Issue 34;

Managing Risk with Diversification

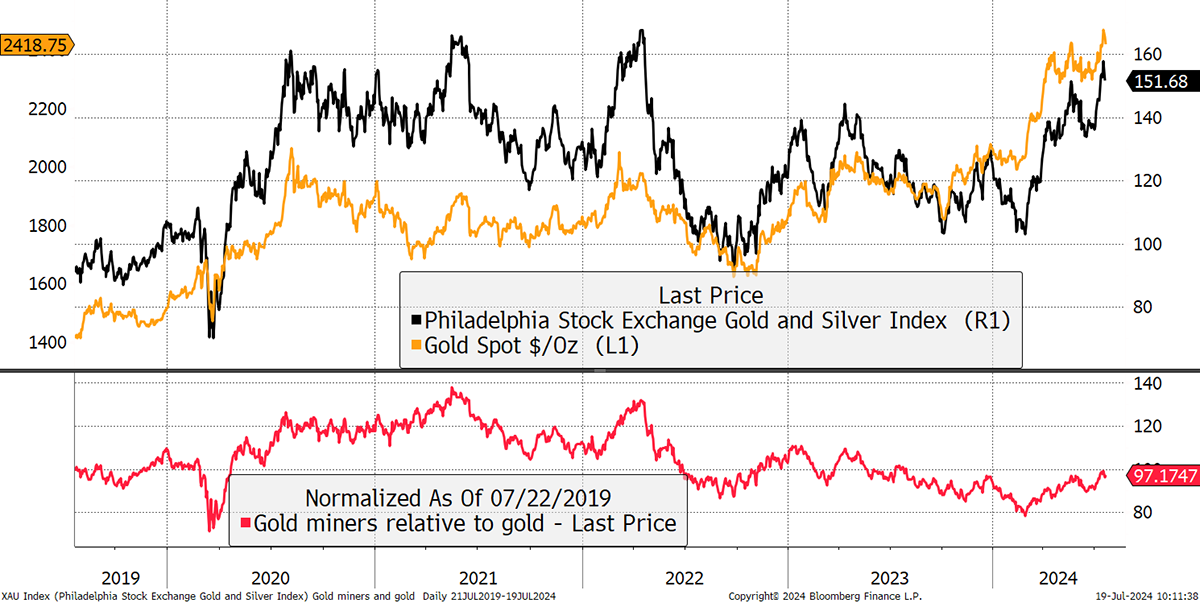

This update follows yesterday’s Atlas Pulse, where I examined the latest all-time high for the gold price. I looked at the positive flows into the ETFs following four years of contraction. I also covered inflation, bonds and the money supply. Finally, I looked at the relationship between gold and the gold miners over the past five years – one that has seen the miners lag significantly since November 2003.

Gold and the Gold Miners

Notice how the gold miners held up quite well in 2021, even when the gold price was softening. Then, in 2022, when equities markets fell, the gold miners practically halved. They’ve rallied since, but consider that the gold price is much higher today. This implies that the miners have room for further upside, as the red line indicates. The gold miners relative to the gold price is still close to the bottom of the range, making this a good time for the gold bulls to embrace the mining stocks.

We have lived through an era that has seen investors embrace the gold streaming or royalty companies. These companies lend to the gold miners to help them develop their mines. They are later rewarded with a portion of revenue without getting their hands dirty. To a seasoned financier, preferential returns, low risk, and clean hands are appealing. But these stocks are highly valued, and while they have performed best in the post-2011 soft gold market, there are much higher returns from embracing those dirty hands.

The operating mines are costly, rough, and dirty, but many of them offer good value and when the gold price is rising, that’s where the money is made. I believe today’s stock is a highly efficient way to capture the upside in gold.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd