The Evolution of Finance: Real-World Assets Tokenization

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 106;

In the realm of cryptocurrency, trends come and go in cycles. It began with the emergence of DeFi, followed by subsequent trends such as GameFi, NFTs, AI/Computing, DePIN, and now, Real-World Assets (RWAs). What sets RWAs apart is their potential magnitude, with the tokenization industry projected to encompass trillions of dollars. Notably, behemoths like BlackRock and Franklin Templeton are spearheading this movement.

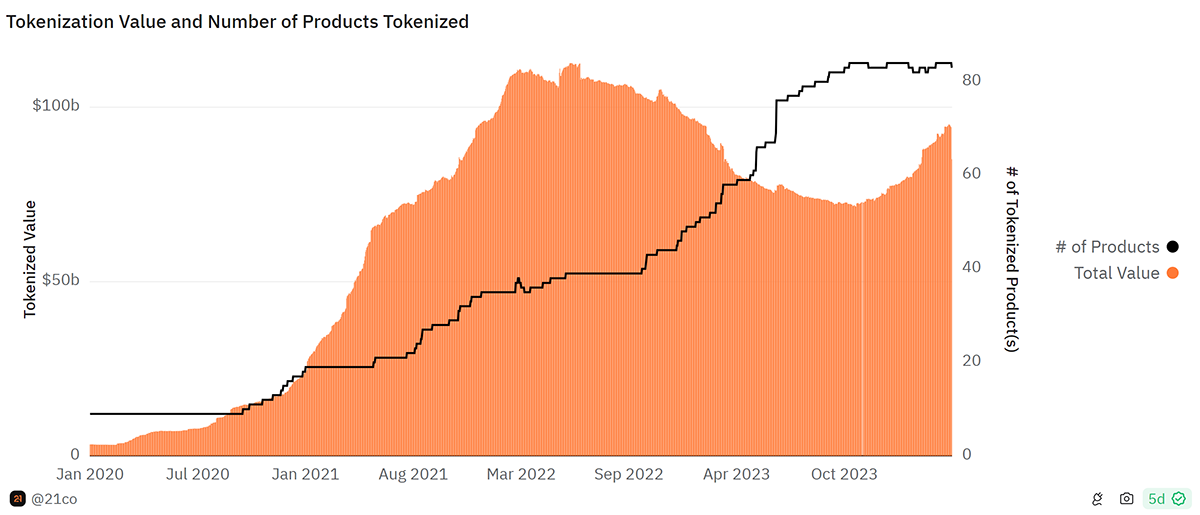

Number of Tokenized Products and Marketcap

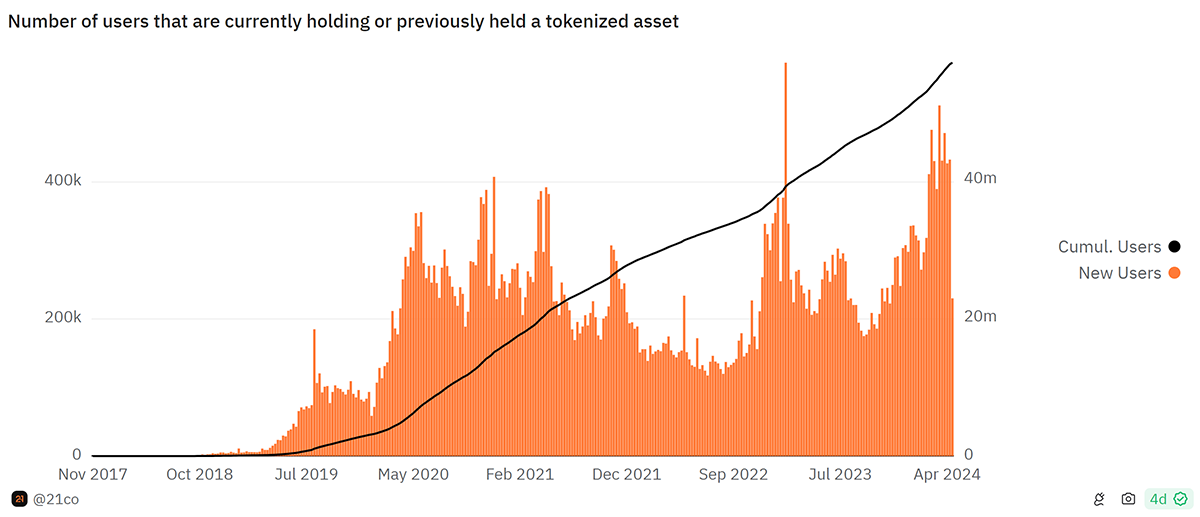

As the name suggests, Real-World Assets (RWAs) are tangible assets in the physical world, ranging from real estate to commodities and more. Through a process known as tokenization, these assets can be brought into the digital world and transformed into digital tokens on the blockchain. The journey of RWA tokenization initially commenced with fiat-backed stablecoins, essentially digitising traditional currencies. However, the landscape has evolved significantly, with a diverse array of RWAs finding their place on the blockchain. As interest in this sector burgeons, there is a marked increase in the user base participating in this realm.

Number of Users Currently Holding or Previously Held Tokenized Assets

The primary asset classes dominating this sector are fiat-backed stablecoins (97% market share), government securities (1.37% market share) and commodities (1.1% market share).

In partnership with RWA tokenization firm Securitize, BlackRock unveiled its first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). Launched 21 March on Ethereum, BUILD has surpassed the AUM of BENJI, which is Franklin Templeton’s tokenized RWA fund on Stellar and Polygon, in less than six weeks. Currently, BUIDL boasts an AUM of $381m, closely trailed by BENJI with $368m; a testament to the success and viability of the RWA market. Together, they encompass 60% of the tokenized government securities market.

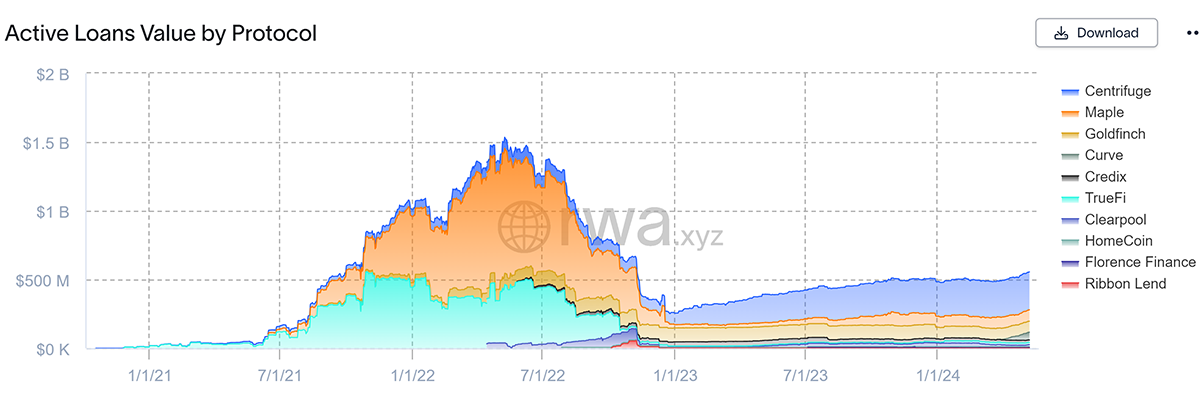

In the realm of RWAs, prominent decentralised projects include Ondo and Centrifuge, both regarded highly within the community. Ondo recently moved $95m worth of assets to BUIDL for instant settlements of its proprietary US Treasury-backed token, OUSG. Although smaller in scale, Centrifuge operates as an RWA lending protocol, boasting an impressive $555m in active loans on its platform.

Active Loans by RWA Lending Protocols

As illustrated in the chart above, the number of active loans on Centrifuge has steadily been growing since late 2022. While the platform offers a tangible real-world use case and boasts robust fundamentals, the value proposition of its native token, CFG, is rather underwhelming.

MakerDAO is another crypto project with a big focus on RWAs. One of the main mechanisms that helps balance the supply and demand of Dai in the market is the DAI Savings Rate (DSR). It allows users to deposit DAI and generate a yield. Currently, the DSR yield is 10%, and a large portion of this yield is generated using RWA investments.

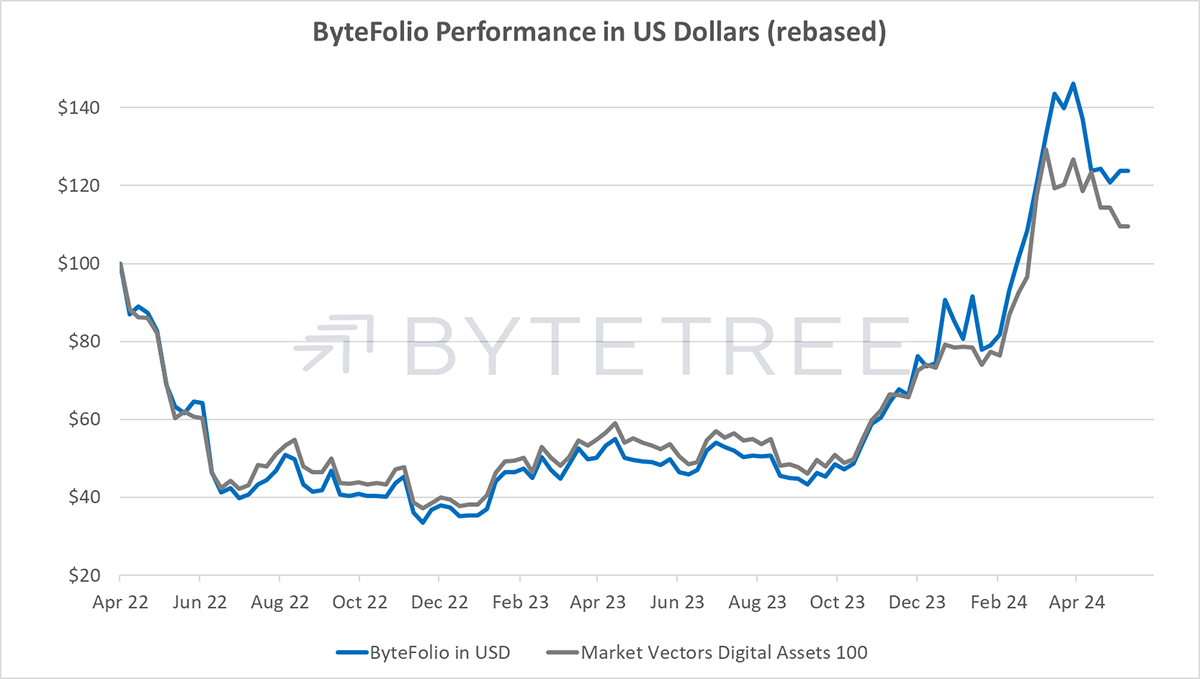

ByteFolio Performance in USD