What Are Commodities Telling Us?

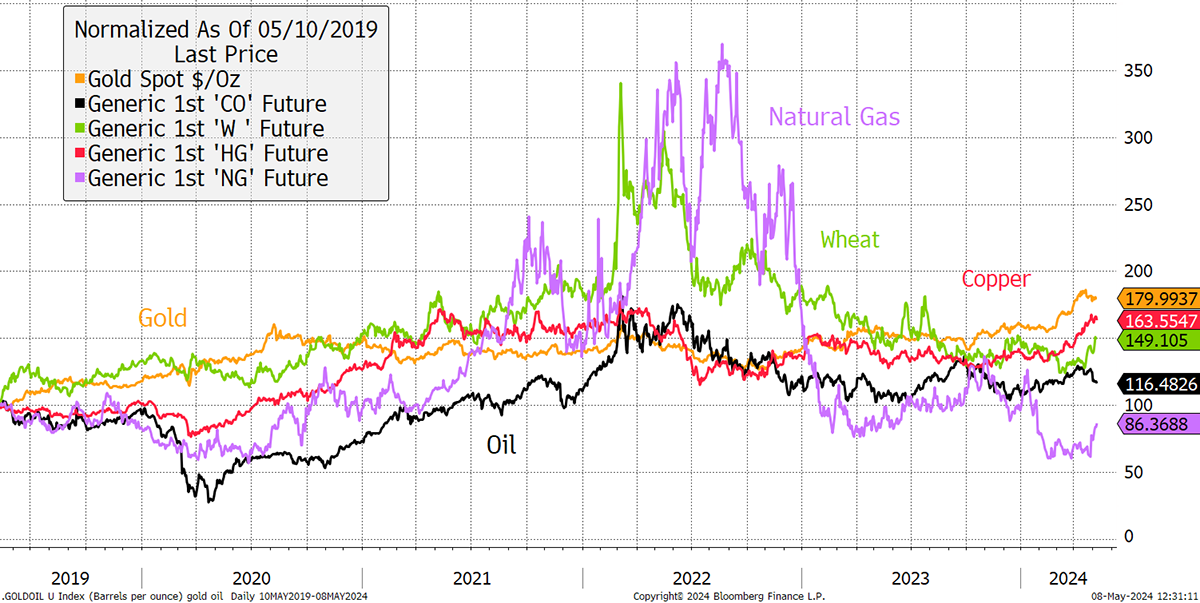

Looking back five years, a picture emerges, which clearly shows how commodity prices remain higher than in the pre-pandemic period. Gold benefitted from the monetary stimulus, while oil and copper suffered during lockdown. Then came the war, a time we associate with the surge in the oil price, but the impact was far greater on natural gas and food prices. Remarkably, the US natural gas price today is 14% below the pre-pandemic levels. Here in Europe, it is still 131% higher. Unfortunately for us Europeans, that is the primary factor driving the electricity price.

Commodity Prices – 5 Years

Electrification has become such a hot topic that it has kept the price of copper elevated. The price of oil, for all the talk, is a mere 16% above pre-pandemic levels. Given inflation has been 22% overall, that’s surprising.

In simple terms, inflation is a measure of economic efficiency. In a truly competitive and open economy, with sound monetary policy, it should remain low as natural forces keep a lid on prices. However, in a world where government policies lead to favourable industries, intervention, oligopolies and politically motivated monetary policy, inflation will be higher. In the latter case, the system is inefficient, which is obvious when you contextualise it.

This question is important for investors because the price of money matters greatly to financial markets. While the oil price suggests economic restraint, gold, food, and copper don’t.

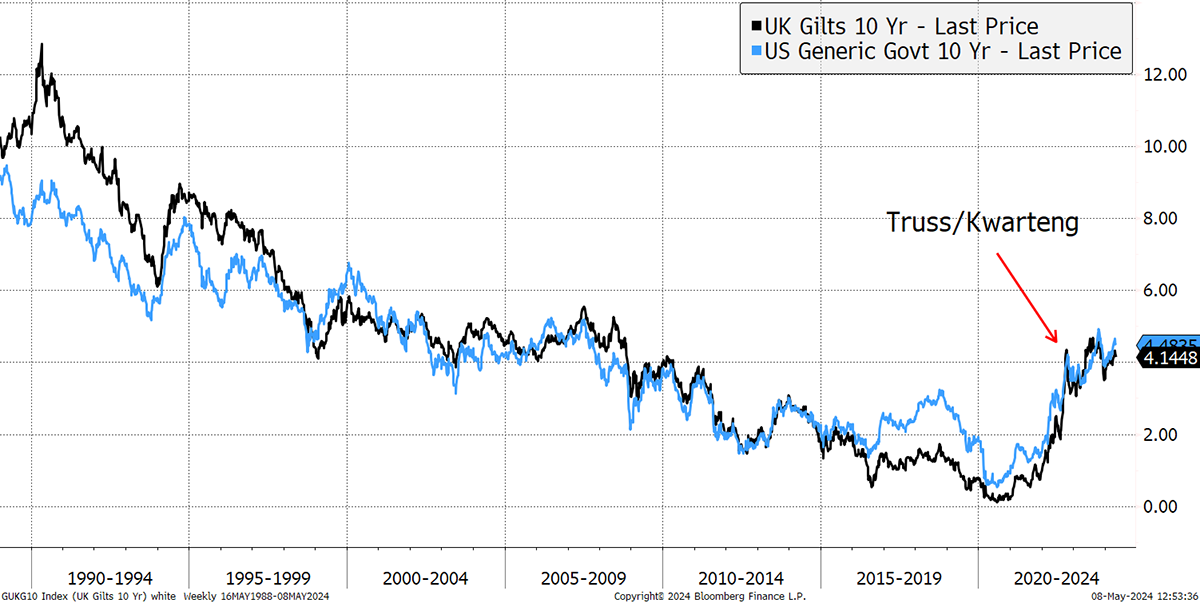

Following the defeat of the UK Conservative Party at the local elections last week, there is a temptation to blame Liz Truss and Kwarzi Kwarteng for high interest rates. Still, nearly two years later, it is becoming increasingly clear that it wasn’t the pro-growth policies but the timing. Bond yields were surging around the world regardless, and it was a bad time to frighten the horses.

UK and US 10-Year Bond Yields

I say that with confidence because any impact from the speech was quickly reversed, and it is laughable that the UK could heavily influence the juggernaut known as US treasuries. The bigger reason bonds sold off was inflation fears. In 2022, UK inflation was 10.1%, and US inflation, which had only just started to turn down, was 8.1%. The bond market was in no mood for stimulus at that time.

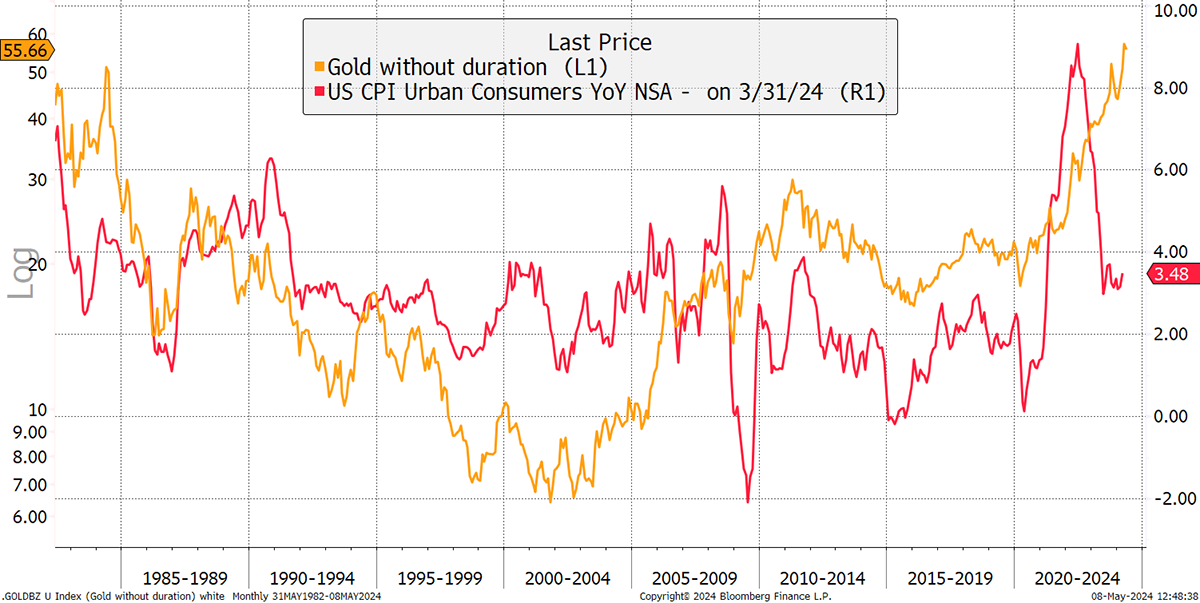

I mention this because last month, I published a gold chart in Atlas Pulse, which showed you what the price of gold looked like if you “stripped out interest rates”. It is well known that gold likes easy money (rate cuts), and yet, despite rate hikes in recent years, gold has performed exceptionally well. My simple thesis was that by taking the “bonds” out of gold, you’d be left with a powerful inflation indicator. It’s not a perfect fit, but there’s something there in a period which was largely disinflationary.

Gold (without Bonds) and Inflation – Post-1982

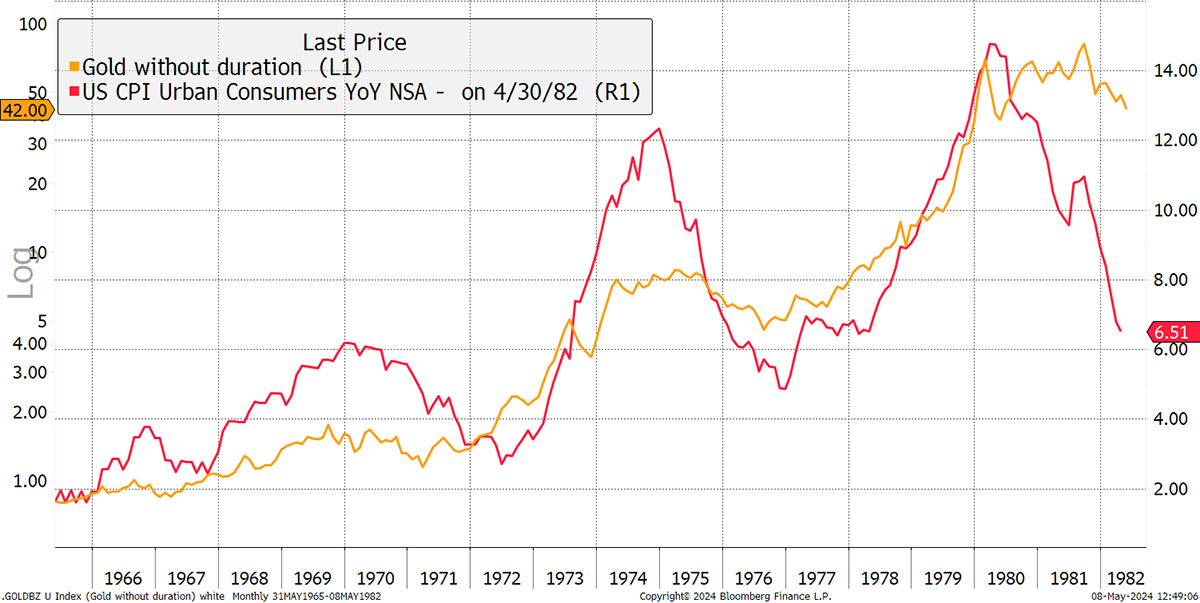

To double check, I’ll take it back another 20 years, where it also fits well during the high inflation period of the 1970s. Moreover, it is a leading indicator for inflation.

Gold (without Bonds) and Inflation – Pre-1982

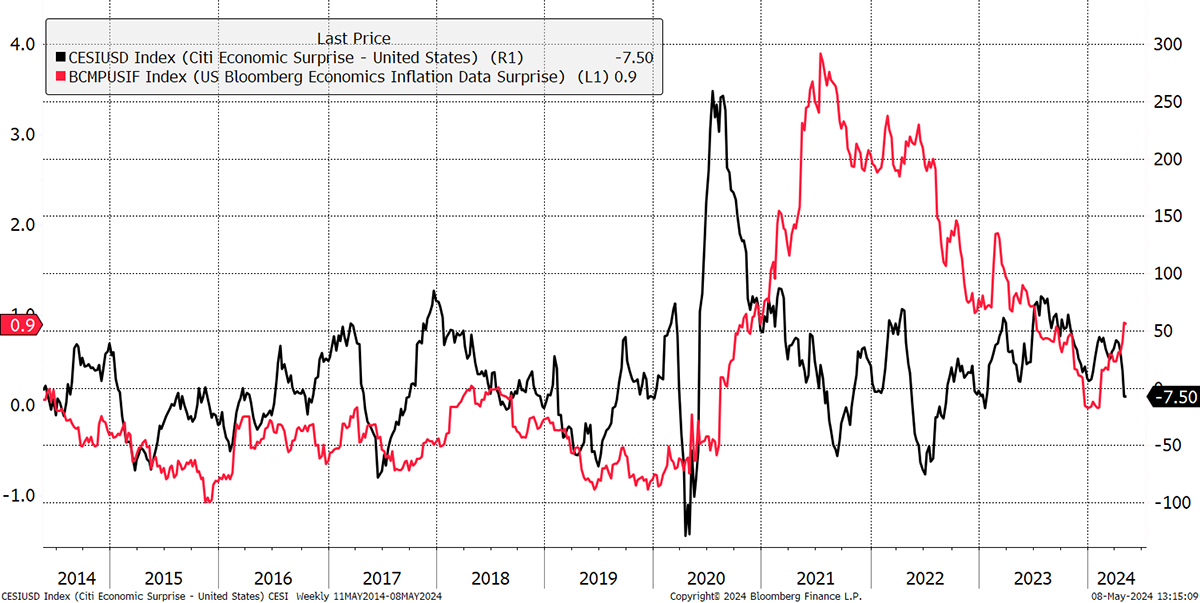

Scroll back up and look at the present; gold has been shrugging off the weakness in bonds and, therefore, suggests higher inflation. I am reaffirming that view because we have just seen this. H/T Callum Thomas.

Economy vs Inflation

It is the first time since late 2020/21 that we have seen a forecast for a slower economy (not yet serious) combined with higher inflation. Gold, copper and wheat confirm it, as does oil. In view of that, I wanted to reaffirm the value bias in the portfolios, which should prove both profitable and resilient when this market regime finally recognises that inflation is not transitory but is here to stay.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd