The Silk Road

Disclaimer: Your capital is at risk. This is not investment advice.

I recently visited Uzbekistan, located in central Asia. Since 2016, when the first post-Soviet Union President Islam Karimov died, the country has opened up to the world and is growing quickly under the new President Shavkat Mirziyoyev. They have embraced the market economy and will welcome an expected 7 million tourists in 2024. The main attraction is its rich history, as Samarkand and Bukhara once sat at the centre of the world economy.

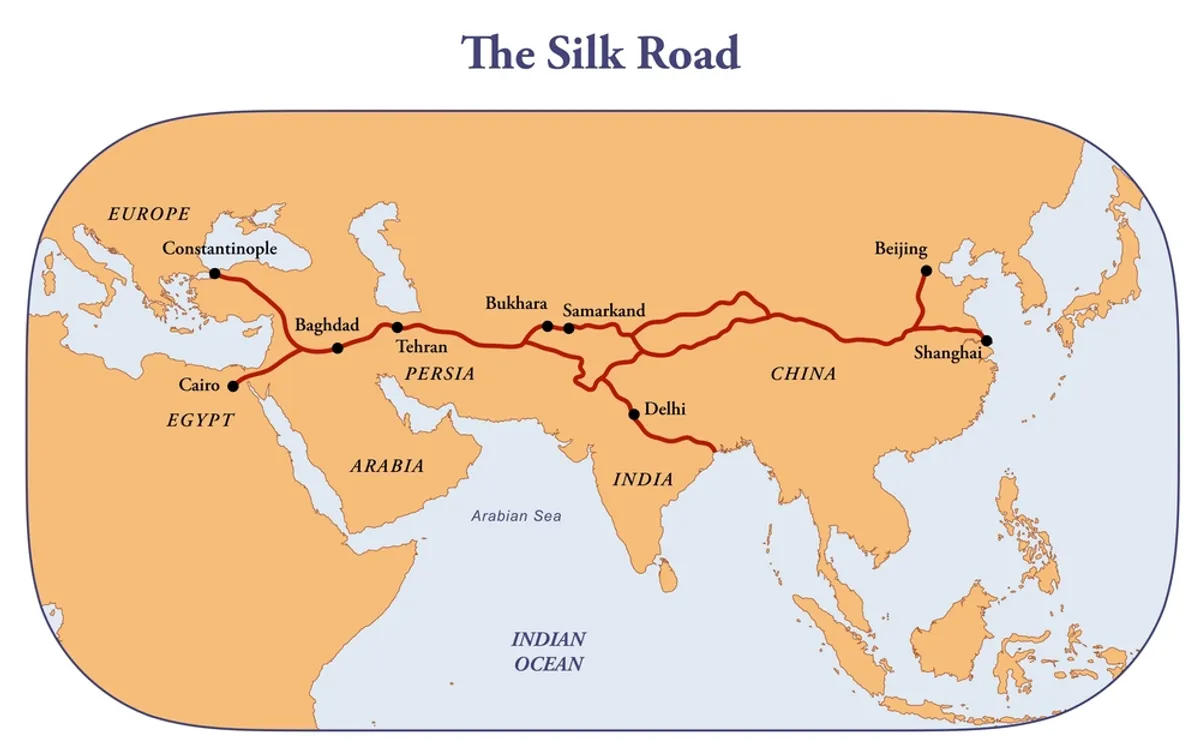

The term “Silk Road” has caught on, but these days, historians prefer “silk routes” as it was more of a network rather than a single road. Samarkand is to the south of the newer capital, Tashkent, and links Turkey and Egypt in the west, with India and China in the east. Camels and horses carried the goods, and Samarkand and Bukhara were the Amazon.com of the 14th century. You could buy everything from spices to silk.

