Ethereum ETFs Won’t Match Bitcoin ETFs

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 110;

When the Bitcoin ETFs were launched in the USA, the Bitcoin funds, including Grayscale, held 837,000 BTC, worth $40 billion at the time. Around 622,000 of those BTC were held by Grayscale, and the rest in the non-US ETFs. Grayscale alone held 75% of the total BTC held by funds, which collectively amounts to around 4.6% of the total BTC supply.

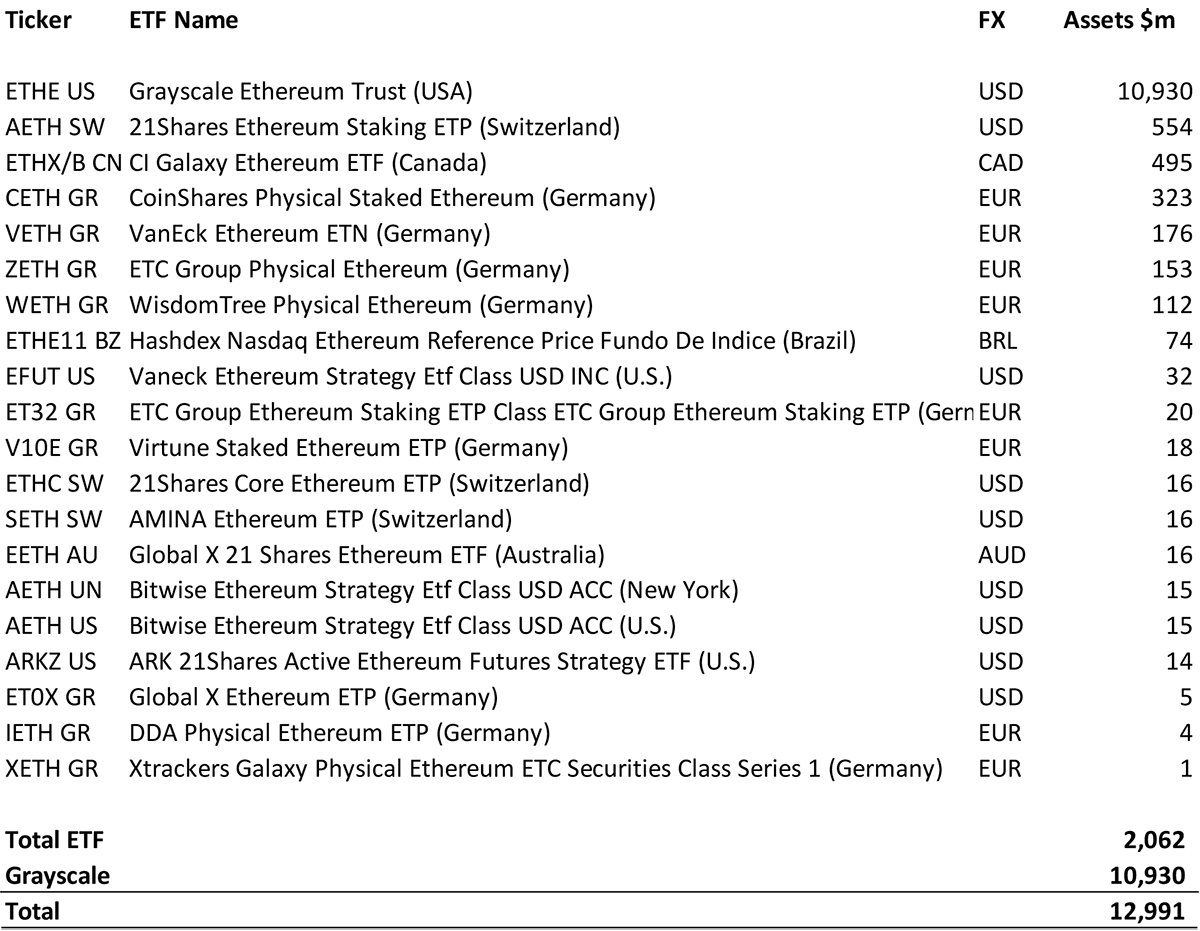

With the Ethereum ETFs soon to launch in the USA, the funds hold just under $13 billion of ETH or 3.4 million ETH. This time, Grayscale holds 84% of the total ETH held by funds, where most of the investment came in 2020. The total ETH held by funds makes up 2.8% of the total supply.

