President Trump and the Printing Press

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report Issue 95;

Real rates have peaked at a time when rate cuts seem to be increasingly likely, and the inflation retracement is largely done. Real rates are headed south.

Highlights

| All-time High | A Closer Look |

| The West Buys Gold | Sentiment Change |

| Gold Miners | High Price Drives Operational Gearing |

| Macro | Real Rates Really Have Peaked |

| BOLD | Bitcoin for Gentlefolk |

A Closer Look at the All-time High

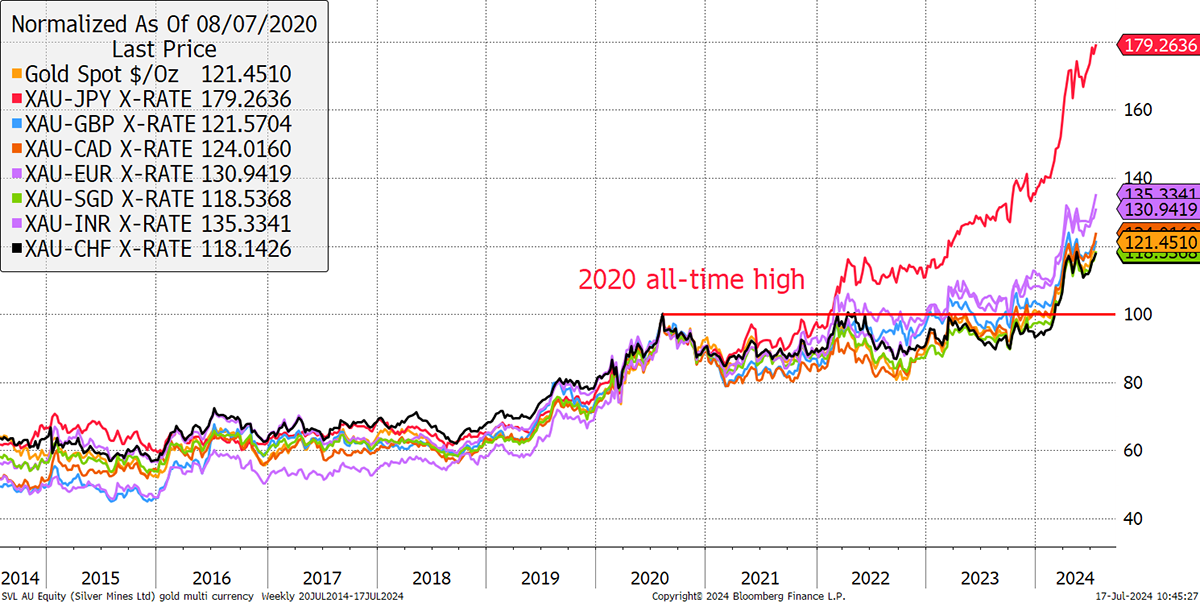

Once again, gold has made another all-time high, something it has been doing repeatedly for the last 5,000 years. The chart shows the gold prices in various key currencies rebased to the last major all-time high in 2020. The important point is that gold has made a new all-time high in every currency after a four-year period of consolidation.

