Last year, with so much talk of deep value opportunities in stockmarkets, I decided to do something about it. In September, I introduced ByteTree Venture, a distinct service that aims to uncover value globally, starting with the UK, where it's most prevalent. I'm excited to share some of the outcomes with you, which I'm quite pleased with.

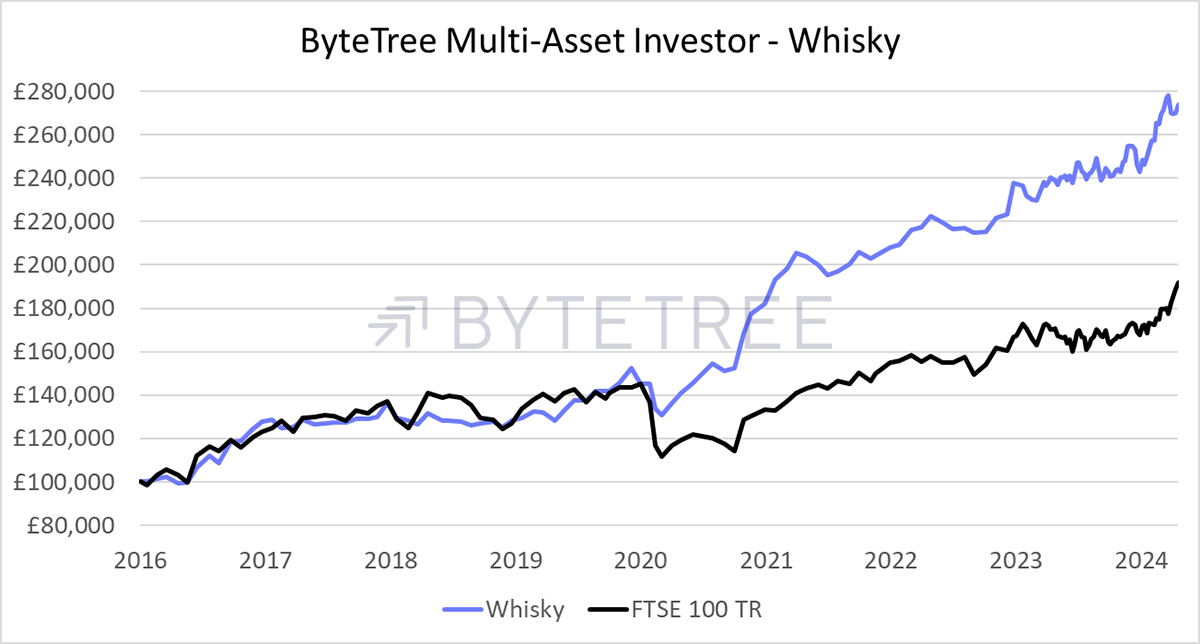

As a professional fund manager, I have been identifying value opportunities for years, and since 2016, in the Whisky and Soda Portfolios, published in The Multi-Asset Investor. These portfolios seek out liquid and robust investment opportunities. Soda is mainly comprised of investment trusts and ETFs, whereas Whisky is largely single stocks, just like Venture.

The Whisky Portfolio is highly liquid and has a measured approach to risk. I seek out value and avoid taking unnecessary risks while still finding profitable opportunities. Whisky has performed well and with lower volatility than the stockmarket due to the strong focus on risk management. Yet there are many profitable opportunities that get left behind because they aren’t up to the high standards that I have set for Whisky inclusion. For example, it’s not just liquidity, but the balance sheet, ethics, sector, and jurisdiction are a few examples of the reason for exclusion.

I often come across great investment opportunities, many small or mid-sized companies that have not been investable in Whisky. These are normally too small, but often have little coverage, and I wanted to put them up in lights.