Ethereum ETFs

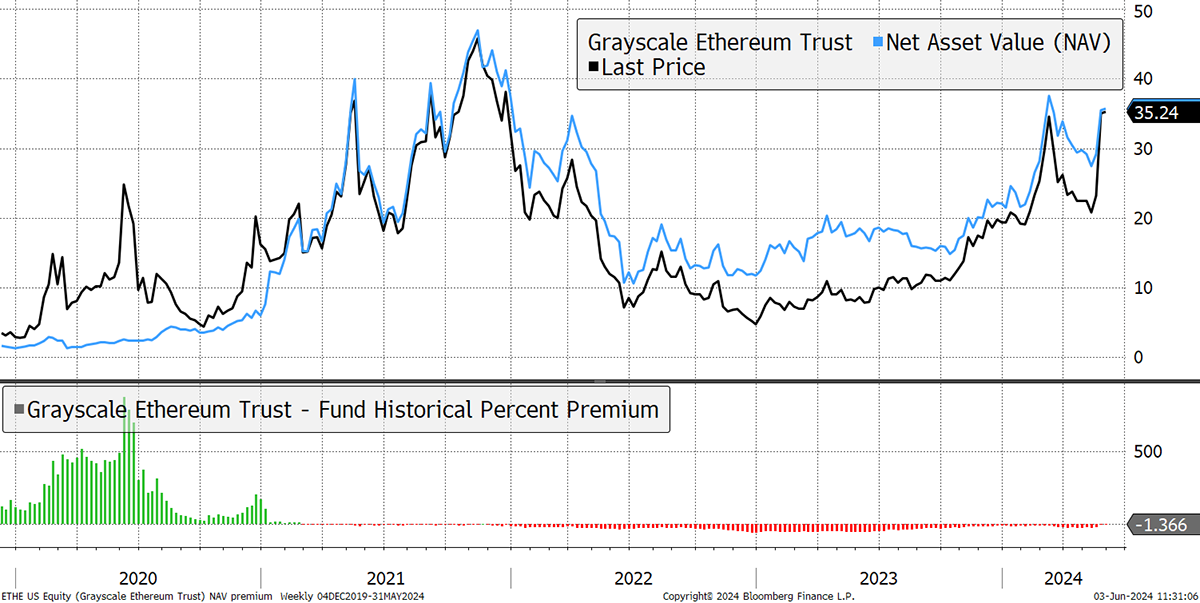

The Grayscale Ethereum Trust (ETHE) traded at a massive premium in 2020, which made it easy for the trust to grow. However, from 2021, the premium turned into a discount, and ETHE never grew again. All the demand went to the ETFs from then on.

Grayscale Ethereum Trust Premium/Discount

For whatever reason, demand for ETH was never that great compared to BTC. ETH funds managed to capture half the share of the network that the BTC funds achieved. Also, the inflows into ETHE were driven by arbitrageurs, just like they were for the Grayscale Bitcoin Trust (GBTC). For whatever reason, the non-Grayscale ETH holdings have been lacklustre.

The US market is important, and ETH ETFs will attract new demand, but I doubt it is anything close to what we saw with the January launch of the Bitcoin ETFs. Global investors have been less enthusiastic about ETH, which they have had access to through Europe and Canada for years. ETH ETFs are great for ETH, but temper expectations.

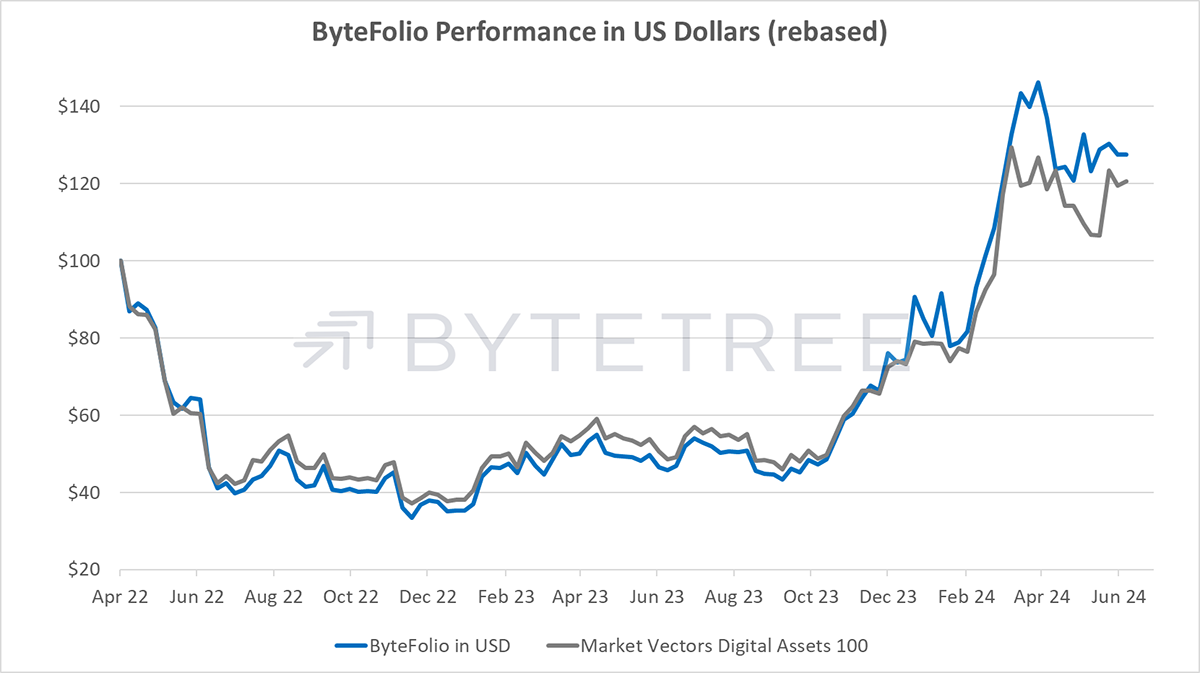

The MVDA Index holds ETH as its second-largest position. We do not, hence the recent narrowing of relative performance. Our views remain unchanged that ETH lags BTC over the long term.