One Million Bitcoins in Sight

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

In February BOLD rose by 11.4%, Bitcoin rose by 44.7%, Gold rose by 0.2%, while equities rose by 4.1% in USD terms. Given the strength in Bitcoin, the weight rose over the month from January’s initial target weight of 24.7% to 32.5% by the month’s end. To return to the target weight, Bitcoin has been reduced back to the new target weight of 24.4%, with 7.8% of the exposure being added to Gold.

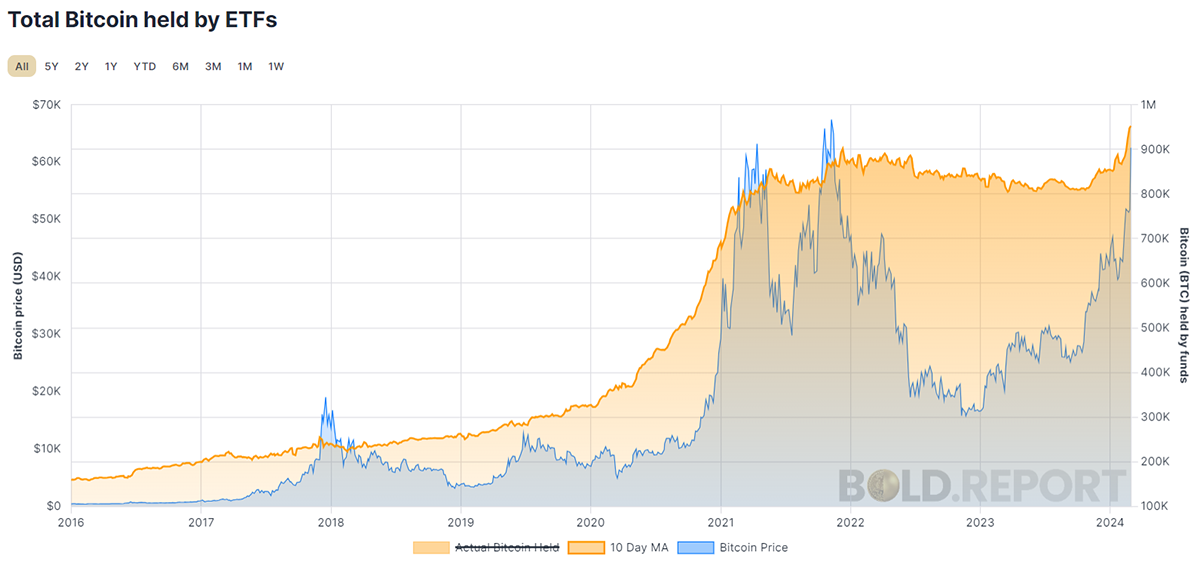

January saw the launch of the nine US spot Bitcoin ETFs with great fanfare. The result is that the world’s Bitcoin ETFs will soon account for one million BTC, approximately 5% of the total.

Bitcoin ETF Holdings Approaching 1 Million

The inflows into the new nine US Bitcoin ETFs have been extraordinary. Last month, I described it as a game of musical chairs. In the last quarter of 2023, in anticipation of the US ETF launches, 48,915 BTC were purchased by the non-US ETFs.

Then, in January, we saw a net demand of just 3,279 BTC. Underlying that was a huge shift in holdings between the funds. The new ETFs acquired 152,000 BTC, while 135,000 BTC were sold from Grayscale’s GBTC, and a further 14,000 BTC were sold from ETFs listed in Canada and Europe. What soon became clear was that the new home for Bitcoin ETFs would be New York City.

February was remarkable. The ETFs collectively purchased 117,462 BTC, costing over $6 billion. The new funds from iShares, Fidelity, and our partner, ARK 21Shares, now hold over $16 billion of Bitcoin. It has surpassed our highest expectations.

Bitcoin has become extended from the trend, but it is important to consider that the next halving will take place on 20 or 21 April (est.). I can’t be sure of the timing because it happens on the 840,000th block, which is somewhat fluid. Blocks are mined, on average, every ten minutes, but there are variations. The halving estimates will improve the closer we get to that last block.

On the other side of BOLD is Gold. Each month, we continue to see redemptions from the Gold ETFs to the tune of 1.3 million ounces per month, or around $2.6 billion. If that happened to Bitcoin, the price would crash, and massively so. It reminds us that one day in the distant future, the Bitcoin ETF inflows will turn into outflows. Not only can Gold easily cope with outflows from the ETFs, but it will also see investors flocking back sooner or later.