It all began in the 6th century BC before falling into a dark age in 712 AD when Samarkand was invaded by Qutaiba ibn Muslim, leaving much of the population dead or exiled. Centuries of instability followed with Genghis Kahn in 1220, who filled the irrigation canals with blood. It was what happened next that saw the great revival as told by Marco Polo in 1370, who commented on Samarkand’s size and splendour. The great era came under the rule of Amir Timur, whose statue sits in the centre of Tashkent with the motto “Strength in Justice”. He remains their national hero, and under his leadership, the country thrived.

With great wealth comes culture, art, and architecture. The mosques, mausoleums, universities, and the observatory are some of the main attractions. It is fascinating to learn how Mirzo Ulugh’beg built an observatory in the 1420s. They studied the sun, the planets and the stars and created astrological tables that are the basis for modern space travel. His lasting quote was, “I leave my works to my deserving generations.” That work found its way to universities in Oxford, UK and Gdańsk, Poland, in the 17th century, among others.

It was interesting to see that an important part of the restoration of wealth was monetary reforms. As the Austrian economists keep reminding us, “fix the money, fix the world.” It is essential, and especially for international trade and market confidence. It is a shame I can’t find more detail on the reforms, but given Uzbekistan is the world’s 10th largest gold producer, we can assume that gold was involved, but I believe the coinage was based on copper.

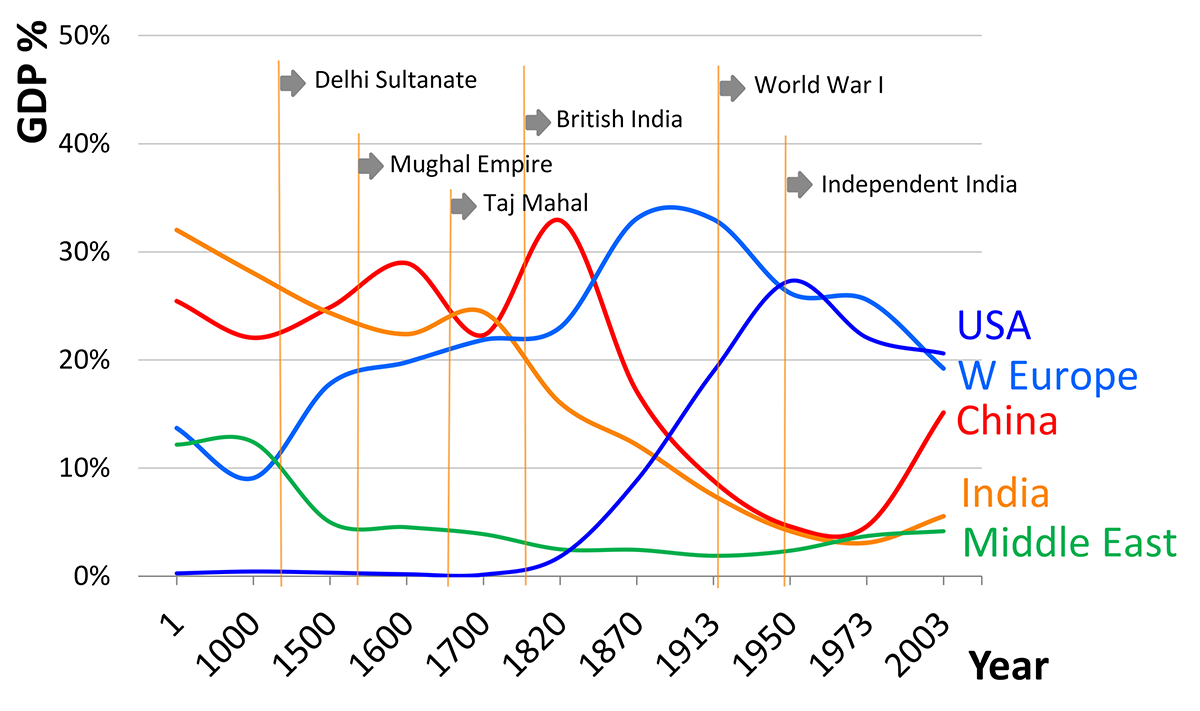

I was first shown this chart many years ago, but it has only just started to make sense. I am not sure of its accuracy, but the message is clear. India, China, the Middle East, including Greece and Turkey, made up the bulk of the world economy for most of history. Northern Europe, the Americas and Australasia joined in much later, despite being inhabited for a long time. Civilisation thrived along the silk routes at a time when we Brits were running around dressed in rabbit fur. What changed everything? Advancements in shipping.

In the 16th and 17th centuries, as ship design improved, much larger cargoes were transported by sea, which was faster and safer, and as a result, the centre of gravity of the world economy shifted to the coasts. Uzbekistan is one of only two double landlocked countries, the other being Liechtenstein, which thrived as a financial centre, while Uzbekistan soon lost its relevance. Nevertheless, it later became an important part of the Soviet Union, gaining independence in 1991.

GDP in 2022 was $80 billion, and with a 35 million population, GDP per capita is around $2,500. That’s a low number, but with 6% GDP growth, it is catching up with Asia. There’s a stockmarket, but it isn’t yet on Bloomberg, or to my knowledge, investible as we know it. US dollar debt to GDP is a manageable 35% and the bonds yield 7.6%. Inflation is 8%, down from 20% a few years ago.

Personal and corporate taxes are low, and unemployment is 6%. According to the Legatum Prosperity Index, Uzbekistan ranks 100th and has gained 13 places since 2011. The currency is the Soum, and $1 = 12,681 Soum. That means a million Soum costs around $79, making everyone here a millionaire.

With an area of 447 million square km, Uzbekistan is about twice the size of the UK, and a little smaller than Spain. It borders with Kazakhstan (2,724 km square similar to Argentina), Kyrgyzstan, Tajikistan, Turkmenistan and Afghanistan.

I already mentioned that it is the 10th largest gold-producing country. There’s also copper, lead, zinc, tungsten and uranium, as well as oil and gas. It’s a major producer of cotton, the second largest producer of carrots (after China naturally), and the largest producer of apricots.

They also make cars with a government-owned Chevrolet (formerly Daewoo) factory outside Tashkent, along with an Isuzu factory, which makes vans. Every other car is a Chevy, and they are all white.

Although predominantly Muslim, there is religious freedom. I was proudly shown the churches and told about the synagogues. Alcohol is freely available, and the local wine and beer works well. Some restaurants I visited were modern and excellent, others from another era. Wherever you go, the bread is excellent. It feels like a culmination of cultures that have coexisted for hundreds of years.

Uzbekistan is on the up and very much a beneficiary of independence, renewed confidence and the Chinese-led belt and braces imitative. When you visit, you can see why they’ve done it. I travelled in a clean bullet train and several modern Chinese cars, which, from the inside, felt like a cross between a spaceship and a Range Rover. The western auto manufacturers should be worried.

Should you visit Uzbekistan? I think so. As someone said, for most people, you’d only need to go once, but if you appreciate history, it’s a must. I was going to share some photos, but they don’t do it justice.

A Week at ByteTree

It’s been a nervous week for markets as bonds fell, dragging equities down with them, which I covered in The Multi-Asset Investor. Might it get worse? It will as long as inflation keeps rising and that is precisely what the strong gold price is telling us.

In crypto, Ali highlighted the heightened risks in a week that saw Bitcoin fall back to $60,000 ahead of the fourth Bitcoin Halving, which is expected to happen in the early hours of Saturday 20 April. At ByteTree we are long-term Bitcoin bulls, but are happy to go against the crowd in describing halving as the great anti-climax a couple of weeks ago. We were right, as we often seem to be.

I apologise for any errors or omissions in my brief history of Uzbekistan.

Have a great weekend,

Charlie Morris

Founder, ByteTree