Creative Destruction

Disclaimer: Your capital is at risk. This is not investment advice.

“The concept is usually identified with the Austrian economist Joseph Schumpeter, who derived it from the work of Karl Marx and popularized it as a theory of economic innovation and the business cycle. It is also sometimes known as Schumpeter's gale. In Marxian economic theory, the concept refers more broadly to the linked processes of the accumulation and annihilation of wealth under capitalism.” - Wikipedia

In simple terms, creative destruction is clearing away the old and making way for the new. At ByteTree, we have just shut down our Terminal, which is where our journey began. Back in November 2013, we began our work to analyse the Bitcoin blockchain and see what all the fuss was about. It told me everything I needed to know, that the Bitcoin Network was alive and well. Most importantly, it proved beyond doubt that it was the real deal.

While I believe we had the most accurate Bitcoin data on the internet, it was a commercial failure. We failed to build an audience, and I realised the hard way that I wasn’t cut out to run a technology business. It’s much harder than it looks.

It was time to focus on our strengths, and 25 years in financial markets sprang to mind. ByteTree would bring it all together. We would provide high-quality research to our clients covering balanced portfolios, global equity, ETFs, small/mid-caps and crypto. There was also room for a Bitcoin and Gold ETF, which is simply brilliant, and our trend-following tools, which are still under development.

To my mind, it is all about opening up financial markets and delivering high-quality and well-reasoned advice to our clients. We carry that out to the best of our ability, and the feedback is heart-warming.

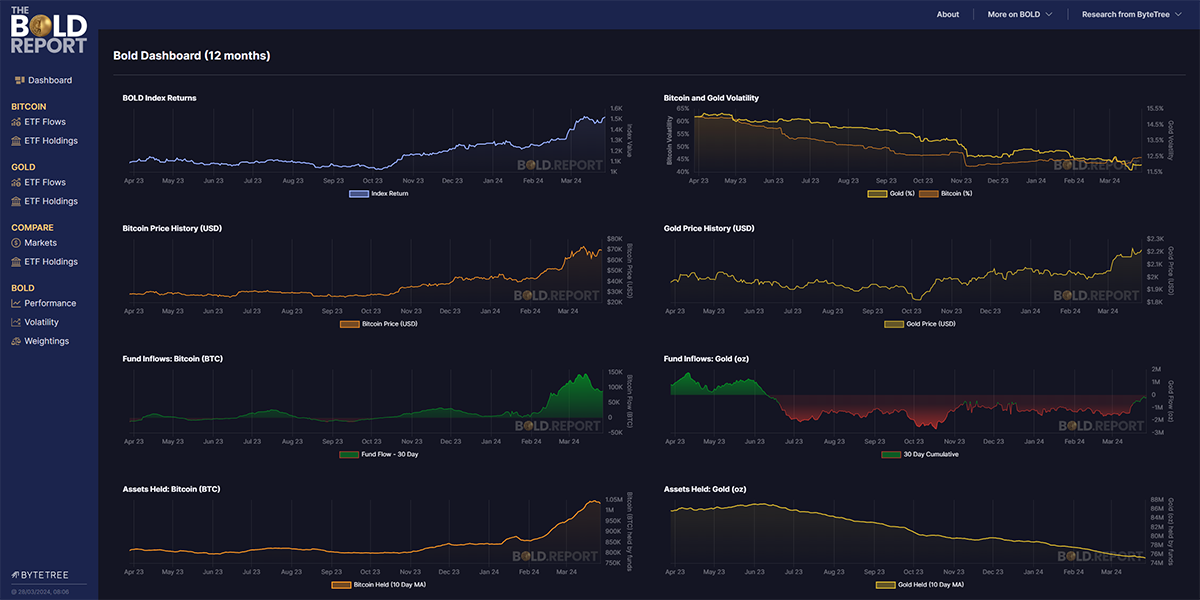

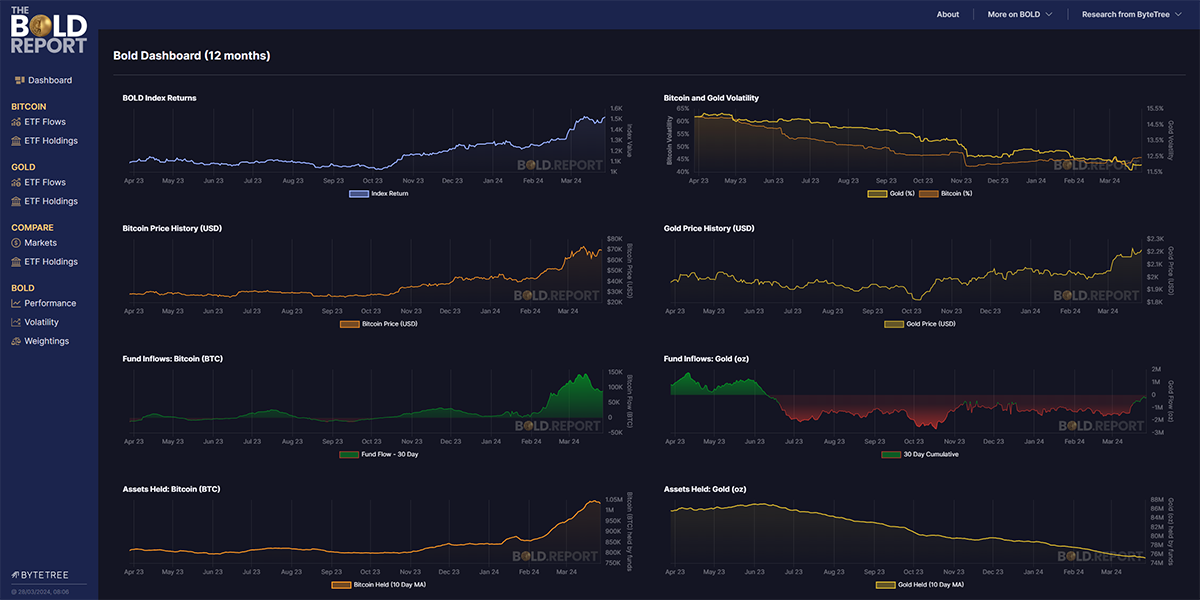

BOLD.report

Don’t fret about the loss of ByteTree Terminal as it has been re-envisioned as the BOLD.report. It’s an admission that the mechanics of the Bitcoin Network have become less relevant. Bitcoin works, it’s robust, and it’s growing. We never needed to question the resilience of gold, merely wait for its time to return. We are living in a period of monetary excess. Governments have borrowed too much money, and deficits are out of control. The price of gold says it all.

A Gold Bull Market

The BOLD Report covers Bitcoin and Gold and, most importantly, the financial flows. At ByteTree, we believe investors should embrace both assets and the site publishes the BOLD weights to help them manage risk. It will also be the home to all things related to our BOLD Index.

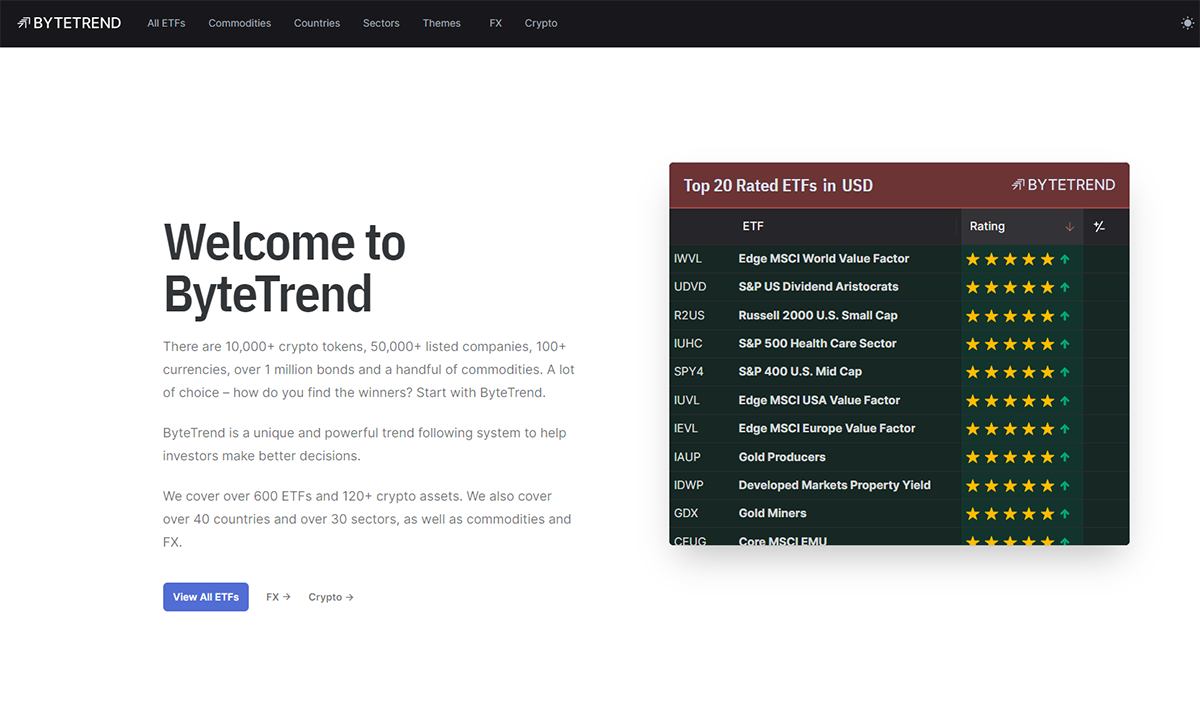

The other part of the terminal is ByteTrend.io. We have more work to do there, and it’s going to be great.

It’s always sad to switch off something we have been building for years, but if you find yourself building black and white TVs, it’s best to switch to colour.

A Week at ByteTree

Another busy week for ByteTree, and it was dominated by crypto. In ATOMIC, I covered the next Bitcoin halving, which is expected to take place on Saturday, 20 April.

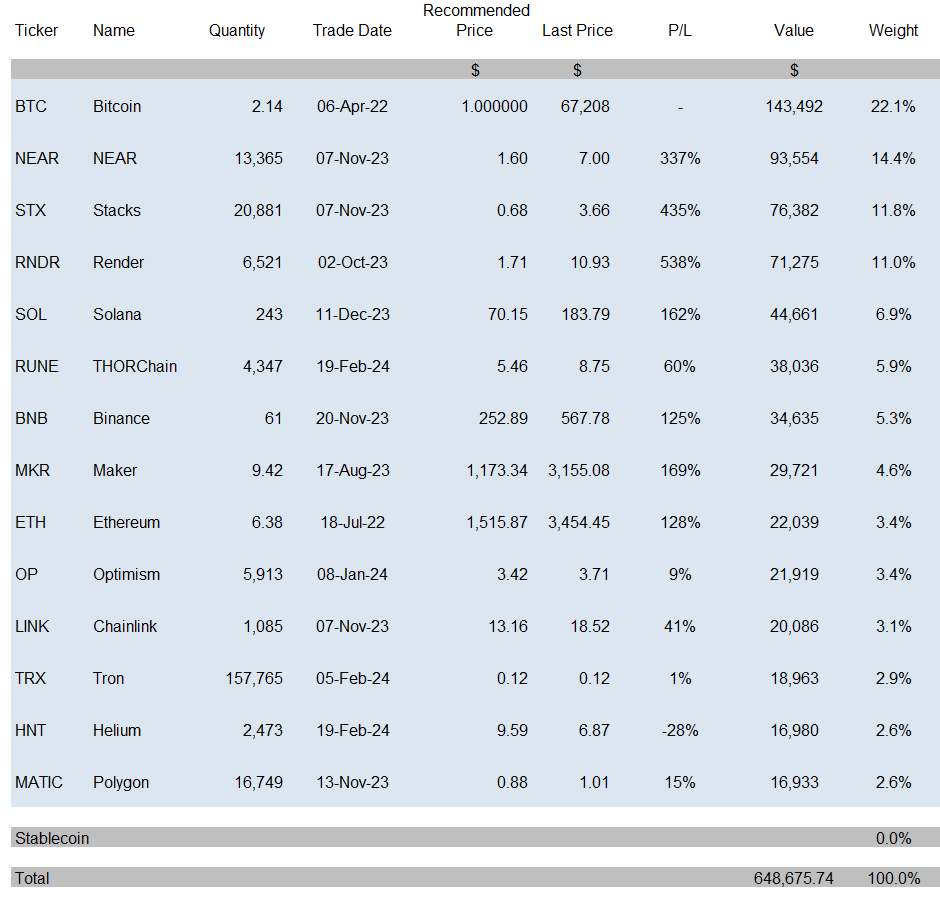

More importantly, at least for Bytetree, we celebrated our 100th issue of ByteFolio. It’s been one hell of a journey, and for some reason, I decided to give the world a rare glimpse of the portfolio.

ByteFolio as of 25 March 2024

ByteFolio is based on a trend-following system that we built (ByteTrend). It identifies market leadership, and we then seed the ideas to our analysts for review. If the trend is strong, and we like the project, the token is added to the portfolio. The analysts’ work is also published in Token Takeaway. Ali covered Helium (HNT), which is a global wireless infrastructure ecosystem powered by blockchain technology. Shock horror; it does something useful in the real world!

Analysing a crypto project is complex stuff that requires new terminology and new ways to think about things. But it is a youthful market, and so full of inefficiencies. That is why our research counts. If crypto interests you, then please have a look for yourself.

