The Multi-Asset Investor Performance Review

Disclaimer: Your capital is at risk. This is not investment advice.

With another quarter behind us, it is a good time to show the results for the Whisky and Soda Portfolios that are published weekly in The Multi-Asset Investor letter. I have been running these for 8 years, having previously managed money at HSBC for 17 years beforehand. More than anything, I have learnt to be inquisitive, sceptical, and patient. In investing, these skills are essential.

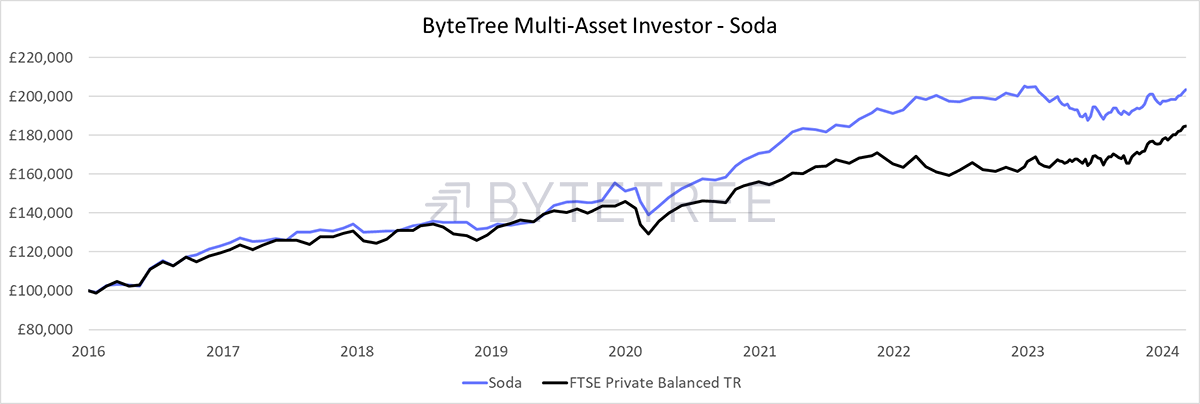

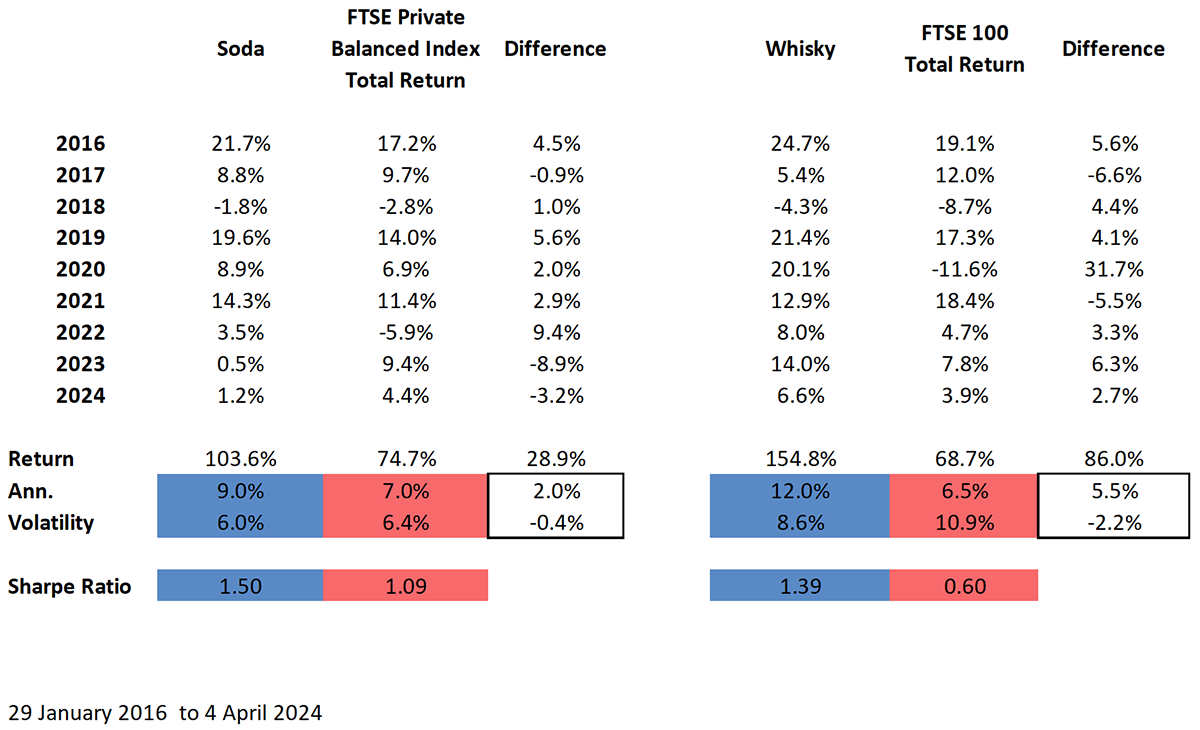

Soda is a long-term, low-turnover portfolio that invests in diversified large-cap stocks, funds, exchange-traded funds (ETFs), and investment trusts. The Soda portfolio is up 1.2% this year, and is up 103.6% since inception on 29th January 2016.

The Soda Portfolio has been a little slow recently, but I keep the risk down to where it should be, which is medium to low. The index it tracks is practically 20% big tech, and that could go horribly wrong at any time. My background is absolute return investing, and I will never compromise on portfolio resilience.

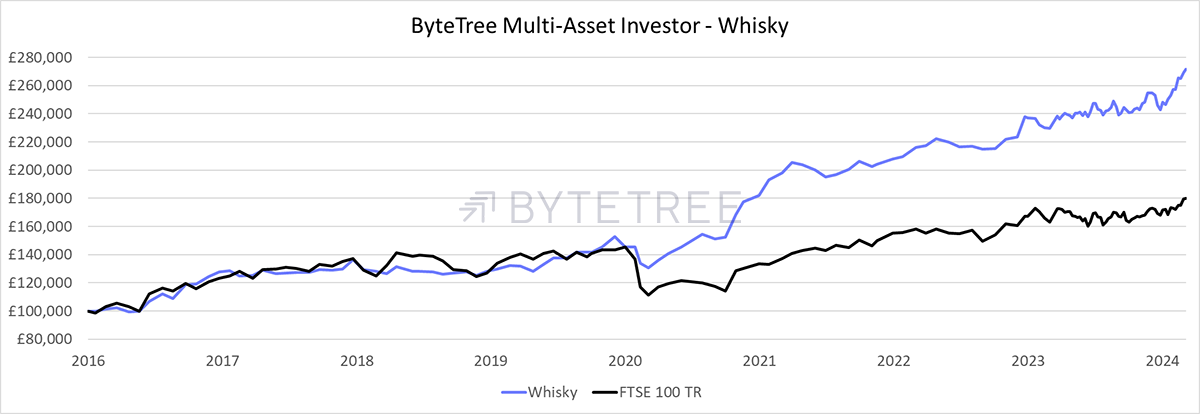

Whisky is a tactical, actively traded portfolio investing in mid- to large-cap stocks in developed markets, investment trusts, global ETFs, and Bitcoin. The Whisky portfolio is up by 6.6% this year and up 171.6% since inception on 29th January 2016. It’s medium risk.

Whisky has picked up again, along with strength in commodities and industrial stocks. I am very pleased with the portfolio this year, following the introduction of more international stocks early last year.

Putting it all together, the Soda Portfolio has been compounding at a 2% rate ahead of the index and with 0.4% less volatility. The Whisky Portfolio has compounded 5.5% faster with 2.2% less volatility. The result is higher returns with less risk, which means higher risk-adjusted returns, measured by the Sharpe ratio. I am very pleased with these numbers.

If you have never seen The Multi-Asset Investor, then why not try it?

Just sign up for a free month, and if it’s not for you, then cancel at any time.

And please have a look at other reviews on Trustpilot. The glowing feedback from our clients has been a delight to read.

A Week at ByteTree

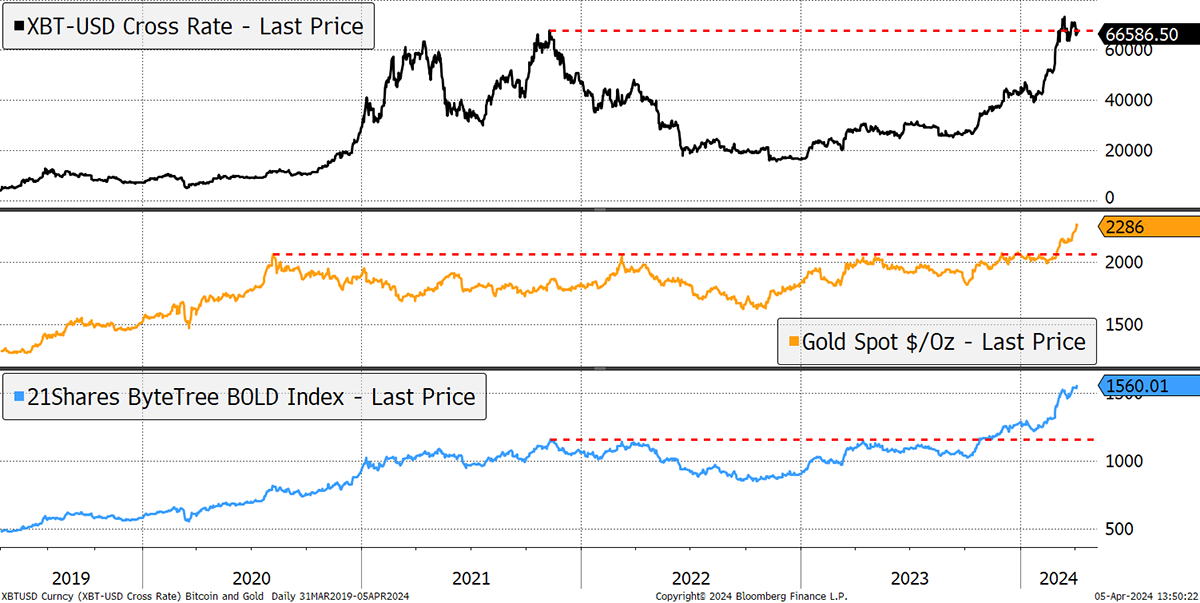

At the beginning of every month, it is time to review and rebalance the BOLD Index. Both Bitcoin and Gold have recently made new all-time highs. Most investors see the reasons for the strength as monetary, especially given it is happening against a backdrop of a strong dollar and a weak bond market. The normal link is to see Bitcoin and Gold rise when bonds are strong and the dollar is weak. This new regime suggests instability in macro-economics and/or geopolitics. Investors are looking for higher exposure to liquid alternative investments.

Bitcoin, Gold and BOLD

It is remarkable how BOLD made an all-time high several months ahead of Bitcoin and Gold. Moreover, it was the last to peak in 2021. There is something truly magical about this asset combination.

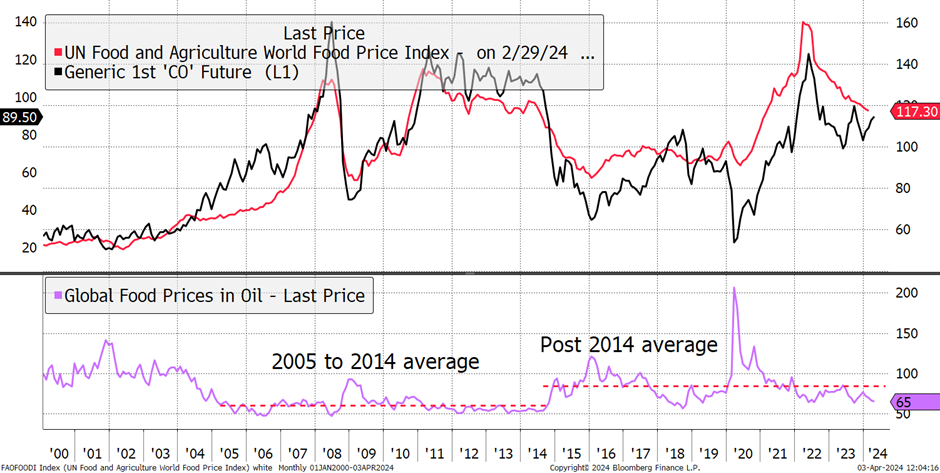

In The Multi-Asset Investor, I looked at commodities and the potential for food prices. When it comes to the cost of production, food follows the oil price, as that is the highest input cost, whether it is for powering machinery or acquiring fertiliser. Oil and food prices are down from the post-pandemic peak, and oil is rising again. It is relatively safe to assume that food prices will follow, as the lower scale (purple) shows that food is trading below the food-to-oil ratio post the 2014 average. I added a new stock, K+S AG (SDF Germany), to Whisky, one that I hadn’t traded since 2007. Dirt cheap.

Food Prices Follow Oil

I also reviewed the Venture Portfolio, which contains our best picks from the small- and mid-caps. Venture was launched in September and is going well. It is still early days, but I am pleased to see the winners building as the weeks and months pass, which is how it is supposed to be. Of the 21 ideas, most stocks have been UK-based, with two outside. Expect non-UK to grow. The split between the mid- and small-caps has been roughly 50/50, with just one large cap. Financials and industrials dominate the table, with three trades in gold miners and some in growth and technology.

Finally, there was a modest change to ByteFolio, and Ali reviewed the top three holdings: NEAR (NEAR), Render (RNDR) and Stacks (STX).

Have a great weekend,

Charlie Morris

Founder, ByteTree