Trade in Soda;

I was recently asked why Brazil and Mexico have not joined the global bull market, especially given that commodities have been doing so well. What might be a catalyst for a positive move higher or a signal to sell?

It has been on my mind that a high-conviction trade hasn’t played out as expected. There’s no cause for concern; it’s more that when something isn’t working, it is best to reevaluate. Both Brazil and Mexico are stable, and Brazil pays a good dividend, but they have slowed. You might think that we should expect more in a youthful commodity bull market. Or perhaps it is just a pullback following a period of strength.

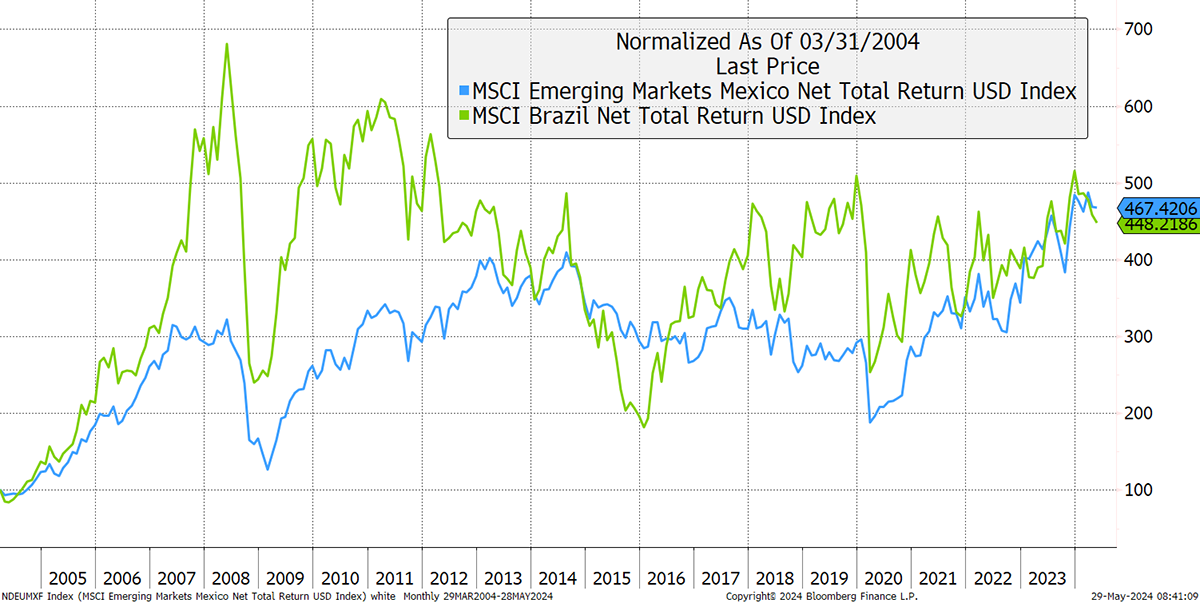

Brazil and Mexico

It is remarkable how two countries, which are easy to think of as neighbours, have capital cities separated by a 9 ½ hour flight. Even more remarkable is how their stockmarkets, including dividends, have had the same return for the past two decades despite having a completely different set of circumstances along the way.

