When’s Alt-season?

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 105;

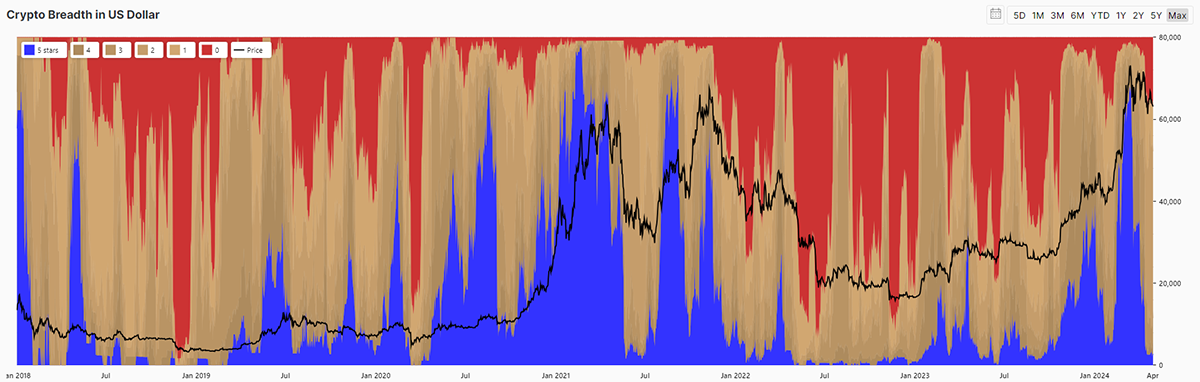

Crypto breadth has slumped. The recent peak occurred on 13 March, shortly before halving, and has dropped back to less excitable levels. At this point, there are still few downtrends by bear market standard, because it takes time for the 280-day moving averages to turn down. That said, 21% of tokens are now in 0-star downtrends and just 3% in 5-star uptrends.

Token Breadth in USD

To remind you, a token scores a ByteTrend star if:

- The price is above the long-term moving average

- The price is above the short-term moving average

- The long-term moving average is rising

- The short-term moving average is rising

- The price last touched max on the max/min lines

If all 5 conditions are met, a token is in a 5-star uptrend. If none are met, it means a 0-star downtrend.

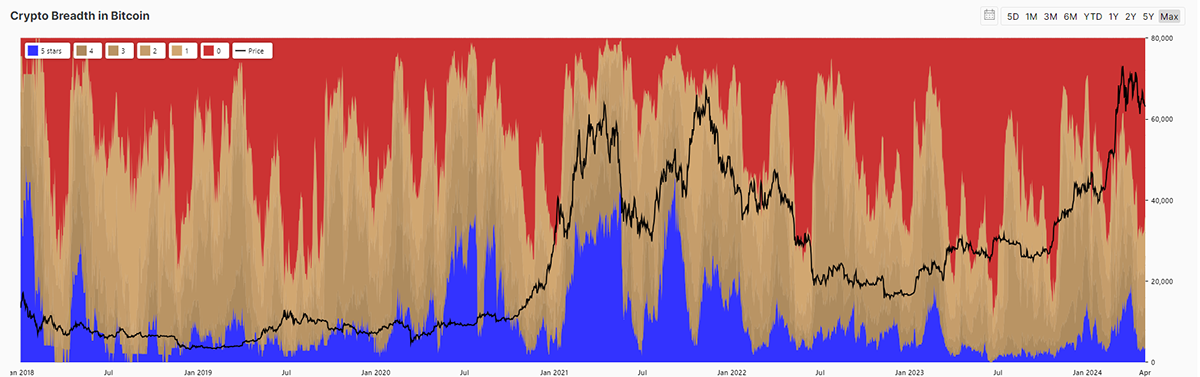

In Bitcoin, breadth in BTC, or tokens in strong trends when measured in BTC, has not picked up this cycle, making Bitcoin outperformance very difficult. I had hoped that a post-halving easing for Bitcoin would pave the way for an alt rally, but it still hasn’t happened. By this measure, 55% of tokens are in downtrends in BTC, and just 4% in uptrends.

Token Breadth in BTC

Still, we carry on seeking out the winners, even though they are few and far between. That will pick up at some point, but waiting for alt season requires patience. The other vital role in this portfolio is to cut the weakest trends, and this week, we have another.

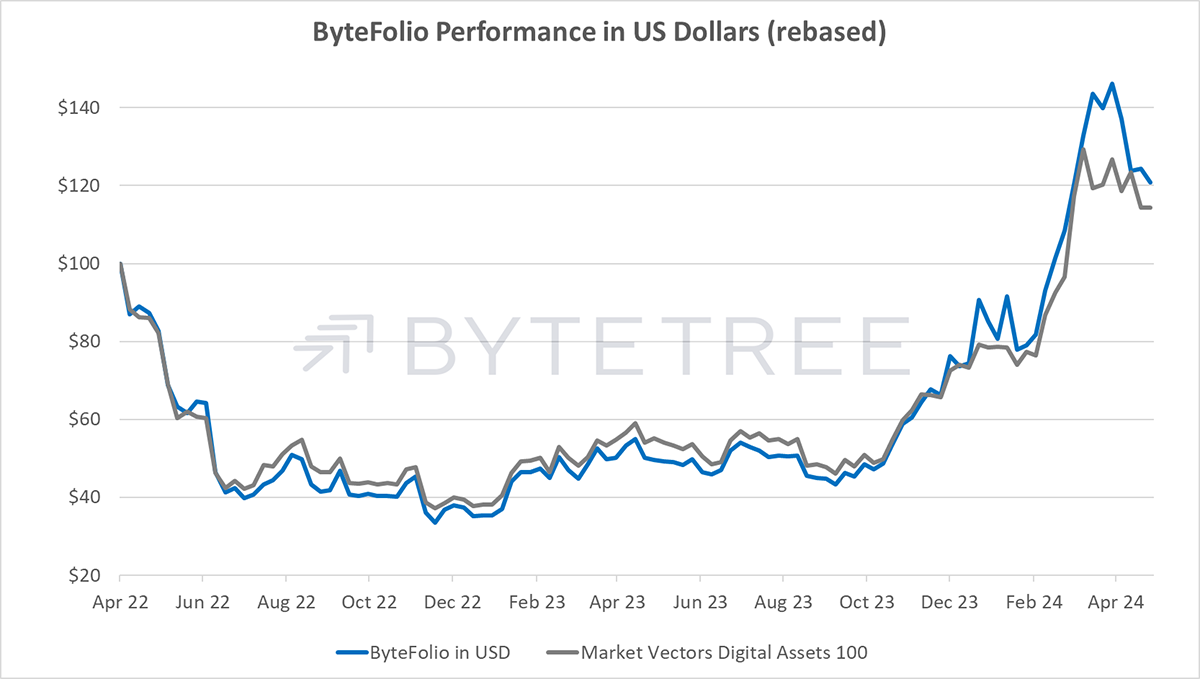

ByteFolio Performance in USD