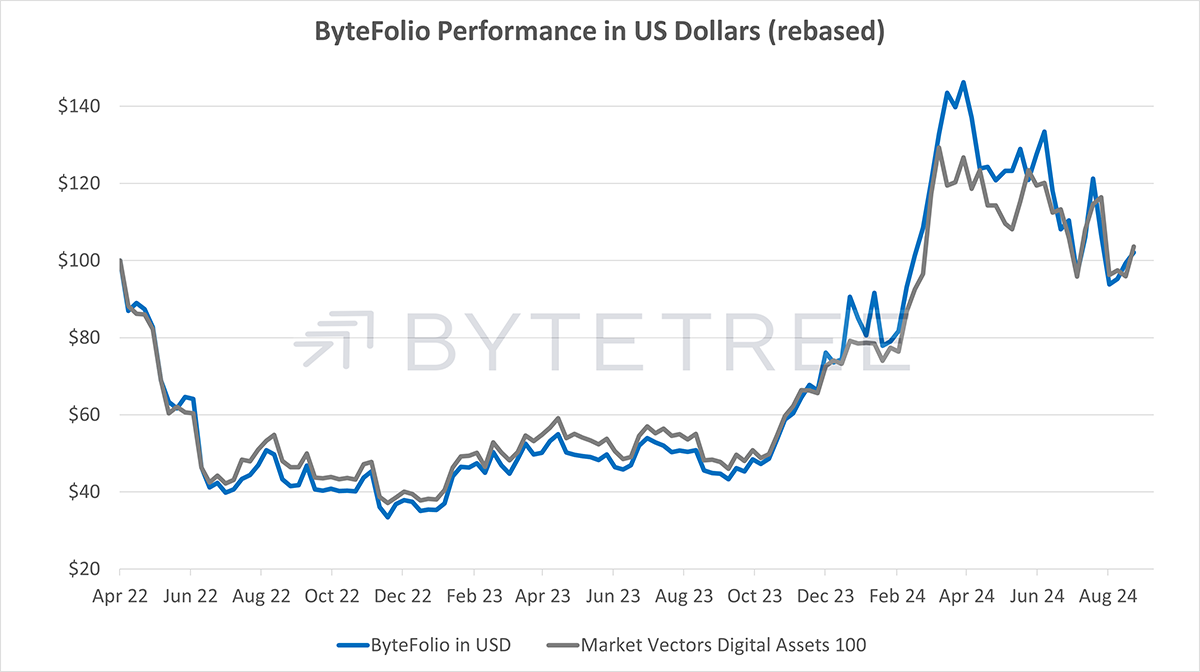

ByteFolio Issue 122;

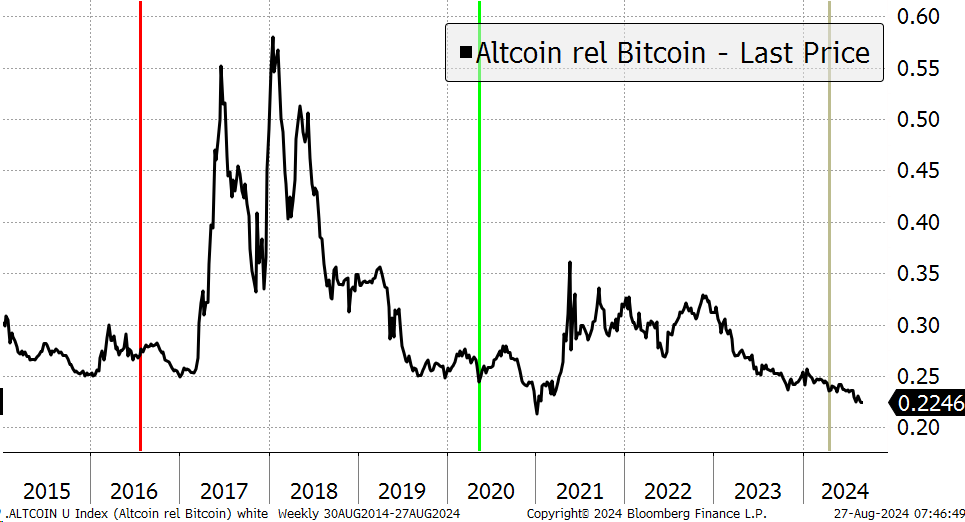

Previous cycles have seen the altcoin rally follow the Bitcoin rally six months after halving. In each case, alts got a little worse before they got better. The chart shows Alts (MVDA 100 Index) vs Bitcoin with halving dates marked.

Altcoins Relative to Bitcoin

If history repeats itself, alts should kick off in the new year, but only once Bitcoin has surged. The good news is that we are on track for a run in Q4.

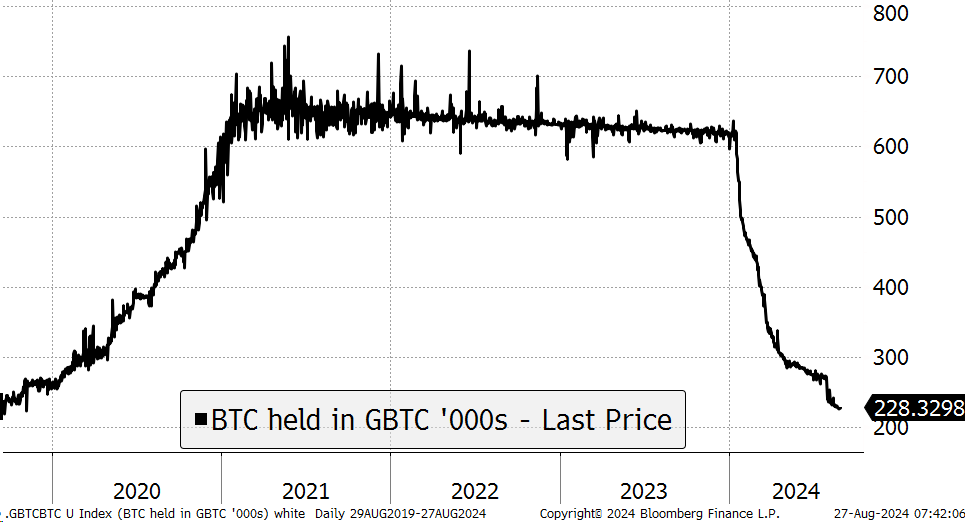

The number of #bitcoin held by Grayscale #GBTC has slumped from around 630k to 230k. This has been the single largest source of leakage in the ecosystem. Now back to 2019 levels. Down 64%. This has been a drag but outflows should slow down from here.🧵👇 pic.twitter.com/XWvtIRgiwq

— Charlie Morris (@AtlasPulse) August 25, 2024

I would argue that the unwinding of GBTC has been unhelpful, as not all of the BTC has been recycled. The BTC held is down 64% since it became an ETF.

BTC Held by GBTC Down by 64%

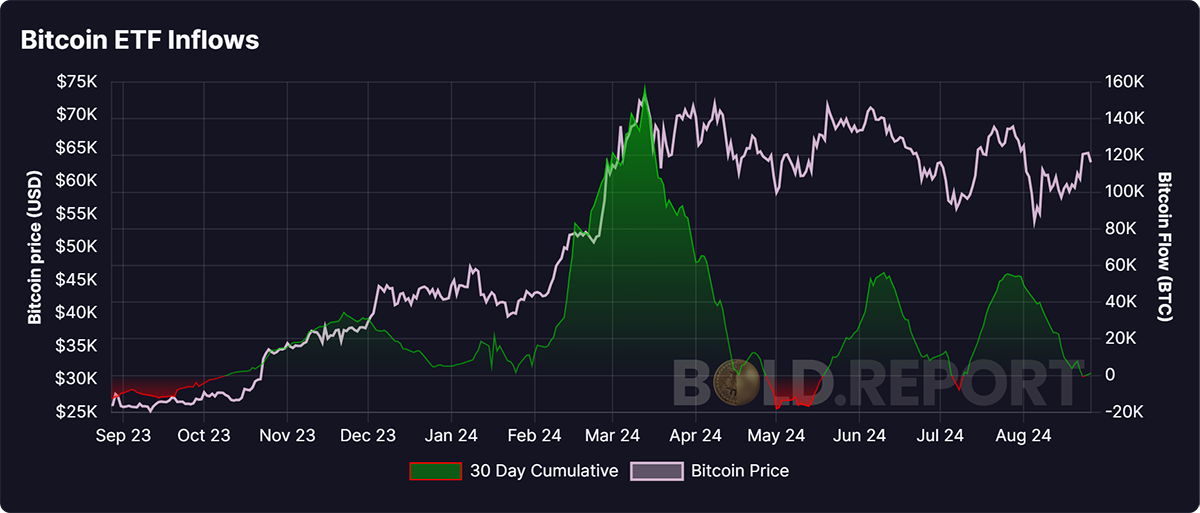

In recent weeks, we have seen heavy outflows from GBTC, and while the new US ETFs have grown, the growth has not been enough to offset GBTC selling. Last week, that changed, and with GBTC now a shadow of its former self, the set-up for net flows in Q4 is looking up.

Bitcoin Held by ETFs

Flows are important as the BTC price clearly moves with the flows. Bitcoin used to be an on-chain adoption story, but these days, it’s about the money, and lots of it. Net inflows buoyed by a calmer BTC will see Bitcoin make new highs.

Bitcoin ETF Inflows

Altcoin investors need to keep the faith. It’s tough out there, but the underperformance of alts vs Bitcoin has been difficult. The good news is that positioning is light, and so when the good times return, there is the potential for yet another strong altcoin rally.