ByteFolio 99;

After making a high of $73.6k, Bitcoin retraced to its weekly low of around $64.7k before quickly exceeding $68k again. This is a market-wide retracement, where the total crypto market cap declined from $2.7 trillion on 14 March to $2.5 trillion today.

Unsurprisingly, the BTC dominance stayed consistently around 52% with minor fluctuations. The Bitcoin ETF net flows further solidify the demand for BTC, with the funds adding +34,677 BTC to their collective holdings in the past 7 days alone. This brings the total for March to an impressive +77,027 BTC in net flows (valued at $5.2bn at the current price). Considering we still have 12 more days left until the end of March, it’s not improbable that the ETF net flows will surpass 100,000 BTC again this month, especially with only 32 days to the halving.

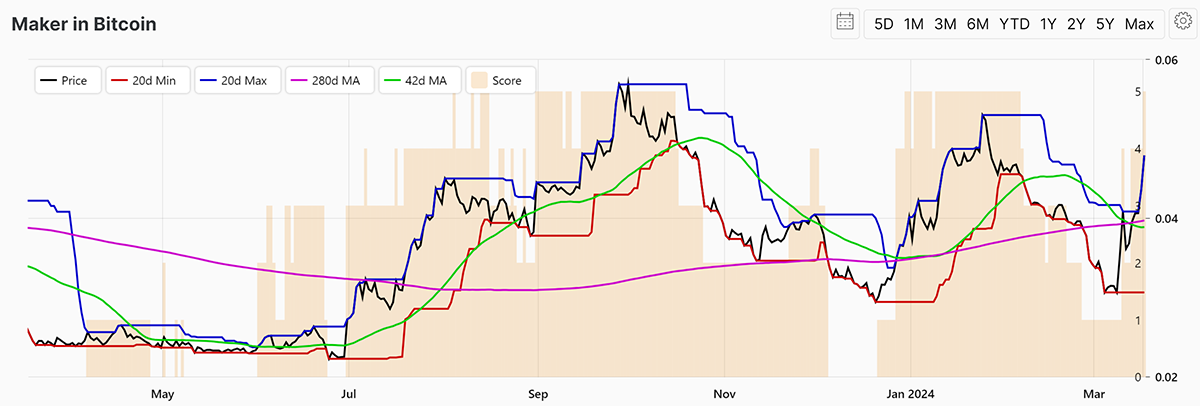

In the wider crypto ecosystem, MakerDAO was one of the top performers over the past week, outperforming both BTC and ETH despite uncertainty within its ecosystem.

MKR in Bitcoin

For those who don’t know, MakerDAO allows its users to mint (borrow) DAI (a decentralised stablecoin) against ETH and/or BTC (and their derivatives) with a minimum collateralisation ratio of 150%. Now, with the price of ETH and BTC having appreciated significantly in the last couple of months, the borrowing power of users has also increased significantly.

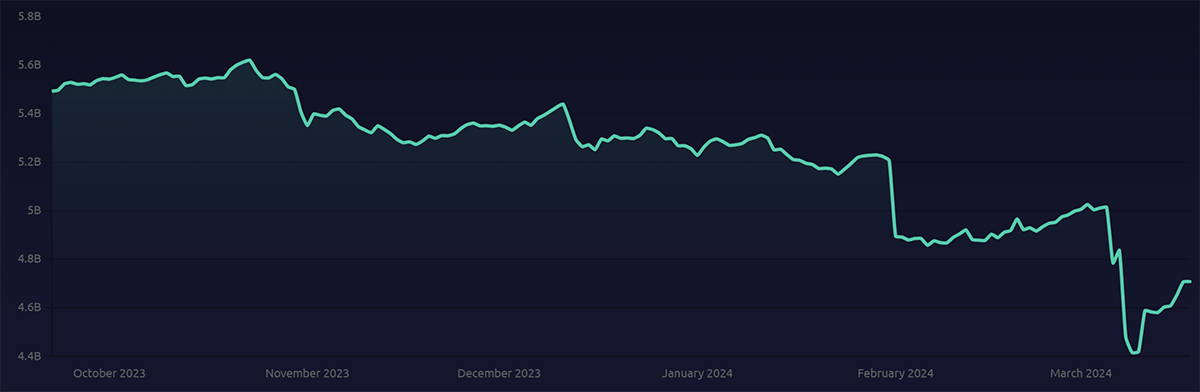

However, even with increased borrowing power, the demand for DAI has continued to decline for months. In fact, DAI’s market cap experienced a sudden drop from over $5bn on 5 March to $4.4bn on 9 March.

DAI Supply

Holding a stablecoin in a crypto bull market has a significant opportunity cost. DAI is stable and doesn’t appreciate, which is the whole point of a stablecoin. Although DAI offered a 5% yield, it didn’t seem to be appealing enough for investors who could make 5% in a single day investing in any blue-chip token, which isn’t uncommon in a crypto bull market.

Then why is MKR seeing a strong bullish trend against BTC on ByteTrend? Well, there is a good reason. As evidenced by the uptick in the DAI supply in the above chart, the demand for DAI is picking up. The catalyst for this surge is the sudden jump in DAI yield from 5% to 15% within a single day — yes, you read that correctly. This change was achieved with the approval of a governance proposal, which also sought to significantly increase the stability fees (interest rate) for debt on the platform. On average, the stability fee for any collateral asset is around 16%.

It's evident that minting DAI currently comes with significant costs, making it highly probable that the DAI supply will struggle to expand. Nevertheless, existing DAI holders have strong incentives to refrain from selling it (or closing their debt positions).

Although the MakerDAO treasury has appreciated from $200m to $244m since this proposal came into effect, this high cost of borrowing will make it extremely difficult for MakerDAO to attract new users. Even though a large portion of the DAI yield is fuelled by RWA investments, such a high yield will never be sustainable, especially if the DAI in the DAI Savings Rate (DSR) increases.

For now, with the increase in DAI supply, the governance proposal is working, even though the overall performance impression is suboptimal. We’ll continue to keep a close eye on MKR and its ecosystem. If you’re interested in learning more about MakerDAO and DAI, I wrote a Token Takeaway back in May 2022, which you can access here.