ByteTree BOLD Index Monthly Rebalancing Report;

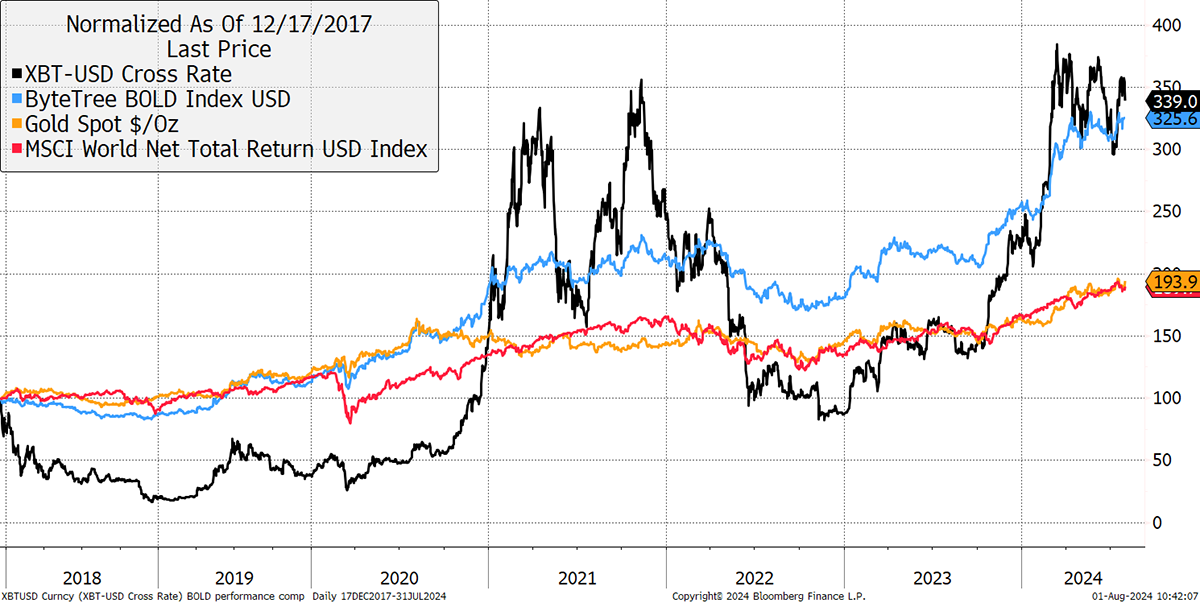

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

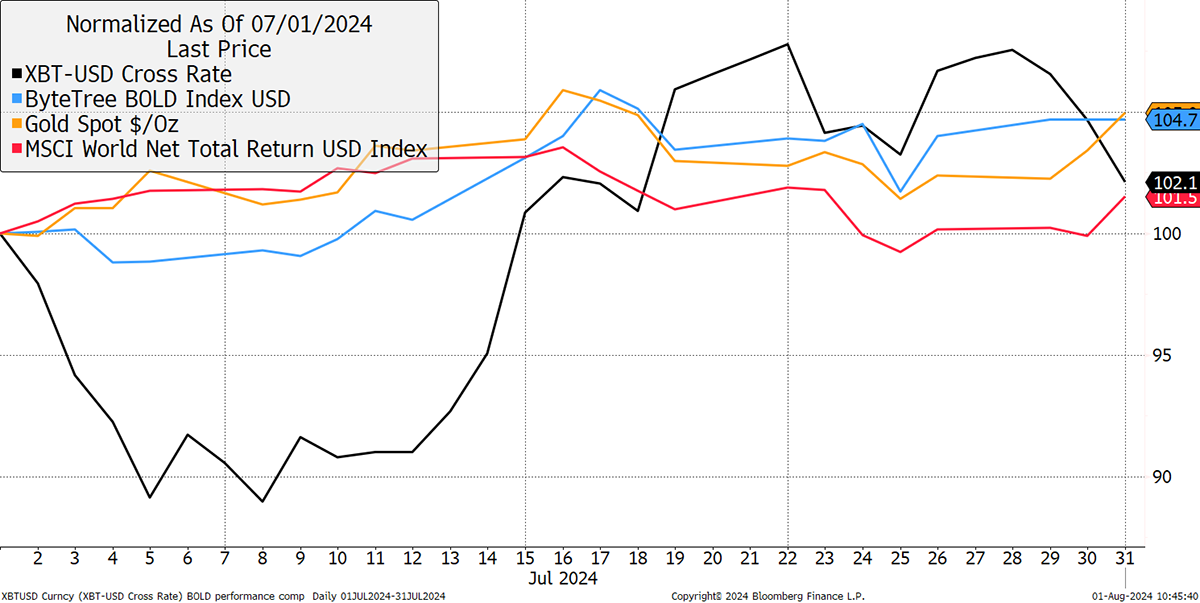

In July BOLD rose by 4.2%, Bitcoin rose by 4.3%, Gold rose by 5.2%, while global equities rose by 1.5% in USD terms. The target weights last month were 25.1% in Bitcoin and 74.9% in Gold. Price changes over the month led to the last day’s weights at 26.0% and 74.0%. This means the latest end-July rebalancing has seen 0.7% reduced from Bitcoin and added to Gold to meet the new target weights.

Bitcoin, Gold, BOLD, Equities in July 2024

BOLD Performance

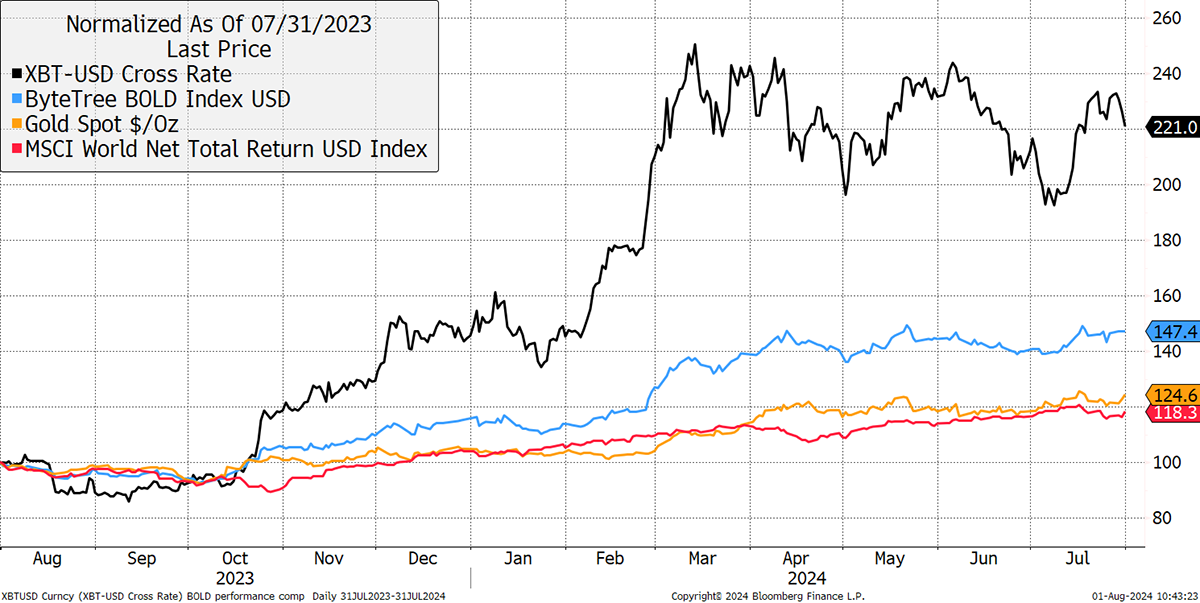

Over the past year, Bitcoin’s performance has returned 121%, in contrast to Gold with 24.6%, which was 6.3% ahead of equities. BOLD managed a respectable 47.4% return.

Bitcoin, Gold, BOLD, Equities over the Past Year

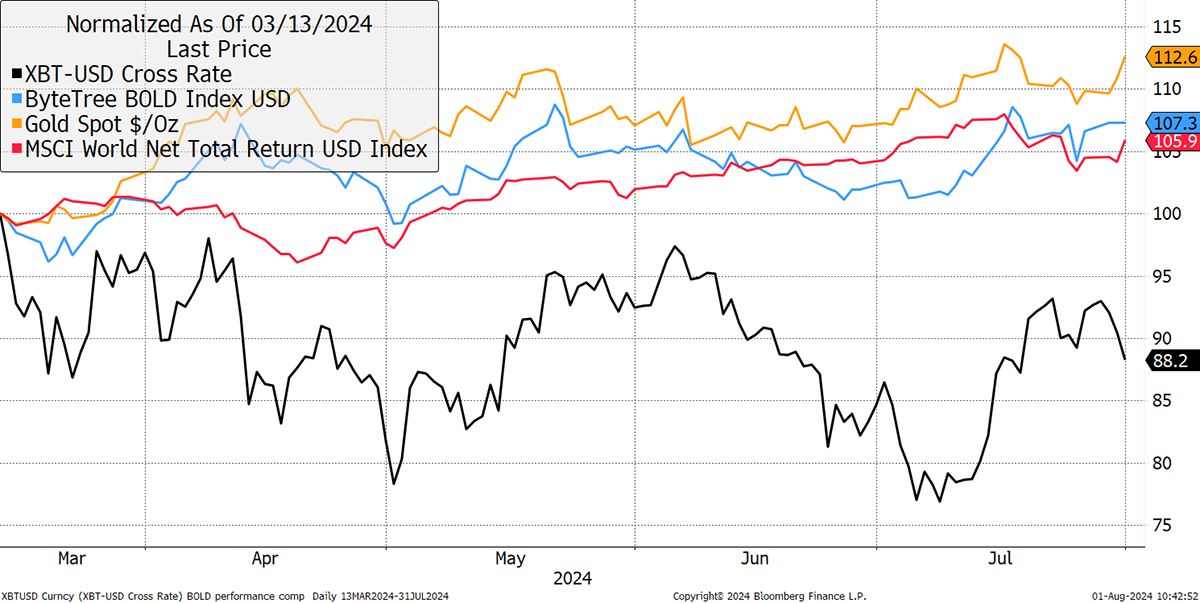

At month end, Bitcoin was still 11.8% underwater from the all-time high that took place on 13 March 2024, having rallied from a 24% drawdown. Since then, Gold, BOLD and equities remained in the pack. Gold rose 12.6%, BOLD 7.3%, and equities 5.9%.

Bitcoin, Gold, BOLD, Equities Since the Bitcoin All-time High on 13 March 2024

BOLD investors should understand why BOLD has kept up, and the answer comes from rebalancing transactions. On 13 March, the last all-time high, BOLD held 26% Bitcoin and 74% Gold.

Asset Returns Since 13 March 2024

| Asset | Return |

|---|---|

| Bitcoin | -11.8% |

| Gold | 12.6% |

| 26/74 | 6.2% |

| BOLD | 7.3% |

Over the period, BOLD is 1.1% ahead of the 26/74 mix because the rebalancing transactions have added value. Yet that is because Bitcoin has fallen, and BOLD has been adding exposure in the down months. Had the falls been greater, the excess return would have been higher and vice versa.

Yet when you refer to the one-year data above, when Bitcoin surged by 121%, it is clear that mixing in lower-return Gold reduces returns. Due to higher Bitcoin volatility in 2023, the start weight was 22.8% Bitcoin and 77.2% Gold. In that instance, there was also a modest excess return, despite the price of Bitcoin rising rapidly over the fixed-weight alternative.

Asset Returns Since 31 July 2023

| Asset | Return |

|---|---|

| Bitcoin | 121.0% |

| Gold | 24.0% |

| 26/74 | 46.1% |

| BOLD | 47.4% |

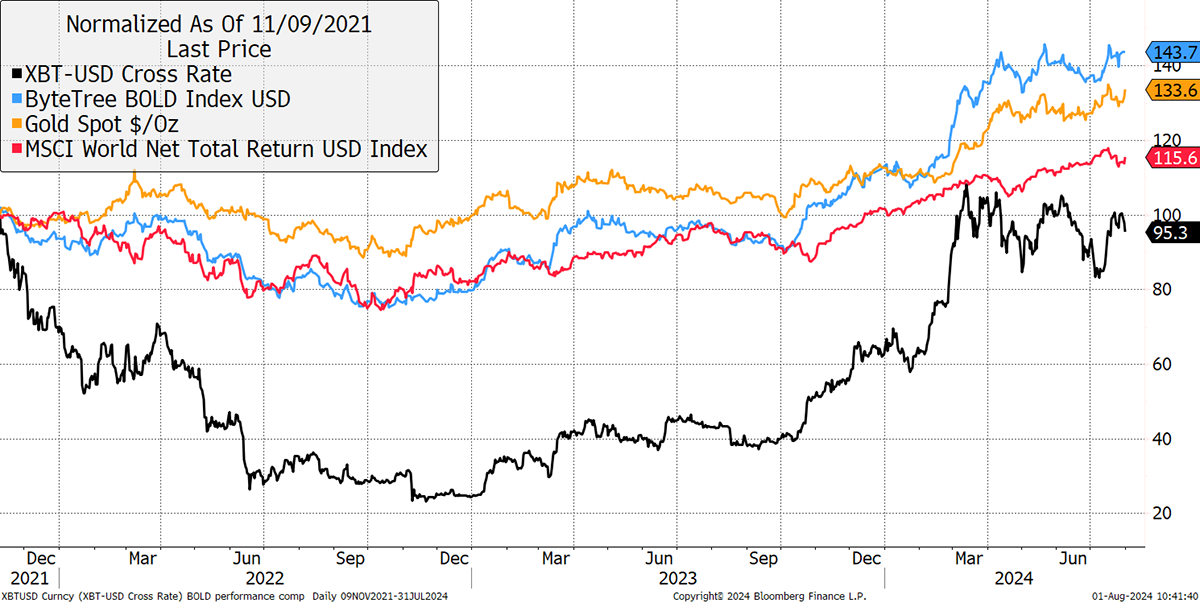

Two more examples from previous table highs. First, the late 2021-high when the Bitcoin weight dropped to 18.2% due to higher volatility.

Bitcoin, Gold, BOLD, Equities Since the Bitcoin High on 9 November 2021

On that occasion, 31 monthly rebalancing transactions led BOLD to deliver 17.1% of excess returns over the Bitcoin and Gold buy-and-hold strategy. BOLD also beat Gold and global equities.

Asset Returns Since 9 November 2021

| Asset | Return |

|---|---|

| Bitcoin | -4.7% |

| Gold | 33.6% |

| 18.2/81.8 | 26.6% |

| BOLD | 43.7% |

And finally, since the 2017 all-time high, when the Bitcoin weight was 18.6%.

Bitcoin, Gold, BOLD, Equities Since the Bitcoin High on 17 December 2017

This time, BOLD is a staggering 104.7% higher than the buy-and-hold approach, which just demonstrates the power of risk-weighting combined with rebalancing transactions.

Asset Returns Since 17 December 2017

| Asset | Return |

|---|---|

| Bitcoin | 239.0% |

| Gold | 93.9% |

| 18.6/81.4 | 120.9% |

| BOLD | 225.6% |

Not only that but BOLD more or less kept up with Bitcoin in a hare and tortoise manner. And once you account for risk, it stands out even further.

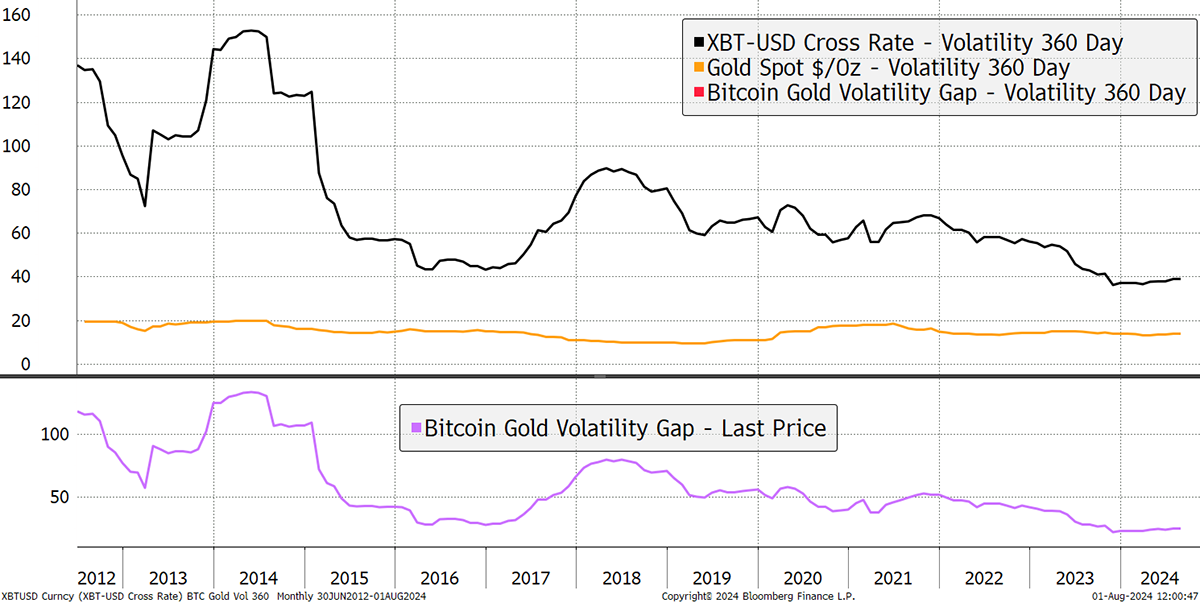

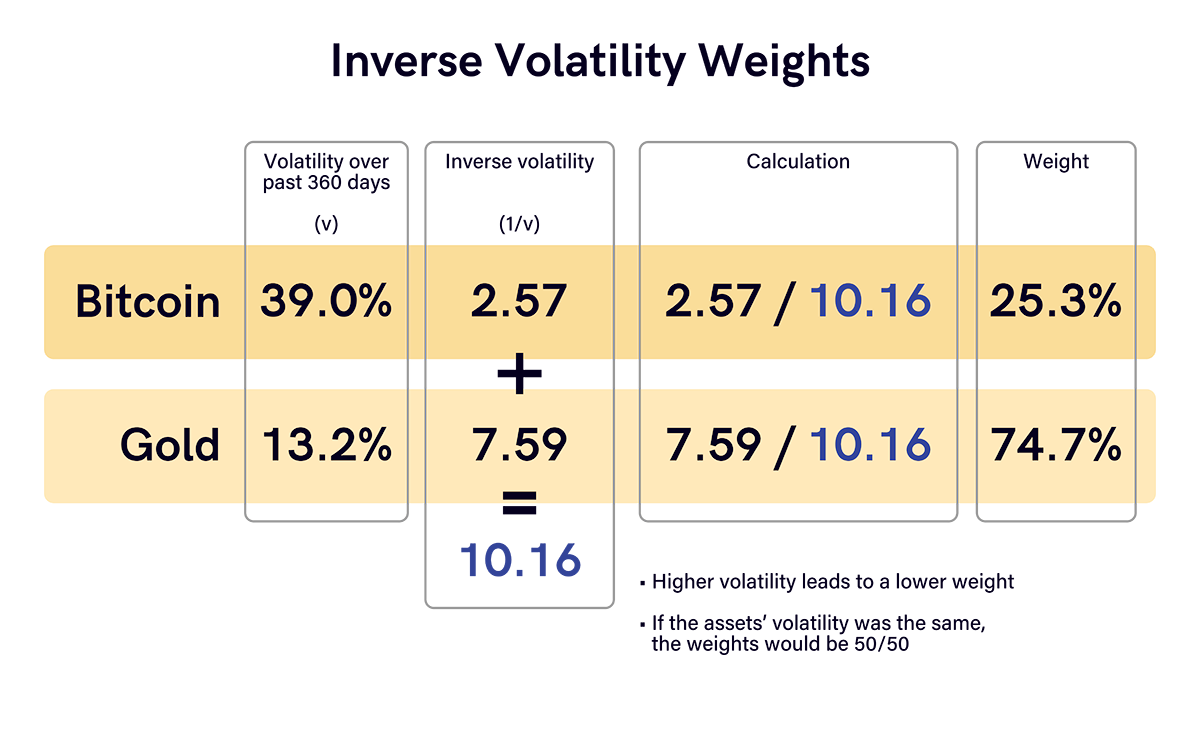

July Rebalancing of the BOLD Index

BOLD allocates Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing. Bitcoin’s volatility, measured over a year, has fallen significantly since the early days and is now no more volatile than a typical blue-chip stock.

Bitcoin and Gold Past 360-day Volatility

The volatility for Bitcoin and Gold over the past 360 days was observed to be 39.0% for Bitcoin and 13.2% for Gold. That means both assets have seen a slight increase in volatility compared to last month. The purple line shows the difference in volatility between the assets. As that falls, the asset weights come closer together. If Bitcoin and Gold had the same volatility, there would be no difference, so the weights would be 50/50. Indeed, if Gold’s volatility was ever higher than Bitcoin’s, then Bitcoin would have a larger share of the BOLD Index.

This has resulted in new target weights of 25.3% Bitcoin and 74.7% Gold using this formula. Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset. It is, hence, “risk-weighted”.

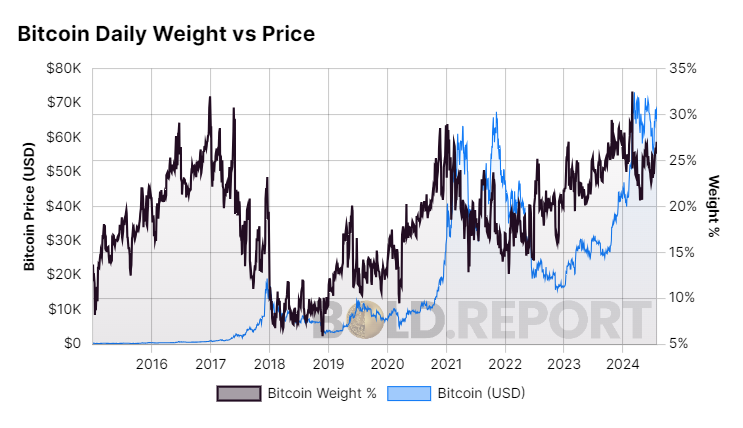

The history of the BOLD allocation to Bitcoin and Gold is now available on our website with daily and monthly target weight data. The key points are how the monthly target data are calculated according to the methodology above. When Bitcoin has been volatile, such as in 2018, the exposure fell markedly. It rose again in 2019/20 as Bitcoin’s volatility cooled. Having low exposure during periods of uncertainty added value and reduced risk.

BOLD Rebalance Weights since 2015

The daily data is dictated by the price movements of Bitcoin and Gold during the month, having been reset at the start of each month at the target weight. Note that the weight % scale is 5% to 35% (not 0% to 100% as above) to make it easier to see the detail.

BOLD’s Daily Bitcoin Weight

The spikes indicate months when there has been significant price dispersion between Bitcoin and Gold. Bitcoin’s lowest ever weight was 5% in November 2018 when the price collapsed by 50%. Its highest weight was 33% in late 2017, which was the market high, and in February this year, ahead of rebalancing. On both occasions, BOLD “took profits” at high prices, which locked in some profits made. This data is now available on the BOLD.Report website and updated daily.

BOLD and the VIX

There’s more to BOLD than simply a blend of Bitcoin and Gold prices. There is excess return from the asset allocation and the rebalancing transactions. The weights also help to keep the signal consistent as an optimised quantity of Bitcoin and Gold is held each month. That makes the BOLD Index a useful macroeconomic indicator, which reflects things like global liquidity, money supply, and inflation.

Most people would agree that it is beneficial to own Gold during a stockmarket crash. It might not go up, and it might even go down, but I am confident that the fall would be much less than the stockmarket itself. Therefore, Gold tends to beat the stockmarket at times of stress and, as a result, is widely held in diversified portfolios. Bitcoin, on the other hand, is more closely linked to the stockmarket, especially volatile technology stocks. Bitcoin has tended to do worse than the stockmarket during equity bear markets.

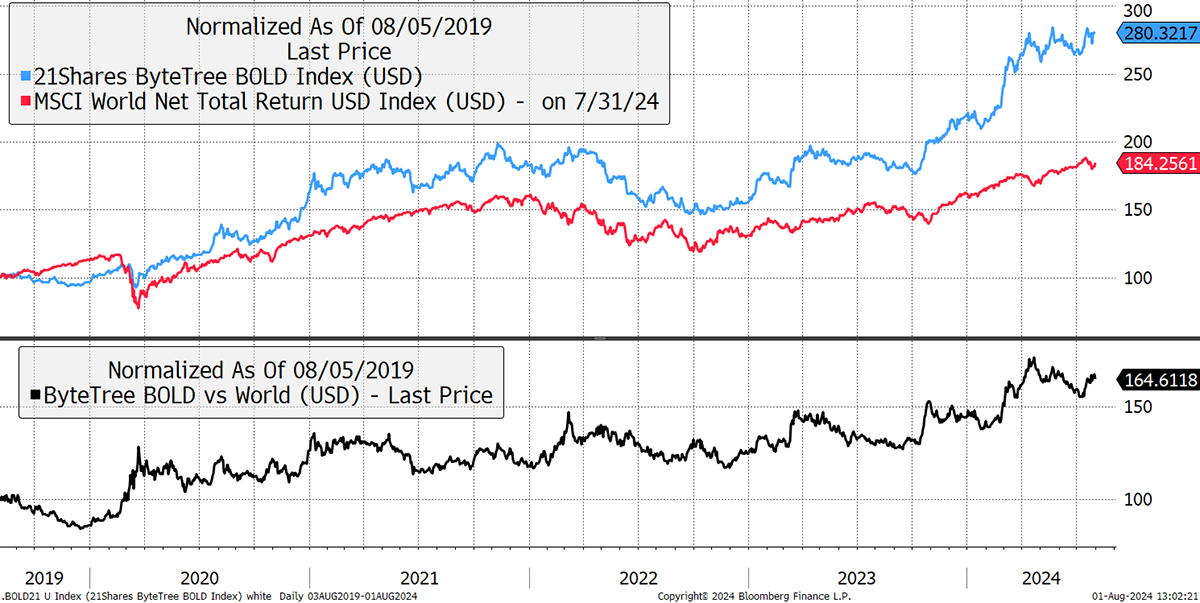

What’s interesting is that despite holding Bitcoin, BOLD tends to beat the stockmarket at times of stress. Not only that, but it has also had a tendency to hold onto that excess return when the stockmarket has recovered. $100 invested into BOLD five years ago is worth $280 today, in contrast to $184 in global equities, including dividends. The black line below shows BOLD compared to Global Equities, which tends to have a positive trend.

BOLD and Global Equities

Investors like returns, but they also like a hedge. That is, the knowledge that their assets will demonstrate stability during times of stress. The black line from above is plotted against the VIX, which measures market-implied volatility derived from the price of options. During times of uncertainty, options cost more than when things are calm.

BOLD and the VIX

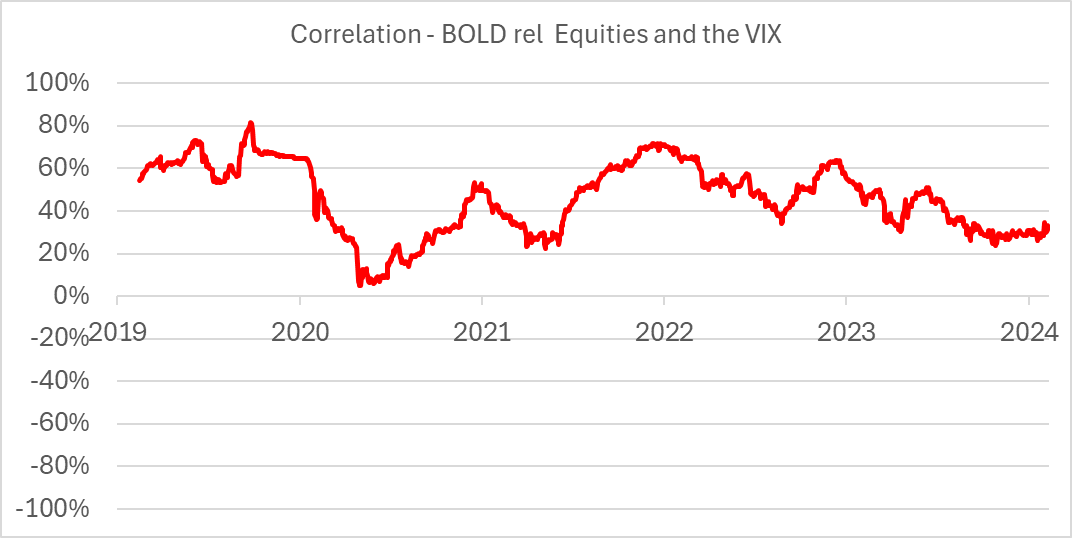

Next, we move to the correlation between the relative performance of BOLD (BOLD relative to Global equities) and the VIX. The VIX rises at times of stress, so if BOLD can beat the market during such times, it is indeed a defensive asset.

Correlation

BOLD might not be going up in a crisis and probably won’t, but it is outperforming the market, which is something only seen by high-quality assets such as the blue-chip consumer staples stocks, high-quality bonds, and even Gold without Bitcoin. It means that adding BOLD reduces portfolio risk, not increases it.

Atlas Pulse and ATOMIC

ByteTree Research publishes monthly publications on Gold, Atlas Pulse, and Bitcoin, ATOMIC. I shall share the highlights from the latest issues.

Atlas Pulse

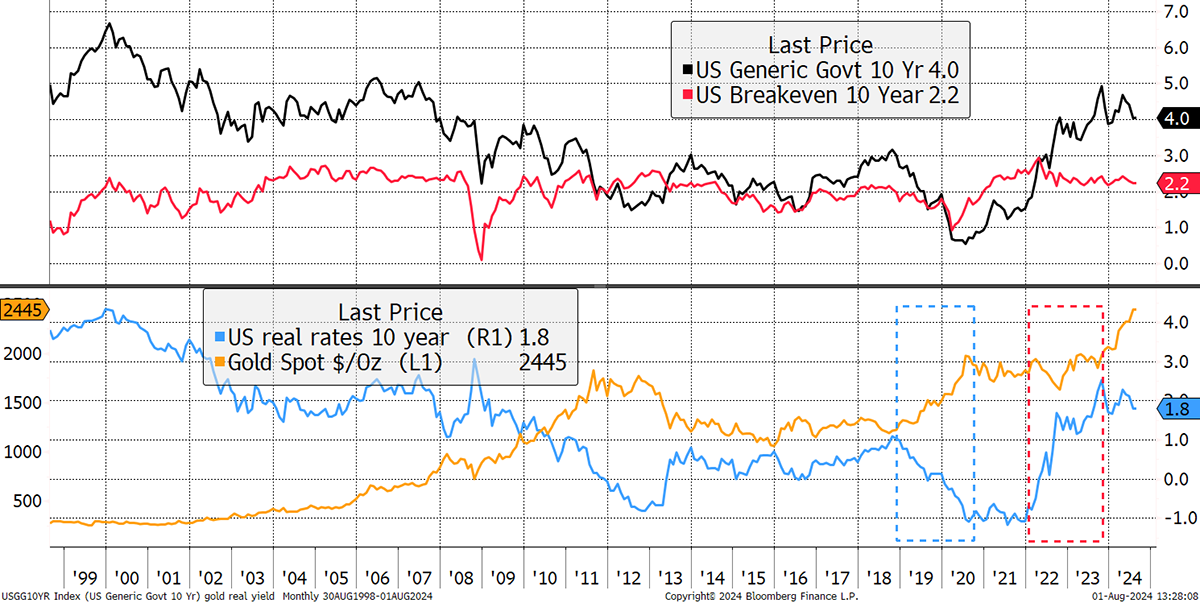

In Atlas Pulse, I looked at the recent all-time highs for Gold, the money supply, fund flows and the miners. The part most relevant to BOLD was the idea that real interest rates are likely to fall from here.

Real interest rates (blue) are the interest rate (black) less inflation expectations (red). We all know Gold likes falling real rates as seen in 2019/20 (blue box). When they surged in 2022/23 (red box), Gold stood its ground. The inverse correlation between real interest rates and the price of Gold hasn’t gone away; Gold simply looked through to the long term and ignored this cycle of higher real rates.

Gold and Real Rates Remain Uncorrelated

ATOMIC

In ATOMIC we covered the Bitcoin on-chain data, the crypto market breadth, Bitcoin’s performance versus the tech sector, institutional flows and more. One interesting addition came from the Bitcoin Miners who are embracing the AI sector. Diversifying income streams is key for surviving crypto winters and upcoming Bitcoin halvings, and the rapid emergence of AI has presented a new opportunity.

Bitcoin mining farms are vast sites that are capable of producing many million trillion hashes per second. The same NVIDIA GPUs used in crypto mining are also used for AI processing, making them high in demand and difficult to come by. Rather than going through the lengthy and costly process of building their own sites, the big tech companies have opened the doors for partnerships with Bitcoin miners.

Summary

Whoever wins the US election, or indeed any other election, is likely to keep on printing money. This is why BOLD exists because they can print in the good times and in the bad. BOLD is the all-weather solution.

Contact

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Vinter Index Provider

21Shares BOLD ETP

BOLD.report

Research

ByteTree provides more in-depth research on Bitcoin and Gold for free on our website.