Happy Birthday BOLD

Disclaimer: Your capital is at risk. This is not investment advice.

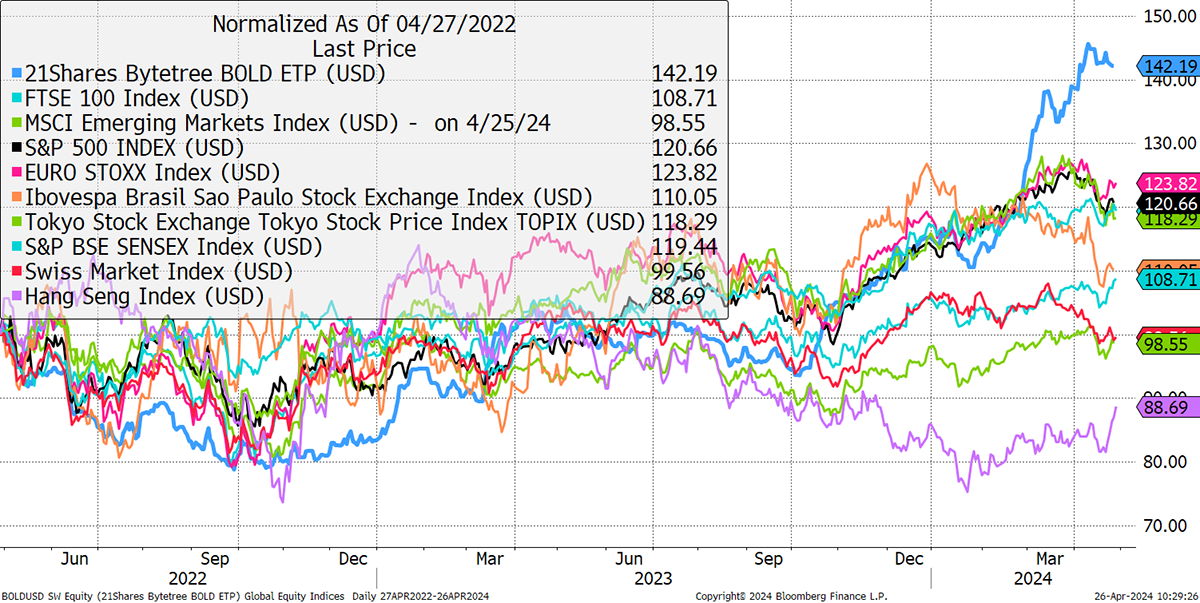

On 27th April 2022, I rang the bell at the SIX Exchange in Zurich to launch the 21Shares ByteTree BOLD ETP (BOLD SW). It was an unfortunate time as Bitcoin soon faced one scandal after another, and within weeks, BOLD had slumped below the world’s stockmarkets.

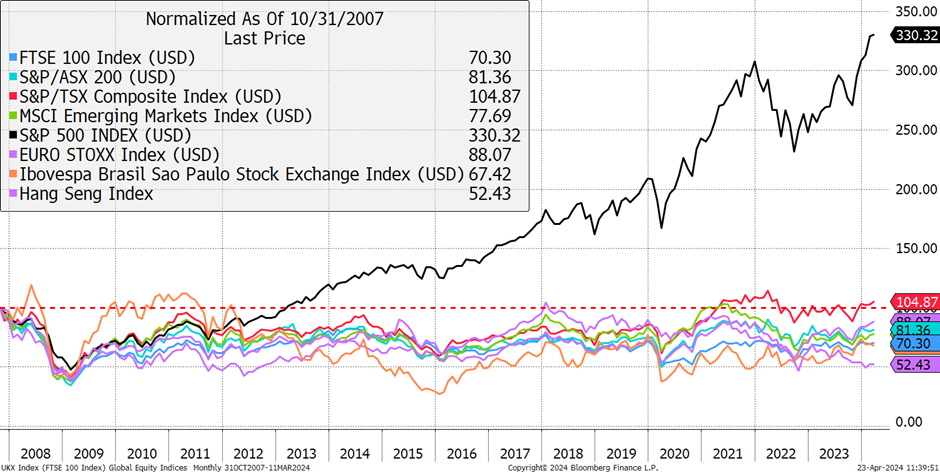

BOLD ETP Versus the Major Stockmarkets

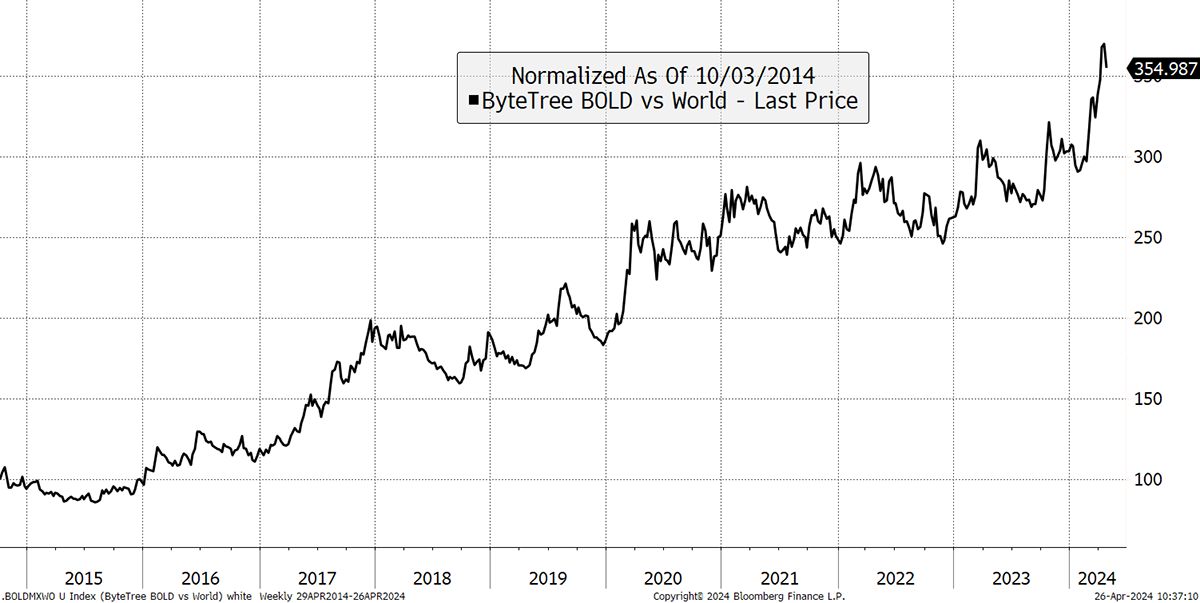

Fortunately, it was only a brief moment in the doghouse, and by the first birthday, BOLD was back in the pack. Better still, BOLD is back in front. That doesn’t surprise me because the BOLD Index has been beating the World Index since it was first conceived.

BOLD Versus the MSCI Global Stockmarket Index

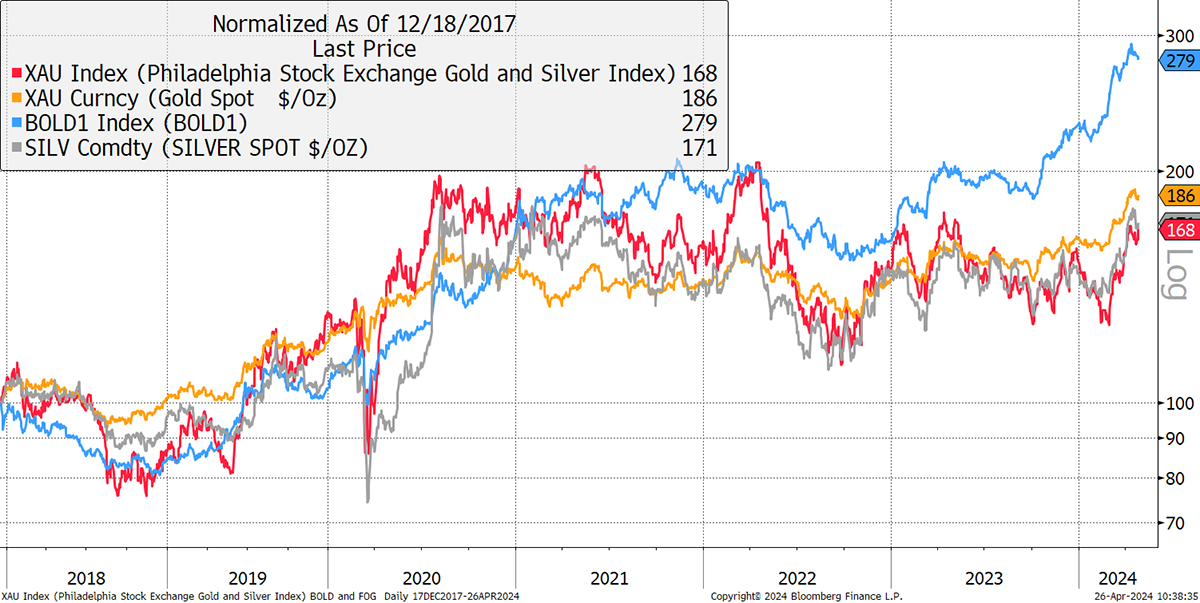

Yet beating stocks wasn’t the original aim. BOLD was designed to enhance gold, which is something silver and the gold miners have struggled to do for several years. Part of the reason is that gold is more liquid, and investors would rather own gold than alternatives, which are inherently correlated. That’s the beauty of BOLD because it is highly liquid, because both Bitcoin and gold are highly liquid, and the assets are inherently uncorrelated. That means while one goes up, the other often works in reverse, giving true diversification. That’s why BOLD is the best gold enhancer out there and has done so with much less volatility than both silver and the miners.

BOLD Was Designed to Enhance Gold

Happy Birthday BOLD. Be sure to look out for the monthly rebalancing report next Wednesday.

A Week at ByteTree

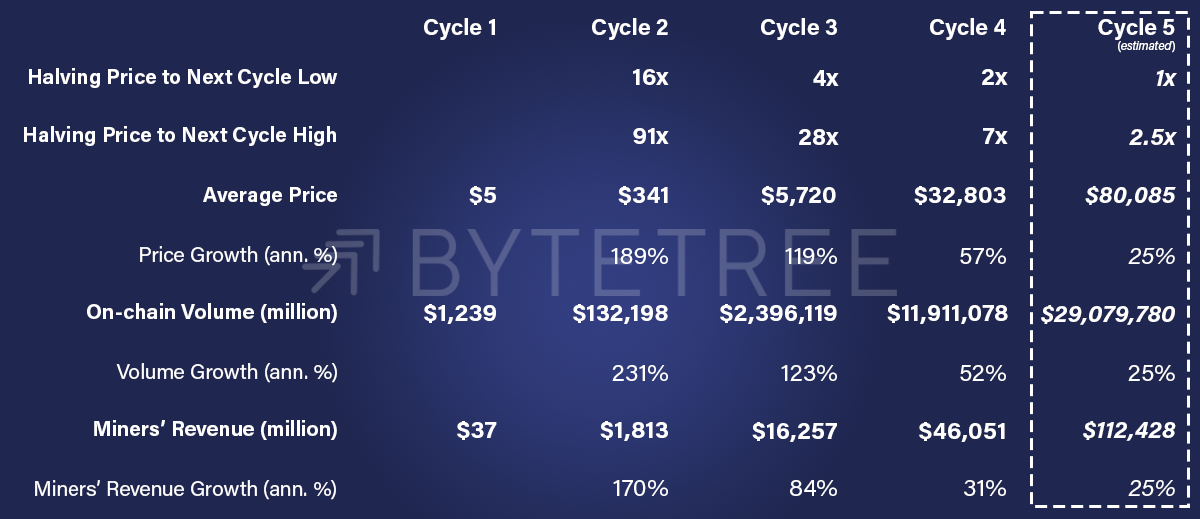

In another jam-packed week, the highlight was ATOMIC, where I gave my predictions for the fifth Bitcoin cycle (or epoch). I rarely make forecasts, to avoid looking foolish, but in this case, they jumped off the page. We entered the 5th cycle last Saturday and the stats point to one thing. Bitcoin is calming down and turning into an old man. Make sure you read it if you haven’t already.

Bitcoin Forecasts for the Fifth Cycle

It was a busy week in The Multi-Asset Investor, where we looked at the FTSE’s new all-time high while simultaneously making excuses why it wasn’t the only stockmarket that couldn’t keep up with the S&P 500.

USA Surges While the World Lags

There was also a flash note looking at growth stocks in emerging markets. I will be talking to a specialist on Zoom on Monday, which I hope to share with you soon thereafter.

In Venture, I looked at yet another deeply undervalued UK small-cap introduced to me by an experienced activist investor. They report next Thursday, so we’ll see what’s in store.

Finally, there was ByteFolio, where we looked at BNB, TFUEL, and PENDLE. The three crypto tokens target different sectors, but they have one thing in common: They are currently showcasing promising trends on ByteTrend.io.

Have a great weekend,

Charlie Morris

Founder, ByteTree