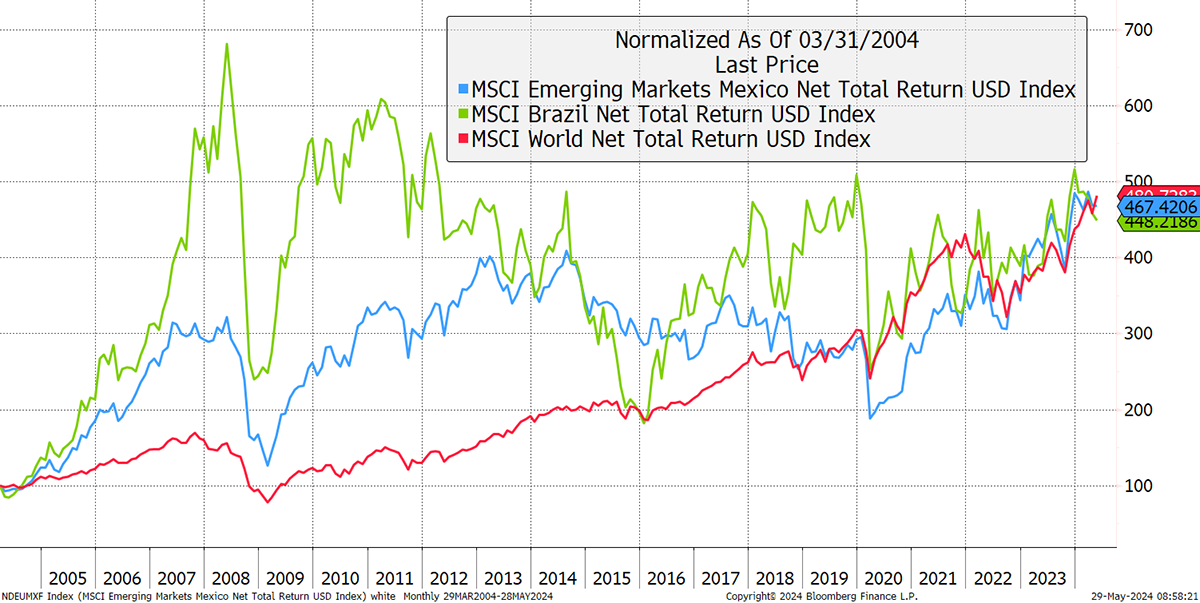

It’s Latin America, so there are the politics, which are never dull. They have always been a cause for concern, but somehow, when I show that same chart again against the world index, it’s a match. Perhaps politics matters less than we think.

Brazil and Mexico Match the World

This lies at the heart of my long-term bull case in Emerging Markets (EM). The mismanagement of an economy has a surprising amount of wiggle room before long-term damage is caused to a country’s financial system. Provided they can balance the books, or at least show intent, markets can be very forgiving, and the long-term returns from equities tend to revert to a trend. It is only when a country is broken, such as Venezuela, that the markets become truly dysfunctional. But the key to this is that even though the start and finish points of an investment journey might end up being the same, the journey is completely different.

Twenty years ago, the US market, along with Japan, had a slow decade as the World Index shot past. EM eagerly stepped in and surged, with Europe and the UK somewhere in between. Post 2011, the US started to reassert itself, with huge growth in software and the internet, and more recently, AI. The result has seen outsized returns for the US market, and capital sucked out of the rest of the world. This has resulted in a clear valuation differential, and when this chapter in financial history finally draws to a close, the capital will resettle around the world, allowing EM to once again take the lead.

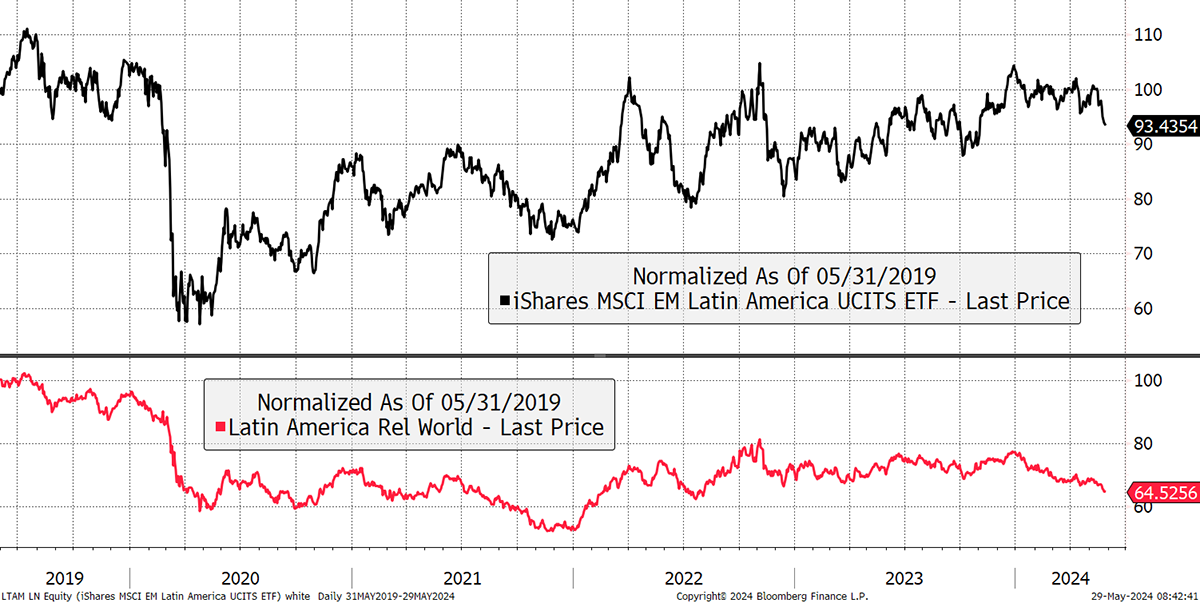

I remain committed to this idea, and while the long-term might be reassuring in theory, the short-term can be painful in practice. I have decided to reduce Latin America in the Soda Portfolio and diversify. Whisky remains unchanged.

Latin America Has Started to Lag the World

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd