand from Bitcoin ETFs, which saw positive net flows of 117,462 BTC in February. That demand does not appear to be waning, as the net flows for March are already at +42,350 BTC at the time of writing.

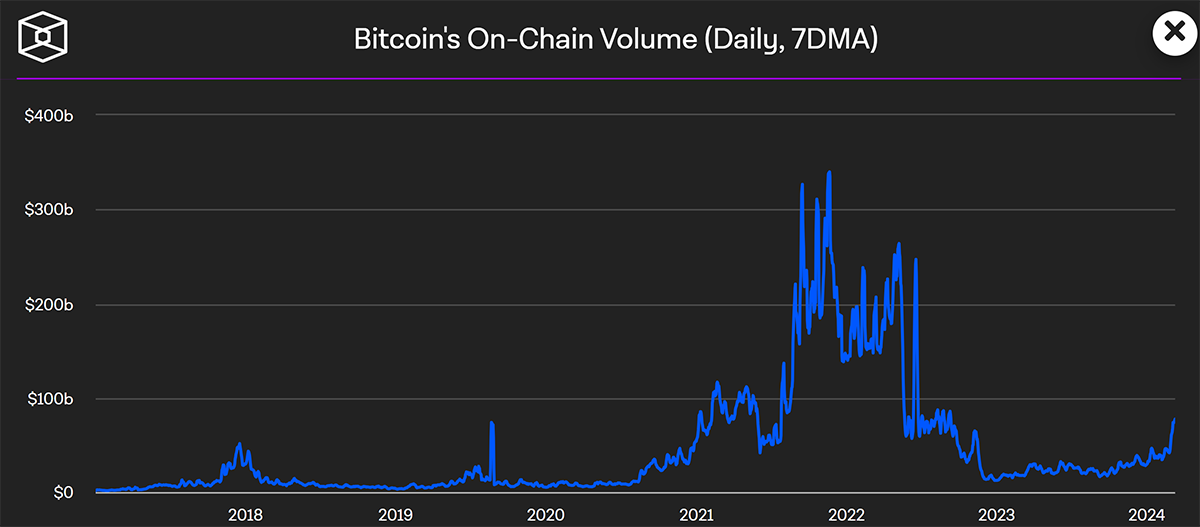

Concurrently, the BTC on-chain volume has also quickly risen to $77.6bn, up 161% year-to-date in 2024.

However, it’s still nowhere close to its high of $337bn in value transacted in November 2021. This suggests that BTC is primarily being used as a store of value rather than as a digital currency.

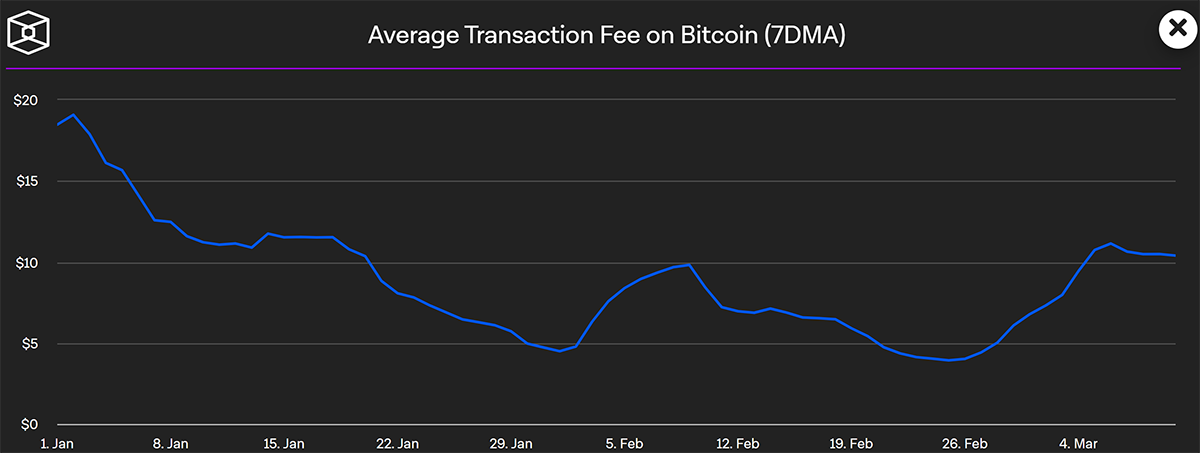

Furthermore, the overall number of transactions has also suffered, driven by the decline in Bitcoin Ordinals, which has caused the on-chain fees to decrease by 43% YTD in 2024, dropping from an average of $18 per transaction to $10.

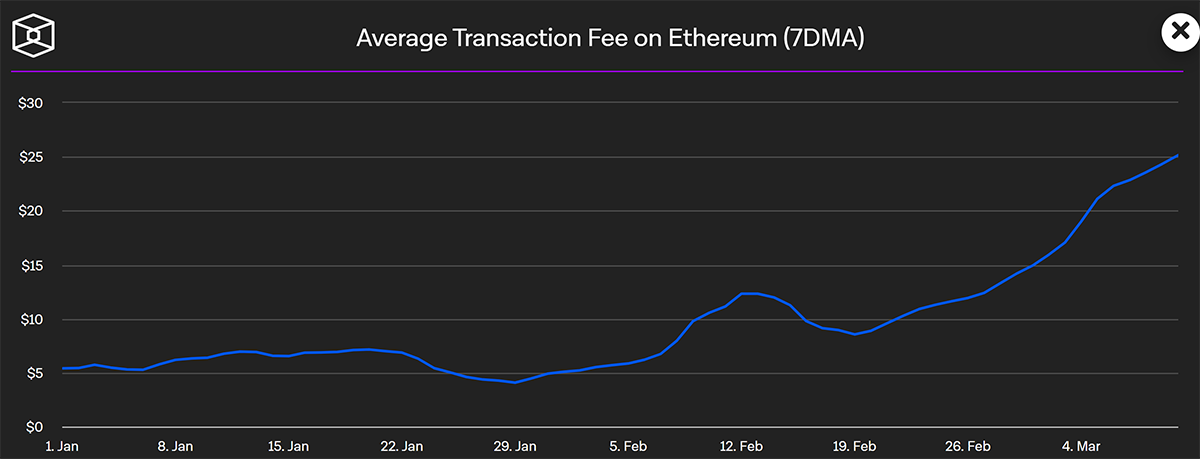

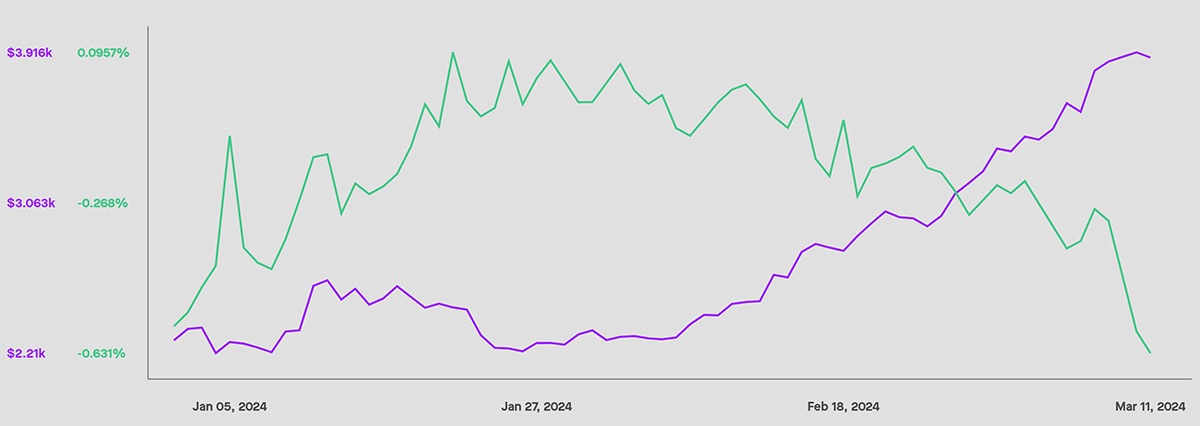

Conversely, Ethereum's transaction fees have surged from $5.4 to $25, marking a 363% increase within the same timeframe.

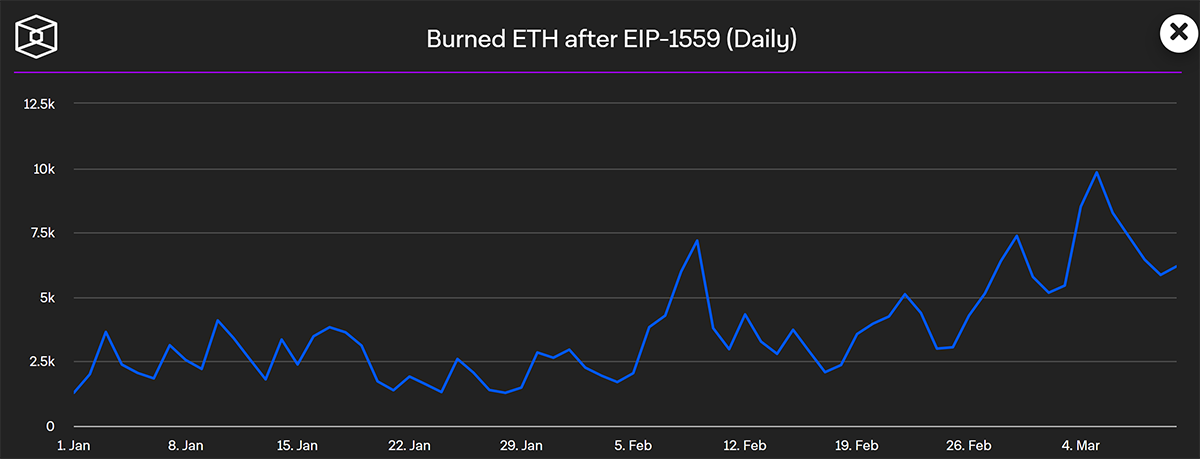

Given that transaction fees are a demand indicator, Ethereum's ecosystem tokens are experiencing significant momentum, memecoins in particular. Presently, memecoins like Shiba Inu, Floki Inu, and PEPE are all scoring 5-star trends against BTC on ByteTrend.io, underscoring robust investor interest. As illustrated in the chart below, heightened fees coincide with a concurrent increase in the burning of ETH.

This has driven ETH inflation into negative territory, benefitting its price.

While elevated fees contribute to the appreciation of the ETH price through its burning mechanism, they render transactions unaffordable for the average user. Sending $100 worth of ETH and being charged $25 in fees is hardly practical. This scenario underscores the need for Layer-2 solutions, which provide a considerably more economical alternative. Nevertheless, amidst the ongoing market activity in the Ethereum ecosystem, the broader Layer-2 market has also seen an uptick in fees.

Notably, Ethereum recently introduced the Dencun Upgrade on its testnet. Dencun, which aims to substantially reduce costs associated with Layer-2 usage, is set to go live on 13 March.