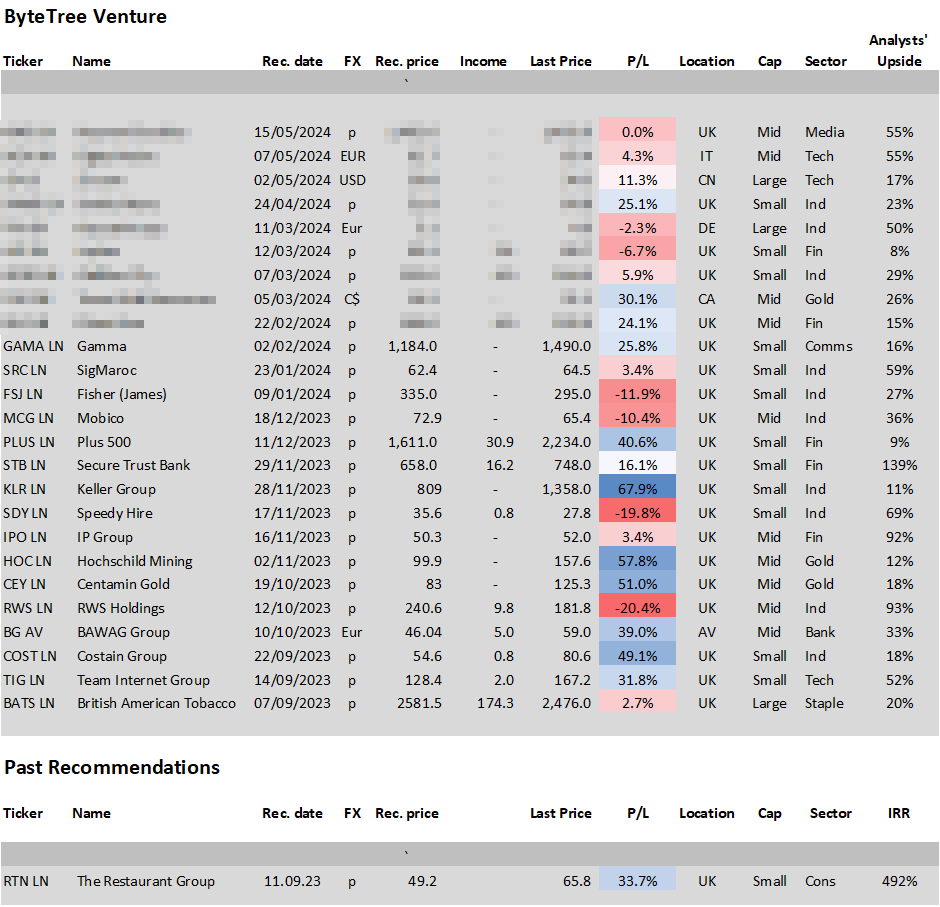

Unlike the Whisky Portfolio, ByteTree Venture is a research service, not a portfolio. It operates without weights, and performance is evaluated on a stock-by-stock basis, rather than as a diversified whole. I don’t anticipate ByteTree Venture clients to invest in every opportunity presented, but to select the ones that align with their investment goals. The role of Venture is to identify compelling opportunities and present each case on its merits.

A recommendation starts with my research, which is summarised in a note. I give the example of Gamma Plc (GAMA), which I covered in February. Venture clients have had plenty of time to invest, so they won’t mind me sharing the idea with a wider audience. If you are interested, please look at the note, which we have made available. GAMA is up 25% so far, with room for more. I show the 26 Venture stocks, hiding those recommended over the past three months, which are exclusively reserved for ByteTree PRO clients.

Some Venture stocks have done very well, while two have stumbled. In the case of RWS, a leading language and service provider first recommended in October, the shares are down 20%. Yet the analysts believe the company is worth nearly twice where it trades today. Speedy Hire (SDY), the other laggard, is trading at a valuation last seen in 2009 following the global financial crisis. It’s a bargain to be had.

Keller (KLR), the winner so far, has been spectacular and just reported blow out results with trading well ahead of expectations, in a “very strong start” for the year. What grabbed my attention last November was the unusually low valuation that wasn’t warranted. It’s up 69%, and practically all these stocks have the potential to do as well as that or in some cases, better.

My approach for Venture is not dissimilar to the screening approach I use in Whisky. I have simply cast a wider net across smaller companies. In addition, I am more flexible on a case-by-case basis, and sometimes embrace situations that might be considered high risk. They aren’t all like that, normally just smaller.

A Week at ByteTree

This week, I made my 26th recommendation in Venture, a UK tech and media stock in eSports and gaming. It’s another great opportunity. If Venture interests you, then upgrade to ByteTree PRO. Remember, there is no lock-in, and you can cancel at any time.

In case you missed last week’s Atlas Pulse, I published a valuation screen of all the stocks held in GDX, the $13 billion US gold mining ETF.

On Monday, ByteFolio looked at Bitcoin’s continued dominance, and TONCOIN, Telegram’s (Web 3.0’s WhatsApp) crypto token.

Finally in The Multi-Asset Investor, I revisited the discounts on investment trusts.

Webinar

We are hosting an Ask Me Anything webinar on Thursday, 23 May, at 4 PM BST. I will present a few slides sharing my thoughts on financial markets and then open up the floor for questions. I will be joined by my old friend Zak Mir, who is a keen ByteTree fan, and he will keep the house in order. You can sign up here to attend the live event.

If you can’t make it, there will be a recording. Just remember if you have a question or comment, then please send it in.

Have a great weekend,

Charlie Morris

Founder, ByteTree