Geopolitical Turbulence

Disclaimer: Your capital is at risk. This is not investment advice.

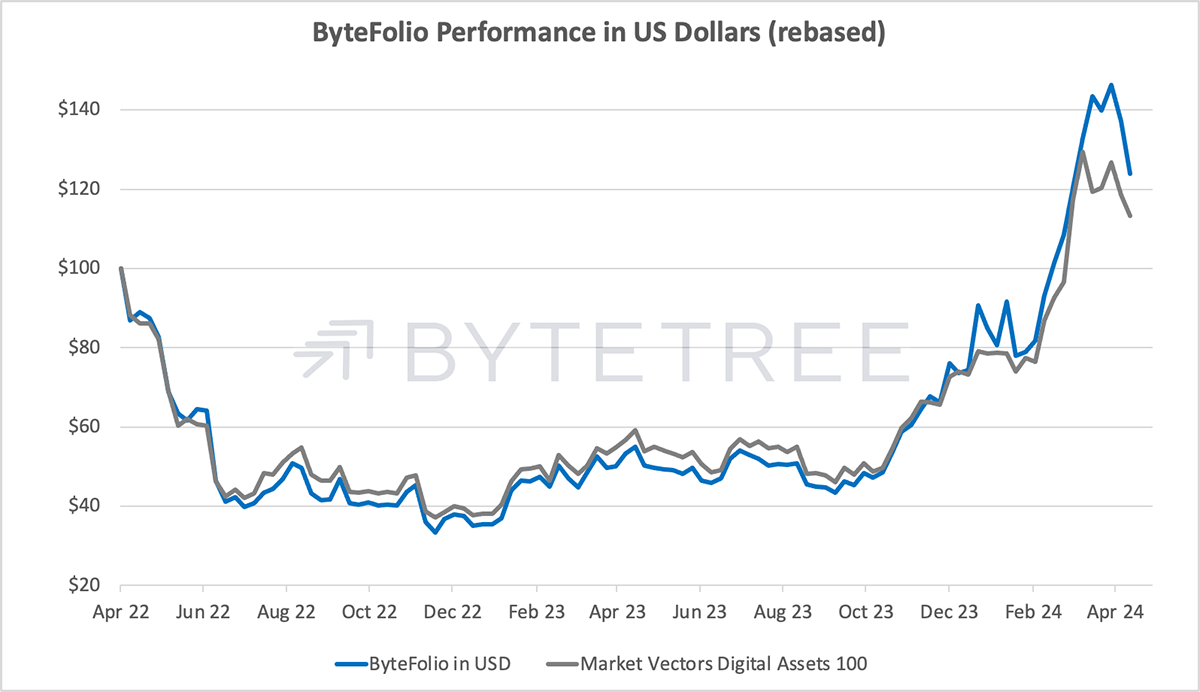

ByteFolio Issue 103;

The Israel-Iran conflict instigated a global market downturn, amplifying fear and uncertainty among investors. Crypto, known for its extreme volatility, bore the brunt of this downturn.

The broader correction in the crypto market commenced around 9 April, worsening amidst the macro turmoil. The total market capitalisation of cryptocurrencies plummeted from $2.5tn on 9 April to as low as $2tn by 14 April, representing a staggering loss of approximately $500bn in just a few days.

Within the realm of cryptocurrencies, altcoins suffered the most, evident from the increasing Bitcoin dominance. On 14 April, BTC dominance had surged to over 55%, its highest level since early 2021. Despite a decrease in monthly BTC ETF inflows, the overall cumulative holdings in Bitcoin ETFs continued to rise.

Total Bitcoin Held by ETFs

The prevailing market sentiment remains negative, a reaction that seems quite rational given the sensitive nature of the Israel-Iran situation. This tension has coincided with the period of short-term profit booking, amplifying the market's reaction. It's crucial to recognise that the recent decline in token values is predominantly influenced by external factors rather than the underlying fundamentals of projects. However, amidst this uncertainty, one thing is clear: uncertainty will persist in the days ahead.

On the bright side, the recent reports of BTC and ETH ETF approval in Hong Kong sparked a market resurgence. Presently, both BTC and ETH have reclaimed nearly half of their losses incurred since 12 April.

BTC/USD Price Chart

Moreover, with the Bitcoin halving slated for this week, anticipation mounts for a potential breakout in BTC price action. However, it's prudent to approach this with caution, as market dynamics rarely unfold in a straightforward manner. Regardless of how BTC responds to the halving next week or even in the subsequent weeks, its long-term value is poised to benefit significantly, as we highlighted last week.