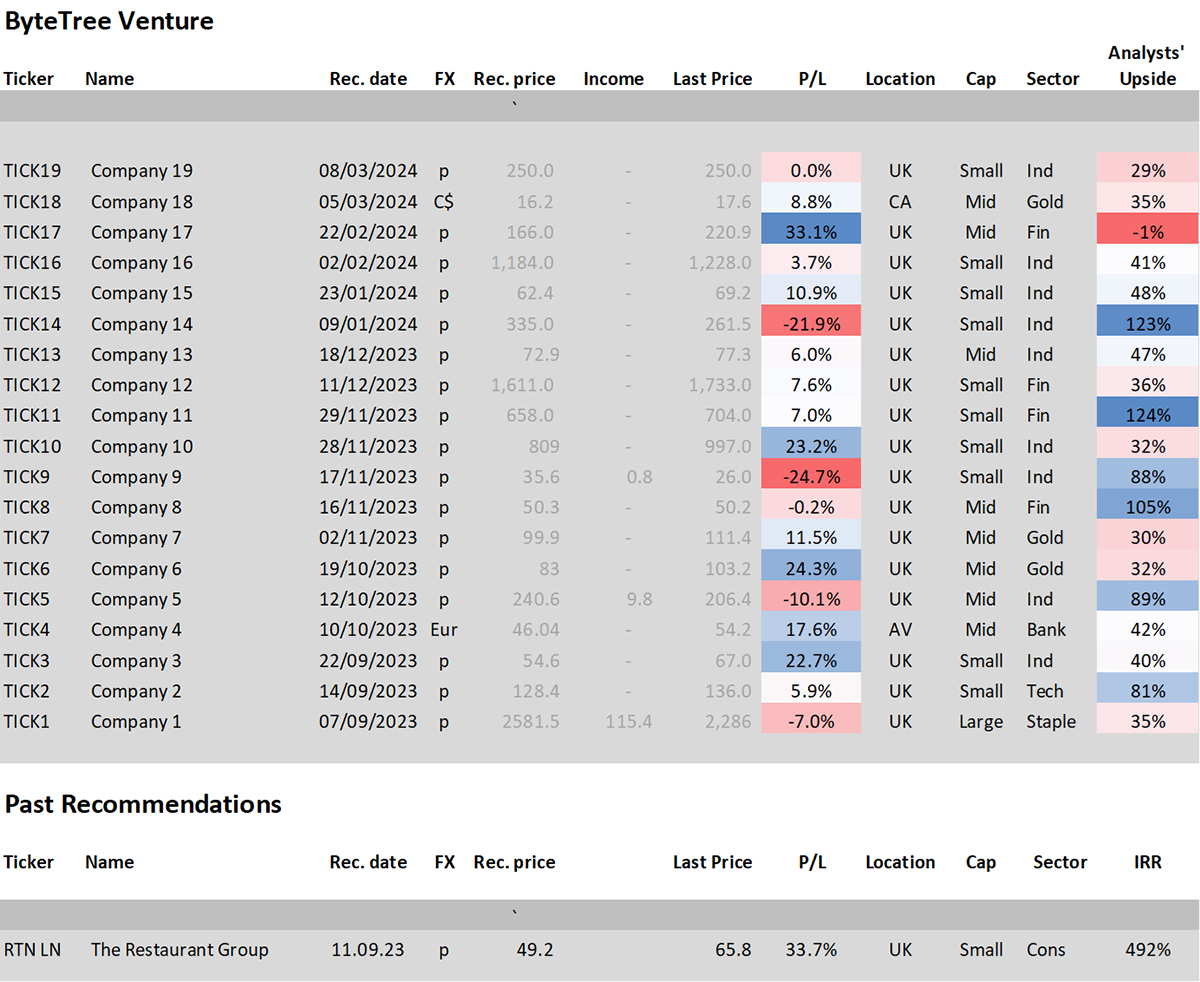

ByteTree Venture

Disclaimer: Your capital is at risk. This is not investment advice.

Last September, I introduced Venture to ByteTree Research. The aim of Venture was to highlight the many opportunities in UK small and mid-cap stocks that were not included in our liquid portfolios. In addition, I would also look at higher risk/reward situations in the UK and globally.

Our second stock was the Restaurant Group, owner of my favourite airport pitstop, Wagamama. It was soon taken over for the simple reason that it was undervalued. We are seeing many bids in the UK market. This week, we’ve had Virgin Money (VMUK), formerly Northern Rock, and the wealth manager/IFA, Mattioli Woods (MTW). We have also seen approaches for Direct Line (DLG), Currys (CURY), and Wincanton (WIN).

The UK stockmarket is broken. It’s not the companies - they are world-class - it’s the lack of capital supporting it. According to a report by Ondra Partners, over 50% of the UK stockmarket was owned by domestic pension funds and insurance companies in 1990. Today, that is below 5%. The report also cites issues relating to pension contributions, a decline of new capital, excessive dividends to compensate for poor share price returns, and systemic capital leakage. These factors add up to £850 billion of lost capital in UK equities. That is why they are so cheap.

You can trace it all back to the Maxwell pension scandal in 1991, where subsequent legislation made pension funds more cautious and turned them toward bonds. Despite that, the UK stockmarket carried on thriving for many more years as the home of natural resources and the friendly hub for the emerging markets, finance, and innovative exotics such as aircraft leasing and renewable energy. Then came the 2008 credit crisis. The failures of RBS and HBOS were a national embarrassment, and the FTSE has been lagging the rest of the world ever since.

After the crisis, regulation snowballed. Company annual reports now run into the hundreds of pages, making a listing for a young, dynamic company implausible. The time and cost of being a public company have swung the balance in favour of private equity, especially with valuations so low.

There was MIFID, followed by MIFID 2, a new regulatory framework, which placed heavy burdens on both the companies and the traders. Research and trading were unbundled, which meant investors now had to pay for research. The biggest casualties were private investors who couldn’t afford £10,000 to £20,000 to subscribe to a broker’s research. Prior to MIFID, it had been accessible, whereas today, it isn’t. If you believe that a nation’s stockmarket is an important part of its economy, fabric, and inclusivity, MIFID took us backwards.

The regulatory framework, while well-intentioned, ended up widening the gap between the UK stockmarket and the UK people. Today, there is less research coverage of smaller companies, and many wealth managers will no longer engage because there isn’t enough stock, which could be realistically traded, to divide between their clients. The outcomes of the new regulation, intended or otherwise, have led to a boom in index funds, which has sent trillions of dollars to the USA.

The S&P 500 has become two-thirds of global equities by value. The seven biggest tech stocks ($12 trillion) are valued more highly than the entire UK stockmarket ($3 trillion) four times over. Yet, this is not entirely driven by corporate supremacy. Although many American companies have been hugely successful, it is a vast misallocation of capital. Put simply, the US equity market is expensive, while much of the rest of the world offers value, especially Asia and the emerging markets. To take it to the next level, the UK is cheap, and UK mid and small-caps are dirt cheap. Those with a memory of the dotcom collapse will recall how well-valued companies did when the bubble burst.

This is where Venture steps in. That the UK stockmarket is undervalued has been well-flagged for a few years now. Some would say Brexit, but there’s little evidence of that because the underperformance began in 2007, as the banks peaked before they crashed.

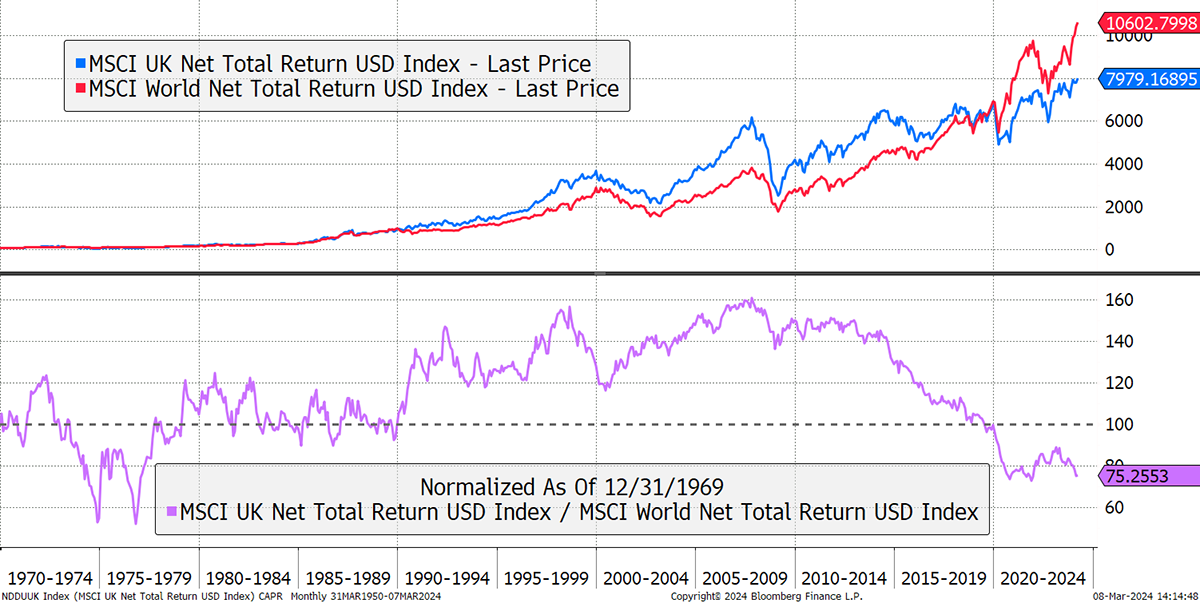

The chart shows UK equities total return (including dividends) and the MSCI World Index, both in dollars, for comparison. $100 invested in the UK since 1969 is worth $7,979, which compares to $10,602 for the world.

UK Lags the World

It is not a big gap, but consider that in 1992, 1998 or 2007, the UK was well ahead of the world, as shown in purple. The fall from grace since 2007 is startling. The first part can be blamed on the credit crisis, but that happened elsewhere too, especially in the USA. The purple line shows the UK relative to the world. The systemic decline really began in 2014, some two years before the Brexit vote.

Some of the reasons are related to the capital flight, as previously mentioned. Other reasons could be the decline of commodity prices, given the FTSE’s high weights in the oil and mining sectors. Another is the lack of a meaningful technology sector during a technological age. Then there was the pandemic, where real-world business suffered in comparison to tech, which thrived. Whatever the reasons, since 2014, the world has done twice as well as the UK.

But unlike Chinese equities, which are going down, UK equities are going up just too slowly. Much of that rise (or return) has been through dividends as opposed to capital appreciation, which reiterates how UK equities have become too cheap.

It wasn’t just falling valuations but falling liquidity. I have been covering opportunities in the FTSE 350 for my Whisky and Soda Portfolios (The Multi-Asset Investor) since 2016. The list of companies trading more than £2 million per day kept shrinking, thus reducing my choice of attractive investments for a growing audience.

Last year, I informed readers that enough was enough, and while I liked the low UK equity valuations, I needed to look further afield to find sufficient liquidity. I widened my scope to include Europe and the US and found some beauties, mainly in Europe. That move to global makes sense because I have more liquid stock to choose from. But it occurred to me that I was leaving all this UK value behind…

I launched Venture because there were many situations where the price was clearly too low. There might not have been booming growth stories, but good businesses with strong balance sheets and cashflow. These companies were under-researched and under-owned. This was the opportunity.

That was last September. On Monday, I added a Canadian gold miner, and this morning, a UK company, which is so cheap that it could practically buy all of its shares back. Not only that, but it is a healthy, growing business. That has been my 20th recommendation, which is a run-rate of around three each month. Sometimes, the number of Venture recommendations will rise, at other times, it will fall.

Looking around the world, most of the value is still found in the UK, but I also found an Austrian bank in October, which jumped off the page. These good and steady businesses at knock down prices are my speciality. Venture has no limits, and the search will be global.

Some believe the Whisky portfolio in The Multi-Asset Investor will be lesser because the best ideas will go to Venture. That is not true. The liquid stocks, which meet a more stringent risk requirement, will live in Whisky, now and always.

Venture is for everything else. It’s not for everyone, but it is fundamentally driven investment research, which would suit a more adventurous investor. We do the hard work, so you don’t have to.

ByteTree Research offers The Adaptive Allocation Report (ETFs, medium risk), The Multi-Asset Investor (stocks, ETFs, and investment trusts, medium and medium-high risk), and Crypto (ultra-high risk). It also offers Venture (equities, high risk) as part of our new Pro bundle, which includes all of our research. Venture is not sold in isolation, and we have no plans to change that. ByteTree also has no lock in policy. So please subscribe on a monthly, no obligation basis, and join our Pro bundle.

A Week at ByteTree

In The Multi-Asset Investor, I wrote about the gold miners and silver. It is fascinating how strong gold is, while no one is paying attention. I’m sure this happened in 2000…

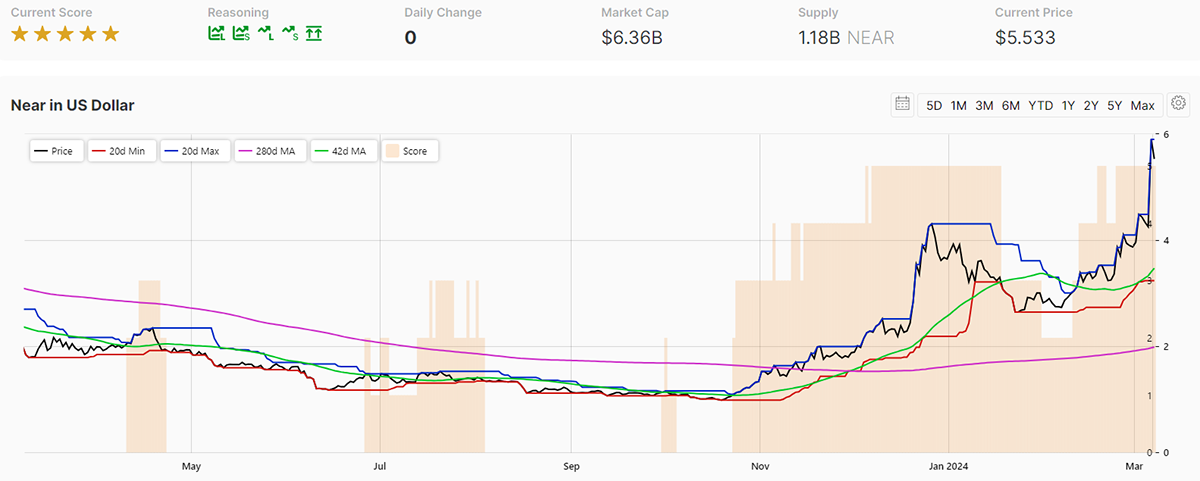

Crypto research has been going well. ByteFolio is a fully invested crypto portfolio, which struggled in 2022 during the crypto winter. Recently it has been flying. This week, the analysts pitched a brave idea in their highest conviction trade. I wasn’t sure, but they ground me down and I gave the green light. Their top pick? The NEAR protocol, a competitor to Ethereum. It surged 40% on Thursday. Well done team.

Have a great weekend,

Charlie Morris

Founder, ByteTree