Crypto Setback: External Factors at Play

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 119;

The overall crypto market cap lost roughly $500bn in value in the last three days, a 21.5% decline. BTC slightly outperformed the broader market with a 20% decline, but altcoins, on the other hand, were hit the hardest. What is going on?

There are reports of whales dumping their crypto holdings, which could have spooked the market, but it is highly unlikely that it could result in such a sell-off. Notably, over $3.5bn worth of tokens were unlocked and issued in July. Although this is significant, it is contained to the token experiencing the supply shock. Additionally, the Bitcoin ETF flows, which saw strong inflows throughout July, have slowed and turned into outflows.

Bitcoin ETF Flows

However, the real problem is not with crypto but with everything surrounding it. The pullback is global across stock markets, particularly Asian, and the Yen is at the epicentre. As Charlie wrote this morning:

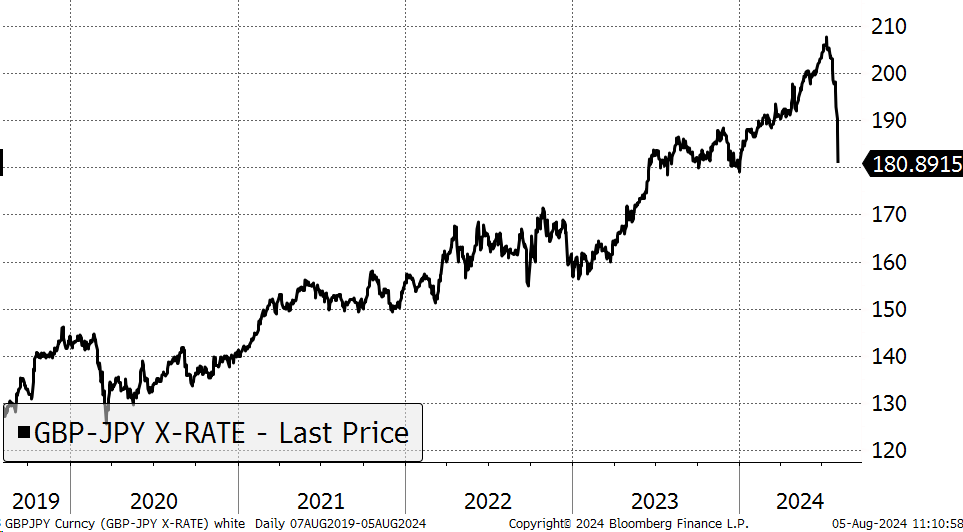

“Essentially, investors have been borrowing cheap Yen, due to its low interest rate, and investing the proceeds elsewhere. You could assume that the destinations of those proceeds are feeling the pain as there are margin calls for Yen loans to be repaid. The Yen is surging, and those loans are now more expensive to repay, forcing liquidations.”

Sterling vs Yen

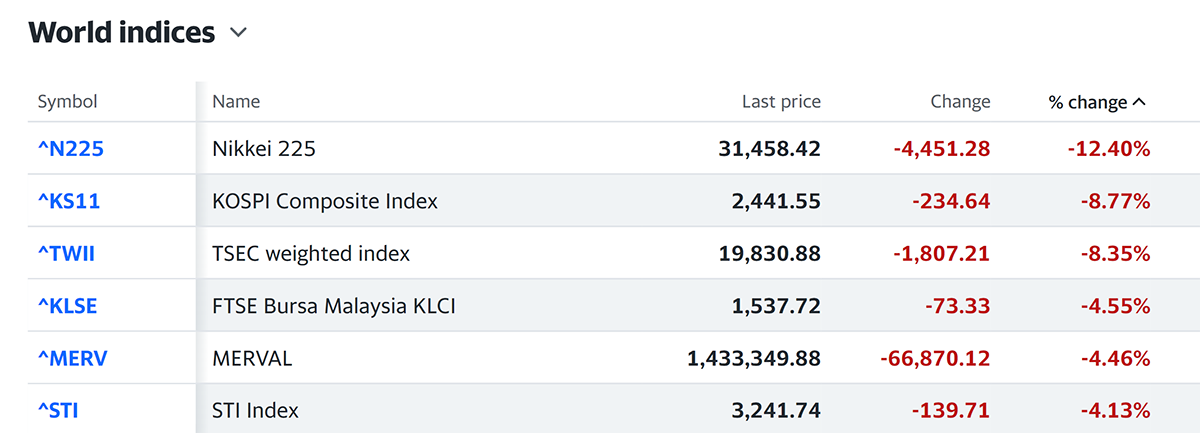

“It is remarkable this carry trade has been going on for so long, much to our frustration. Yen strength has caused the Nikkei to fall 25% in short order, making Japanese equities the lowest compared to the world since the 1970s.”

Nikkei 225 Down 25%

The Korean, Taiwanese, Malaysian, and Singaporean indices also experienced a drop.

Top 6 Indices with Biggest Losses in Their Latest Trading Session

Then, there is the broader uncertainty.

Following a slowdown in hiring, the US unemployment rate is rising and recorded 4.3% for July, the highest since November 2021. This could cause the already slowing economy to deteriorate further, increasing the chances of an economic recession. Top that off with the unpredictable US election season, which is witnessing fierce competition between Harris and the supposedly pro-crypto candidate, Trump.

Additionally, rising tensions in the Middle East continue to fuel global uncertainty. The Israel-Iran conflict, with many third parties involved, is a significant risk to the stability of the global economy and alternative investments.

Headlines from the Weekend

In times like these, investors often seek refuge in low-volatility, low-risk assets like gold and bonds. Crypto, being the most volatile asset class, easily triggers Fear, Uncertainty, and Doubt (FUD).

As crypto veterans, we've seen sharp declines before, all of which were temporary. The crypto market is resilient, as evidenced by its ability to bounce back from external shocks, uncertainty and regulatory challenges. It’s important to remember the bigger picture as the fundamentals of the top cryptocurrencies, like Bitcoin and Solana, remain unchanged. Investors need to focus on the long-term potential of blockchain technology and the innovative solutions it offers.

Regardless of the outcome of the US election, I believe we are moving toward a crypto-friendly future. Once the market recognises that crypto is not to blame for the macroeconomic and geopolitical turmoil, the recovery should be as swift as the downturn. As the market matures and adapts, the intrinsic value of cryptocurrencies will become more apparent, paving the way for a robust and thriving digital economy.