The share price chart for META (META) is one for the history books. The stock collapsed in 2021 from a record valuation as the market moved into an advertising downturn and rejected META’s heavy investment in the metaverse. It was a brutal move. The company slashed costs and remarkably, META made a new high. Today it spends money on AI instead.

The META Surge

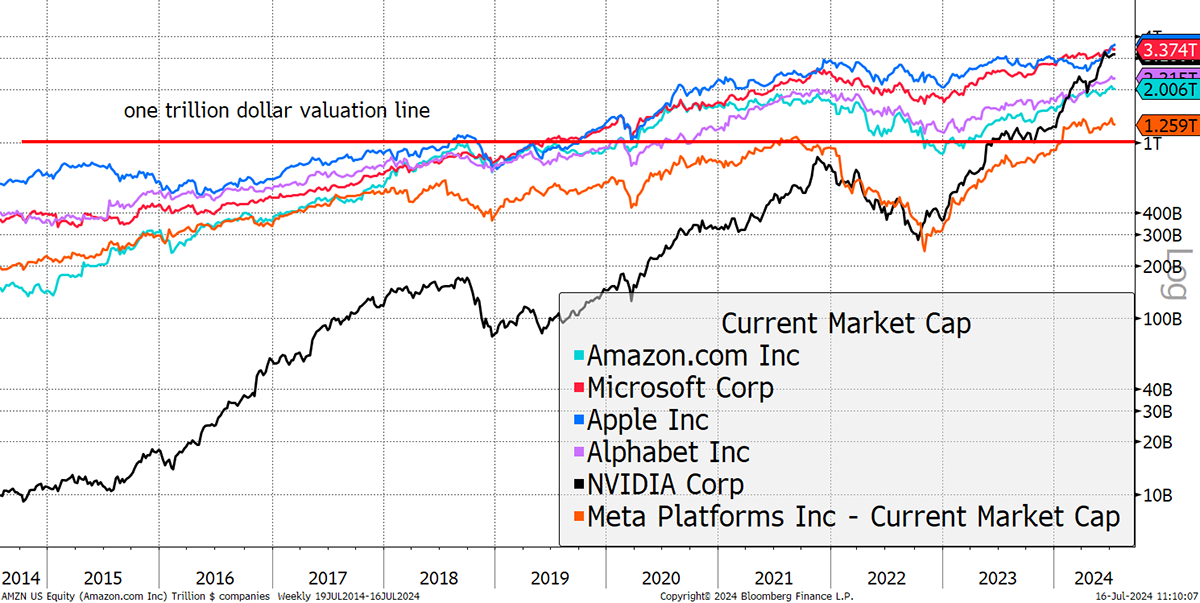

I mention it because META is valued at $1.26 trillion, and before 2018, there were no companies with a trillion-dollar valuation (excluding Saudi Arabia’s Aramco). META made it to a trillion, collapsed back to $250 billion, and then pulled itself back above the line. It is impressive, although you can’t ignore how the company had $39 billion in cash flow last year yet paid $14 billion in employee stock compensation, which comes on top of wages. Nice work if you can find it.

The Trillion Dollar Club

You’ll already know that I believe investors buying these stocks will come off badly because something has to break. I have always felt that would be the great rotation, a similar event to what we saw in the 2000 to 2003 era. At that time, the market sensed that things could not get any better, and they didn’t. And when they got worse, the market took no prisoners.

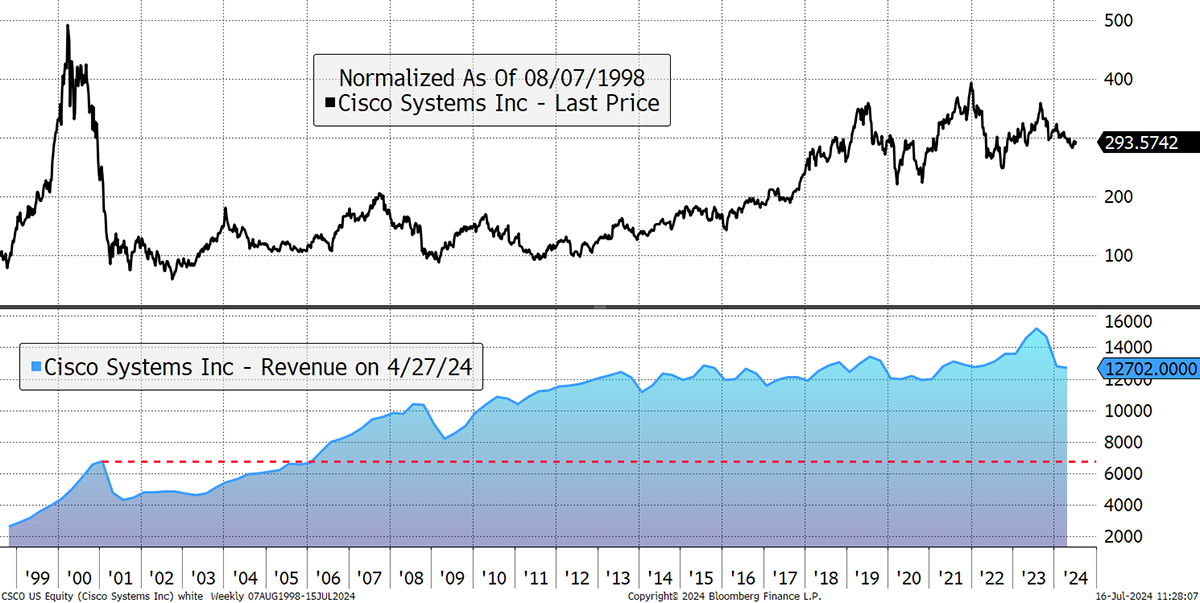

Today’s star stock is the AI chip maker Nvidia (NVDA), but 25 years ago, it was the server maker Cisco (CSCO). The chart starts in 1998 with the shares rebased to $100. They rise to $500 before collapsing back below $100. See how the share price peaked a year ahead of the sales (revenue). The sales didn’t make a new high until 2005, and to this day, they have grown at just 2.7% p.a. from the 2000 peak. And the shares? They are still 40% lower after 24 years.

Cisco – The End of an Era

It’s a similar story for Intel (INTC), except the sales grew by just 1.6% p.a. post-2000, and the shares are 54% lower to this day. It is remarkable how destructive bubbles can be.

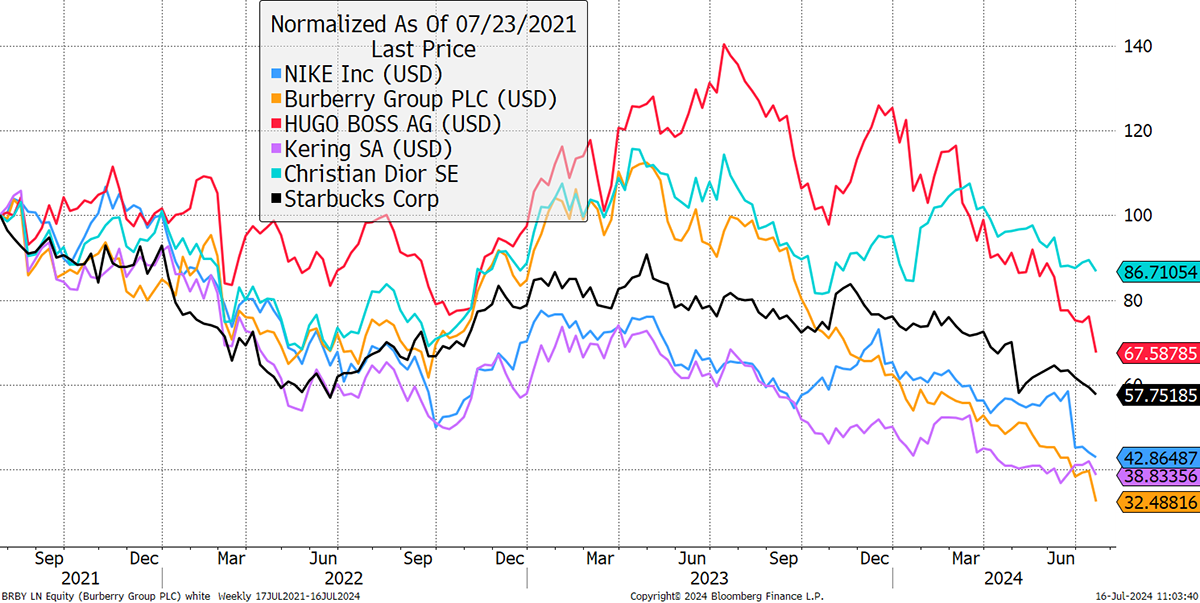

You may have seen the headlines for Burberry (BRBY) this morning, where the CEO was replaced after just two years. BRBY shares are down 71% since their peak last year. I looked at it in detail two years ago but couldn’t understand why the market was prepared to pay such a high valuation for a company with flat revenues for the past eight years.

But BRBY isn’t alone. In the chart below, I show it alongside other premium consumer stocks, such as NIKE (NKE), HUGO BOSS (BOSS Germany), Kering (KER France), Christian Dior (CDI France), and not-so-luxury but similarly overpriced products, Starbucks (SBUX). My simple conclusion from this is that the consumer is feeling the pinch.

Consumer Stocks Under Pressure

By the way, I could have added Chipotle Mexican Grill (CMG) to the list, which is now weighing on Pershing Square (PSH LN), which we recently sold. If you haven’t done so, please do.

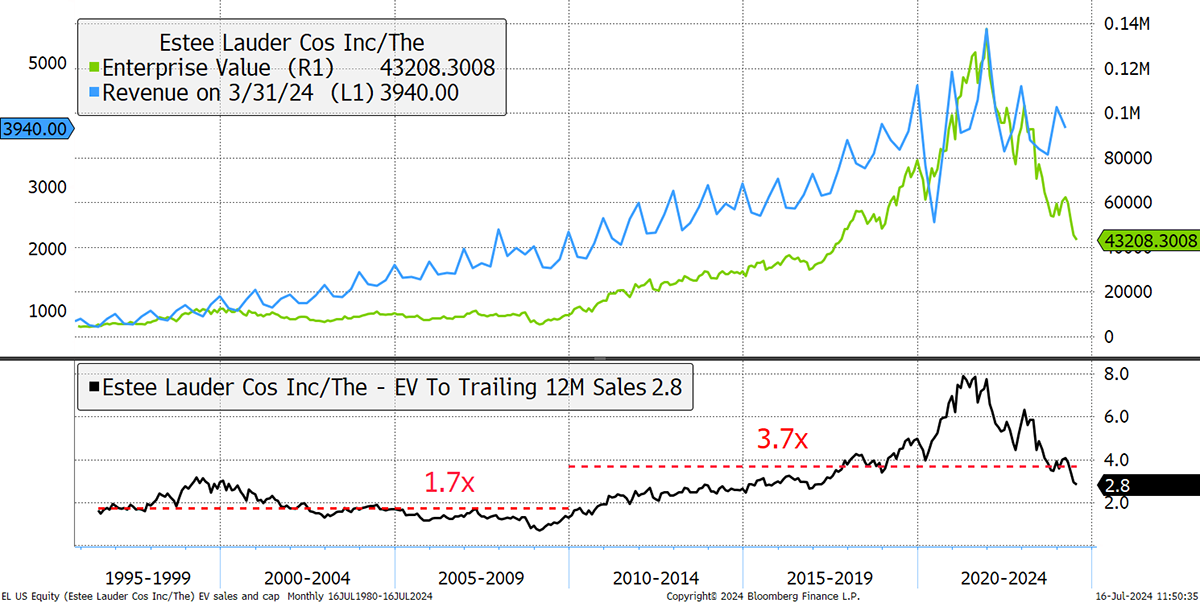

I also see weakness in lower-end consumer stocks such as Estee Lauder (EL), the breweries and staples such as chocolate. I highlight EL, which has been a master of this era. Pre-2010, the average enterprise value to sales (EV is market cap less cash, plus debt) was 1.7x, and since then, 3.7x. This long-term valuation premium is commonplace in US stocks and explains much of the excess returns of the overall market as valuations rose. Investors have been happy to pay twice what they used to for the same thing.

Estee Lauder – An Unnecessary and Unsustainable Rerating

EL didn’t grow faster in the second phase, nor did it deliver higher returns to investors. But there’s a couple of things it did successfully. It geared up the balance sheet from around $1 billion to $10 billion, while also boosting stock-based compensation from around $50 million to $300 million each year.

There are so many companies that resemble EL, from the big tech stocks to McDonalds. We investors have lived through an era of extraordinary refinancing, and many large companies with access to the deep US capital markets have been caught up in this type of financial engineering. EL stock is down 73% since 2021, and it’s still on 2.8x EV to sales, against a 1.7x historical average. Is it cheap? With a 3.1% free cash flow yield, I’d say no. But sooner or later, it will be.

This derating will eventually hit everything, and I hope I have made our approach clear. We are investing in companies at low prices, where the derating is already behind us. You end up with companies that make and do things we need, with ample cash generation, a strong balance sheet and a little growth too. This is how the winning investors of the 2000 to 2003 era were positioned, and I hope this explains why we are doing it today.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd