ATOMIC 100;

So much talk about Bitcoin halvings, but what about the doublings?

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Crazy Forecasts | Doublings and Halvings |

| Technicals | Weak Seasonality |

| On-chain | Bear |

| Investment Flows | Neutral |

| BOLD | Is Bitcoin Down ‘coz Gold Is Up? |

I last looked at this in January 2021, when Bitcoin enjoyed its 19th doubling (and third halving) since first being publicly traded in 2010. With a market cap of $1.2 trillion, Bitcoin has done one hell of a job, but we mustn’t forget that Apple, Microsoft, NVIDIA, Alphabet, Amazon, and META have all returned more, as their market caps are even higher.

The difference with Bitcoin is that it was open to the public from the early days, and so people were able to participate when it came to market with a market cap of around $150,000. Imagine that. META was the most recent company mentioned to float in 2014 at $16 billion. Those who bought the IPO were already 100,000x worse off than those who bought Bitcoin on its first trade at 6 cents in 2010.

Admittedly, we are probably talking about a very few people here, but the point is that it was possible, whereas in public companies, you’re lucky to get a look in until most of the value creation is already done. This is an important point, and one that explains the excitement behind crypto over the stockmarket. Great success is not only deemed possible but accessible to all.

Since the IPO, META has doubled twice, and a third double would need to see the stock gain a further 13% from here. Three doubles mean 8x in capital.

META Has Doubled Twice

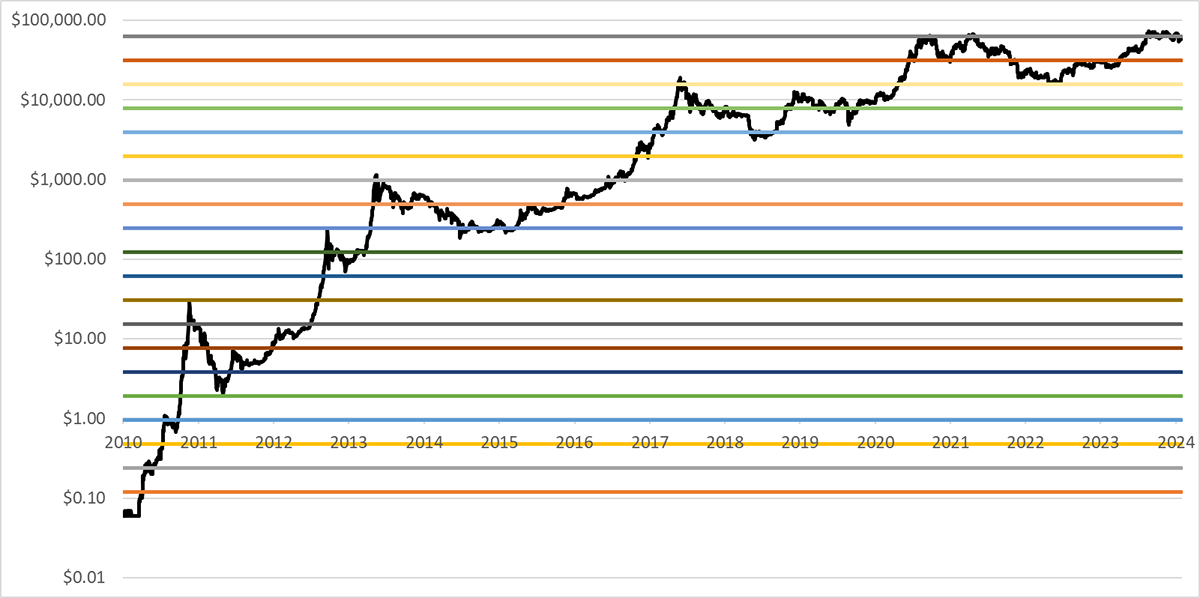

In contrast, Bitcoin has doubled 20 times, more than anything in history. It helps us visualise the game of rice on a chessboard. Sadly, Bloomberg data only shows 18 doubles, but if you could dig back into 2010, there were another two to be had.

Bitcoin Has Doubled Twenty Times – Log Scale