Bashing Cyclicals

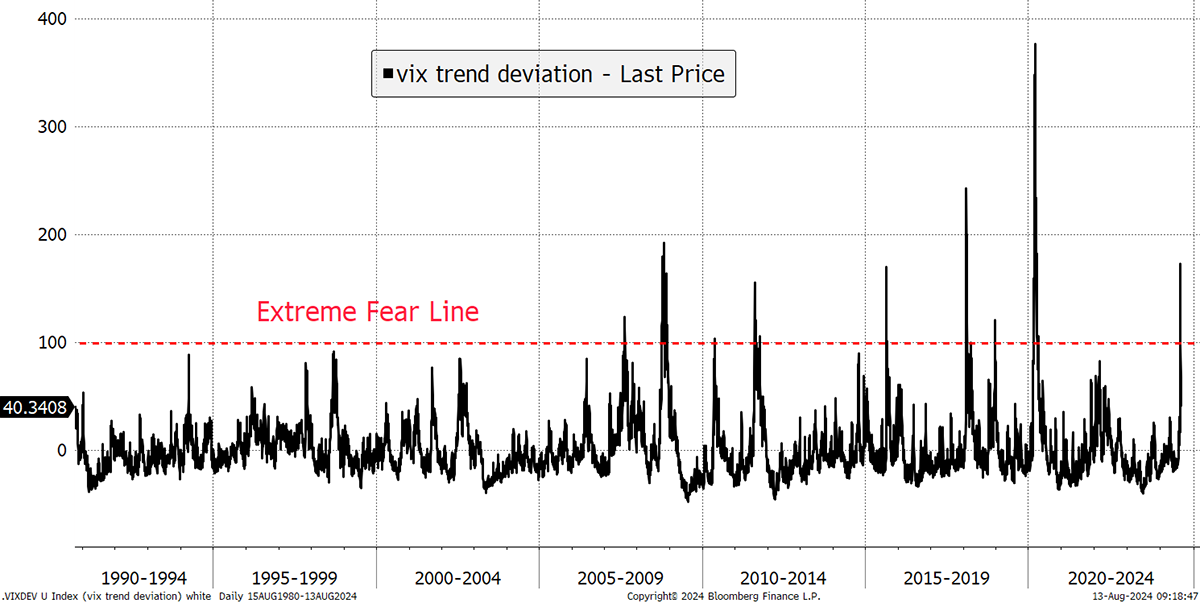

Soda is doing well, and Whisky, less so. That reflects the asset mix, whereby Soda focused on quality, whereas Whisky has remained more cyclical. Last week, the US economy appeared to be slowing down with weak employment data, and the market reaction seemed to be fairly extreme. The VIX Index, which is derived from option prices, surged last Monday as if it were a full-on financial crisis. Other times when the VIX was over 100% above its 200-day moving average were during major market blow-ups.

The VIX

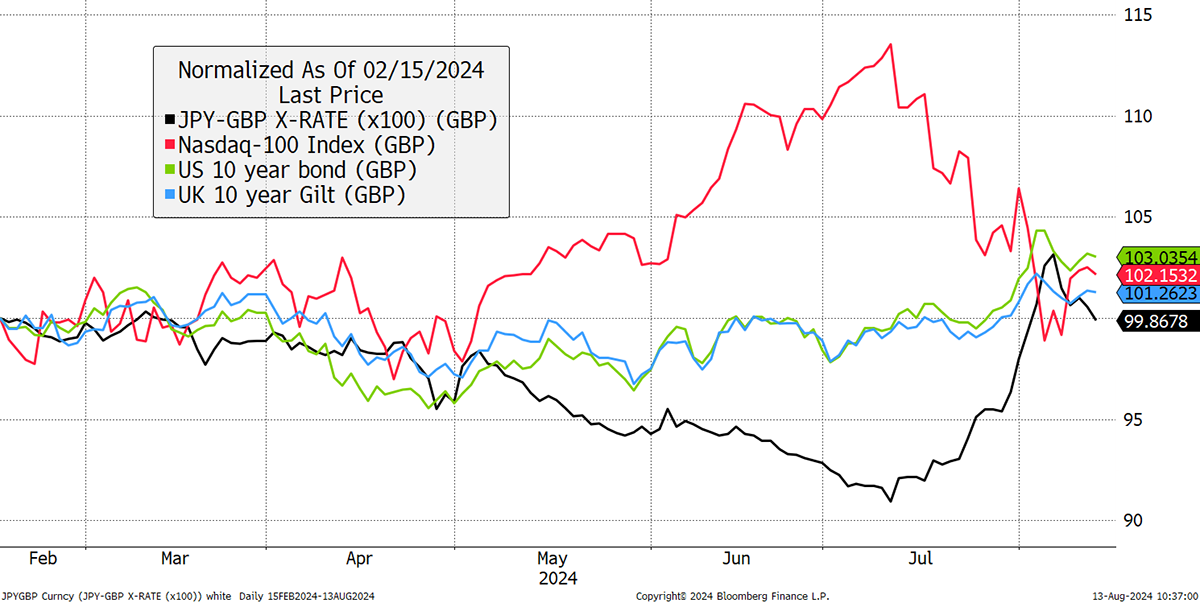

The jobs data alone probably didn’t warrant the VIX Spike, but it is a clear signal that extremes have emerged across financial markets, and on this occasion, the yen was the poster child. I believe I have covered that in detail, but I suspect many people are wondering what’s next. Having fallen by 9% since February, the yen turned around and was briefly 5% up last week. From the low to the high, the yen rose by 15% in 17 days. Today, it has settled a little, and is now flat since February. It was a helpful offset to portfolio weakness elsewhere.

Yen vs Sterling

Some claim the carry trade, whereby speculators borrow cheap yen to invest elsewhere, is largely unwound. I doubt that, as the yen has been weakening since 2020, and it is impossible to measure how much unwinding remains. What is clear to me is that the yen offers efficient portfolio protection, much more so than government bonds. I am therefore very comfortable continuing to hold it.

The Yen Is an Efficient Portfolio Hedge

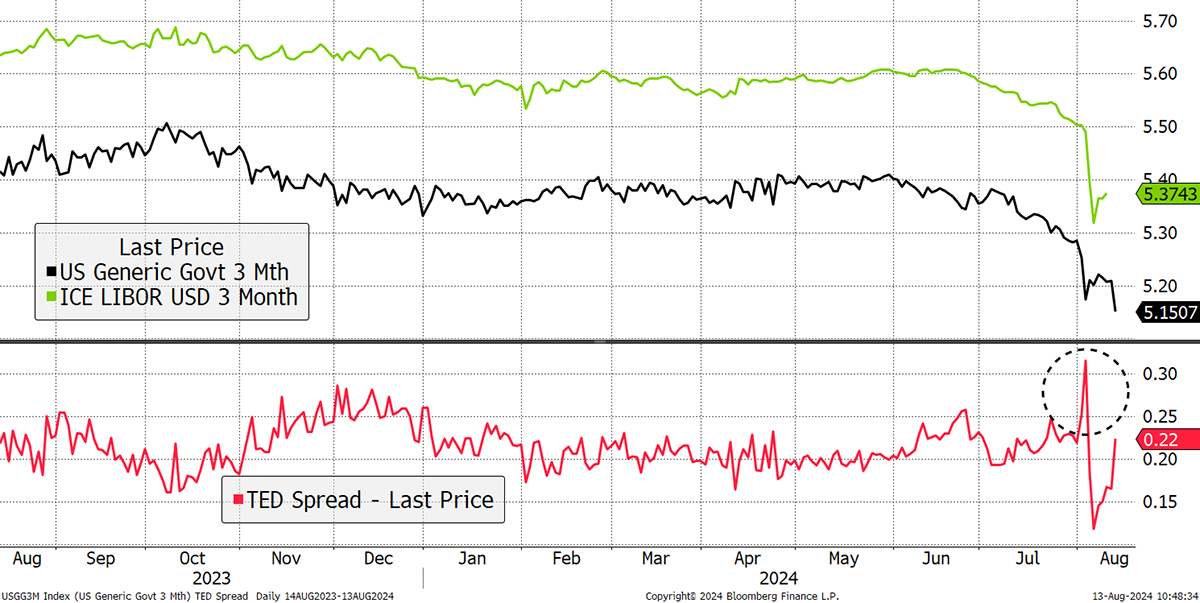

There were other signs of stress, and most notable was the TED spread, which is the difference between 3-month Treasuries and cash rates. When the TED spread rises, it means there are problems in the banking system, which is why the bank stocks fell sharply. This time, it peaked at 0.37%, which pales into insignificance compared to 1.5% in March 2020, the pandemic crash, and 4.6% in 2008, during the financial crisis. Yet the swift reaction to nip it in the bud is a clear sign of market intervention. This is likely a key reason that markets have bounced.

The TED Spread was Soon Quashed

Looking at the market groups of stocks and gold, you can see the prevailing trends compared to global equities. Gold remains king, but value stocks (red) are under pressure again. The recent decline fits with the expectations for interest rate cuts in the US, which are expected at the next Fed meeting on 18 September. Another reason for last week’s panic was that cuts may come harder and sooner. The trouble with that is it makes the panic worse. Growth stocks are so-so, with quality continuing to deliver steady gains.

The Money Map Groups

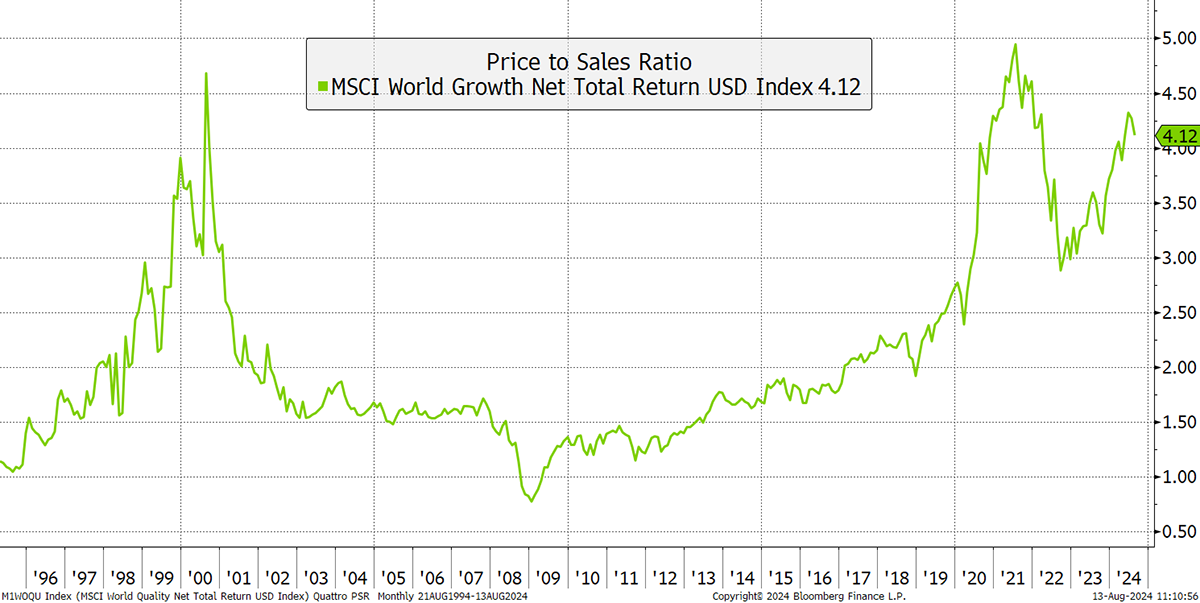

Quality has been driven by big tech, but the defensives, such as consumer staples, which have cheapened, are kicking in alongside healthcare and utilities. Defensives are well suited to the Soda portfolio, where stability prevails, but are generally frustrating for Whisky, where the aim is to make money. Growth is always a wild ride, but valuations are extreme, and that is a key reason I have followed a different path since late 2020.

Growth Stock Valuations

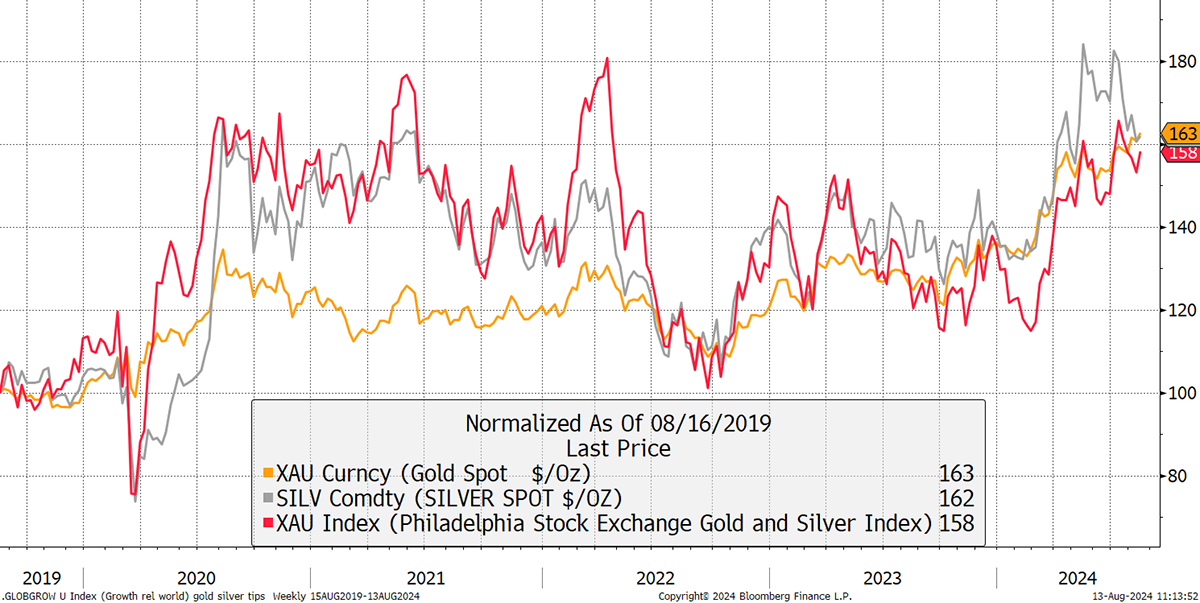

Gold, silver and gold mining stocks have remained tight despite a feeling that silver has slumped. It has taken a hit in recent weeks, but the bulls would point out that it has “caught down” from an overbought position. The mining stocks have been behaving well, and I suspect both silver and the miners have great potential, especially if we see real interest rates fall. Given how high they are, this seems quite likely, and I remain bullish on precious metals.

Gold, Silver, and Miners

I shall go through the key events in the portfolios and highlight notable stocks.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd