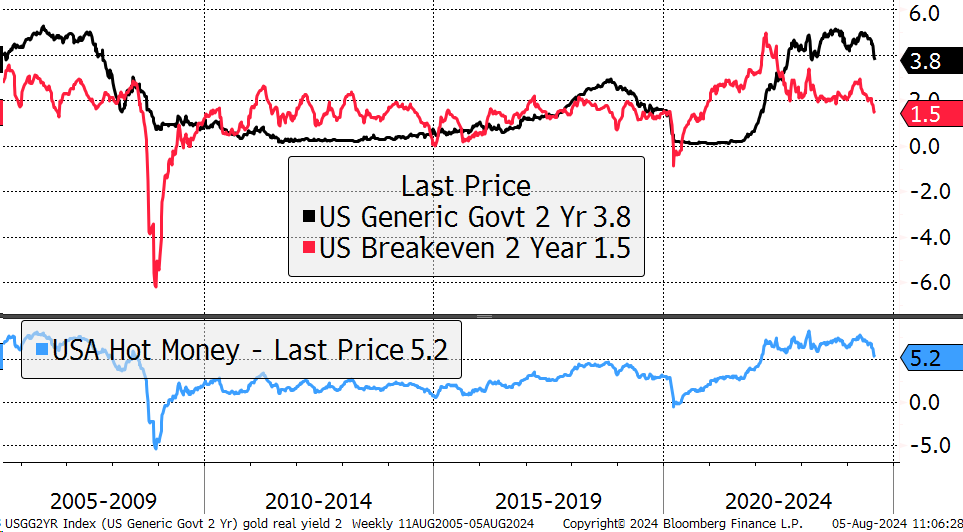

Given recent events in financial markets, this is an update to explain recent events. The market has had a deflation fright but without a major event such as a default. That means bond yields (black) and inflation expectations (red) have fallen. Their combined value (blue) has cooled from 7.9% to 5.2% in recent weeks.

The System Is Cooling

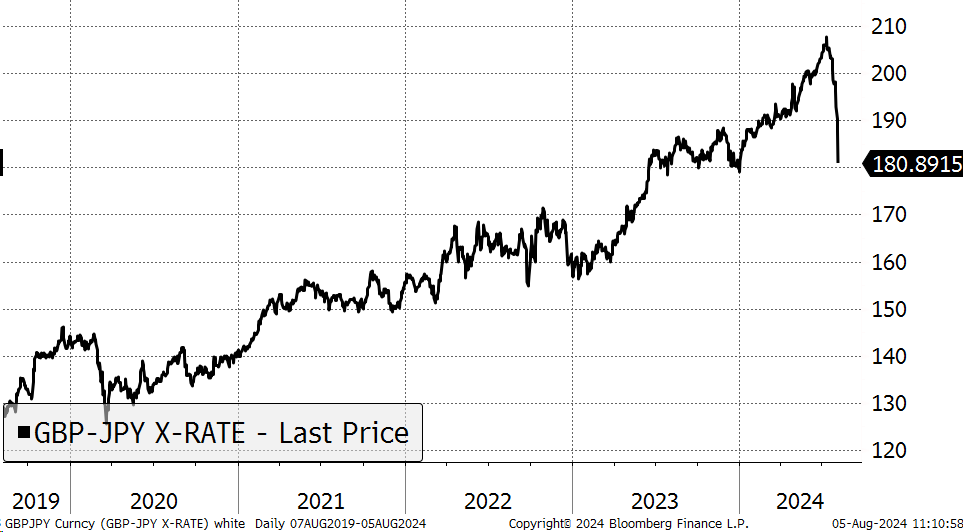

At the epicentre of this is the Yen. I have spent much time covering the Yen and the carry trade. Essentially, investors have been borrowing cheap Yen, due to its low interest rate, and investing the proceeds elsewhere. You could assume that the destinations of those proceeds are feeling the pain as there are margin calls for yen loans to be repaid. The Yen is surging, and those loans are now more expensive to repay, forcing liquidations.

Sterling versus Yen

It is remarkable this carry trade has been going on for so long, much to our frustration. Yen strength has caused the Nikkei to fall 25% in short order, making Japanese equities the lowest compared to the world since the 1970s.

Nikkei Down 25%

Other casualties have been technology stocks, bank stocks, and the Mexican Peso.

The US dollar is also down, which is surprising, as in recent market events, it has tended to act as a safe haven. Government bonds have risen along with the Yen and the Swiss Franc. The Chinese Renminbi has also gained.

However, I would note that European bond spreads have also widened, as it costs more to borrow in France than in Germany. Gold and silver have acted as safe havens, but Bitcoin has not. It tested $50,000 earlier today following a 20% fall but has rebounded somewhat. The rumour is that a major investor has a large position funded in Yen. Also, in crypto, altcoins are weak, with ETH making a 3-year low in BTC.

Some recent sales have proved useful, such as Pershing Square (PSH) -23%, and the European banks ETF (CB5) -10% since Tuesday. The latter has come under stress as French OATs now yield 0.8% more than German bunds.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd