How Undervalued Are UK Small-Caps?

Disclaimer: Your capital is at risk. This is not investment advice.

The leading global value managers are highly focused on UK small-caps because they have been left behind. As a result, we have seen an abnormally high-level of takeover activity as foreign investors and private equity funds snap up once-in-a-lifetime bargains. The UK economy is far from strong but it’s not weak enough to take the blame for the UK market discount.

For that, we look to things like pension fund policy, which in 1992 owned 32% of the UK market. Today? Just 1.8%. There’s also outdated stamp duty on UK share transactions, which has been cut in countries that want more vibrant stockmarkets where business gets done. There’s excessive regulation, which accelerated after the 2008 financial crisis. There are also repeated political dramas, super-taxes for North Sea Oil and Gas, net-zero targets, and the general anti-business agenda. Despite all of this, the smaller UK companies are world-class and ripe with innovation, creativity, and promise.

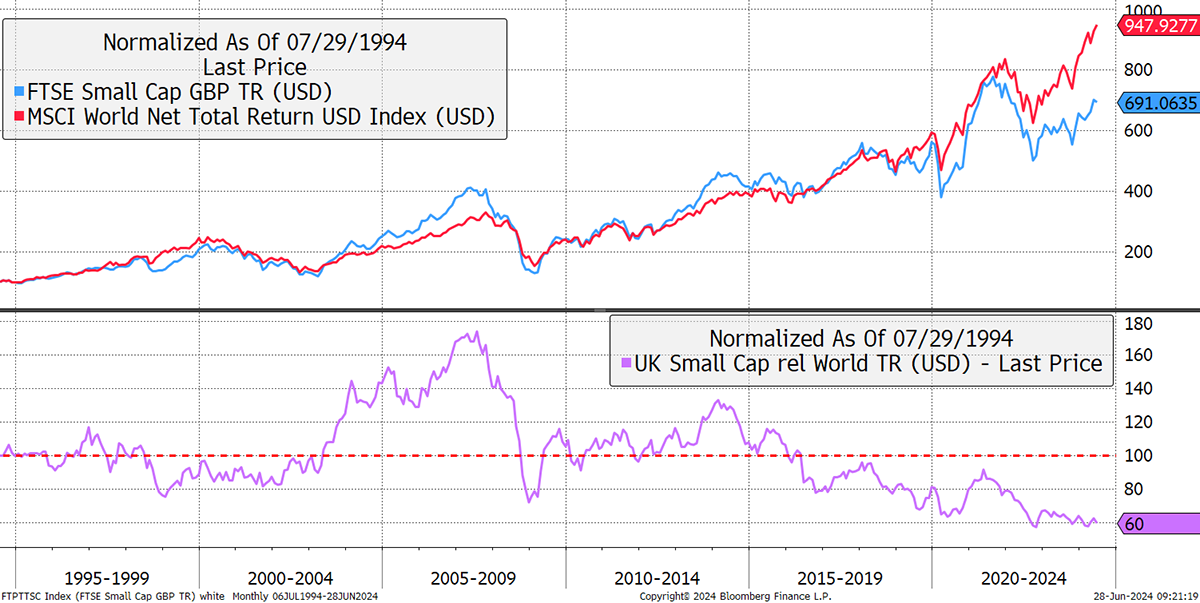

UK Small-Caps Relative to the World Total Return in USD – 30 Years

Having been highly correlated with global equities for three decades, UK small-caps have fallen behind. $100 in the world index back in 1994 would be worth $947 today, and in the UK smaller companies, $691. Over 30 years, they were not supposed to keep up with global equities but smash them. The high point on the purple relative chart was in May 2007 when UK small-caps were 70% ahead of the world over 12 years. Since that time, it has been carnage.

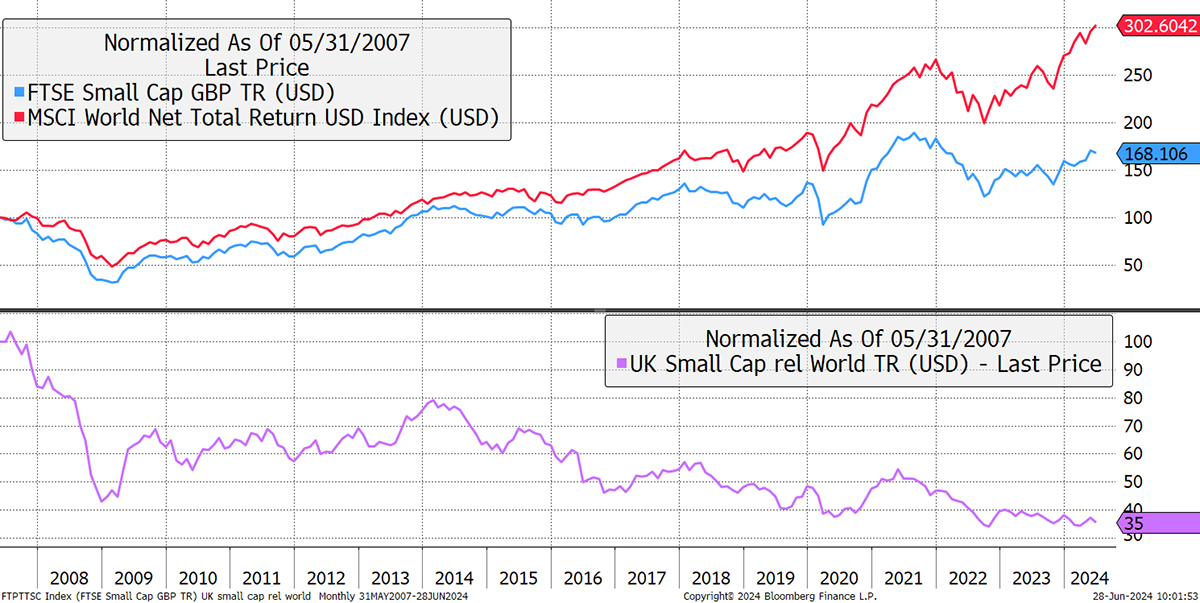

Rebasing the chart to May 2007 shows UK small-caps lagging the world by 65%, which means they need to double to catch up. The good news is that they will, and that’s why the smart money is getting interested. It starts with the smart money, and the big money follows.

UK Small-Caps Relative to the World Total Return in USD – Since May 2007

In the 32nd issue of Venture, I selected a small UK pharmaceutical company that has fallen 68% since 2022 despite growing sales for 20 years in 100 countries and generating strong cashflow. In a rational market, opportunities like this wouldn’t exist.

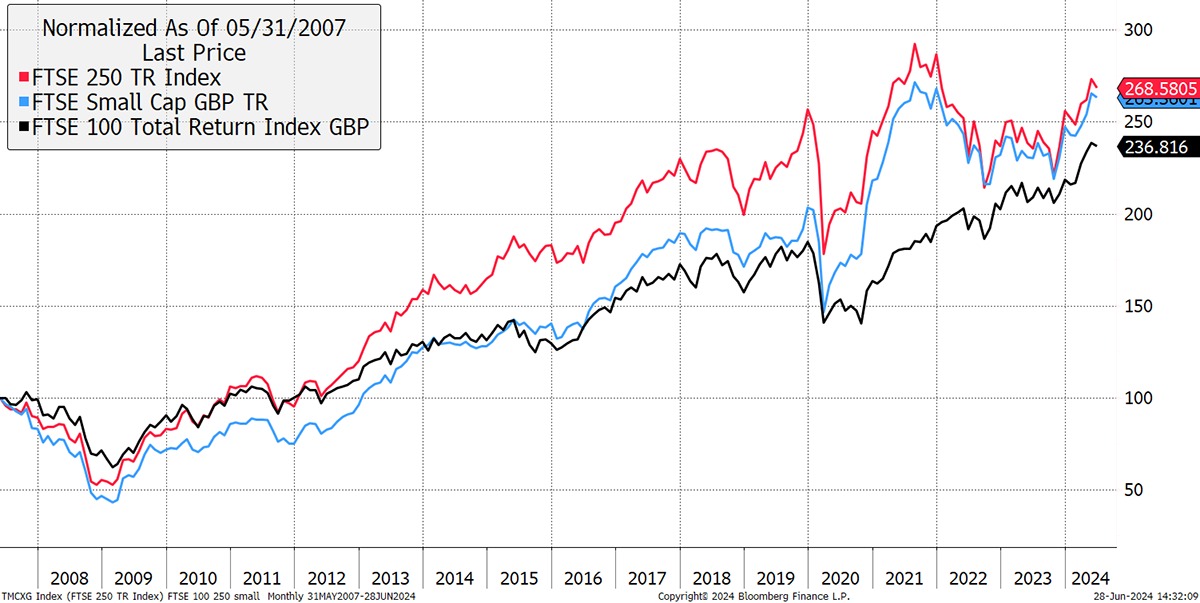

But then we realise it’s not just UK small caps. When we look at UK small, mid and large caps side by side, they have enjoyed remarkably similar performance, which suggests that all UK stocks have lagged the world, not just the small caps. Yet the smaller companies grow faster and should be much further ahead than they are. At least, that is what financial theory suggests should happen.

UK Large, Mid and Small-Caps Total Return Since May 2007

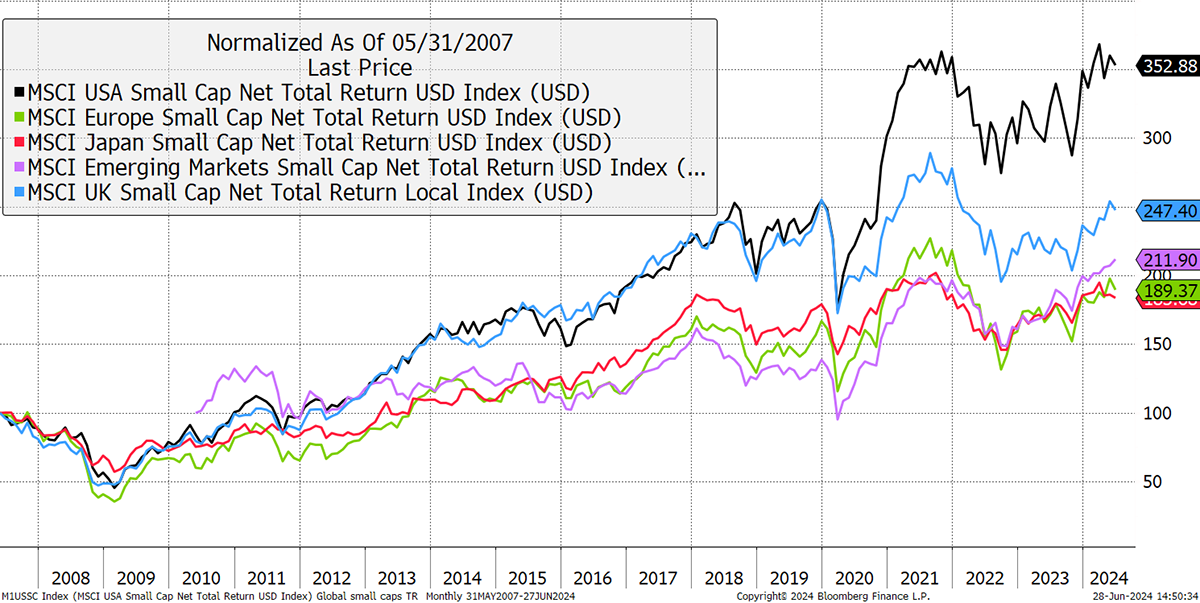

To compare against smaller companies elsewhere, I have used MSCI data for consistency, with dividends reinvested and priced in US dollars. There’s a surprise. UK small-caps kept up with US small-caps from the pre-financial crisis May 2007 peak right up until the pandemic in 2020. The US smalls then ripped, leaving the UK behind. Interestingly, European, Emerging and Japanese small-caps stayed in a tight group for 15+ years. This similarity is remarkable and suggests to me that small caps, in general, will be a market-beating force for years to come.

Global Small-Caps Total Return Since May 2007

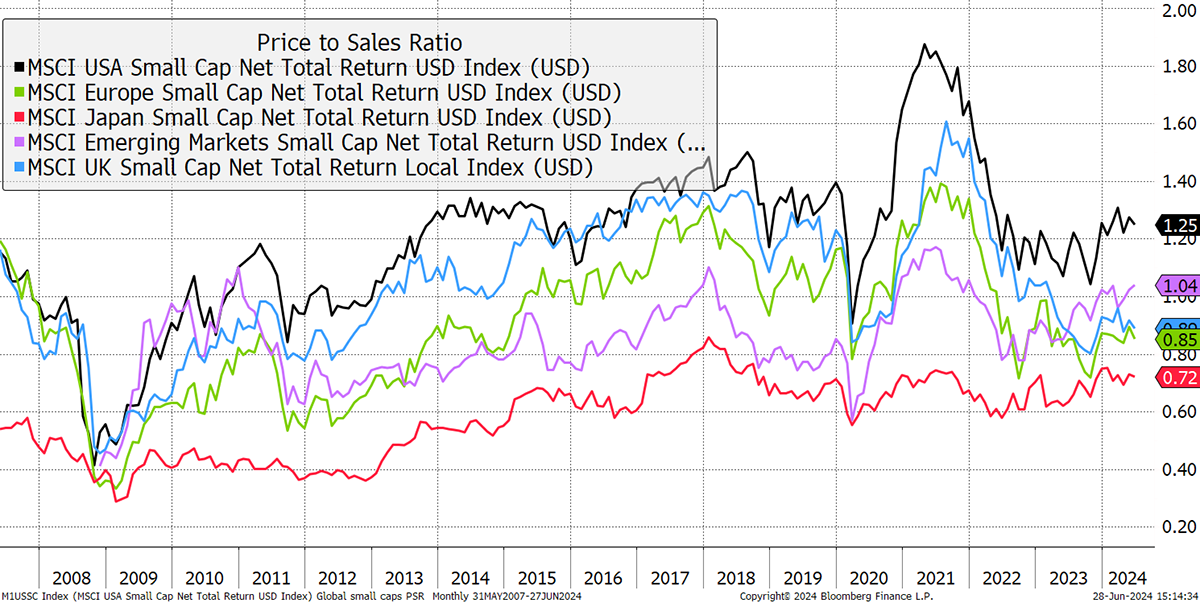

Comparing valuations across regional small-caps isn’t easy, but we can get a pretty good idea by comparing the price the market is willing to pay for sales, i.e. the price-to-sales ratio. UK smalls were up there with the US smalls, which remain lofty. Yet the UK smalls have fallen back down into the general pack. In conclusion, they are too good to be this cheap and deserve to trade at a premium.

Regional Small-Caps – Price-to-Sales Ratio

In recent months, I have shown the regional differences in different ways. What is clear is that the US premium is apparent wherever you look. And, if you believe in financial theory, price is what you pay, and value is what you get. That means, if you overpay, expect to be disappointed; maybe not this week or even this year, but you will be. Value always wins in the end.

A Week at ByteTree

In The Multi-Asset Investor, I added a hedge fund for the first time in a long time. It’s an opportunity that is underpriced and too good to be missed.

In The Adaptive Asset Allocation Report, Robin and Rashpal clung onto the US equity rocket. They are unashamed momentum investors and don’t give a monkey about value because they don’t mind changing direction at any time. In other words, at some point, they’ll be jumping off the rocket. Yet they are concerned about volatility in certain areas and readily admit that the big technology stocks are very clearly in a bubble. They wrote:

“Investors looking for diversification to their equity holdings are better off holding Gold over bonds. Gold bullion is the only commodity ranked amongst the Strongest Ranked assets in the AAA Model, highlighting that it is not being viewed as a commodity but rather as a store of value.”

ByteTree doesn’t need to be convinced about gold.

Crypto featured heavily this week. In Token Takeaway, Ali covered Arweave (AR), a decentralised Web 3.0 project that allows you to store your digital data indefinitely for a single up-front fee. This project is one-of-a-kind, and its native token, AR, is central to the platform. The AR token performance in USD shows a recent downtrend, reflecting the overall crypto market downturn that we mentioned in ByteFolio.

There was also an ATOMIC on Bitcoin. I went over the reasons for the recent price weakness and reminded readers that Bitcoin likes Hot Money. That is, it tends to be more buoyant when rates and inflation are high. Given they are currently both cooling, the price has eased back. Not to worry, the bulls will have their moment in “Uptober”.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()