Merryn Talks Money

Disclaimer: Your capital is at risk. This is not investment advice.

Merryn Somerset-Webb, the founder of Money Week in 2000, and along with her colleague, John Stepek, now work at Bloomberg. She has an excellent podcast, Merryn Talks Money, and last week I was their guest. I was joined by Alex Chartres from Ruffer, for their first live event to discuss the controversial subject of Bitcoin and Gold.

For many years, at the end of the interviews, Merryn has been asking her guests to choose between Bitcoin and Gold for a ten-year investment. Unsurprisingly, most say gold, and fair enough as it is well-established and less risky. Some answer Bitcoin, which generally comes as a surprise, especially when the guest is over 40, but it happens.

Alex Chartres is a fund manager at Ruffer and writes thought-provoking pieces in the Ruffer Review. He gave a good summary of where we are and why portfolios should embrace alternative assets. One good reason is that equities and bonds have become correlated, and so alternative assets are a must to achieve diversification. He sits in the gold corner, but didn’t object to Ruffer’s legendary Bitcoin trade in 2020.

That trade was a masterstroke, making billions of dollars for their clients, but it was controversial. It was said that in the client meetings that followed, Bitcoin was the only subject that came up for months on end.

I was excited by the announcement because, at the time, I believed it would lead to widespread Bitcoin adoption across the UK wealth management industry. But it didn’t, as the FCA imposed a ban on Bitcoin exchange traded products (ETP, ETF etc.) soon after Ruffer’s trade hit the newswires. That soon put a stop to the UK becoming the crypto capital of the world, as Rishi Sunak had hoped. The price of Bitcoin back then was a little over $10,000. Today, it is $67,000. It is a shame that opportunity was missed.

It was a vibrant discussion, with moments of laughter, and the audience was delightful. There were several ByteTree clients, and I thank them for their support. You’ll find the Merryn Talks Money Podcast here. I hope that this interview will help more people learn that Bitcoin and Gold should not be a choice, but a combination. That is why I created the BOLD Index.

A Week at ByteTree

The beginning of every month comes the BOLD Rebalancing Report, which explains how and why the weights change for the following month. With Bitcoin up 13% in May, and Gold up 1.8%, there was a modest reduction of Bitcoin, which was added to gold. Many of you will understand how this works, but if you don’t, please have a look at the note or watch the webinar I did with Alex Pollak from our BOLD partner, 21Shares AG.

There were two notes in Venture last week, one in hydrogen, which the International energy agency sees booming in the coming years. Hydrogen can be made from water, using electricity, and once spent, the only emission is water vapour. Toyota has been researching this space for the past three decades and is committed. Hydrogen will catch on, and this is a stock to own.

The other note referred to a UK property developer. It has a strong balance sheet and is significantly undervalued with an extensive landbank and a rich history.

In The Multi-Asset Investor, I looked at the value in Hong Kong Property. Hang Lung (10 HK) trades at 12% of book value with 23% gearing and a 10% dividend yield. We understand how it got there, but presumably the next upturn will be the chance of a lifetime.

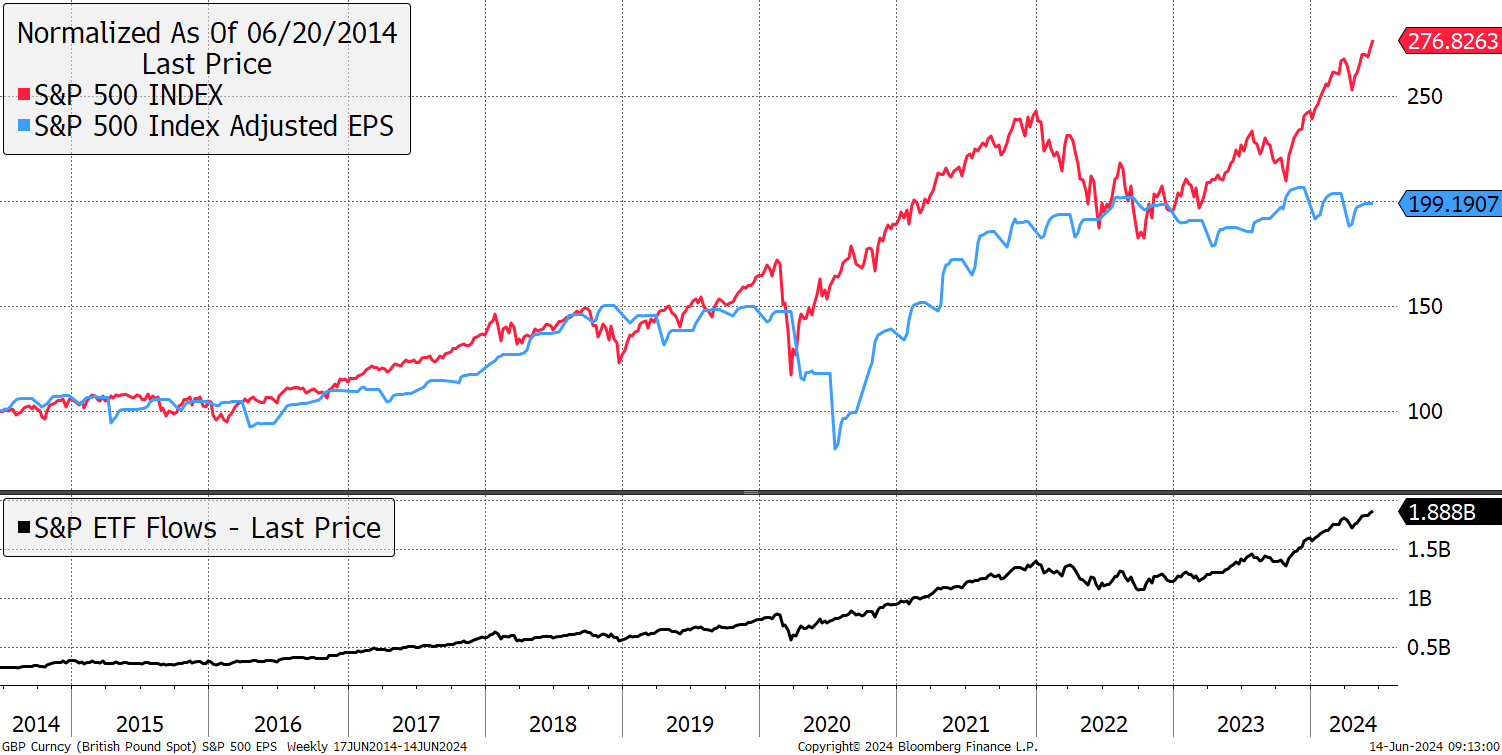

I also looked at the S&P 500 and its top four ETFs which now manage $1.9 bn. The flows are unprecedented as active investors have seemingly thrown in the towel and just bought the index. There can be little doubt that it’s a bubble of historical proportions. We know that because US large caps are still rising while profits have not followed. Furthermore, the rest of the world has been left behind.

Prices Up, Profits Flat

In crypto, the analysts look at Arweave, a decentralized service for cloud computing, and yet another real-world application that crypto intends to disrupt.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()