Crypto Slowdown

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 112;

All the promises of halving that would send Bitcoin to the moon have been empty. Despite strong inflows into the ETFs this year, the price keeps hitting resistance above $70,000. Today, the price is back below the 30-day moving average, and the trend has dropped to a 2/5. Yet, it is still in a longer-term uptrend.

Bitcoin Price

Bad news also comes from the blockchain, where the dollar transactional value has turned down. I don’t know how long this will last, but it appears to be a decisive change. It suggests that we should not be surprised to see a break lower.

Bitcoin Fair Value

My thesis remains unchanged that Bitcoin breaks higher in October, after a summer break. This happened in both 2016 and 2020. It took a six-month break post-halving before the network settled down from the pre-halving hype.

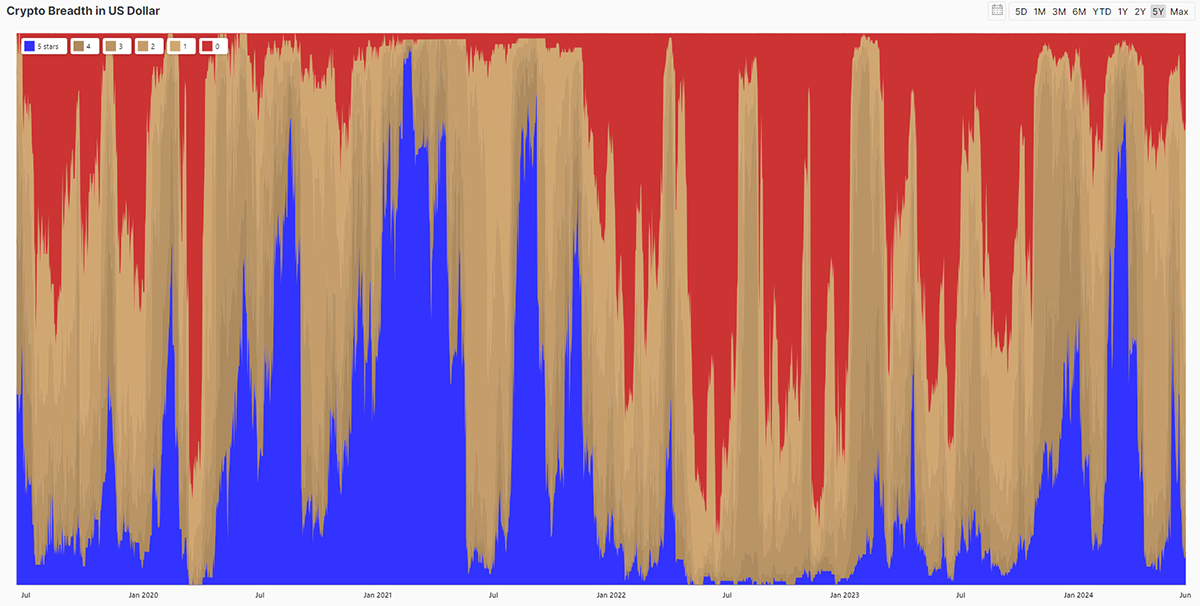

For the tokens, it gets worse. The number of uptrends (5-star trends) is down to 6% in USD and 2.7% in BTC, confirming the space is weak and that alt-season is not around the corner.

Top 100 Token Breadth Is Weak

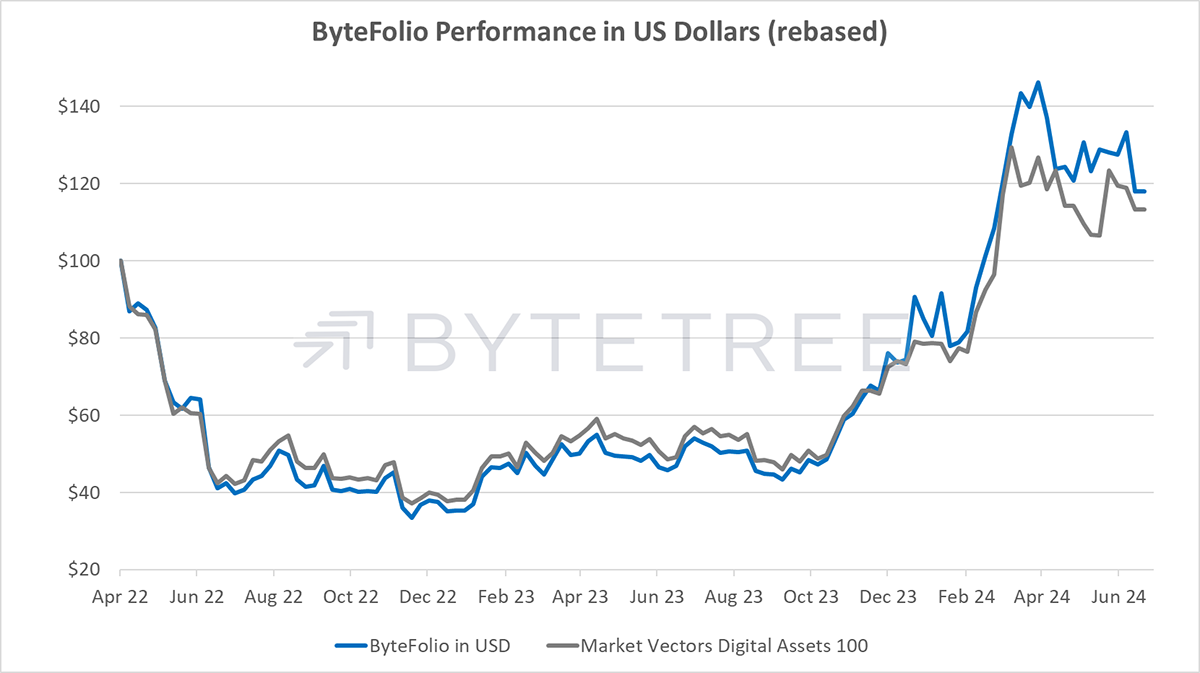

The downside for Bitcoin is probably limited, but ByteFolio will increase exposure in situations where our conviction has waned.