69 Days ‘til Uptober

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 99;

Bitcoin mining farms are vast sites that are capable of producing many million trillion hashes per second. The same NVIDIA GPUs used in crypto mining are also used for AI processing, making them high in demand and difficult to come by. Rather than going through the lengthy and costly process of building their own sites, the big tech companies have opened the doors for partnerships with Bitcoin miners.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Technicals | Uptrend Restored |

| On-chain | Turned Up |

| Investment Flows | Bullish ETF flows but some exceptional supply |

| Crypto | Bitcoin Miners Diversify into AI |

| BOLD | Resilient |

Following a soft patch since March, Bitcoin is recovering once again. The weakness was caused by excess pre-halving hype, which always cools off. More recently, we have rears over heavy selling as the Mt GOX customers received their confiscated Bitcoins last seen in Japan in 2014. The dumping didn’t materialise but then came the Germans. Confiscated booty by law enforcement built up a stash of €3 billion, and it was time to cash in. Bitcoin seemed to shrug it off. The Bitcoin bears should acknowledge that is a much more liquid market than the sceptics think.

Technicals

Over the month, Bitcoin has bounced back above $65k, turning the 30-day moving average (green) positive and bashing the 20-day max lines. Bitcoin is back in an uptrend, but the resistance at $70k remains in place.

Bitcoin 5/5 trend score

It might manage to break out this time, but regular readers know that we might have to wait until October. That’s the most reliable month for Bitcoin surprises, especially in having years.

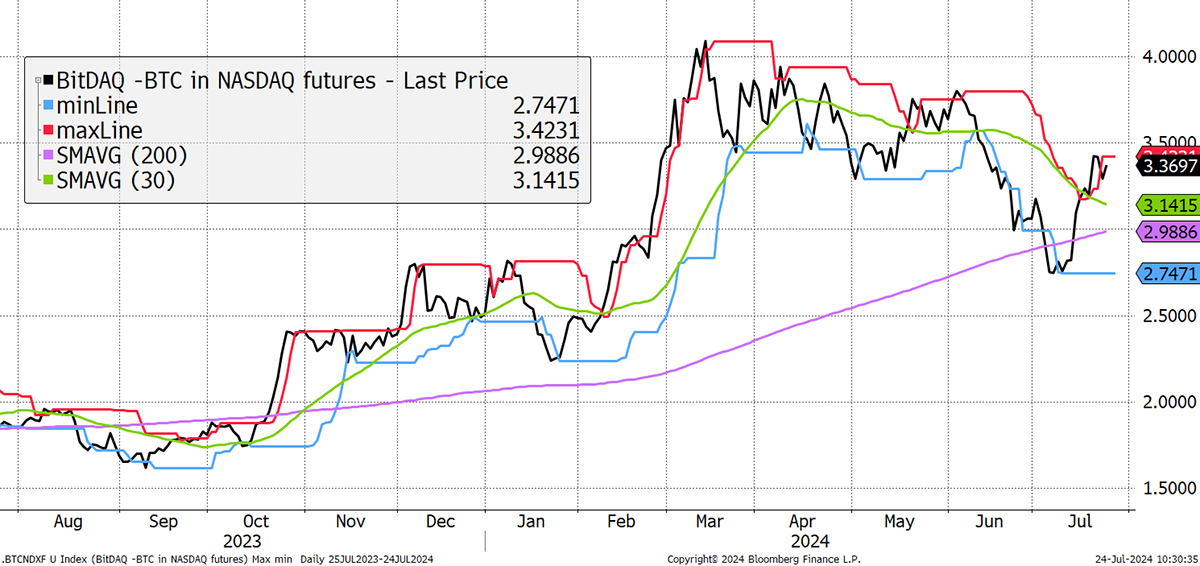

Another positive is Bitcoin’s revival versus the NASDAQ. The 30-day (green) moving average is still negatively sloping, but the rest of the chart looks good.

BitDAQ

That said, looking at BitDAQ over the long term, the previous all-time high from the heady days of 2021 still needs to be broken. If that happens, expect to see gazillions of dollars parked in tech stocks shift over to Bitcoin. As I said, if it’s going to happen, October would be my bet. It only requires a relative 34% move, which could plausibly come from a mix of Bitcoin strength and tech slippage.

BitDAQ – Long-term

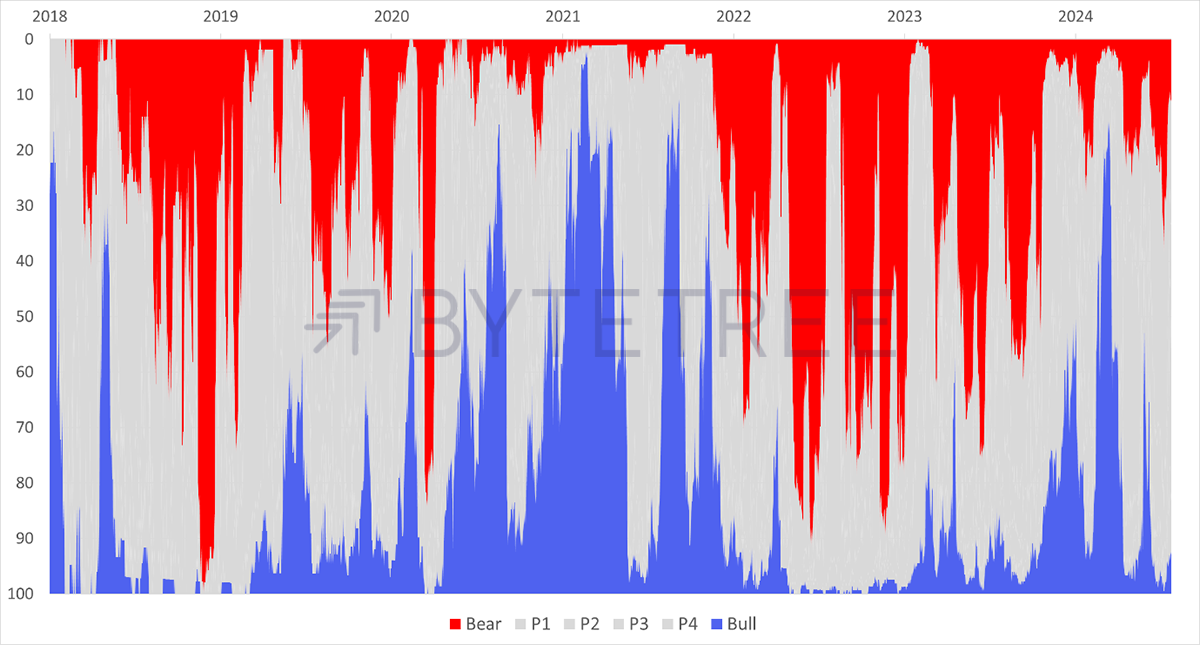

Moving to the crypto sector, there are an increasing number of (red) downtrends creeping into the mix, which point towards general market malaise in not only crypto, but asset markets in general. At the same time, there are fewer uptrends (blue).

Crypto Breadth in US Dollars

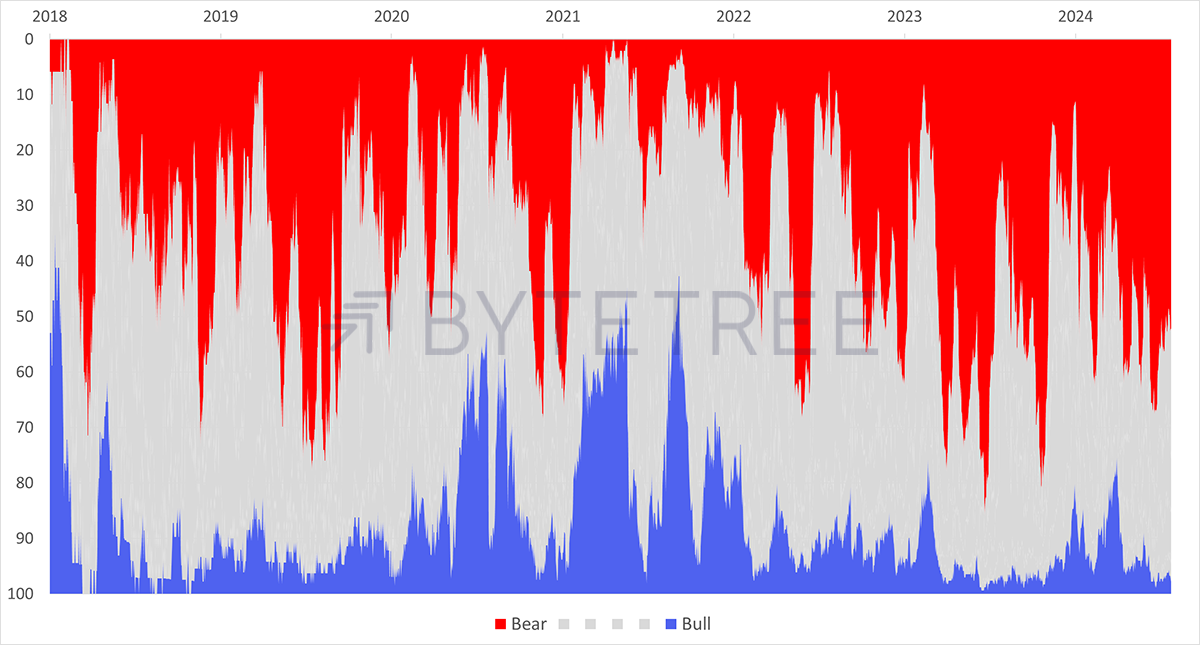

Looking at that same breadth data but measured in BTC, there is no question that these last few years have deepened Bitcoin’s dominance. That means Bitcoin keeps on winning but leaving the tokens for dust. Very few tokens (blue) can manage an uptrend when measured in BTC, but half of the top projects consistently lag Bitcoin (red).

Crypto Breadth Remains Weak

It is a reminder that while altcoin rallies are fun while they last, it is a challenging place for investors to operate.

Investment Flows

The big news yesterday was the launch of the US Ethereum ETFs, the second-largest crypto token. There’s not much to report yet, but iShares Ether (ETHA) manages $277 million (presumably some seed capital) with $129 million of shares traded yesterday. The Grayscale Ethereum Trust (ETHE) also converted to an ETF and lost 6% of assets worth $500 million. Little wonder ETH is failing to rally against BTC.

ETH in BTC

In June, I explained why the ETH ETF launches didn’t get us excited, and that remains the case.

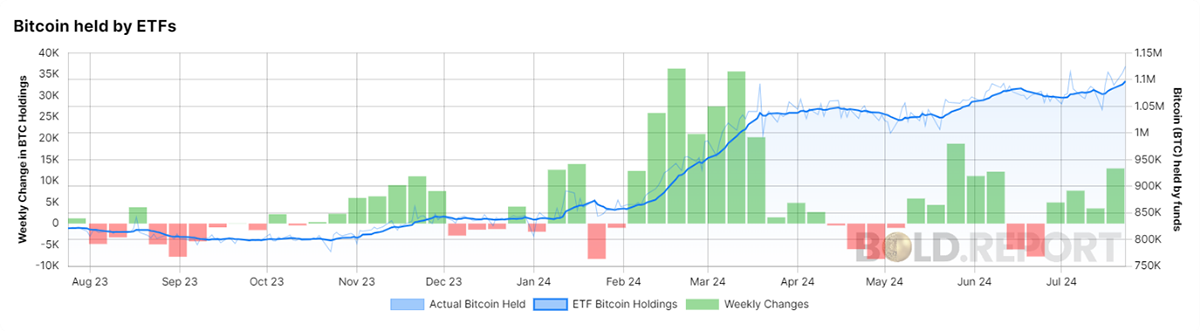

Back to Bitcoin, which is the macroeconomic trade, and the flows are looking good. With four weeks of inflow and 1.1 million BTC held by ETFs around the world, that’s a hoard worth $75 billion. Keep up these inflows, and the breakout to an all-time high will happen soon.

Bitcoin Held by ETFs

On the other side was a month of unusually high supply. There were sales by the German government, which has over $2 billion of Bitcoin collected through law enforcement. Apparently, governments around the world have been HODLing like bandits. From time to time, law enforcement bumps into crypto because it’s a bad idea for criminals, and when that happens, their stash grows. According to Bitcoin Treasuries, government Bitcoin holdings now amount to 517,414 BTC, which is half as much as the world’s ETFs.

On the subject of Mt Gox, the lawyers released 47,228 BTC onto the market from a total of 138,985 BTC held on behalf of creditors. That’s nearly a year’s supply, which got the market into a spook. Going back to the early days, Mt Gox was the world’s leading Bitcoin exchange, handling 70% of all transactions.

In 2013, the Bitcoin price on Mt Gox traded at a 20% premium to other exchanges, such as Bitstamp, because they stopped allowing cash to leave the system. Investors on the Mt Gox exchange would overpay for Bitcoin so they could get their money out. But the exchange kept losing Bitcoins to hackers. Money was heading for the exit, and eventually, it imploded. Mt Gox filed for bankruptcy in February 2014, having lost 950,000 BTC due to hacking. Some were later recovered, and the Mt Gox wallets still hold 138,985 BTC on behalf of creditors.

Bitcoin 2010 to 2014

The fact that the Bitcoin market can absorb this supply is impressive, and no one should doubt the depth of liquidity. Either that or it’s the best-managed Ponzi scheme there ever was.

On-chain

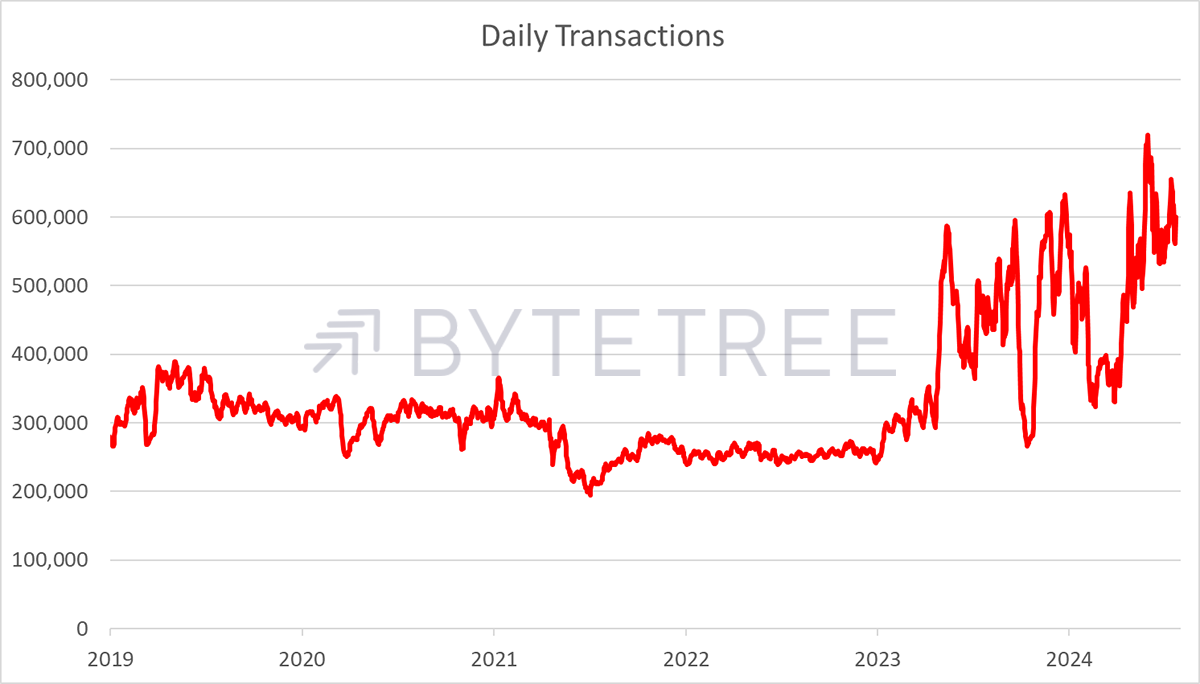

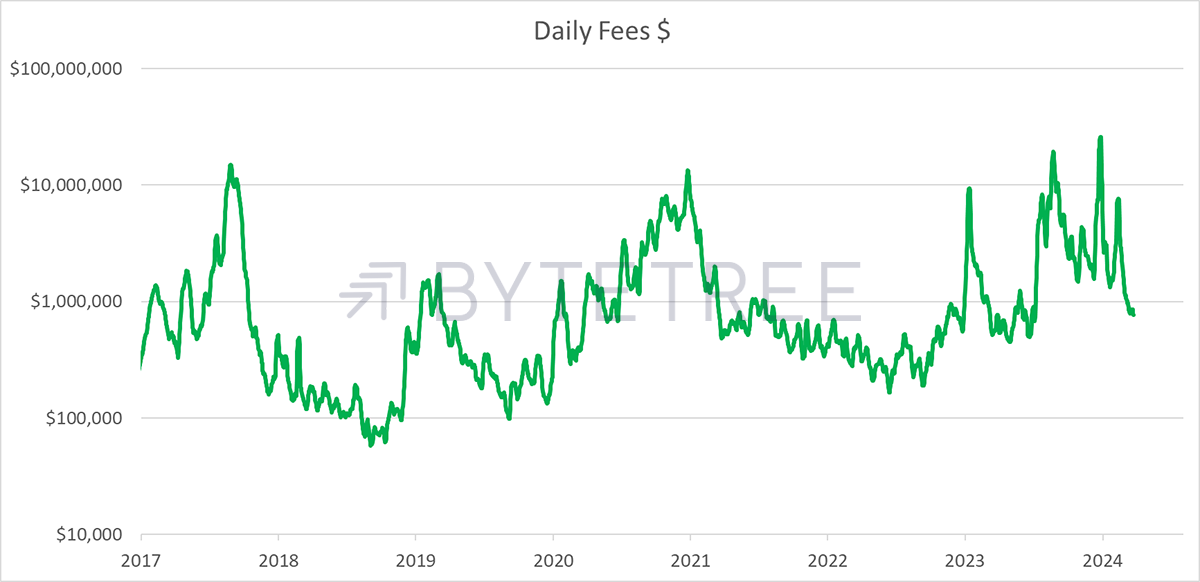

The Bitcoin Network Demand Model scores 1/4, which is soft but recovering from a recent pullback. Transactions seem to be doing well.

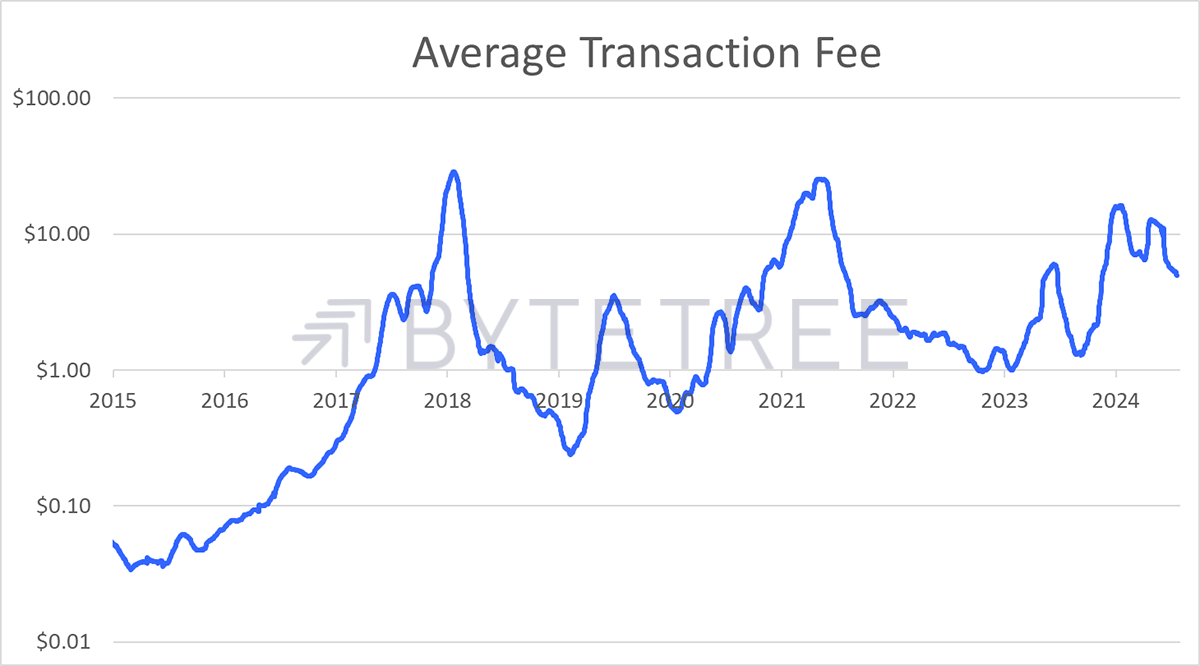

But fees are falling despite buoyant transactions. Fees used to be the single most effective metric for predicting the Bitcoin price, but software upgrades have led to changes, which has made fees fickler. In the long term, we need to keep the fees down to boost the network, but against that, we need to feed the miners. With the block reward halving every four years, something will have to give in the years ahead. Nothing to fear because there are choices, and having observed Bitcoin for over a decade, they always seem to do the right thing in the end.

At least the average transaction fee remains mid-range because excessive fees can choke off the network.

The number I consider to be the best these days is the network size, which measures the number of dollars changing hands over the network. It has turned up again, which is bullish. October, here we come.

ByteTree Bitcoin Network Fair Value

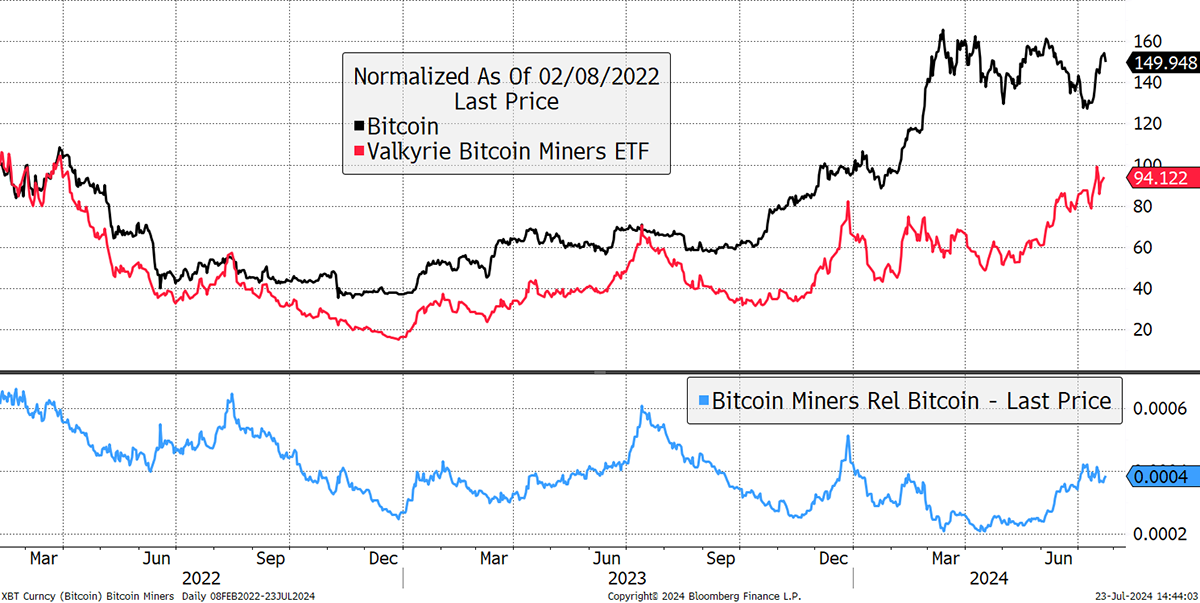

But we need the miners and fortunately these companies have started to outperform Bitcoin. On the face of it, their revenue has just halved, so you’d think they might be in trouble, but perhaps not.

Bitcoin and the Bitcoin Miners

Bitcoin Miners Diversify into AI

By Laura Johansson

Bitcoin mining is a tough business: the competition is fierce, the Bitcoin price is volatile, and hardware can be tough to come by. That’s without even mentioning the two built-in features that make Bitcoin mining challenging by design: difficulty and halving. There was a time when anyone could mine bitcoin from their home computers. In crypto time, that might as well have been aeons ago, and today, the high-risk, high-reward game is only reserved for the top players.

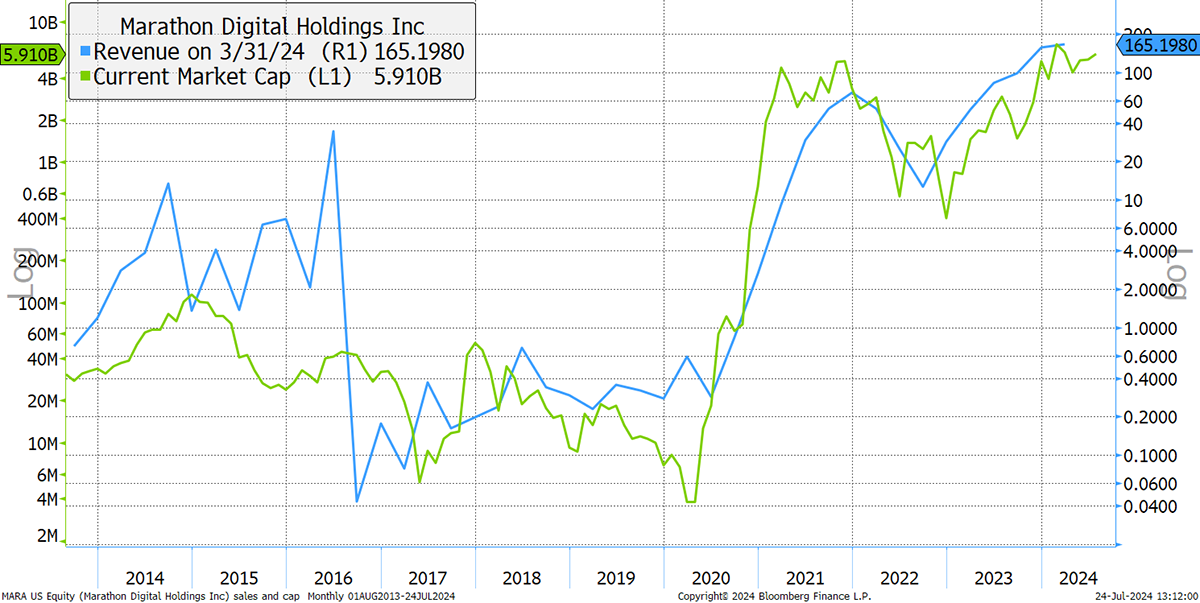

Marathon Digital Holdings (MARA) is a US-based Bitcoin Miner that is at the top of the ranks with a current market cap of $6.12 billion.

Marathon Digital – Sales and Market Cap

According to their Q1 2024 results (Q2 2024 results are due on 1 August), MARA reported a record $165.2 million in revenue, which is up by 223% versus Q1 2023, when the Bitcoin price was hovering between $16k and $30k. Diversifying income streams is key for surviving crypto winters, upcoming Bitcoin halvings, and the rapid emergence of AI has presented a new opportunity.

Bitcoin mining farms are vast sites that are capable of producing many million trillion hashes per second. The same NVIDIA GPUs used in crypto mining are also used for AI processing, making them high in demand and difficult to come by. Rather than going through the lengthy and costly process of building their own sites, the big tech companies have opened the doors for partnerships with Bitcoin miners.

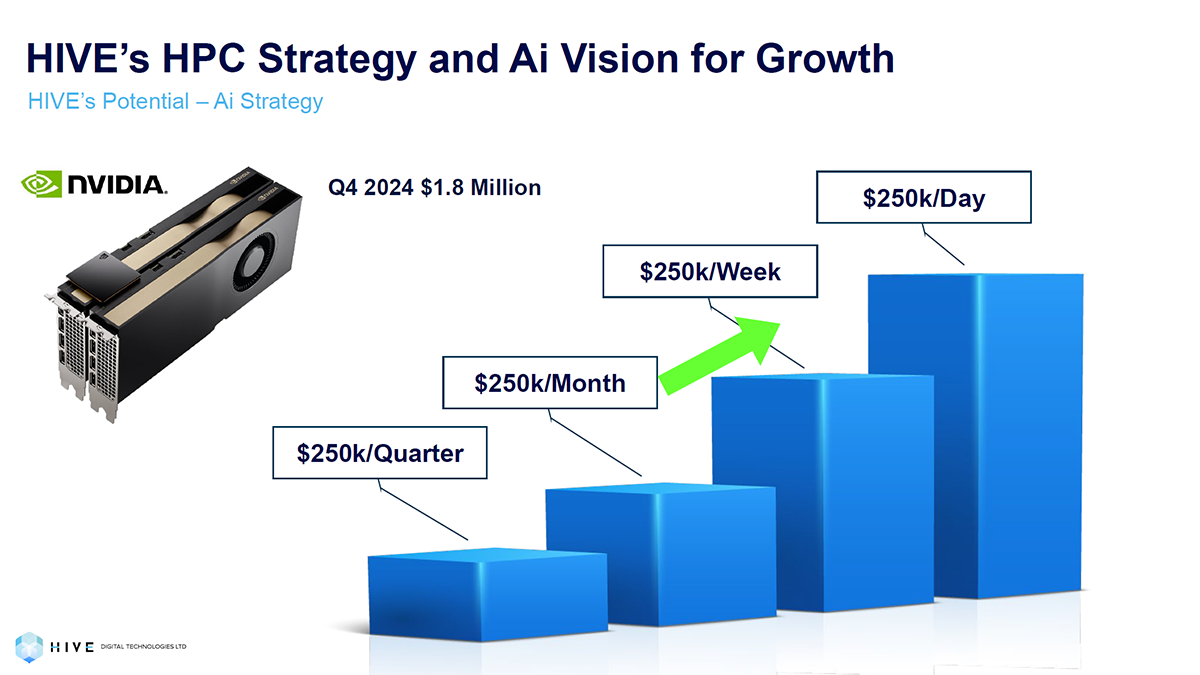

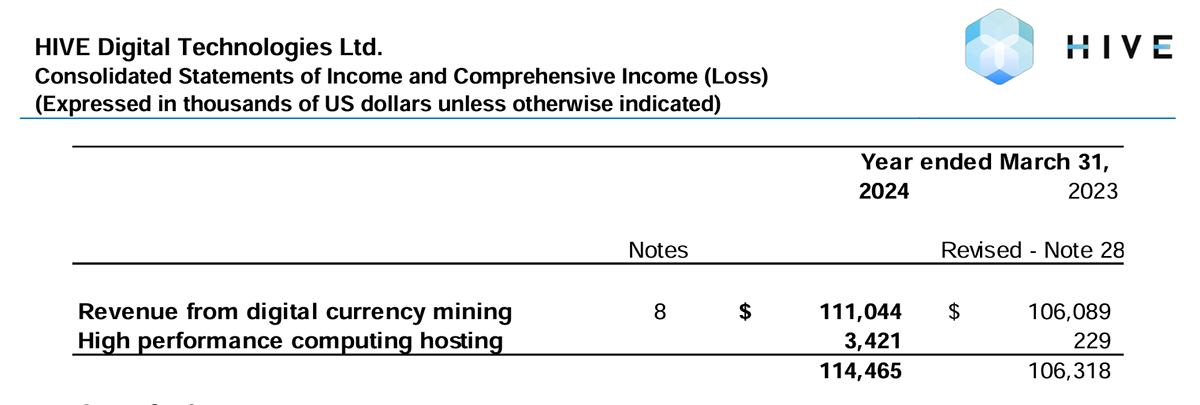

According to a recent article by The Financial Times, Core Scientific, which is currently the 6th largest Bitcoin miner by market capitalisation, is ”aggressively pursuing” AI contracts. They are not alone, as Canadian miners Hut 8 and HIVE have also pivoted more into AI. Last year, HIVE underwent a company rebranding and changed its name from HIVE Blockchain Technologies Ltd to HIVE Digital Technologies. While their main focus will remain on Bitcoin mining, they are particularly keen on getting a foothold within High Performance Computing (HPC) and AI.

HIVE’s Q1 2024 results revealed that their HPC hosting revenue was marginal compared to mining revenue, but admittedly, it is also in its very early stages.

Bitcoin mining will only become ever more competitive, and diversifying their income stream is a sensible survival strategy. AI is still an emerging field, and it is difficult to say whether it will prove sustainable in the long term. But for the Bitcoin mining industry, it’s a must, or else the next crypto winter will be littered with bankrupt miners.

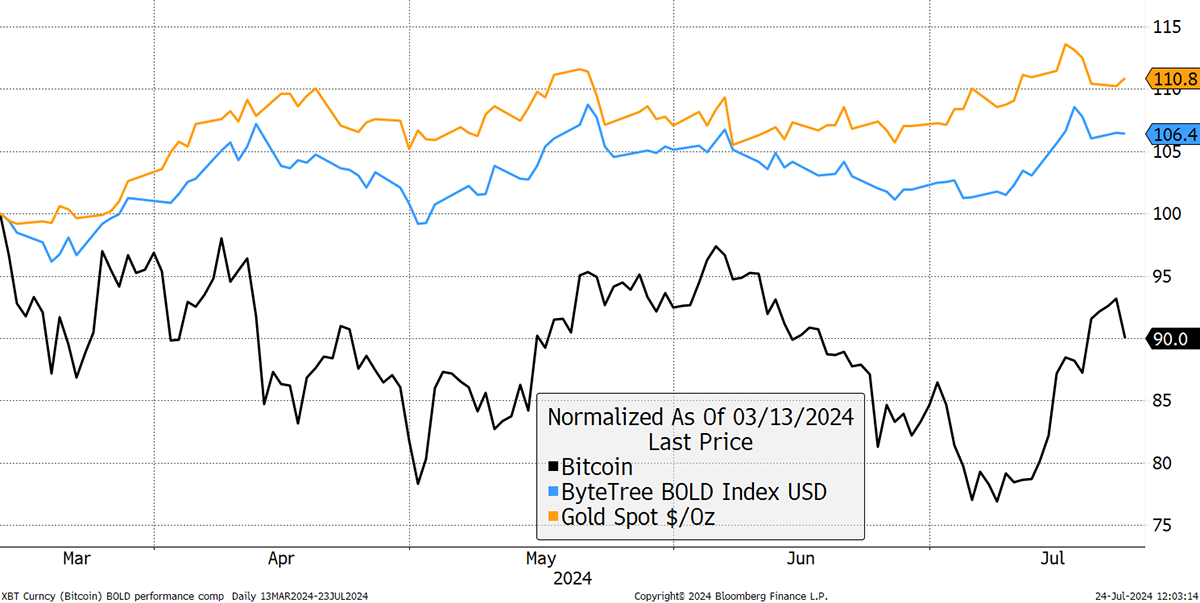

BOLD in a Storm

The recent Bitcoin high occurred on 13 March. Since then, it has slipped 10%, while Gold is up 10.8%. It’s just another demonstration of how holding BOLD is a very gentle way of having exposure to these spectacular assets. Bitcoin and Gold are natural partners.

BOLD Beats

If you would like to learn more, please have a look at BOLD.Report.

Summary

The post-having stall is with us, but this is the first time we can say that Bitcoin is in the mainstream. Whether they like it or not, governments own it, and sooner or later, institutional investors will do too.

HODL, or should I say BODL.

Charlie Morris is the Editor and Creator of ATOMIC. Fascinated by the emergence of a new asset class, but unsure how to make sense of it, he started to analyse the Bitcoin blockchain in 2013.

Charlie has 25 years of fund management experience and is a pioneer of multi-asset investing. At HSBC Global Asset Management, he launched the Absolute Return Service in 2002, which grew to over $3 billion. Much of that success came from moving away from the crowd and embracing a wider range of asset classes that traditional investors were not familiar with at the time.

We very much welcome your comments and feedback. Help us improve our service by contacting us at atomic@bytetree.com.

Comments ()