Gold can shake off heavy selling pressure because there is a large and consistent demand from the world’s central banks. Investors sell, and the central banks buy. Unlike Bitcoin, Gold has a backstop. The 5,000 years of history is merely an added bonus. Make no mistake: when the investors and the central banks are buying Gold simultaneously, there is only one way the price can go, and that’s up.

Gold is a long way from dead, and Bitcoiners who think it is are confused. Gold can plod along for decades with never-ending demand from jewellery, bullion, and the central banks. When the investors return, it’s heyday.

Please view ByteTree’s charts and dataset on Bitcoin and Gold ETFs and feel free to share. It is the best in the world!

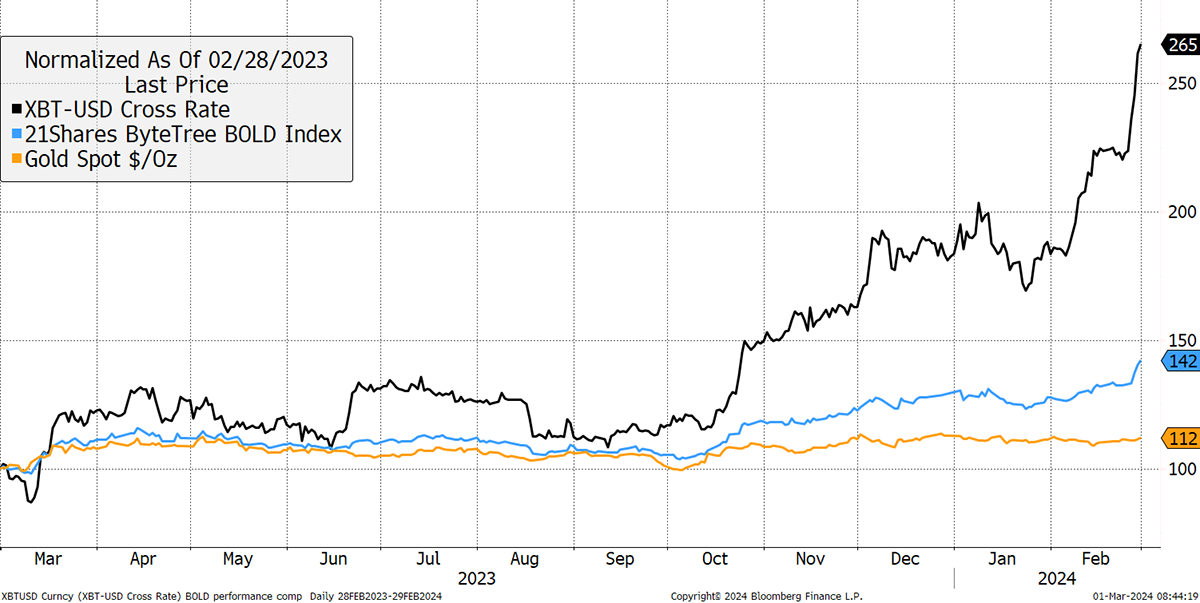

BOLD has returned 42% over the past year, while Bitcoin has surged 265%, with Gold a more gentle 12%.

Bitcoin, Gold, and BOLD in the Past Year

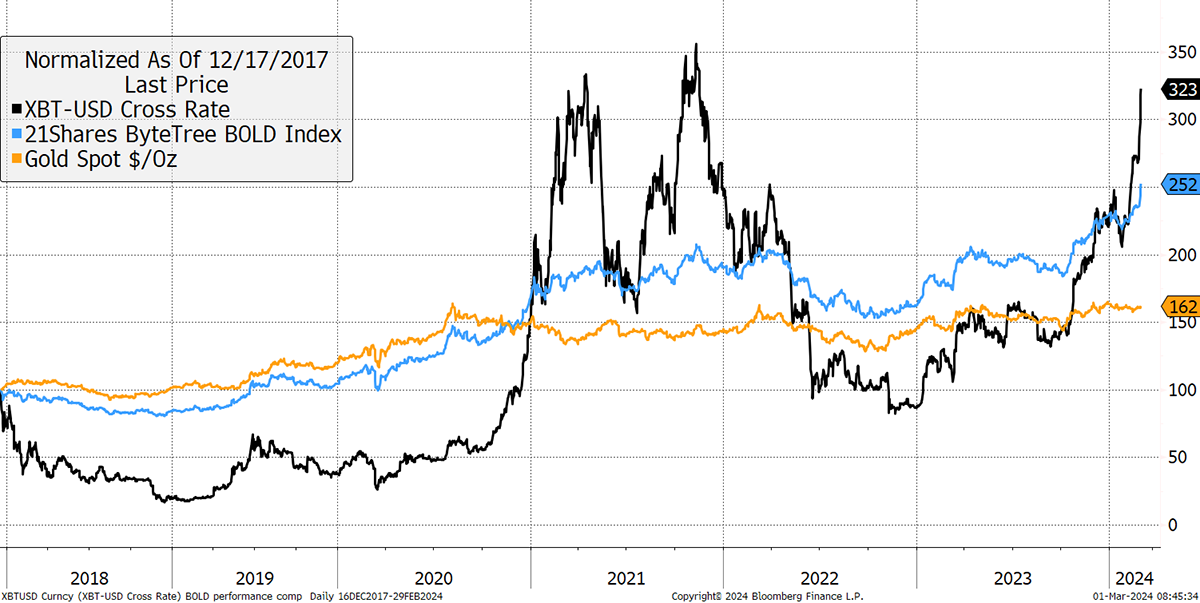

I want to show the performance since Bitcoin’s 2017 high ($19,041) in December 2017. BOLD has returned 152%, Gold 62%, and Bitcoin 232%. What is remarkable is how BOLD has been in the lead for 4 ½ years of the 6 ¼ year stretch. BOLD had a much calmer journey, smoothed by Gold’s counter-cyclical nature. What’s more, the performance has only favoured Bitcoin in recent weeks.

Six Years of Bitcoin, Gold, and BOLD (Since 17 December 2017)

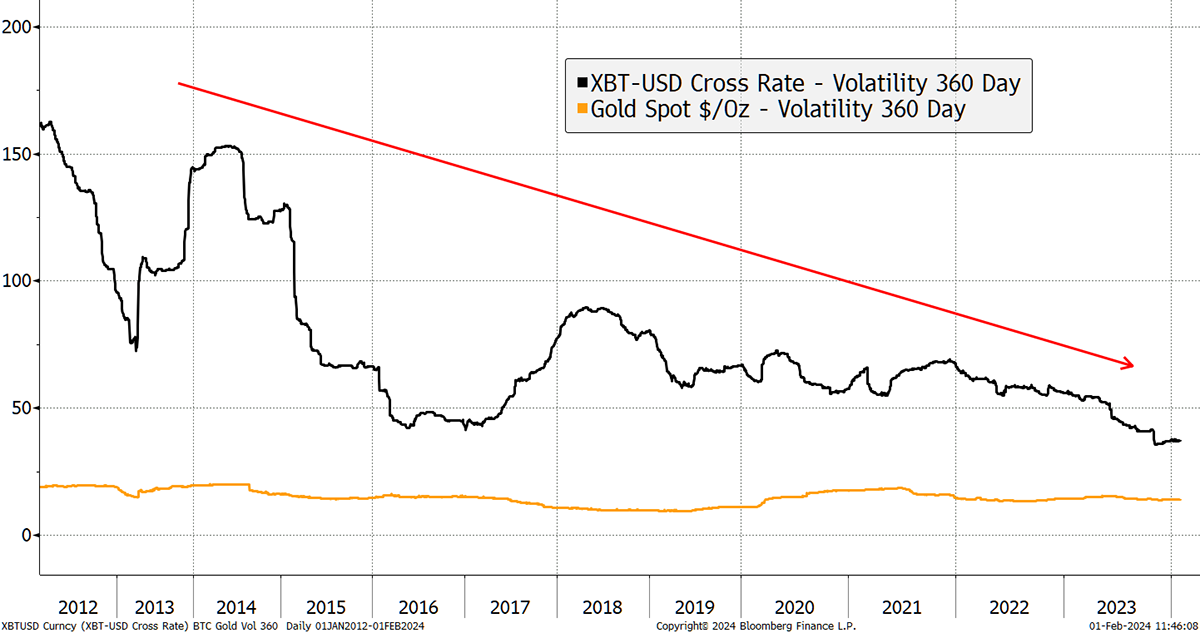

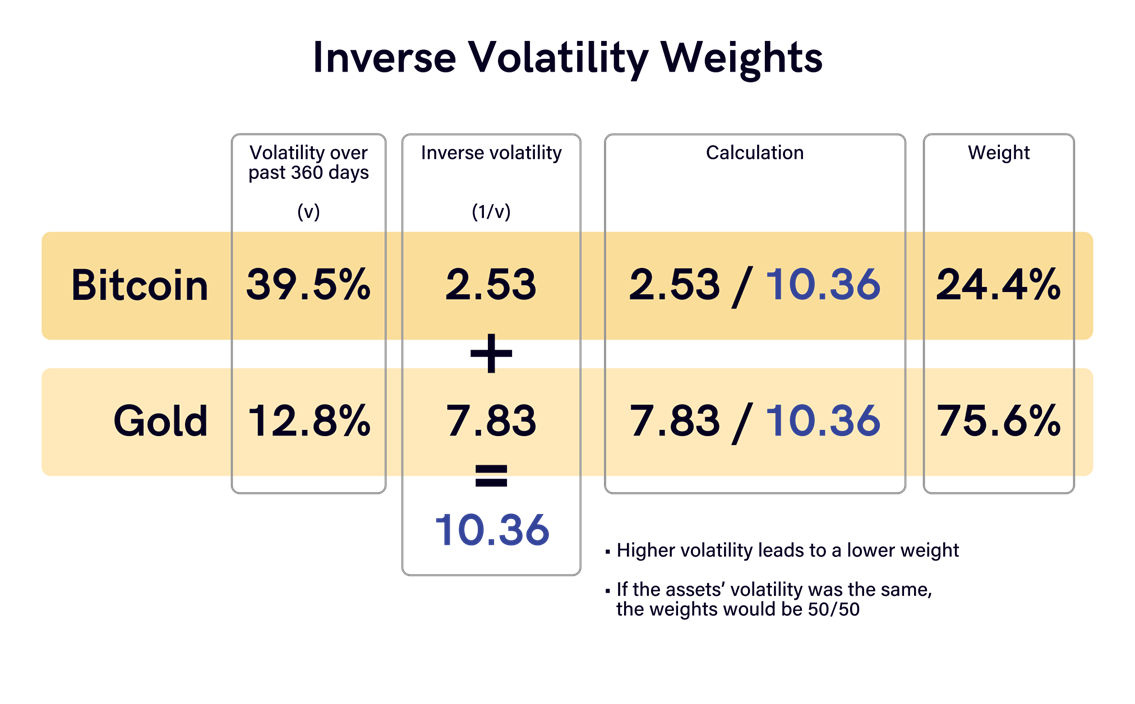

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the month rebalancing. Bitcoin’s volatility, measured over a year, has fallen significantly since the early days and is now no more volatile than a typical blue-chip stock.

Bitcoin and Gold Past 360-day Volatility

The volatility for Bitcoin and Gold over the past 360 days was observed to be 39.5% for Bitcoin and 12.8% for Gold. This has resulted in new target weights of 24.4% Bitcoin and 75.6% Gold using this formula. Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset. Hence, it is “risk-weighted”.

