Feeding the Commodity Rally

Trades in Whisky;

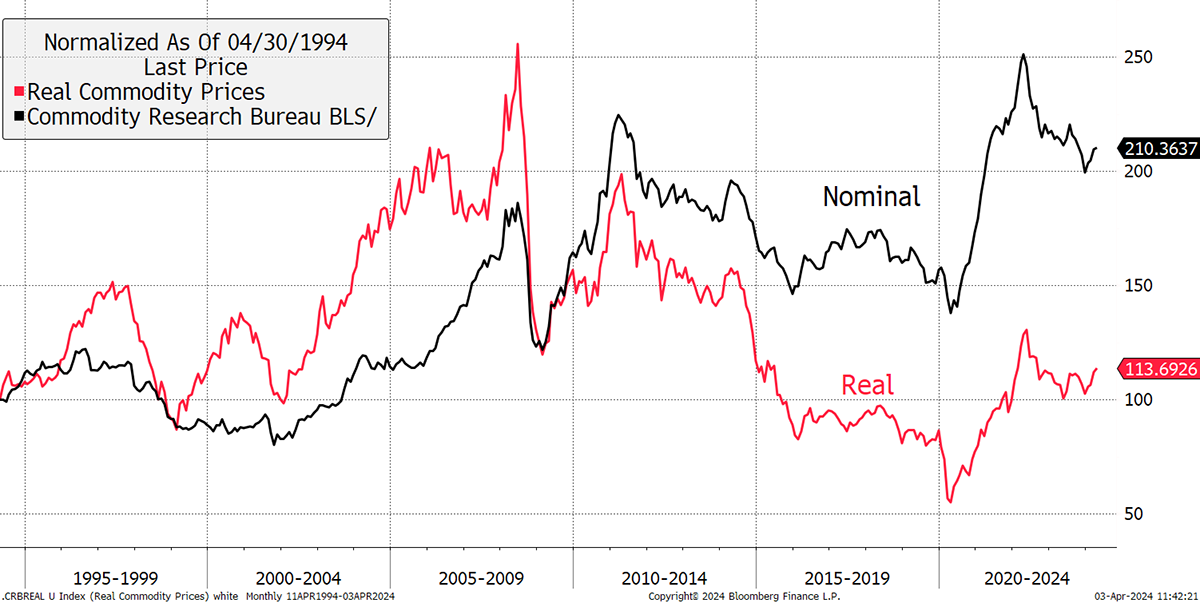

The portfolios are feeling the pull from strength in precious metals and energy, which is good news and not before time. Commodity prices collapsed in the early stages of the pandemic, only to surge later on. After adjusting for inflation, commodities are at the same level as they were 30 years ago and appear to be rising.

Commodity Prices

Within commodities, there has been divergence. We’ve seen gold, which has surged nine times since $255 at the 1999 low. Then we have food prices, which have appreciated by much less.

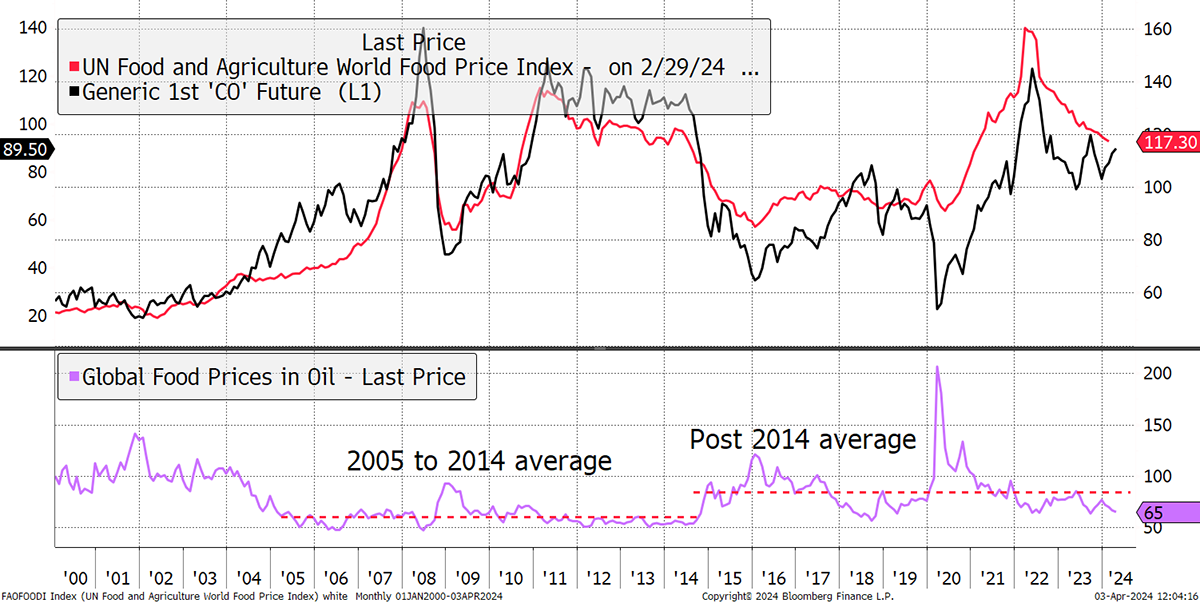

When it comes to the cost of production, food follows the oil price, as that is the highest input cost, whether it is for powering machinery or acquiring fertiliser. Oil and food prices are down from the post-pandemic peak, and oil is rising again. It is relatively safe to assume that food prices will follow, as the lower scale (purple) shows that food is trading below the food-to-oil ratio post the 2014 average.

Food Prices Follow Oil

The pandemic spike may have exaggerated that average, but I highlight 2015/6, where there was no pandemic, yet food prices remained firm. The 2005 to 2014 average was much lower than the past ten years, implying that something has changed. Note that 2014 was the year of the US shale boom when prices collapsed. However you look at it, it costs more to produce food today, relative to oil, than it did back then.

I don’t know how long this commodity bull run lasts, but gold has taken the lead. That means it is monetary, which means gold goes up first, and everything else follows. It isn’t so much a demand boom like we had when China enjoyed a double-digit growth rate before the financial crisis, but a scramble for real assets. This is what happened to commodity prices in the 1970s. Gold led, and everything else followed. I sense an opportunity.

Trades in Whisky

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd