Bitcoin Supply Shock

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 115;

The narrative around halving is that there are fewer coins for the miners to sell. Less supply coming onto the market makes demand go further and buoys the price. Since the latest halving, the daily total of new supply is 450 BTC per day ($25 million) or 13,500 BTC per month ($750 million) or 164,250 BTC per year ($9 billion). That’s all well and good, but Mt Gox lawyers have just released 47,228 BTC onto the market from a total of 138,985 BTC. That’s nearly a year’s supply.

Going back to the early days, Mt Gox was the world’s leading Bitcoin exchange, handling 70% of all transactions. In 2013, the Bitcoin price on Mt Gox traded at a 20% premium to other exchanges, such as Bitstamp, because they stopped allowing cash to leave the system. Investors on the Mt Gox exchange would overpay for Bitcoin so they could get their money out. But the exchange kept losing Bitcoins to hackers. Money was heading for the exit, and eventually, it imploded.

Bitcoin 2010 to 2014

Mt Gox filed for bankruptcy in February 2014, having lost 950,000 BTC due to hacking. Some were later recovered, and the Mt Gox wallets still hold 138,985 BTC on behalf of creditors. Those coins are now on the move, and the market has been spooked. In addition to that, German law enforcement is dumping years’ worth of ceased BTC, making the supply outlook look rough.

The market can absorb this Bitcoin, but it will take time. Consider how our view is that Bitcoin will make a new high in October once the post-halving hype calms down. There is always some excitement leading up to halving, and not only does the price rise, but the miners also hoard. That delays the longer-term positive impact of halving because the miners have too much inventory that needs to be cleared, hence why there is a post-halving hangover.

That clearing just became bigger as much of the Mt Gox supply will hit the market. But that’s nothing a lower price can’t sort out over a few months. Demand is whatever it is, and with more supply, things will simply clear at lower prices. And when it’s done, the market can surge once again. I’m standing by the ByteTree call for a new high in October.

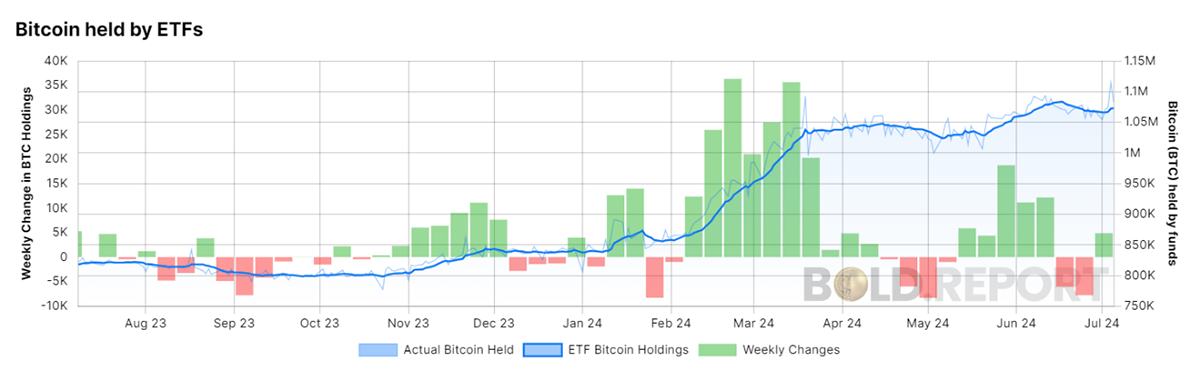

Bitcoin Held by ETFs

We should also take comfort in the fact that the Bitcoin ETFs added to their holding last week. It wasn’t huge, but more importantly, they’re not selling. So many investors still don’t own Bitcoin, and that underpins the long-term bull case. This supply storm will soon pass.

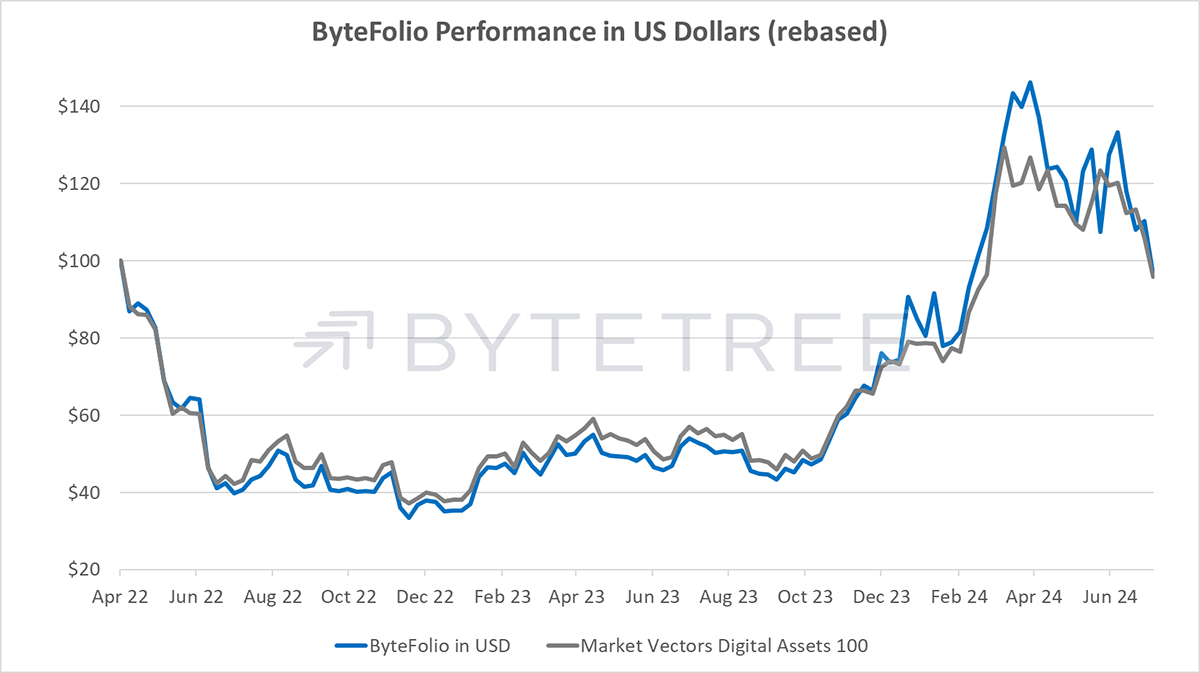

ByteFolio Performance in USD