Gold New Highs in Every Currency

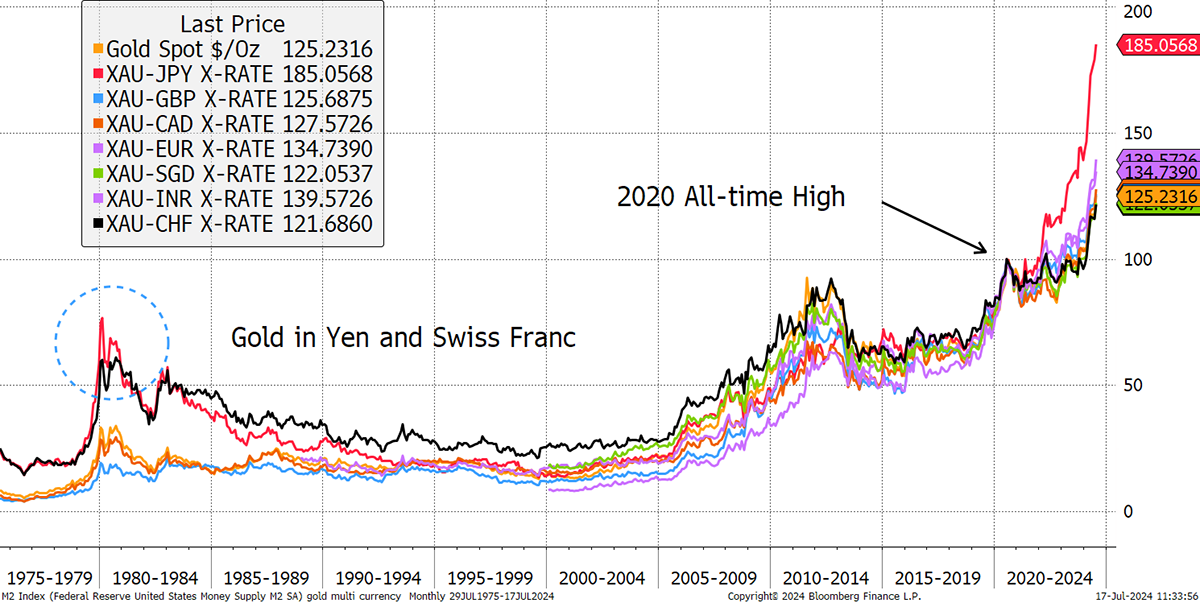

Looking at a longer-term horizon, it is important not to forget the 31-year gap between the high of 1980 and 2011. Yet this chart is still rebased as at the 2020 high, meaning the worst currencies, i.e. GBP (blue), were much lower in 1980 than the best currencies, i.e. yen (red), which started higher up back then.

Gold in yen has done well recently, as the yen has fallen, but if you go back 50 years, you get a different perspective. Gold in yen has only appreciated at 2% p.a. since 1980, and 1.65% in the other strong currency, the Swiss Francs. Gold in dollars has returned 3% p.a., and in Sterling, 4.5%. Gold returns would have been even higher in emerging market currencies, where the currencies fell further.

Gold New Highs in Every Currency

The post-1980 period is regarded as having been largely disinflationary for the developed world, so you can only imagine what gold returns would have been like in the emerging market currencies where inflation has been notably higher. I estimate gold to have returned 9% p.a. in Indian Rupees since 1980 (not shown on the chart), making it easy to understand why it thrives in Indian culture.

While popular in many parts of the world, it remains a divisive asset in the West. Gold articles in the mainstream media reliably have a busy comments section because, after all of this time, many still aren’t convinced. You repeatedly see it described as a barbarous relic, irrelevant, overvalued, a pet rock, or criticism that it doesn’t pay interest.

I vividly recall there were very few bears in 2011, at the last notable peak, just as there were few bulls in 1999 when investors were tempted by tech. I embrace these negative comments, which reassure me that the gold trade still has a long way to go. Few point out that it has beaten the S&P 500, including dividends, this century.