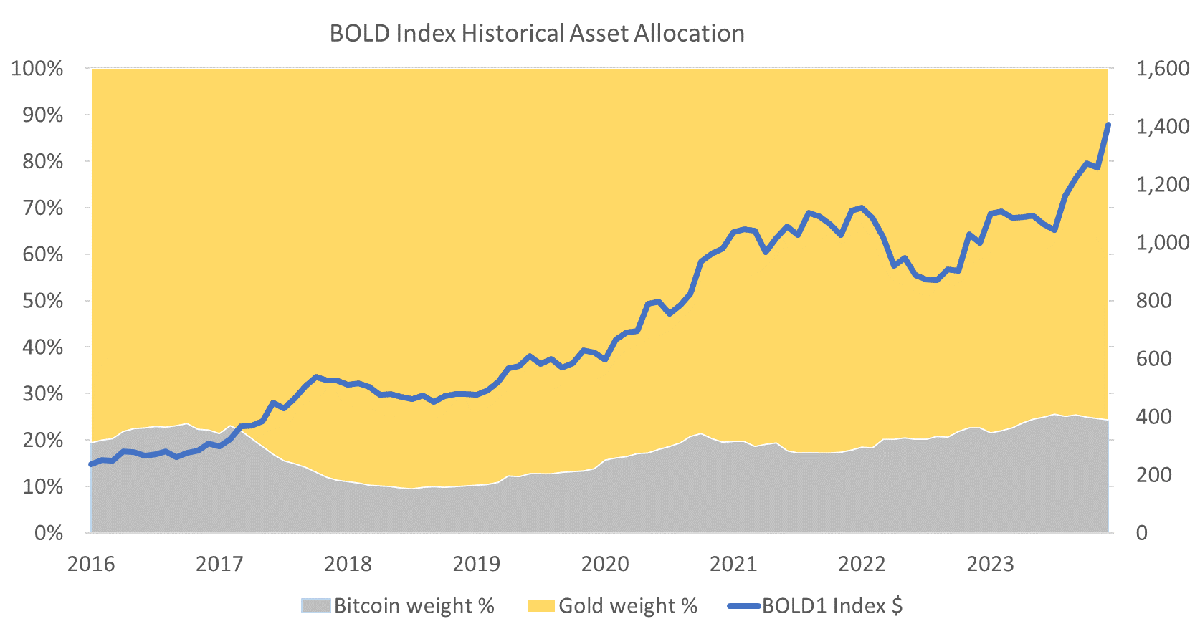

As the volatility has fallen, the Bitcoin weight has been steadily rising since 2018.

Notice how the allocation to Bitcoin was low in late 2017 and 2018, and hence, the drawdown in the 2018 bear market was subdued. When Bitcoin’s volatility picks up, so does its risk. BOLD helps investors to manage this.

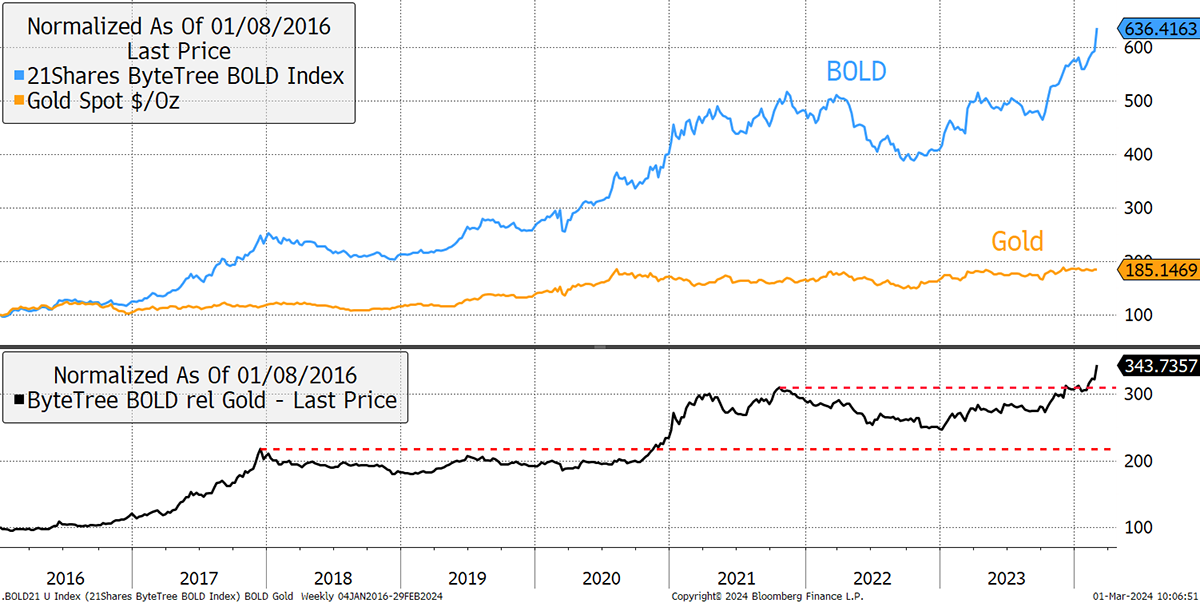

They say a little Bitcoin goes a long way, and it has proven true. I show BOLD and Gold with the lower black line, showing BOLD measured in Gold. The 3.5x outperformance effectively means a BOLD investor has increased their Gold holdings by 3.5x. That is not just because of the power of Bitcoin rallies, it’s also rebalancing transactions.

BOLD versus Gold

Rebalancing transactions occur at the end of each month, and this accumulates the weaker asset. In a Bitcoin bull market, that’s Gold, and in a Bitcoin bear market, that’s Bitcoin. This process ensures BOLD has less risk as it enters a bear market and more risk when it enters a bull market. Without rebalancing, that would not hold true.

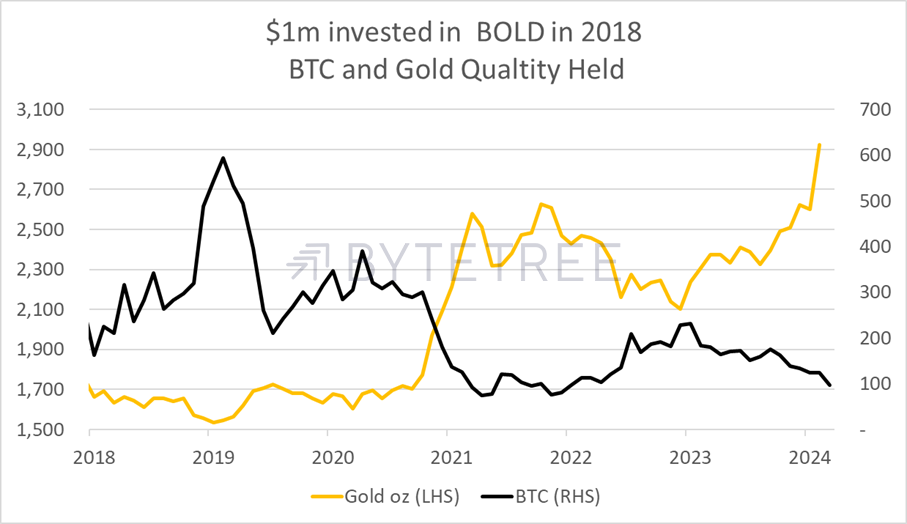

In late 2022, Bitcoin had fallen by 76% in the bear market. That meant an investor who backed BOLD with $1 million in January 2018 increased their 78 BTC to 231 BTC in 2022 at the expense of Gold. However, over the past 14 months, they have done the opposite, where Bitcoin has been reduced while Gold has been boosted from 2,104 ounces to 2,922 ounces.

By repeating this process month after month, value is added to the portfolio by consistently buying low and selling high. It works because Bitcoin and Gold have a low correlation, which means when Bitcoin is surging or crashing, Gold probably remains stable. That is not to say Gold cannot fall in price; it can, but that is most likely to take place when Bitcoin is strong as it is naturally a risk-ON asset while Gold is a risk-OFF asset.

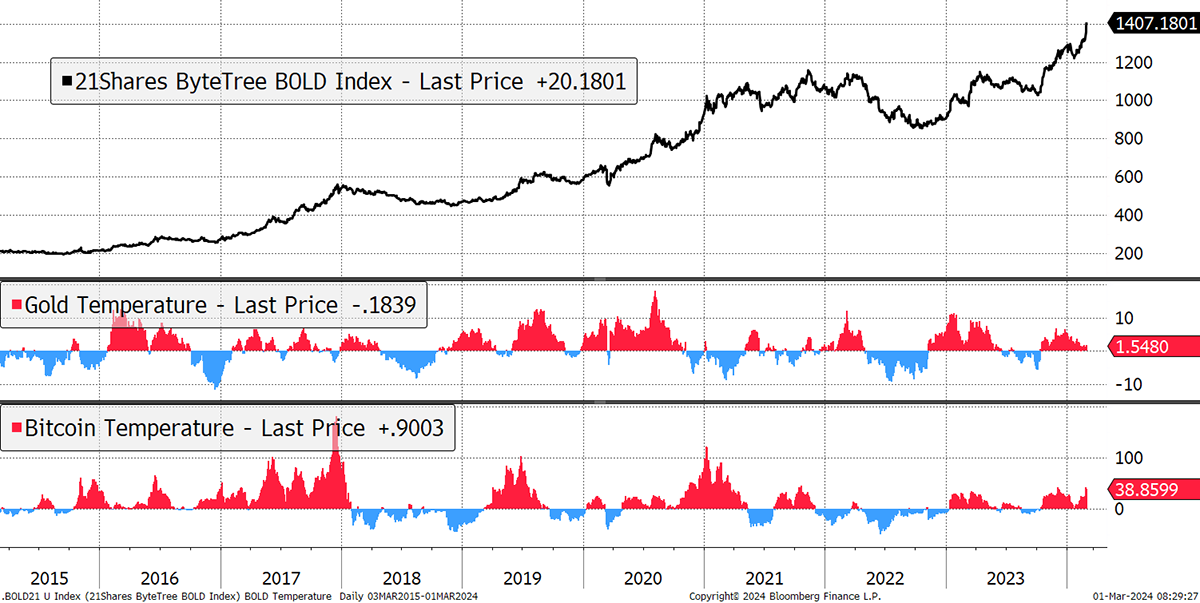

The chart shows BOLD with Bitcoin and Gold “hot” or “cold” below. I have used the deviation from 90-day moving averages. Occasionally, these hot and cold patches are aligned, and that generally happens when the dollar has strong moves, either up or down.

BOLD, Bitcoin and Gold Temperature

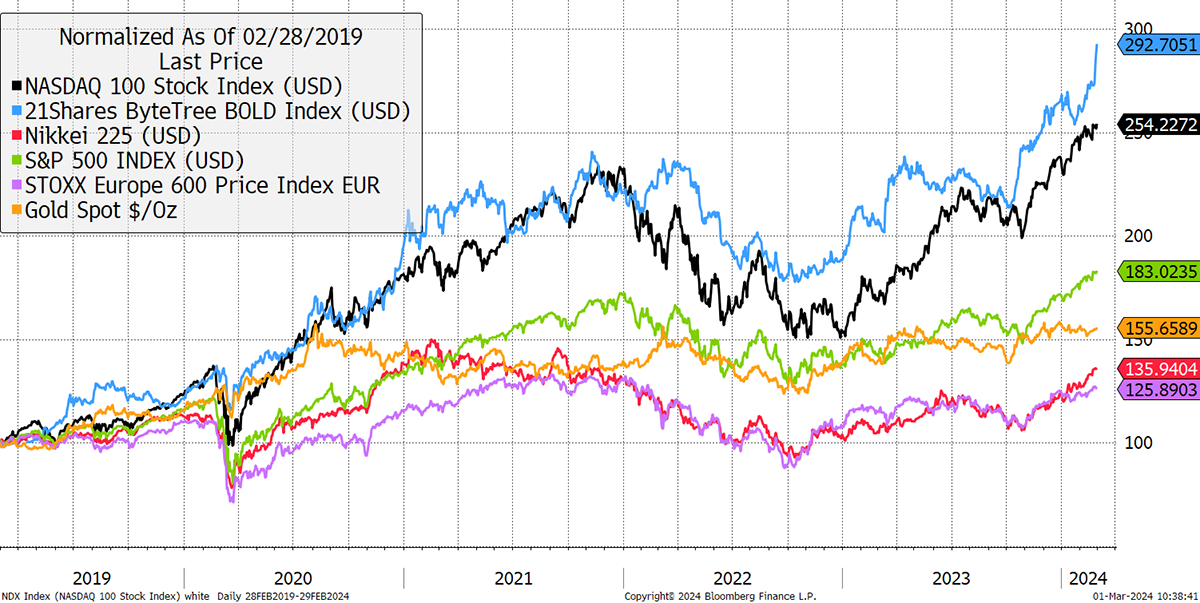

Correlated or not, holding Bitcoin and Gold side by side is less risky than holding Bitcoin in isolation, and perhaps that’s true for Gold too. What’s more, BOLD complements other assets in a portfolio. I show BOLD alongside the major stockmarkets. It is remarkably similar to the NASDAQ, just with less risk and higher returns. Note that the stockmarkets are priced in US dollars, which cools Japan. Europe includes the UK.

BOLD Compared to Major Equity Markets

Summary

It has been a wild ride for Bitcoin, but we mustn’t forget that Gold is on the verge of an all-time high. Sooner or later, the excitement around Bitcoin will cool, and the money will shift back into Gold.

Contact

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Vinter Index Provider

21Shares BOLD ETP

Bitcoin and Gold Research