The Passive Bubble

Trade in Soda;

Market historians will look back on this era and conclude that it was one of the greatest bubbles of all time, but we have no idea what they will call it because it can only be named after it ends. Candidates might be the AI bubble, the Government Bubble, the Regulation Bubble, or perhaps just the Passive Bubble. By passive, I mean passive investment, as opposed to active. This index tracking has been exacerbated by the huge growth in ETFs, which now amounts to $13 trillion of assets.

I was going through ByteTrend.io, as I do most days, to look at the market trends. What struck me was how the US market shows up as both a leader and a laggard, depending on whether the companies are mid-sized or large. At the top of the list were US large-caps, and at the bottom, US mid-caps. I wrote about UK small-caps last Friday and felt this was a natural follow-up.

US Large, Mid and Small-Caps over the Past 5 years

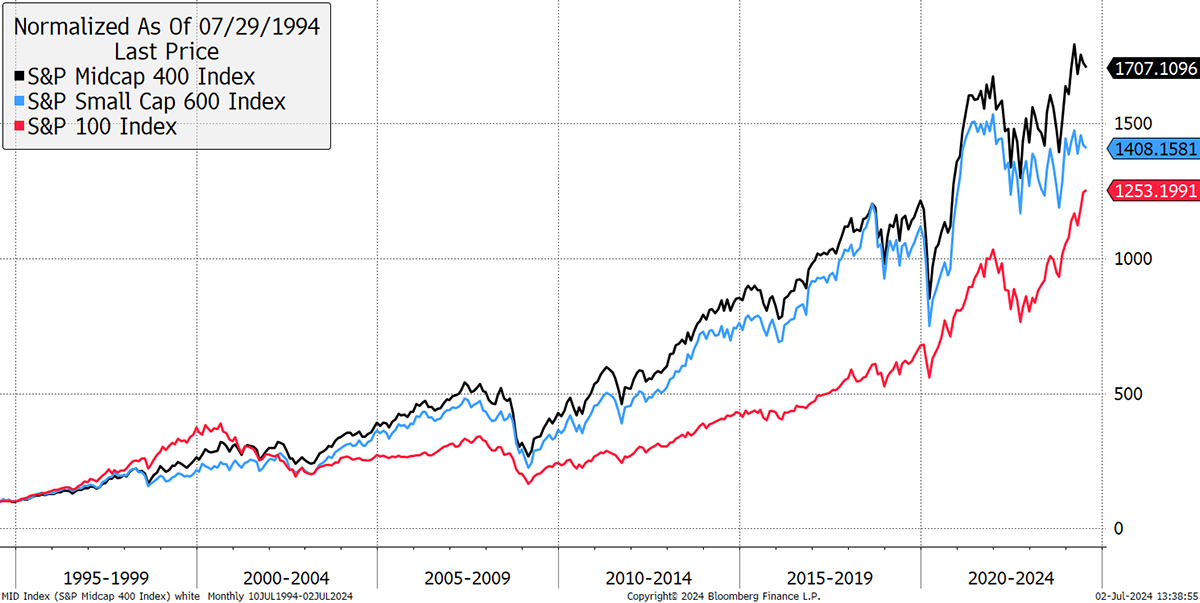

The big stocks are having a run and leaving the rest behind, and that’s abnormal. Small companies normally grow faster, while large companies defend their position and pay dividends with their surplus cash. I can illustrate that with small, mid and large-caps since 1994, which is as far back as the data will go. The only other time this happened was in the late 1990s.

US Large, Mid and Small-Caps over the Past 30 Years

Of the choices mentioned earlier, I am tempted to call it the Passive Bubble because it captures everything, including the excessive money creation and government deficits of recent years. So much money has bought the S&P 500 that it has squeezed the biggest stocks higher. I calculate that the top 4 US-listed S&P 500 ETFs have seen inflows of $846 billion since 2011. Let’s not forget there are many thousands more ETFs around the world that have been fuelling the fire.

The squeeze on the large stocks occurs, especially in the US, because the demand outweighs supply. Not only are the ETFs buying up huge quantities of shares, but the companies they are buying are doing the same through buybacks. The result is high valuations for large caps and the wilderness for everything else.

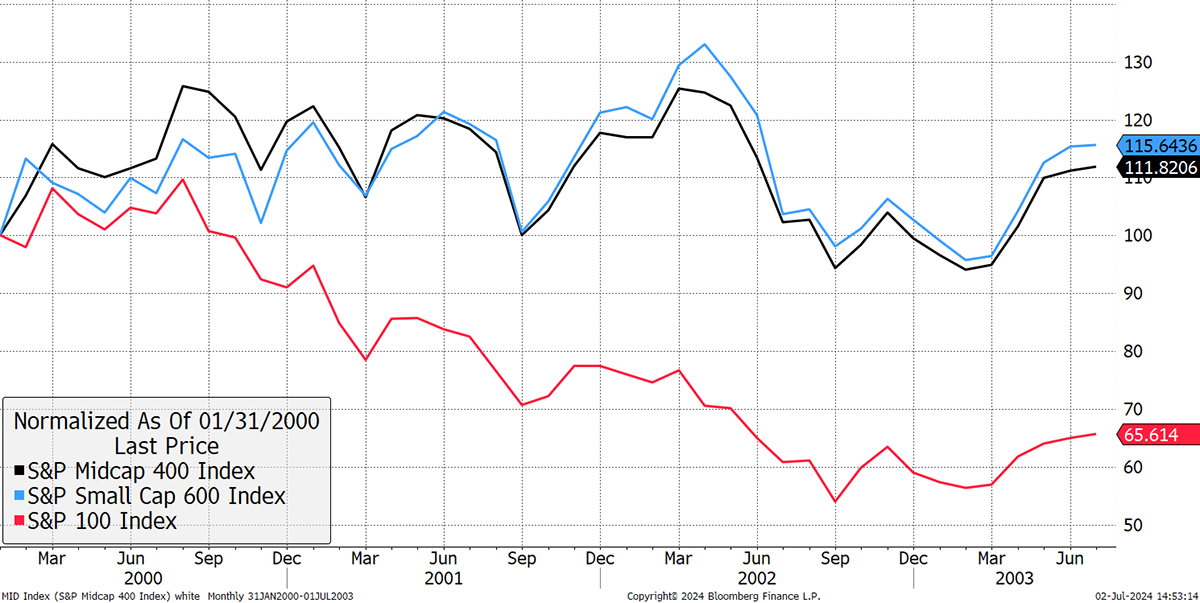

As I said, this happened in the late 1990s, in not just a bubble but a large-cap bubble. What is remarkable about this is what happened when the bubble burst. The large caps got the overdue bear market, while the rest of the market didn’t. Small and mid-caps held up well in the brutal bear market that followed.

US Large, Mid and Small Caps – January 2000 to June 2003

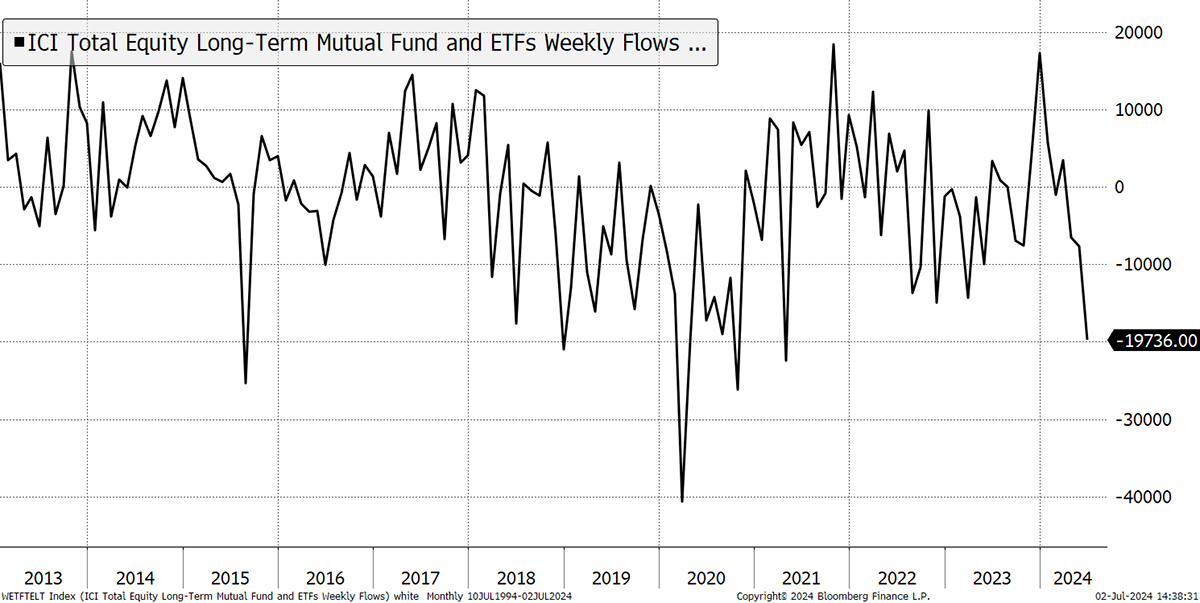

As investors pulled money from the market, it didn’t impact the parts of the market that weren’t involved in the first place. Demand for mid and small-caps rapidly increased after the music stopped. That next repeat can’t be too far away because the Investment Company Institute Data shows how flows have turned negative this year, and the reading has begun to stand out.

Fund Outflows

That’s not all because strange things are happening. As the economic data points towards a slowdown, especially in consumer-facing parts of the economy, we have seen the oil price rally 13% and bond yields jump over renewed inflation fears. In a market that is expecting rate cuts to justify high valuations, these macroeconomic inconveniences will be unwelcome. I have decided to take some risk off the table, slowly at first.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd