Trump Slump

Disclaimer: Your capital is at risk. This is not investment advice.

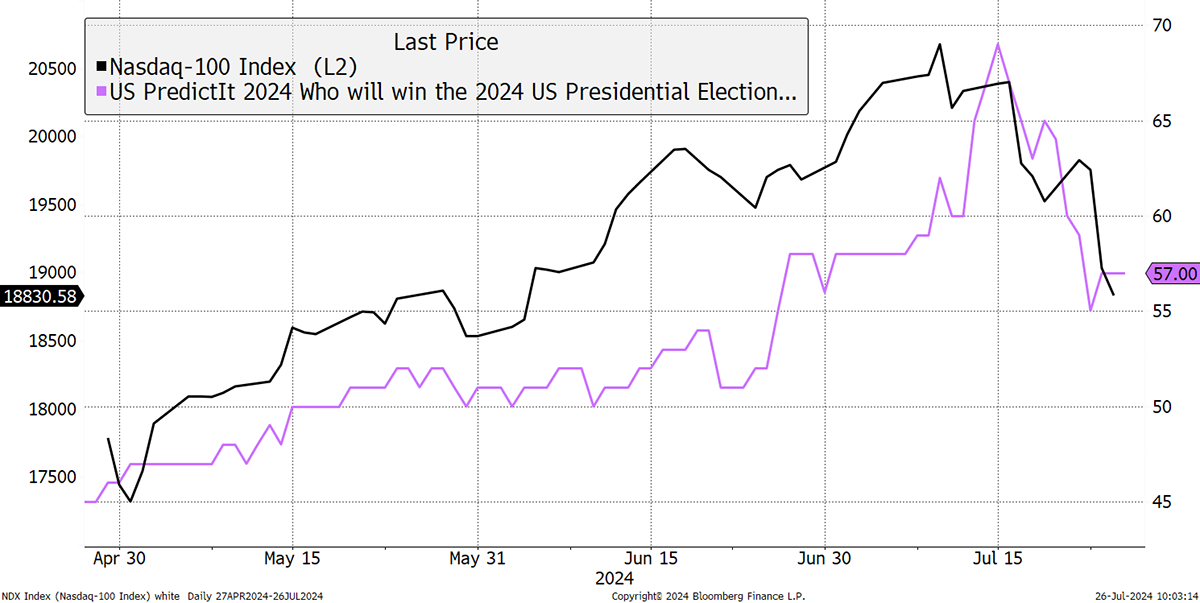

The US stockmarket had a rough week, which I would largely attribute to politics. With a 68% probability of a Trump victory two weeks ago, the market knew what it was getting and rallied. He was a stockmarket-friendly President, as it rose 83% between 2017 and 2021 when he sat in the White House.

Then Biden (S&P 500 +47% since he took office) stood aside for Kamala Harris, and the probability for a Trump victory fell to 57%, which saw the NASDAQ snap. Presumably, Harris will be a continuation of Biden and won’t necessarily be negative, but it’s the fear of the unknown. As investors know, the stockmarket hates uncertainty. After all, the market doesn’t know what a Harris presidency looks like, whereas love him or loathe him, Trump is the market’s friend.

Trump and the NASDAQ

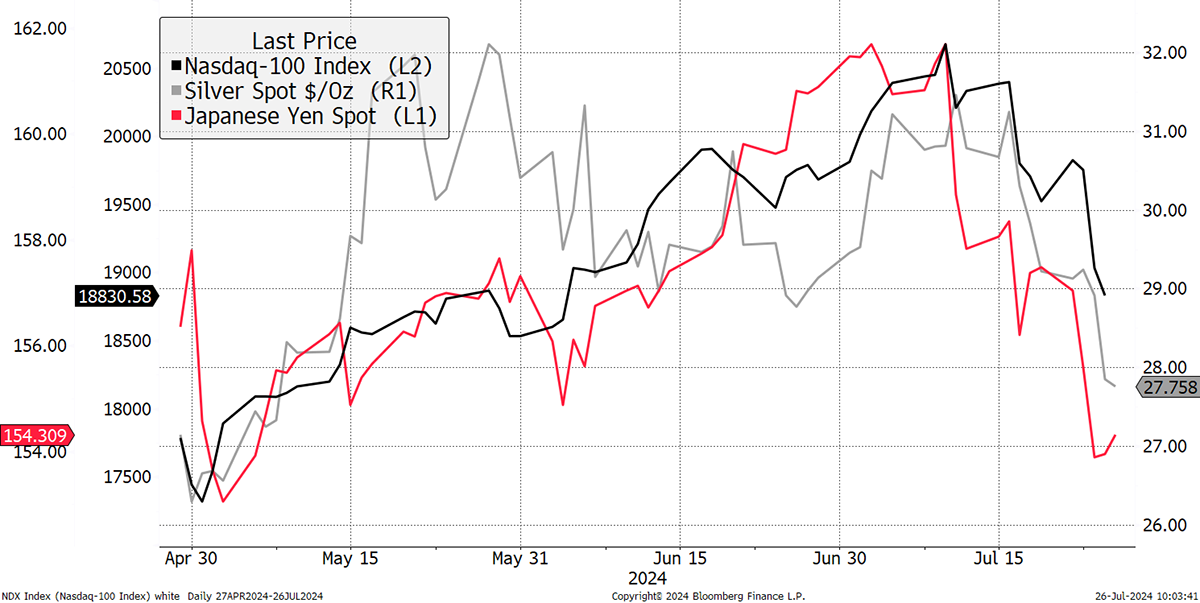

But the market snap could have been driven by something else. The yen had a strong rally after a period of weakness. It had been weak due to the “carry trade”, whereby speculators borrow cheap yen and invest elsewhere. It looks like they might have been invested in technology stocks, and even silver, which had a tough week.

The Yen Carry Trade Unwinds

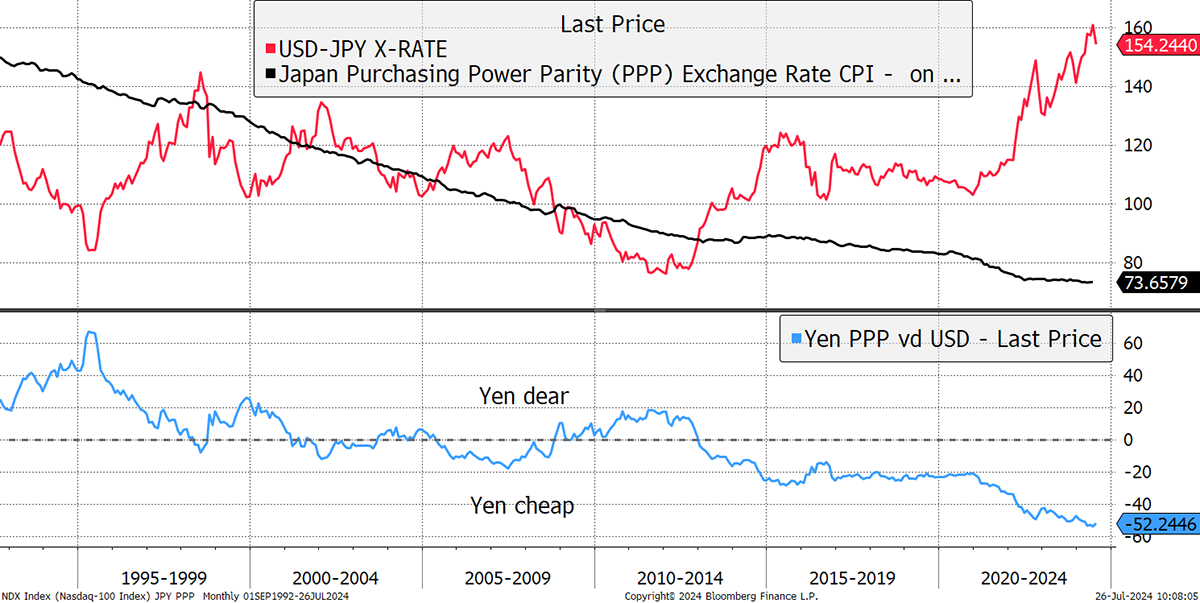

When investors unwind their carry trade, they have to sell their investments and buy back their yen. It always seems to happen quickly and on cue. The stockmarket fell while the yen soared. As I have shown before, the yen is significantly undervalued, as illustrated by the purchasing power parity, whereby a basket of goods is compared in different countries. For those in doubt of the yen’s cheapness, the proof comes in the form of a boom in Japanese tourism.

The Yen Is Cheap

The carry trade was driven by cheap money. Looking at the bond yields in the US and Japan, it is 3.2% cheaper to borrow in yen than in dollars. That was 3.8% in April, and with US yields falling, a yen rally was overdue. Maybe the unwinding of the carry trade has legs, in which case there could be more downside for technology stocks.

Looking at the FTSE 100 (blue), it barely noticed the shenanigans across the Pacific. The FTSE has been resilient, and the pound strong, meaning that it is outperforming the world index. Long may it continue.

The FTSE Is Beating the World

A Week at ByteTree

In The Multi-Asset Investor, I looked at the low-cost airlines, following weak results from Ryanair (RYA) on Monday, which saw the shares fall 38% since the all-time high in April. It’s clear that there are great airlines and lousy airlines, and most are lousy. RYA had been the model to follow, but with a high valuation, and the greatest efficiencies in the industry, the risk is a derating as it’s as good as it gets.

In comes our JET2, a fast-growing challenger that has overtaken Wizz Air (WIZZ). It’s efficient and is now the market leader in UK holidays, making use of regional hubs. Its balance sheet is rock solid, and it is structurally undervalued. Why? I think one reason is because it trades on the junior AIM market which means some investors exclude it, such as index funds. In fact, most of the larger AIM stocks are great companies and are also undervalued. That’s good news for investors.

Perhaps the highlight of the week was my chat with Jan Nieuwenhuijs, the gold analyst at Gainesville Coins. He recently moved to Bonaire, a Dutch territory in the Caribbean, which means the palm trees in the background were real. We discussed Bitcoin and gold, mainly gold, with the highlight being his East-West thesis. The West used to drive the gold price, but in recent years, that job was handed to the East. Now Jan thinks it’s both. He also made comments on silver, where he’s bullish but doesn’t consider it to be a monetary metal. That’s gold’s job, alongside Bitcoin.

You can follow his work in The Gold Observer, which I highly recommend.

I wrote about Bitcoin in ATOMIC, counting the days until Uptober when Bitcoin tends to perform, which has been especially true in halving years. We also looked at the miners and their move into AI.

Finally, in crypto, it was nice to see NEAR finally getting an ETP in Sweden; no doubt more will follow. We think it’s a great project. The analysts also looked at Polygon, SEI, and WazirX, and Shehriyar Ali followed up with Akash Network in Token Takeaway.

The next Venture will be covering a speciality pharmaceutical company. It's an exciting opportunity, but given that the market is now closed, we will publish it first thing on Monday morning.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()