Being the end of the month, it was time for another dose of The Adaptive Asset Allocation Report. Robin wrote,

“We are seeing a melt-up situation. Most equity markets are rising together. No one wants to be short.”

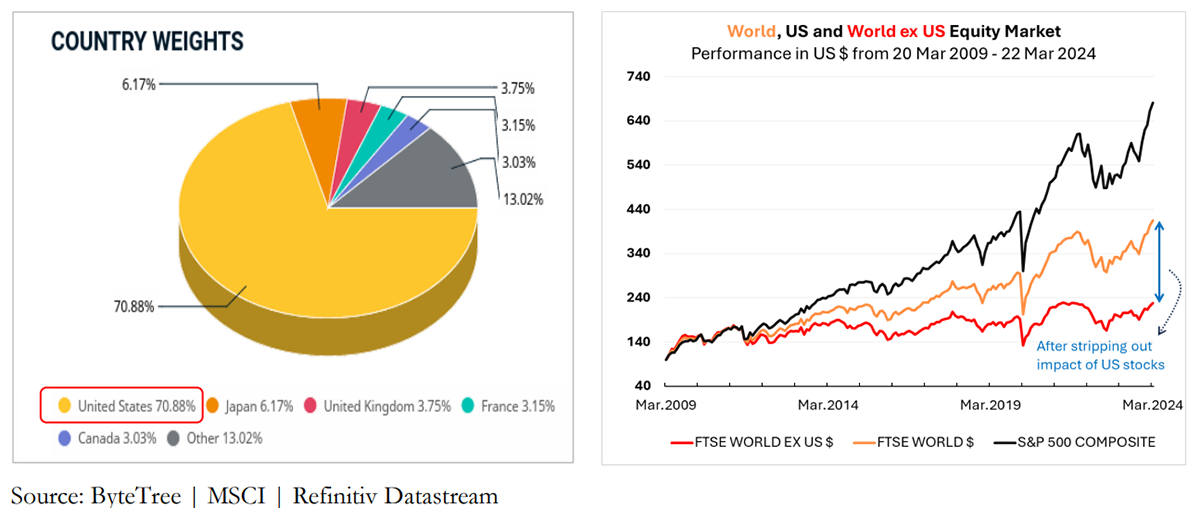

The AAA Report still has a US bias in their portfolio because that’s where the momentum takes them, but they are uncomfortable with it. That’s because it’s madness. The US keeps on gaining and is led by big tech. It’s a bubble, and everyone knows it, yet it carries on. Over 15 years, the gap between the US and the rest of the world has never before been this wide. Sooner or later, it will break, and the rest of the world will enjoy a glorious decade, rather like the noughties or even the 1980s.

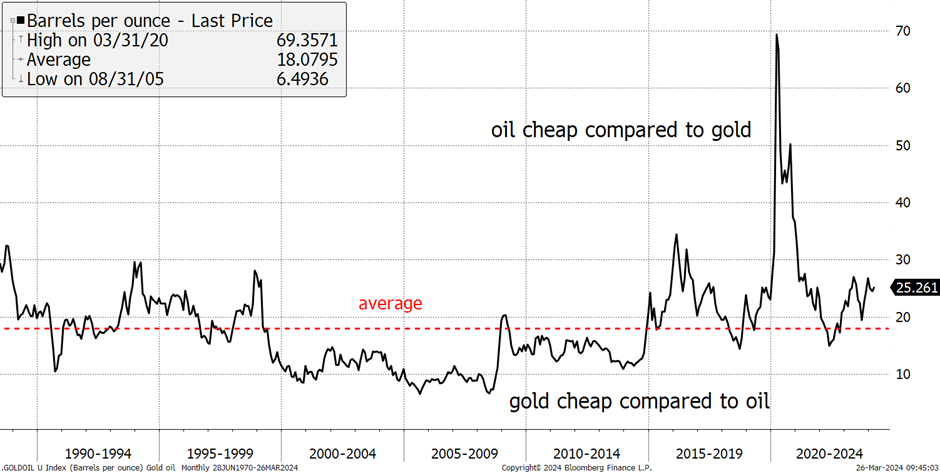

In The Multi-Asset Investor, I looked at oil, which has been firming up. I always enjoy the gold vs. oil chart, which suggests oil could trade at $120 per barrel, and that wouldn’t be out of line.

Gold versus Oil

I was tempted to increase energy exposure, but both portfolios already hold enough. I’m not forecasting a super spike, but I won’t let go of an opportunity either.

I hope you had a very Happy Easter,

Charlie Morris

Founder, ByteTree