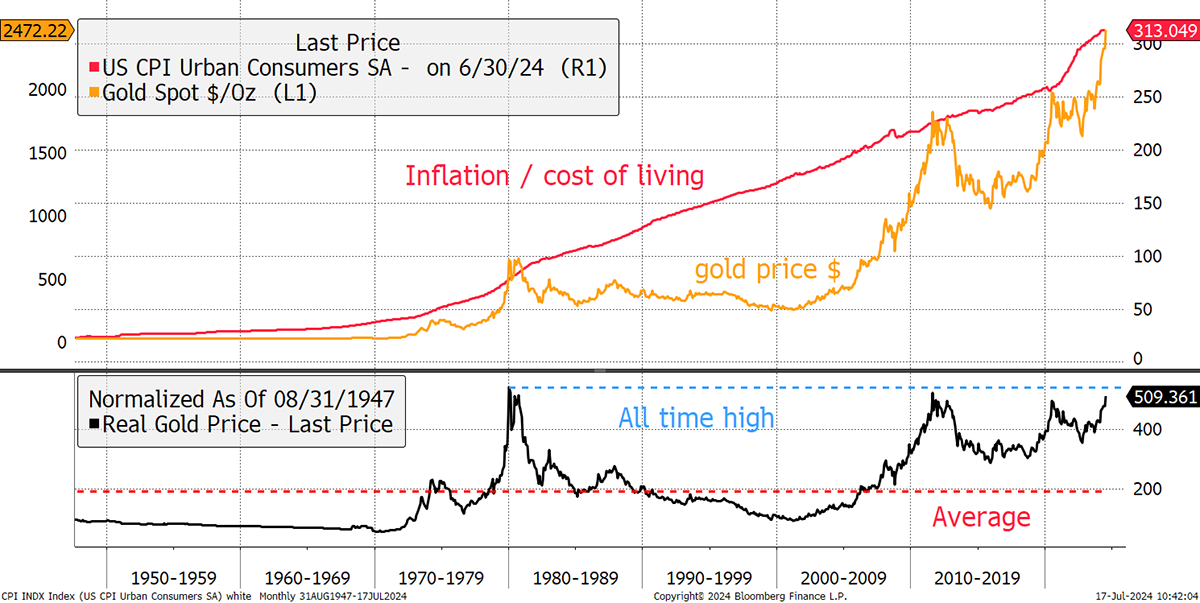

Those who believe gold is overvalued sometimes cite that it has risen faster than the cost of living. This can be illustrated using the gold and CPI data since 1947 when the series starts.

Gold Has Matched the Cost of Living

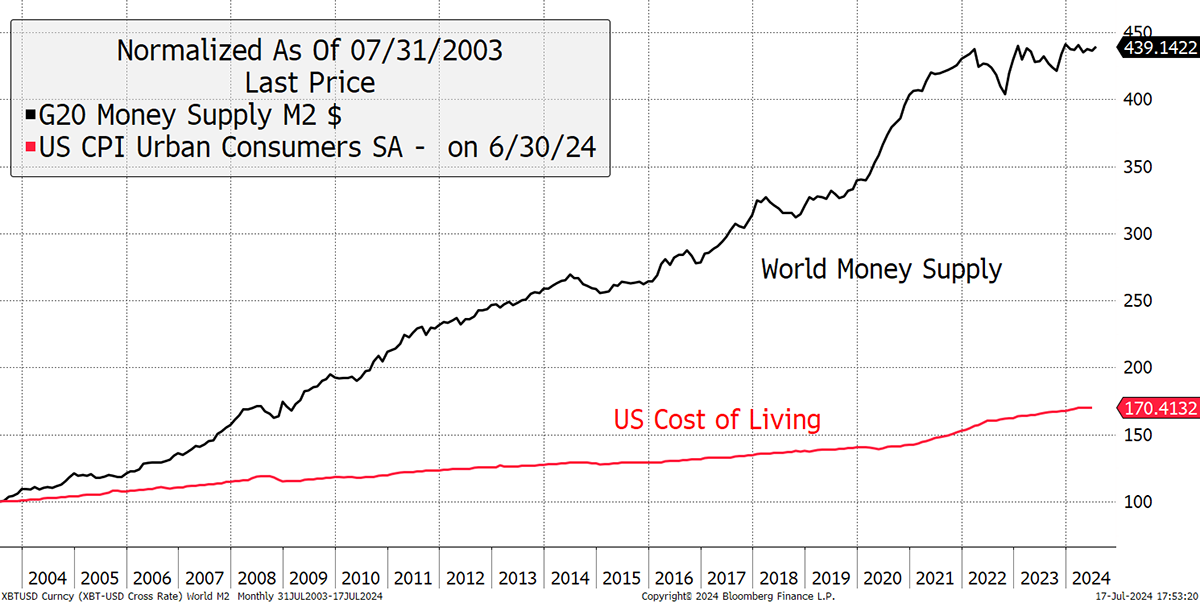

That is useful to know, but gold cannot simply be aligned with long-term US inflation when the money supply around the world has grown at a much faster pace. Gold’s job is not simply to keep up with the price of goods but the value of money. Over the last two decades, which can be measured, the supply of new fiat currency (black) has far exceeded the rate of inflation (red).

Inflation versus the Money Supply

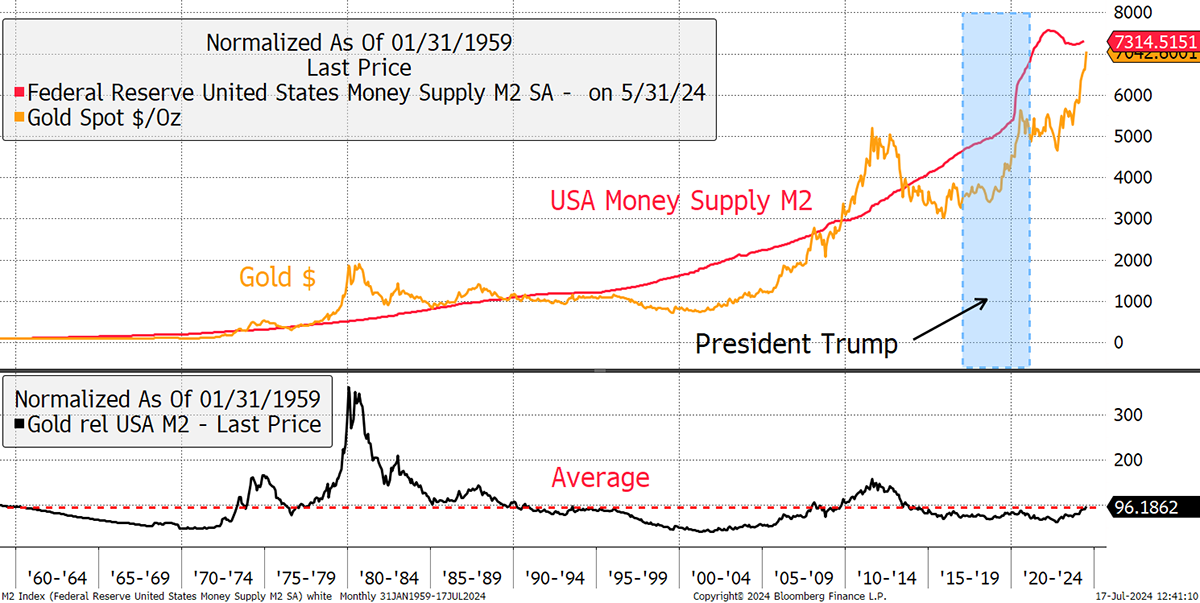

Data limitations for the world mean it is hard to delve into the last century, but US data is available. While the gold price may seem elevated against US CPI, it has lagged the US money supply, and that broadly follows the global money supply. It all seems to make sense, and gold is currently telling us that the money printer is ready to go brrr. Yet this time, it’s gold’s turn rather than Bitcoin’s.

Gold and the US Money Supply

The blue area highlights when President Trump was last in office. His track record embraced the printing press and saw the money supply pick up, even before the pandemic first spluttered.

Donald Trump is good for gold.

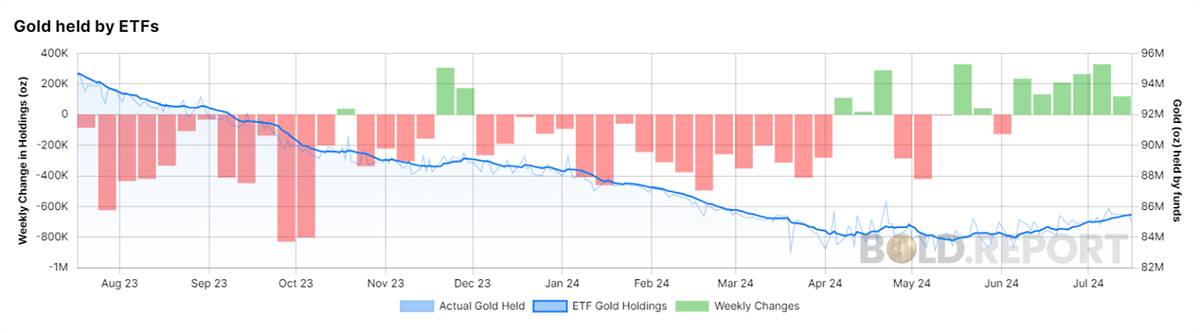

Sentiment Change

Regular readers of Atlas Pulse will be familiar with this data on gold demand from global investors, which has been so negative outside of places like China and India. We have recently seen six consecutive weeks of positive gold flows. Not only have western investors finally stopped selling gold, but they have also turned into buyers. Nearly one million ounces were added to the gold vaults in July, with 233,000 ounces in June. This has turned the trend positive.

Gold Held by ETFs

This is a positive development as gold is at its best when there are multiple sources of sustained demand in the absence of a bubble. And that bubble is years away, as positioning remains light and a hard money environment, which would put downward pressure on the gold price, is seemingly unlikely in the Trump 2.0 world.

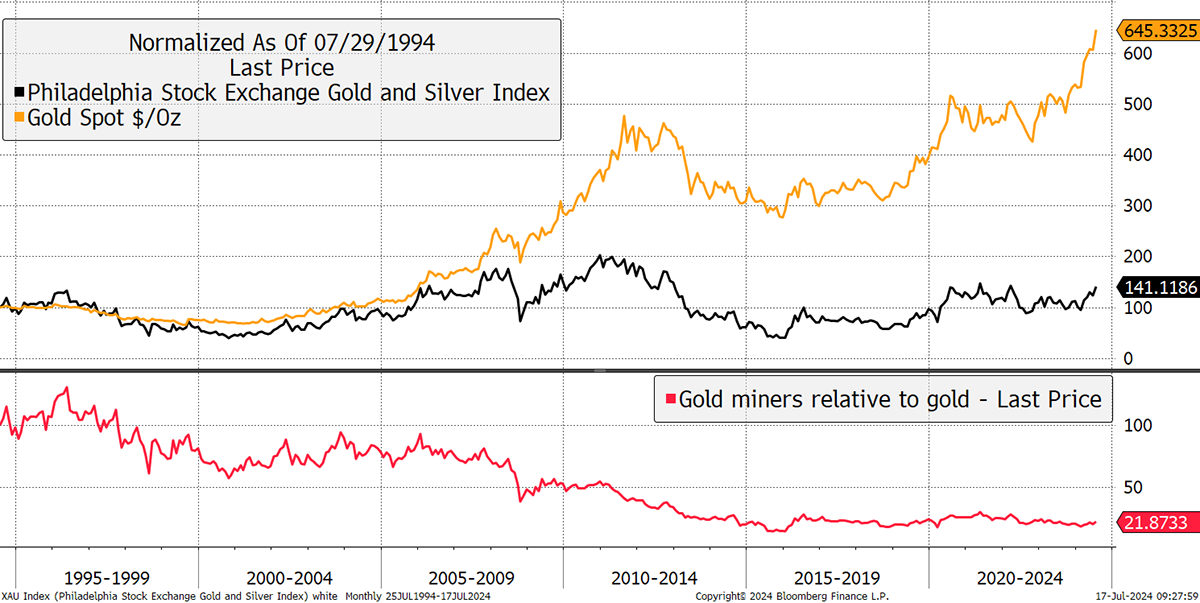

Miners – High Price Drives Operational Gearing

Since 1995, the gold miners have turned $100 into $141 while gold managed to reach a respectable $645. Having been joined at the hip pre-2008, many have asked what happened to the gold miners and why they have done so badly. The simple answer is high costs and poor capital management. Yet what I have witnessed in recent years is a more disciplined sector that is less dependent on debt and more focused on cash flow. The long-term bear market in gold mining has had a positive impact on corporate behaviour.

Gold and the Gold Miners since 1995

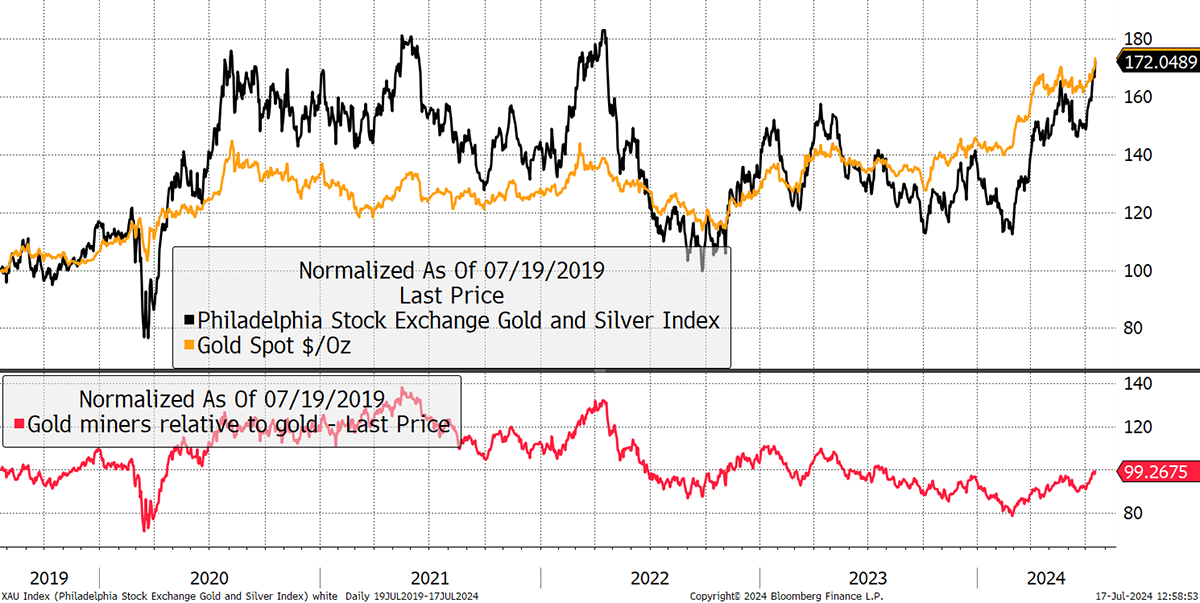

Yet that same chart looks more promising over the past five years when the gold miners have delivered the same return, just with higher volatility. The positive is the relative strength line (red) below, which has turned up from a low base. The gold miners have started to outperform gold again. After all of this time, I’m holding out for a surge.

Gold and the Gold Miners since 2019

I have made three gold recommendations in ByteTree Venture, all of which are performing well (84%, 60% and the most recent, 40%). The good news is that I have another one, which will be published in ByteTree Venture tomorrow. If gold has further to go, then the miners will have to stay in front this time.

Macro – Real Rates Really Have Peaked

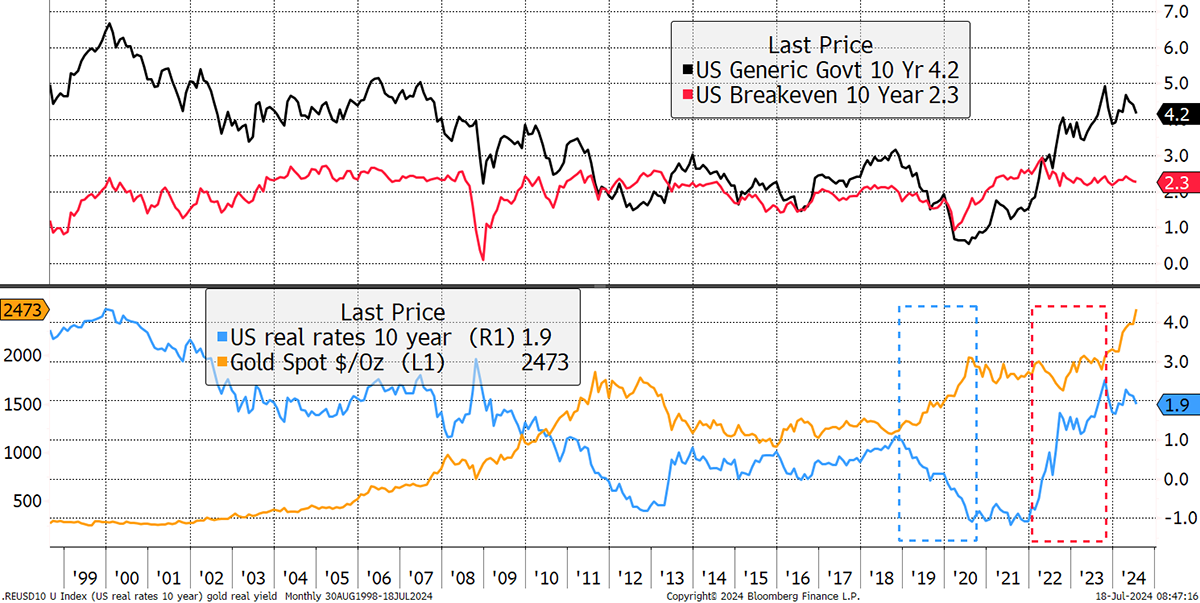

Real interest rates (blue) are the interest rate (black) less inflation expectations (red). We all know gold likes falling real rates as seen in 2019/20 (blue box). When they surged in 22/23 (red box), gold stood its ground. The inverse correlation between real interest rates and the price of gold hasn’t gone away; gold simply looked through to the long term and ignored this cycle of higher real rates.

Gold and Real Rates Remain Uncorrelated

This should be unsurprising given the world’s need for credible alternative assets and the likelihood that Trump’s tenure will likely elevate inflation. Real rates have peaked at a time when rate cuts seem to be increasingly likely, and the inflation retracement is largely done. Real rates are headed south.

BOLD Update

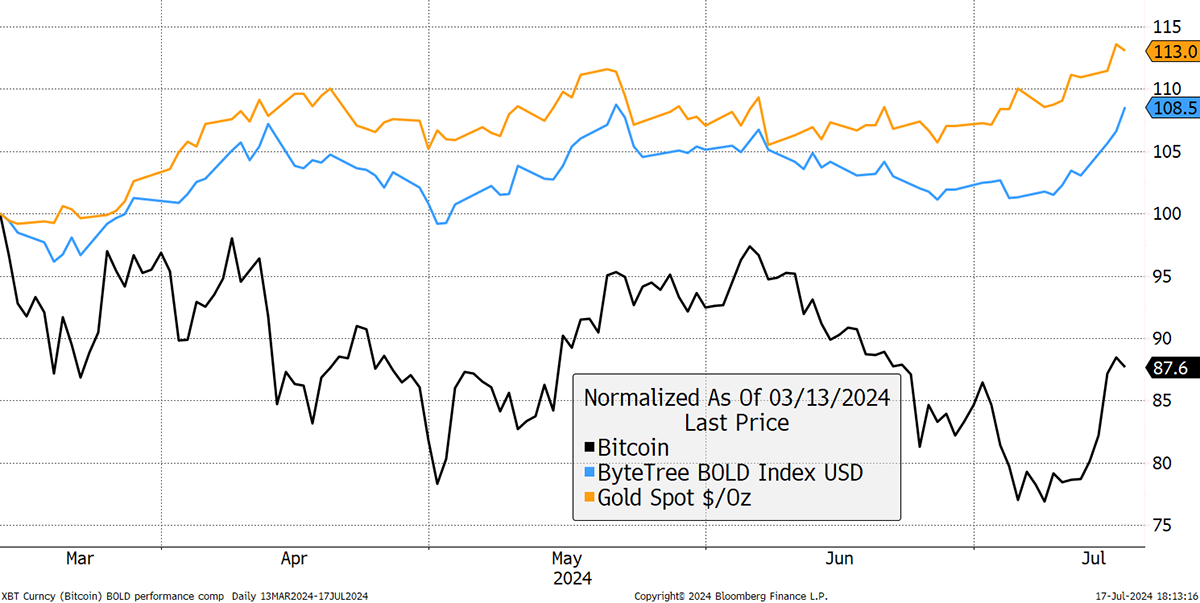

Once again, our BOLD Index shows its metal. The chart shows Bitcoin, Gold and BOLD since the high point for Bitcoin in March. Bitcoin is down 12.4%, yet BOLD is up 8.5%, and close to Gold (+13%). To understand how this has worked out so well is to understand the power of the rebalancing transactions between Bitcoin and Gold. BOLD rebalanced at the end of March, April, May, and June, each time buying Bitcoin at a reduced price. When Bitcoin turns up again, like it did this week, BOLD was topped up with Bitcoin and ready for the rally. Had BOLD not rebalanced over the period, BOLD would have been 2% lower over just four months. It might not sound much, but it soon adds up.

Bitcoin, Gold, and BOLD Since the 13 March High

I will be talking about this and all other golden things with Jan Nieuwenhuijs next week. Please join us.

ByteTree Webinar

We invite you to join Charlie Morris, Founder of ByteTree.com, for this webinar on ByteTree’s Bitcoin and Gold Index, BOLD. He will be joined by Jan Nieuwenhuijs, Founder and Editor of The Gold Observer and analyst at Gainesville Coins. They will discuss the gold market, which has recently made a new all-time high, and explore how Bitcoin fits into the mix. The webinar will conclude with a Q&A.

Wednesday 24 July 2024 at 16:00 BST (11:00 ET, 17:00 CET)

Please register to attend this webinar. You will also receive a link to the recording the following day.

Summary

Global investors are buying gold again. They left from 2020 to earlier this year, selling between $2,000 and $1,600. Now they are back, and buying above $2,400. If only they read Atlas Pulse, they’d have saved themselves a fortune.

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.

Comments ()