Meet the Managers

Disclaimer: Your capital is at risk. This is not investment advice.

It isn’t just ByteTree that has embraced investing in Bitcoin and Gold with our BOLD Index. On Wednesday, I had the pleasure of discussing this subject with two specialist fund managers in this field. They are both disciples of the Austrian School of Economics and see Bitcoin and Gold as assets that offer protection against monetary inflation.

Larry Lepard, from Equity Management Associates (EMA) in Boston (US), has been investing in gold and silver miners since 2008. In 2013, he added Bitcoin into the mix, along with Bitcoin-related companies.

Mark Valek is a fund manager and partner of Incrementum AG, based in Liechtenstein. He has managed the Incrementum Digital & Physical Gold Fund since 2020. He’s an Austrian, Austrian, you might say.

We discussed whether Bitcoin and Gold were in competition, their volatility, and how to allocate between them. We also asked why governments and regulators see Bitcoin in such a poor light and whether central banks would ever own it. The audience had lots of great questions before I asked the hardest of them all.

If you had to put all of your assets into either gold or bitcoin for 10 years, which would you choose?

What do you think they said?

A Week at ByteTree

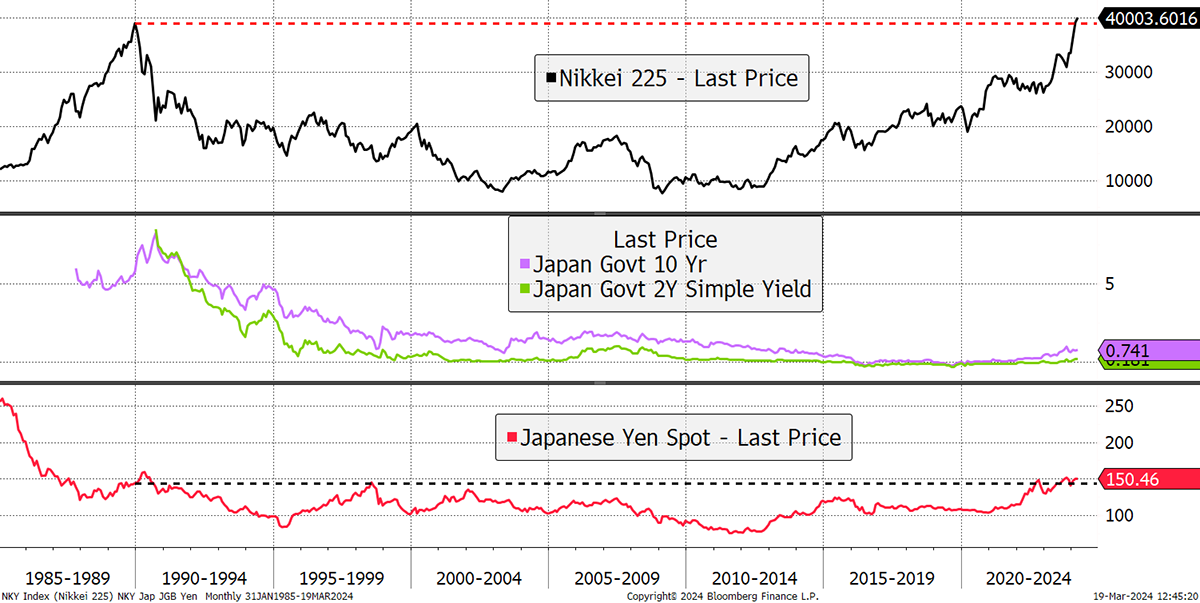

In The Multi-Asset Investor, I covered the Japanese change in monetary policy, where they have formally ended their zero-interest rate policy. It is perhaps more symbolic at this point but confirms that the pre-pandemic era of cheap money is over.

Japanese Financial Markets Since 1985

I can’t be sure what the outcome will be except it will drive change in financial markets. Higher yields are coming, but probably slowly. The bond market is still highly priced, and so best avoided. The yen is still underpriced and is a safe haven should things turn sour. The stockmarket’s all-time high is a direct result of the cheap yen, along with the tourist boom.

In Crypto, Ali discussed MakerDAO and its native token MKR, which was one of the top performers over the past week, outperforming both Bitcoin and Ethereum. This stems from a recent uptick in demand for DAI, Maker’s native stablecoin. By design, stablecoins are, well, stable, and holding a stablecoin in a crypto bull market comes with a significant opportunity cost. So why the uptick?

I will be covering Bitcoin next week in ATOMIC in a pre-halving special. The expected time of the 840,000th block is on 20th April at 20:21 GMT. I’ll explain what it all means.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()